-

×

Pro Indicator Pack with Trade Confident

1 × $15.00

Pro Indicator Pack with Trade Confident

1 × $15.00 -

×

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00 -

×

Dynamite TNT Forex System with Clarence Chee

1 × $6.00

Dynamite TNT Forex System with Clarence Chee

1 × $6.00 -

×

SI Indicator Course 2023 with Scott Pulcini

1 × $15.00

SI Indicator Course 2023 with Scott Pulcini

1 × $15.00 -

×

Investment Mathematics with Andrew Adams

1 × $6.00

Investment Mathematics with Andrew Adams

1 × $6.00 -

×

Pattern Cycles with Alan Farley

1 × $6.00

Pattern Cycles with Alan Farley

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Gold Trading Academy Video Course

1 × $23.00

Gold Trading Academy Video Course

1 × $23.00 -

×

Pro Tradeciety FOREX TRADING ACADEMY

1 × $31.00

Pro Tradeciety FOREX TRADING ACADEMY

1 × $31.00 -

×

Recover Your Losses & Double Your Account Size with Tokyo The Trader - PLFCrypto

1 × $6.00

Recover Your Losses & Double Your Account Size with Tokyo The Trader - PLFCrypto

1 × $6.00 -

×

ATM Forex 2009 System Manual, Videos & Indicators with Keith Cotterill

1 × $6.00

ATM Forex 2009 System Manual, Videos & Indicators with Keith Cotterill

1 × $6.00 -

×

Module III - Peak Formation Trades with FX MindShift

1 × $6.00

Module III - Peak Formation Trades with FX MindShift

1 × $6.00 -

×

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00 -

×

Offshore Keys (2023)

1 × $5.00

Offshore Keys (2023)

1 × $5.00 -

×

Zen in the Markets with Edward Allen Toppel

1 × $6.00

Zen in the Markets with Edward Allen Toppel

1 × $6.00 -

×

Stock Options Day Trading Mindset for Success with Allen Maxwell, Scott Paton, & Scott Alex

1 × $5.00

Stock Options Day Trading Mindset for Success with Allen Maxwell, Scott Paton, & Scott Alex

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00 -

×

The TradingKey - Mastering Elliott Wave by Rob Roy 2010 + Complete Workbooks with HUBB Financial

1 × $6.00

The TradingKey - Mastering Elliott Wave by Rob Roy 2010 + Complete Workbooks with HUBB Financial

1 × $6.00 -

×

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00 -

×

LT Gamma Confirmation

1 × $23.00

LT Gamma Confirmation

1 × $23.00 -

×

Guide To Selling High Probability Spreads Class with Don Kaufman

1 × $6.00

Guide To Selling High Probability Spreads Class with Don Kaufman

1 × $6.00 -

×

The Options Trading Body of Knowledge with Michael Thomsett

1 × $6.00

The Options Trading Body of Knowledge with Michael Thomsett

1 × $6.00 -

×

The Greatest Trade Ever with Gregory Zuckerman

1 × $6.00

The Greatest Trade Ever with Gregory Zuckerman

1 × $6.00 -

×

Forex Millionaire Course with Willis University

1 × $6.00

Forex Millionaire Course with Willis University

1 × $6.00 -

×

The Ultimate Trading Course Elite & Complete Guide with Sean Dekmar

1 × $31.00

The Ultimate Trading Course Elite & Complete Guide with Sean Dekmar

1 × $31.00 -

×

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00 -

×

Dan Sheridan Butterfly Course + Iron Condor Class Bundle Pack

1 × $23.00

Dan Sheridan Butterfly Course + Iron Condor Class Bundle Pack

1 × $23.00 -

×

Auction Dashboard

1 × $15.00

Auction Dashboard

1 × $15.00 -

×

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00 -

×

AIME System Forex Trading Course

1 × $6.00

AIME System Forex Trading Course

1 × $6.00 -

×

Trading Systems Explained with Martin Pring

1 × $6.00

Trading Systems Explained with Martin Pring

1 × $6.00 -

×

Forex 800k Workshop with Spartan Trader

1 × $23.00

Forex 800k Workshop with Spartan Trader

1 × $23.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Lazy Emini Trader Master Class

