-

×

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00 -

×

Simpler Options - Weekly Butterflies for Income

1 × $6.00

Simpler Options - Weekly Butterflies for Income

1 × $6.00 -

×

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00 -

×

Selected Articles by the Late by George Lindsay

1 × $6.00

Selected Articles by the Late by George Lindsay

1 × $6.00 -

×

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00 -

×

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00 -

×

The Any Hour Trading System with Markets Mastered

1 × $6.00

The Any Hour Trading System with Markets Mastered

1 × $6.00 -

×

The Great Depression with David Burg

1 × $6.00

The Great Depression with David Burg

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Self-Mastery Course with Steven Cruz

1 × $62.00

Self-Mastery Course with Steven Cruz

1 × $62.00 -

×

Math Trading Course 2023

1 × $34.00

Math Trading Course 2023

1 × $34.00 -

×

NXT Level FX with Investors Domain

1 × $5.00

NXT Level FX with Investors Domain

1 × $5.00 -

×

Advance Gap Trading with Master Trader

1 × $39.00

Advance Gap Trading with Master Trader

1 × $39.00 -

×

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00 -

×

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00 -

×

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00 -

×

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00 -

×

Complete Series

1 × $31.00

Complete Series

1 × $31.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

Investment Illusions with Martin S.Fridson

1 × $6.00

Investment Illusions with Martin S.Fridson

1 × $6.00 -

×

Emini Bonds

1 × $23.00

Emini Bonds

1 × $23.00 -

×

Intro To Trading - 3 Module Bundle

1 × $23.00

Intro To Trading - 3 Module Bundle

1 × $23.00 -

×

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Cracking The Forex Code with Kevin Adams

1 × $6.00

Cracking The Forex Code with Kevin Adams

1 × $6.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

How to Find the Most Profitable Stocks with Mubarak Shah

1 × $6.00

How to Find the Most Profitable Stocks with Mubarak Shah

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00 -

×

Hedge Fund Investment Management with Izze Nelken

1 × $6.00

Hedge Fund Investment Management with Izze Nelken

1 × $6.00 -

×

Path to Profits By Scott Redler - T3 Live

1 × $6.00

Path to Profits By Scott Redler - T3 Live

1 × $6.00 -

×

How to Spot Trading Opportunities

1 × $6.00

How to Spot Trading Opportunities

1 × $6.00 -

×

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00 -

×

Fierce 10 with Mandi Rafsendjani

1 × $5.00

Fierce 10 with Mandi Rafsendjani

1 × $5.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00 -

×

Investing in 401k Plans with Cliffsnotes

1 × $6.00

Investing in 401k Plans with Cliffsnotes

1 × $6.00 -

×

P.A.T Trading Course (Low Video Quality) with Martin Cole

1 × $6.00

P.A.T Trading Course (Low Video Quality) with Martin Cole

1 × $6.00 -

×

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00 -

×

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00 -

×

Learning Track: Quantitative Approach in Options Trading

1 × $39.00

Learning Track: Quantitative Approach in Options Trading

1 × $39.00 -

×

The Compleat DayTrader I & II with Jack Bernstein

1 × $6.00

The Compleat DayTrader I & II with Jack Bernstein

1 × $6.00 -

×

The Dynamic Trading Master Course with Robert Miner

1 × $54.00

The Dynamic Trading Master Course with Robert Miner

1 × $54.00 -

×

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

ICT Charter 2020 with Inner Circle Trader

1 × $13.00

ICT Charter 2020 with Inner Circle Trader

1 × $13.00 -

×

Index Funds with Mark Hebner

1 × $6.00

Index Funds with Mark Hebner

1 × $6.00 -

×

Futures & Options Course with Talkin Options

1 × $15.00

Futures & Options Course with Talkin Options

1 × $15.00 -

×

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

Consistently Profitable Trader with Pollinate Trading

1 × $13.00

Consistently Profitable Trader with Pollinate Trading

1 × $13.00 -

×

Trading The Nasdaq Seminar with Alan Rich

1 × $6.00

Trading The Nasdaq Seminar with Alan Rich

1 × $6.00 -

×

The Geography of Money with Benjamin J.Cohen

1 × $6.00

The Geography of Money with Benjamin J.Cohen

1 × $6.00 -

×

Investment Science with David G.Luenberger

1 × $6.00

Investment Science with David G.Luenberger

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Handbook of Risk with Ben Warwick

