-

×

Automatic Millionaire (Audio Book) with David Bach

1 × $6.00

Automatic Millionaire (Audio Book) with David Bach

1 × $6.00 -

×

Future Energy with Bill Paul

1 × $6.00

Future Energy with Bill Paul

1 × $6.00 -

×

Trading For Busy People with Josias Kere

1 × $6.00

Trading For Busy People with Josias Kere

1 × $6.00 -

×

Module IV - Day Trading to Short Term Swing Trades with FX MindShift

1 × $6.00

Module IV - Day Trading to Short Term Swing Trades with FX MindShift

1 × $6.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

Pit Bull with Martin Schwartz

1 × $6.00

Pit Bull with Martin Schwartz

1 × $6.00 -

×

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00 -

×

Beat The Market Maker

1 × $62.00

Beat The Market Maker

1 × $62.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00 -

×

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Management of Equity Investments with Dimitris Chorafas

1 × $6.00

The Management of Equity Investments with Dimitris Chorafas

1 × $6.00 -

×

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00 -

×

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00 -

×

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00 -

×

Filtered Waves. Basic Theory with Arthur A.Merrill

1 × $7.00

Filtered Waves. Basic Theory with Arthur A.Merrill

1 × $7.00 -

×

Mastering Candlestick Charts II with Greg Capra

1 × $6.00

Mastering Candlestick Charts II with Greg Capra

1 × $6.00 -

×

Elliott Wave Street Course with Juan Maldonado

1 × $17.00

Elliott Wave Street Course with Juan Maldonado

1 × $17.00 -

×

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00 -

×

Investing Smart. How to Pick Stocks with Investors Business Daily By Dhun H.Sethna

1 × $4.00

Investing Smart. How to Pick Stocks with Investors Business Daily By Dhun H.Sethna

1 × $4.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00 -

×

Stock Options Day Trading Mindset for Success with Allen Maxwell, Scott Paton, & Scott Alex

1 × $5.00

Stock Options Day Trading Mindset for Success with Allen Maxwell, Scott Paton, & Scott Alex

1 × $5.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The Banker’s Edge Webinar & Extras

1 × $6.00

The Banker’s Edge Webinar & Extras

1 × $6.00 -

×

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Unlocking the Profits of the New Swing Chart Method with Dave Reif & Jeff Cooper