1 × $15.00

Lazy Emini Trader Master Class

1 × $15.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

Profit Wave Trade Strategy with Base Camp Trading

1 × $4.00

Profit Wave Trade Strategy with Base Camp Trading

1 × $4.00 -

×

How to Collect Income Being Short with Don Kaufman

1 × $6.00

How to Collect Income Being Short with Don Kaufman

1 × $6.00 -

×

Forex EURUSD Trader Live Training (2012)

1 × $6.00

Forex EURUSD Trader Live Training (2012)

1 × $6.00 -

×

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00 -

×

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00 -

×

Electronic AGS Trading Workshop with John Carter & Hunert Senters

1 × $6.00

Electronic AGS Trading Workshop with John Carter & Hunert Senters

1 × $6.00 -

×

Ultimate Day Trading Program with Maroun4x

1 × $5.00

Ultimate Day Trading Program with Maroun4x

1 × $5.00 -

×

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00 -

×

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00 -

×

Evolved Trader with Mark Croock

1 × $69.00

Evolved Trader with Mark Croock

1 × $69.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

Stock Market–Swing Trading Strategies for Wall Street with Bill Wermin

1 × $6.00

Stock Market–Swing Trading Strategies for Wall Street with Bill Wermin

1 × $6.00 -

×

Earnings Engine with Sami Abusaad - T3 Live

1 × $6.00

Earnings Engine with Sami Abusaad - T3 Live

1 × $6.00 -

×

Trading Day By Day & Code (chickgoslin.com) with Chick Goslin

1 × $6.00

Trading Day By Day & Code (chickgoslin.com) with Chick Goslin

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00

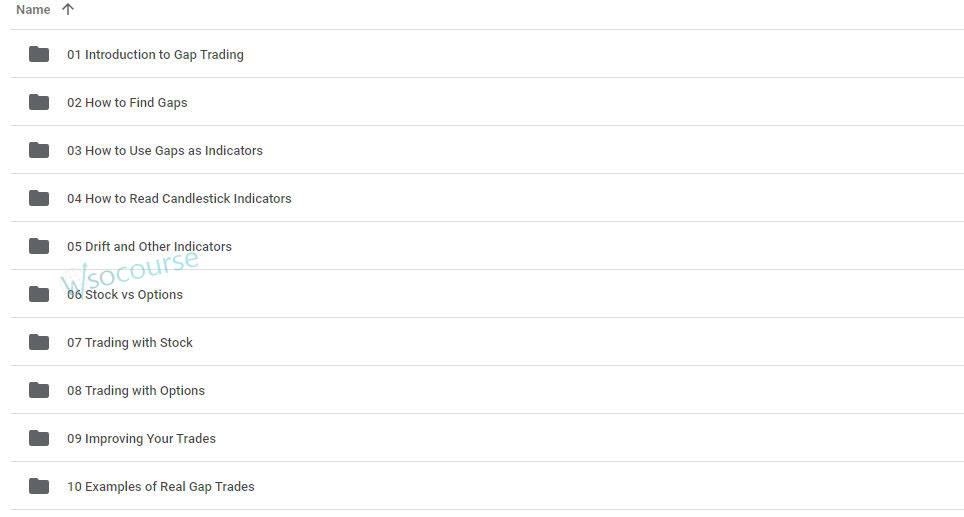

Gap Trading for Stock and Options Traders with Damon Verial

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Gap Trading for Stock and Options Traders with Damon Verial” below:

Gap Trading for Stock and Options Traders with Damon Verial

Gap trading is a strategy that takes advantage of price gaps in the stock market. These gaps can present lucrative opportunities for traders who know how to navigate them effectively. Damon Verial, a seasoned market analyst, provides insightful strategies for gap trading. In this article, we explore how stock and options traders can benefit from gap trading techniques taught by Damon Verial.

Introduction

Who is Damon Verial?

Damon Verial is a respected market analyst and financial educator known for his expertise in stock and options trading. His strategies focus on data-driven analysis and practical trading techniques.

What is Gap Trading?

Gap trading involves taking advantage of the price gaps that occur when a stock opens at a significantly different price than its previous closing price. These gaps can result from after-hours news, earnings reports, or other market-moving events.

Understanding Price Gaps

Types of Gaps

Common Gaps

Common gaps occur in the middle of a trading range and are usually insignificant in terms of price movement.

