-

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

Day Trade Futures Online with Larry Williams

1 × $6.00

Day Trade Futures Online with Larry Williams

1 × $6.00 -

×

How to Buy Stocks Before They Skyrocket

1 × $6.00

How to Buy Stocks Before They Skyrocket

1 × $6.00 -

×

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00 -

×

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00 -

×

Daily Price Action

1 × $23.00

Daily Price Action

1 × $23.00 -

×

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00 -

×

Trading Masterclass XVII with Wysetrade

1 × $6.00

Trading Masterclass XVII with Wysetrade

1 × $6.00 -

×

Project Manager’s Spotlight on Risk Management with Kim Heldman

1 × $5.00

Project Manager’s Spotlight on Risk Management with Kim Heldman

1 × $5.00 -

×

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00 -

×

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00 -

×

Exacttrading - Price Action Trader Course

1 × $15.00

Exacttrading - Price Action Trader Course

1 × $15.00 -

×

The Great Reflation with Anthony Boeckh

1 × $6.00

The Great Reflation with Anthony Boeckh

1 × $6.00 -

×

Master Time Factor & Forecasting with Mathematical Rules

1 × $6.00

Master Time Factor & Forecasting with Mathematical Rules

1 × $6.00 -

×

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00 -

×

Pattern Recognition: A Fundamental Introduction to Japanese Candlestick Charting Techniques Class with Jeff Bierman

1 × $6.00

Pattern Recognition: A Fundamental Introduction to Japanese Candlestick Charting Techniques Class with Jeff Bierman

1 × $6.00 -

×

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00 -

×

Elliott Wave Simplified with Clif Droke

1 × $6.00

Elliott Wave Simplified with Clif Droke

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

TradeWithChris - TWC Forex Trading Course

1 × $6.00

TradeWithChris - TWC Forex Trading Course

1 × $6.00 -

×

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

Pricing of Bond Options with Detlef Repplinger

1 × $6.00

Pricing of Bond Options with Detlef Repplinger

1 × $6.00 -

×

Activedaytrader - Mastering Technicals

1 × $15.00

Activedaytrader - Mastering Technicals

1 × $15.00 -

×

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00 -

×

Earnings Reaction Gaps Workshop with John Pocorobba

1 × $27.00

Earnings Reaction Gaps Workshop with John Pocorobba

1 × $27.00 -

×

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00 -

×

Mastering Daily Option Trading with Option Pit

1 × $93.00

Mastering Daily Option Trading with Option Pit

1 × $93.00 -

×

Nora Bystra Legacy International Complete Course

1 × $6.00

Nora Bystra Legacy International Complete Course

1 × $6.00 -

×

Getting Started in Stocks with Alvin D.Hall

1 × $6.00

Getting Started in Stocks with Alvin D.Hall

1 × $6.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

The LP Trading Course

1 × $13.00

The LP Trading Course

1 × $13.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00 -

×

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00 -

×

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

1 × $6.00

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

1 × $6.00 -

×

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00 -

×

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

Futures Trading Blueprint with Day Trader Next Door

1 × $5.00

Futures Trading Blueprint with Day Trader Next Door

1 × $5.00 -

×

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00 -

×

Optimize Funding Program 2023 with Solo Network Courses

1 × $13.00

Optimize Funding Program 2023 with Solo Network Courses

1 × $13.00 -

×

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00 -

×

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00 -

×

Project Gorilla

1 × $5.00

Project Gorilla

1 × $5.00 -

×

Selling Options for Income, Profits & Opportunistic Hedge Trading Management with Powercycletrading

1 × $69.00

Selling Options for Income, Profits & Opportunistic Hedge Trading Management with Powercycletrading

1 × $69.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Phantom of the Pit BY Art Simpson