1 × $23.00

Unlocking the Profits of the New Swing Chart Method with Dave Reif & Jeff Cooper

1 × $23.00 -

×

Mind Over Markets

1 × $6.00

Mind Over Markets

1 × $6.00 -

×

Profit Power Seminar

1 × $23.00

Profit Power Seminar

1 × $23.00 -

×

Cash In On Chaos with Hans Hannula

1 × $6.00

Cash In On Chaos with Hans Hannula

1 × $6.00 -

×

The Ultimate Forex Structure Course

1 × $31.00

The Ultimate Forex Structure Course

1 × $31.00 -

×

Precise Exits & Entries with Charles LeBeau

1 × $6.00

Precise Exits & Entries with Charles LeBeau

1 × $6.00 -

×

The TFDW Bundle – Tradingfanatic

1 × $15.00

The TFDW Bundle – Tradingfanatic

1 × $15.00 -

×

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

Volume Profile Video Course with Trader Dale

1 × $8.00

Volume Profile Video Course with Trader Dale

1 × $8.00 -

×

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00 -

×

Day Trade Online (2nd Ed.) with Christopher Farrell

1 × $6.00

Day Trade Online (2nd Ed.) with Christopher Farrell

1 × $6.00 -

×

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00 -

×

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00 -

×

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00 -

×

Mastering Technical Analysis with Investi Share

1 × $23.00

Mastering Technical Analysis with Investi Share

1 × $23.00 -

×

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00 -

×

Masterclass 5.0 with RockzFX

1 × $5.00

Masterclass 5.0 with RockzFX

1 × $5.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00 -

×

The AIC-22 Workshop with Amy Meissner - Aeromir

1 × $41.00

The AIC-22 Workshop with Amy Meissner - Aeromir

1 × $41.00 -

×

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00 -

×

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00 -

×

Inside the House of Money (2006) with Steven Drobny

1 × $6.00

Inside the House of Money (2006) with Steven Drobny

1 × $6.00 -

×

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00 -

×

Selective Forex Trading with Don Snellgrove

1 × $6.00

Selective Forex Trading with Don Snellgrove

1 × $6.00 -

×

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00 -

×

Secret Weapon to Trading Options on ETF's Class with Don Kaufman

1 × $6.00

Secret Weapon to Trading Options on ETF's Class with Don Kaufman

1 × $6.00 -

×

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

The Age of Turbulence with Alan Greenspan

1 × $6.00

The Age of Turbulence with Alan Greenspan

1 × $6.00 -

×

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00 -

×

Electronic Trading "TNT" I Gorilla Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" I Gorilla Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

The MMXM Traders Course - The MMXM Trader

1 × $5.00

The MMXM Traders Course - The MMXM Trader

1 × $5.00 -

×

Heiken Ashi 101

1 × $15.00

Heiken Ashi 101

1 × $15.00 -

×

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00 -

×

The Game In WallStreet & How to Play it Successfully with Hoyle

1 × $6.00

The Game In WallStreet & How to Play it Successfully with Hoyle

1 × $6.00 -

×

The LP Trading Course

1 × $13.00

The LP Trading Course

1 × $13.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Market Forecasting. Stocks and Grain

1 × $6.00

Market Forecasting. Stocks and Grain

1 × $6.00

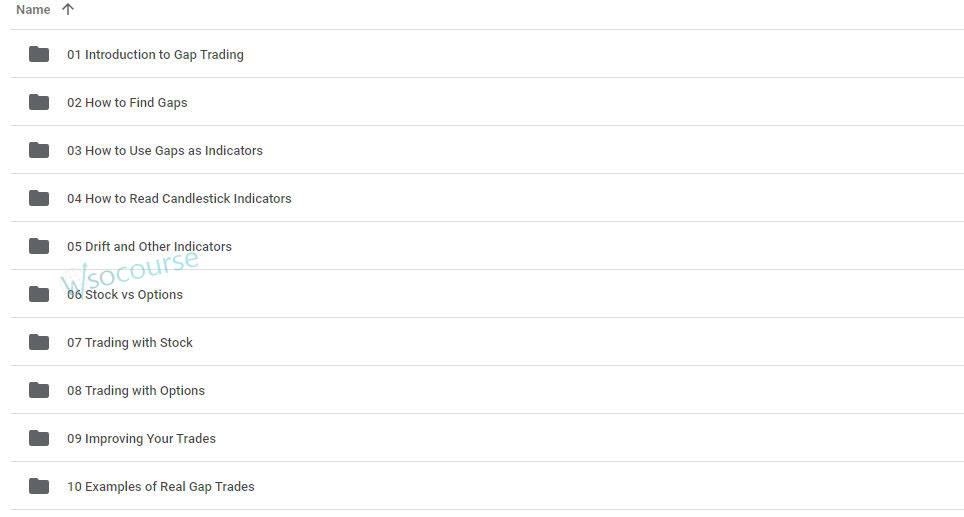

Gap Trading for Stock and Options Traders with Damon Verial

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Gap Trading for Stock and Options Traders with Damon Verial” below:

Gap Trading for Stock and Options Traders with Damon Verial

Gap trading is a strategy that takes advantage of price gaps in the stock market. These gaps can present lucrative opportunities for traders who know how to navigate them effectively. Damon Verial, a seasoned market analyst, provides insightful strategies for gap trading. In this article, we explore how stock and options traders can benefit from gap trading techniques taught by Damon Verial.

Introduction

Who is Damon Verial?

Damon Verial is a respected market analyst and financial educator known for his expertise in stock and options trading. His strategies focus on data-driven analysis and practical trading techniques.

What is Gap Trading?

Gap trading involves taking advantage of the price gaps that occur when a stock opens at a significantly different price than its previous closing price. These gaps can result from after-hours news, earnings reports, or other market-moving events.

Understanding Price Gaps

Types of Gaps

Common Gaps

Common gaps occur in the middle of a trading range and are usually insignificant in terms of price movement.

Breakaway Gaps

Breakaway gaps happen at the beginning of a trend and indicate a strong movement in the direction of the gap.