1 × $6.00

The Handbook of Risk with Ben Warwick

1 × $6.00 -

×

SOAP. Served On A Platter CD with David Elliott

1 × $6.00

SOAP. Served On A Platter CD with David Elliott

1 × $6.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00 -

×

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00 -

×

License to Steal with John Carlton

1 × $6.00

License to Steal with John Carlton

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00 -

×

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00 -

×

The LP Trading Course

1 × $13.00

The LP Trading Course

1 × $13.00 -

×

Financial Astrology Course with Brian James Sklenka

1 × $6.00

Financial Astrology Course with Brian James Sklenka

1 × $6.00 -

×

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00 -

×

Catching the Big Moves with Jack Bernstein

1 × $6.00

Catching the Big Moves with Jack Bernstein

1 × $6.00 -

×

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

Technical Trading: System and Design Testing Class with Jeff Bierman

1 × $6.00

Technical Trading: System and Design Testing Class with Jeff Bierman

1 × $6.00 -

×

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00

Rockwell Trading - Can You Make A Living Day Trading - 2 DVD

1 × $6.00 -

×

Sixpart Study Guide to Market Profile

1 × $6.00

Sixpart Study Guide to Market Profile

1 × $6.00 -

×

D5 Render Course with Nuno Silva

1 × $27.00

D5 Render Course with Nuno Silva

1 × $27.00 -

×

Forex Trading MasterClass with Torero Traders School

1 × $5.00

Forex Trading MasterClass with Torero Traders School

1 × $5.00 -

×

EURUSD Trading System with CopperChips

1 × $6.00

EURUSD Trading System with CopperChips

1 × $6.00 -

×

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

PDFT (Price Driven Forex Trading) Course with Avi Frister

1 × $6.00

PDFT (Price Driven Forex Trading) Course with Avi Frister

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00

Gap Trading for Stock and Options Traders with Damon Verial

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

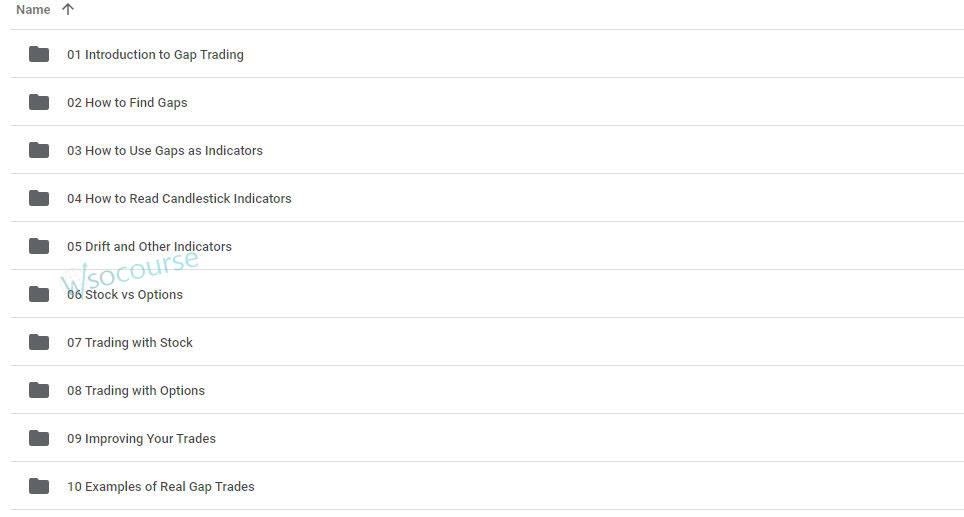

You may check content proof of “Gap Trading for Stock and Options Traders with Damon Verial” below:

Gap Trading for Stock and Options Traders with Damon Verial

Gap trading is a strategy that takes advantage of price gaps in the stock market. These gaps can present lucrative opportunities for traders who know how to navigate them effectively. Damon Verial, a seasoned market analyst, provides insightful strategies for gap trading. In this article, we explore how stock and options traders can benefit from gap trading techniques taught by Damon Verial.

Introduction

Who is Damon Verial?

Damon Verial is a respected market analyst and financial educator known for his expertise in stock and options trading. His strategies focus on data-driven analysis and practical trading techniques.

What is Gap Trading?

Gap trading involves taking advantage of the price gaps that occur when a stock opens at a significantly different price than its previous closing price. These gaps can result from after-hours news, earnings reports, or other market-moving events.