1 × $6.00

Phantom of the Pit BY Art Simpson

1 × $6.00 -

×

D5 Render Course with Nuno Silva

1 × $27.00

D5 Render Course with Nuno Silva

1 × $27.00 -

×

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00 -

×

Royal Exchange Forex with Jan Teslar

1 × $6.00

Royal Exchange Forex with Jan Teslar

1 × $6.00 -

×

AnkhFX Academy Course

1 × $17.00

AnkhFX Academy Course

1 × $17.00 -

×

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00 -

×

The Stock Selector System with Michael Sheimo

1 × $6.00

The Stock Selector System with Michael Sheimo

1 × $6.00 -

×

FX GOAT 3.0 (STRATEGIES) with FX GOAT FOREX TRADING ACADEMY

1 × $15.00

FX GOAT 3.0 (STRATEGIES) with FX GOAT FOREX TRADING ACADEMY

1 × $15.00 -

×

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00

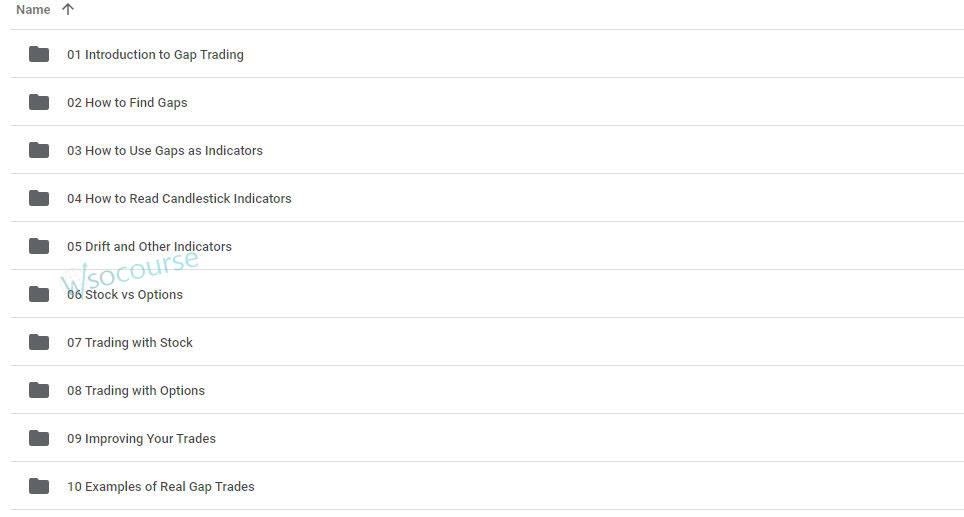

Gap Trading for Stock and Options Traders with Damon Verial

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Gap Trading for Stock and Options Traders with Damon Verial” below:

Gap Trading for Stock and Options Traders with Damon Verial

Gap trading is a strategy that takes advantage of price gaps in the stock market. These gaps can present lucrative opportunities for traders who know how to navigate them effectively. Damon Verial, a seasoned market analyst, provides insightful strategies for gap trading. In this article, we explore how stock and options traders can benefit from gap trading techniques taught by Damon Verial.

Introduction

Who is Damon Verial?

Damon Verial is a respected market analyst and financial educator known for his expertise in stock and options trading. His strategies focus on data-driven analysis and practical trading techniques.

What is Gap Trading?

Gap trading involves taking advantage of the price gaps that occur when a stock opens at a significantly different price than its previous closing price. These gaps can result from after-hours news, earnings reports, or other market-moving events.

Understanding Price Gaps

Types of Gaps

Common Gaps

Common gaps occur in the middle of a trading range and are usually insignificant in terms of price movement.

Breakaway Gaps

Breakaway gaps happen at the beginning of a trend and indicate a strong movement in the direction of the gap.

Runaway Gaps

Runaway gaps, also known as continuation gaps, occur in the middle of a trend and indicate strong ongoing momentum.

Exhaustion Gaps

Exhaustion gaps appear near the end of a trend and suggest a possible reversal or slowdown in the price movement.