Runaway Gaps

Runaway gaps, also known as continuation gaps, occur in the middle of a trend and indicate strong ongoing momentum.

Exhaustion Gaps

Exhaustion gaps appear near the end of a trend and suggest a possible reversal or slowdown in the price movement.

Identifying Gaps

Chart Patterns

Using chart patterns and technical analysis tools helps identify potential gaps. Verial emphasizes the importance of understanding these patterns for successful gap trading.

Volume Analysis

Volume analysis can confirm the significance of a gap. High trading volume typically accompanies more meaningful gaps.

Strategies for Gap Trading

Pre-Market Preparation

Monitoring Pre-Market Activity

Check pre-market trading activity to identify potential gaps. News, earnings reports, and economic data released before the market opens can create significant gaps.

Setting Up Alerts

Set up alerts for stocks you are monitoring to get notified of significant pre-market price changes.

Trading Breakaway Gaps

Entry Points

For breakaway gaps, enter trades in the direction of the gap. If a stock gaps up, consider buying; if it gaps down, consider shorting.

Stop-Loss Orders

Set stop-loss orders to manage risk. Place them just below the gap for long positions and just above the gap for short positions.

Trading Runaway Gaps

Following the Trend

Trade in the direction of the existing trend. Runaway gaps indicate strong momentum, so align your trades with this movement.

Adjusting Positions

As the trend continues, adjust your positions to lock in profits and manage risk.

Trading Exhaustion Gaps

Recognizing Reversals

Exhaustion gaps often signal reversals. Look for confirmation through volume analysis and other technical indicators before entering a trade.

Short-Term Opportunities

Exhaustion gaps can provide short-term trading opportunities. Be prepared to enter and exit trades quickly to capitalize on these movements.

Gap Trading with Options

Advantages of Options in Gap Trading

Leverage

Options provide leverage, allowing you to control a larger position with a smaller investment.

Defined Risk

Options have predefined risk, making them suitable for volatile gap trading scenarios.

Options Strategies for Gaps

Buying Calls and Puts

Buy calls if you expect the stock to gap up and puts if you expect it to gap down. This strategy allows you to capitalize on significant price movements.

Straddles and Strangles

Use straddles and strangles to profit from significant price movements in either direction. These strategies involve buying both call and put options.

Risk Management

Setting Stop-Loss Orders

Importance of Stop-Losses

Stop-loss orders protect your capital by limiting potential losses. Always use them when trading gaps.

Adjusting Stop-Losses

Adjust stop-loss levels as the trade progresses to lock in profits and minimize risk.

Position Sizing

Calculating Position Size

Determine the appropriate position size based on your risk tolerance and the potential size of the gap.

Diversifying Trades

Avoid putting all your capital into a single gap trade. Diversify your trades to spread risk.

Tools and Resources for Gap Trading

Trading Platforms

Choose a trading platform that offers real-time data, advanced charting tools, and customizable alerts.

Educational Resources

Leverage books, articles, and online courses to deepen your understanding of gap trading strategies.

Market Analysis Tools

Use market analysis tools to monitor news, earnings reports, and other events that can create gaps.

Conclusion

Why Practice Gap Trading?

Gap trading offers unique opportunities for significant profits by capitalizing on price movements caused by market events. With Damon Verial’s strategies, traders can effectively navigate these gaps and enhance their trading performance.

FAQs

1. What is gap trading?

Gap trading involves taking advantage of price gaps that occur when a stock opens at a different price than its previous close, usually due to market-moving events.

2. What are the different types of gaps?

The different types of gaps include common gaps, breakaway gaps, runaway gaps, and exhaustion gaps, each indicating different market conditions.

3. How can options be used in gap trading?

Options can be used in gap trading to provide leverage and defined risk. Strategies like buying calls and puts, and using straddles and strangles, can be effective.

4. Why is risk management important in gap trading?

Risk management is crucial in gap trading to protect your capital and minimize potential losses. This includes setting stop-loss orders and diversifying trades.

5. What tools are helpful for gap trading?

Helpful tools for gap trading include advanced trading platforms, market analysis tools, and educational resources to stay informed about potential gaps and trading strategies.

Be the first to review “Gap Trading for Stock and Options Traders with Damon Verial” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.