Breakaway Gaps

Breakaway gaps happen at the beginning of a trend and indicate a strong movement in the direction of the gap.

Runaway Gaps

Runaway gaps, also known as continuation gaps, occur in the middle of a trend and indicate strong ongoing momentum.

Exhaustion Gaps

Exhaustion gaps appear near the end of a trend and suggest a possible reversal or slowdown in the price movement.

Identifying Gaps

Chart Patterns

Using chart patterns and technical analysis tools helps identify potential gaps. Verial emphasizes the importance of understanding these patterns for successful gap trading.

Volume Analysis

Volume analysis can confirm the significance of a gap. High trading volume typically accompanies more meaningful gaps.

Strategies for Gap Trading

Pre-Market Preparation

Monitoring Pre-Market Activity

Check pre-market trading activity to identify potential gaps. News, earnings reports, and economic data released before the market opens can create significant gaps.

Setting Up Alerts

Set up alerts for stocks you are monitoring to get notified of significant pre-market price changes.

Trading Breakaway Gaps

Entry Points

For breakaway gaps, enter trades in the direction of the gap. If a stock gaps up, consider buying; if it gaps down, consider shorting.

Stop-Loss Orders

Set stop-loss orders to manage risk. Place them just below the gap for long positions and just above the gap for short positions.

Trading Runaway Gaps

Following the Trend

Trade in the direction of the existing trend. Runaway gaps indicate strong momentum, so align your trades with this movement.

Adjusting Positions

As the trend continues, adjust your positions to lock in profits and manage risk.

Trading Exhaustion Gaps

Recognizing Reversals

Exhaustion gaps often signal reversals. Look for confirmation through volume analysis and other technical indicators before entering a trade.

Short-Term Opportunities

Exhaustion gaps can provide short-term trading opportunities. Be prepared to enter and exit trades quickly to capitalize on these movements.

Gap Trading with Options

Advantages of Options in Gap Trading

Leverage

Options provide leverage, allowing you to control a larger position with a smaller investment.

Defined Risk

Options have predefined risk, making them suitable for volatile gap trading scenarios.

Options Strategies for Gaps

Buying Calls and Puts

Buy calls if you expect the stock to gap up and puts if you expect it to gap down. This strategy allows you to capitalize on significant price movements.

Straddles and Strangles

Use straddles and strangles to profit from significant price movements in either direction. These strategies involve buying both call and put options.

Risk Management

Setting Stop-Loss Orders

Importance of Stop-Losses

Stop-loss orders protect your capital by limiting potential losses. Always use them when trading gaps.

Adjusting Stop-Losses

Adjust stop-loss levels as the trade progresses to lock in profits and minimize risk.

Position Sizing

Calculating Position Size

Determine the appropriate position size based on your risk tolerance and the potential size of the gap.

Diversifying Trades

Avoid putting all your capital into a single gap trade. Diversify your trades to spread risk.

Tools and Resources for Gap Trading

Trading Platforms

Choose a trading platform that offers real-time data, advanced charting tools, and customizable alerts.

Educational Resources

Leverage books, articles, and online courses to deepen your understanding of gap trading strategies.

Market Analysis Tools

Use market analysis tools to monitor news, earnings reports, and other events that can create gaps.

Conclusion

Why Practice Gap Trading?

Gap trading offers unique opportunities for significant profits by capitalizing on price movements caused by market events. With Damon Verial’s strategies, traders can effectively navigate these gaps and enhance their trading performance.

FAQs

1. What is gap trading?

Gap trading involves taking advantage of price gaps that occur when a stock opens at a different price than its previous close, usually due to market-moving events.

2. What are the different types of gaps?

The different types of gaps include common gaps, breakaway gaps, runaway gaps, and exhaustion gaps, each indicating different market conditions.

3. How can options be used in gap trading?

Options can be used in gap trading to provide leverage and defined risk. Strategies like buying calls and puts, and using straddles and strangles, can be effective.

4. Why is risk management important in gap trading?

Risk management is crucial in gap trading to protect your capital and minimize potential losses. This includes setting stop-loss orders and diversifying trades.

5. What tools are helpful for gap trading?

Helpful tools for gap trading include advanced trading platforms, market analysis tools, and educational resources to stay informed about potential gaps and trading strategies.

Be the first to review “Gap Trading for Stock and Options Traders with Damon Verial” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.