Understanding Price Gaps

Types of Gaps

Common Gaps

Common gaps occur in the middle of a trading range and are usually insignificant in terms of price movement.

Breakaway Gaps

Breakaway gaps happen at the beginning of a trend and indicate a strong movement in the direction of the gap.

Runaway Gaps

Runaway gaps, also known as continuation gaps, occur in the middle of a trend and indicate strong ongoing momentum.

Exhaustion Gaps

Exhaustion gaps appear near the end of a trend and suggest a possible reversal or slowdown in the price movement.

Identifying Gaps

Chart Patterns

Using chart patterns and technical analysis tools helps identify potential gaps. Verial emphasizes the importance of understanding these patterns for successful gap trading.

Volume Analysis

Volume analysis can confirm the significance of a gap. High trading volume typically accompanies more meaningful gaps.

Strategies for Gap Trading

Pre-Market Preparation

Monitoring Pre-Market Activity

Check pre-market trading activity to identify potential gaps. News, earnings reports, and economic data released before the market opens can create significant gaps.

Setting Up Alerts

Set up alerts for stocks you are monitoring to get notified of significant pre-market price changes.

Trading Breakaway Gaps

Entry Points

For breakaway gaps, enter trades in the direction of the gap. If a stock gaps up, consider buying; if it gaps down, consider shorting.

Stop-Loss Orders

Set stop-loss orders to manage risk. Place them just below the gap for long positions and just above the gap for short positions.

Trading Runaway Gaps

Following the Trend

Trade in the direction of the existing trend. Runaway gaps indicate strong momentum, so align your trades with this movement.

Adjusting Positions

As the trend continues, adjust your positions to lock in profits and manage risk.

Trading Exhaustion Gaps

Recognizing Reversals

Exhaustion gaps often signal reversals. Look for confirmation through volume analysis and other technical indicators before entering a trade.

Short-Term Opportunities

Exhaustion gaps can provide short-term trading opportunities. Be prepared to enter and exit trades quickly to capitalize on these movements.

Gap Trading with Options

Advantages of Options in Gap Trading

Leverage

Options provide leverage, allowing you to control a larger position with a smaller investment.

Defined Risk

Options have predefined risk, making them suitable for volatile gap trading scenarios.

Options Strategies for Gaps

Buying Calls and Puts

Buy calls if you expect the stock to gap up and puts if you expect it to gap down. This strategy allows you to capitalize on significant price movements.

Straddles and Strangles

Use straddles and strangles to profit from significant price movements in either direction. These strategies involve buying both call and put options.

Risk Management

Setting Stop-Loss Orders

Importance of Stop-Losses

Stop-loss orders protect your capital by limiting potential losses. Always use them when trading gaps.

Adjusting Stop-Losses

Adjust stop-loss levels as the trade progresses to lock in profits and minimize risk.

Position Sizing

Calculating Position Size

Determine the appropriate position size based on your risk tolerance and the potential size of the gap.

Diversifying Trades

Avoid putting all your capital into a single gap trade. Diversify your trades to spread risk.

Tools and Resources for Gap Trading

Trading Platforms

Choose a trading platform that offers real-time data, advanced charting tools, and customizable alerts.

Educational Resources

Leverage books, articles, and online courses to deepen your understanding of gap trading strategies.

Market Analysis Tools

Use market analysis tools to monitor news, earnings reports, and other events that can create gaps.

Conclusion

Why Practice Gap Trading?

Gap trading offers unique opportunities for significant profits by capitalizing on price movements caused by market events. With Damon Verial’s strategies, traders can effectively navigate these gaps and enhance their trading performance.

FAQs

1. What is gap trading?

Gap trading involves taking advantage of price gaps that occur when a stock opens at a different price than its previous close, usually due to market-moving events.

2. What are the different types of gaps?

The different types of gaps include common gaps, breakaway gaps, runaway gaps, and exhaustion gaps, each indicating different market conditions.

3. How can options be used in gap trading?

Options can be used in gap trading to provide leverage and defined risk. Strategies like buying calls and puts, and using straddles and strangles, can be effective.

4. Why is risk management important in gap trading?

Risk management is crucial in gap trading to protect your capital and minimize potential losses. This includes setting stop-loss orders and diversifying trades.

5. What tools are helpful for gap trading?

Helpful tools for gap trading include advanced trading platforms, market analysis tools, and educational resources to stay informed about potential gaps and trading strategies.

Be the first to review “Gap Trading for Stock and Options Traders with Damon Verial” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.