Identifying Gaps

Chart Patterns

Using chart patterns and technical analysis tools helps identify potential gaps. Verial emphasizes the importance of understanding these patterns for successful gap trading.

Volume Analysis

Volume analysis can confirm the significance of a gap. High trading volume typically accompanies more meaningful gaps.

Strategies for Gap Trading

Pre-Market Preparation

Monitoring Pre-Market Activity

Check pre-market trading activity to identify potential gaps. News, earnings reports, and economic data released before the market opens can create significant gaps.

Setting Up Alerts

Set up alerts for stocks you are monitoring to get notified of significant pre-market price changes.

Trading Breakaway Gaps

Entry Points

For breakaway gaps, enter trades in the direction of the gap. If a stock gaps up, consider buying; if it gaps down, consider shorting.

Stop-Loss Orders

Set stop-loss orders to manage risk. Place them just below the gap for long positions and just above the gap for short positions.

Trading Runaway Gaps

Following the Trend

Trade in the direction of the existing trend. Runaway gaps indicate strong momentum, so align your trades with this movement.

Adjusting Positions

As the trend continues, adjust your positions to lock in profits and manage risk.

Trading Exhaustion Gaps

Recognizing Reversals

Exhaustion gaps often signal reversals. Look for confirmation through volume analysis and other technical indicators before entering a trade.

Short-Term Opportunities

Exhaustion gaps can provide short-term trading opportunities. Be prepared to enter and exit trades quickly to capitalize on these movements.

Gap Trading with Options

Advantages of Options in Gap Trading

Leverage

Options provide leverage, allowing you to control a larger position with a smaller investment.

Defined Risk

Options have predefined risk, making them suitable for volatile gap trading scenarios.

Options Strategies for Gaps

Buying Calls and Puts

Buy calls if you expect the stock to gap up and puts if you expect it to gap down. This strategy allows you to capitalize on significant price movements.

Straddles and Strangles

Use straddles and strangles to profit from significant price movements in either direction. These strategies involve buying both call and put options.

Risk Management

Setting Stop-Loss Orders

Importance of Stop-Losses

Stop-loss orders protect your capital by limiting potential losses. Always use them when trading gaps.

Adjusting Stop-Losses

Adjust stop-loss levels as the trade progresses to lock in profits and minimize risk.

Position Sizing

Calculating Position Size

Determine the appropriate position size based on your risk tolerance and the potential size of the gap.

Diversifying Trades

Avoid putting all your capital into a single gap trade. Diversify your trades to spread risk.

Tools and Resources for Gap Trading

Trading Platforms

Choose a trading platform that offers real-time data, advanced charting tools, and customizable alerts.

Educational Resources

Leverage books, articles, and online courses to deepen your understanding of gap trading strategies.

Market Analysis Tools

Use market analysis tools to monitor news, earnings reports, and other events that can create gaps.

Conclusion

Why Practice Gap Trading?

Gap trading offers unique opportunities for significant profits by capitalizing on price movements caused by market events. With Damon Verial’s strategies, traders can effectively navigate these gaps and enhance their trading performance.

FAQs

1. What is gap trading?

Gap trading involves taking advantage of price gaps that occur when a stock opens at a different price than its previous close, usually due to market-moving events.

2. What are the different types of gaps?

The different types of gaps include common gaps, breakaway gaps, runaway gaps, and exhaustion gaps, each indicating different market conditions.

3. How can options be used in gap trading?

Options can be used in gap trading to provide leverage and defined risk. Strategies like buying calls and puts, and using straddles and strangles, can be effective.

4. Why is risk management important in gap trading?

Risk management is crucial in gap trading to protect your capital and minimize potential losses. This includes setting stop-loss orders and diversifying trades.

5. What tools are helpful for gap trading?

Helpful tools for gap trading include advanced trading platforms, market analysis tools, and educational resources to stay informed about potential gaps and trading strategies.

Be the first to review “Gap Trading for Stock and Options Traders with Damon Verial” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.