-

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

Defending Options with Simpler Options

1 × $6.00

Defending Options with Simpler Options

1 × $6.00 -

×

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00 -

×

Mastering Metatrader 4 in 90 Minutes & Members Site with Alan Benefield

1 × $15.00

Mastering Metatrader 4 in 90 Minutes & Members Site with Alan Benefield

1 × $15.00 -

×

How to Spot Trading Opportunities

1 × $6.00

How to Spot Trading Opportunities

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

Elliott Wave Simplified with Clif Droke

1 × $6.00

Elliott Wave Simplified with Clif Droke

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Generating Consistent Profits On Smaller Accounts

1 × $23.00

Generating Consistent Profits On Smaller Accounts

1 × $23.00 -

×

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00 -

×

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00 -

×

ASFX Beginner Training Course & VIP Chat with ASFX Day Trading

1 × $31.00

ASFX Beginner Training Course & VIP Chat with ASFX Day Trading

1 × $31.00 -

×

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Sample Item Sets 2003 - CFA Level 3

1 × $6.00

Sample Item Sets 2003 - CFA Level 3

1 × $6.00 -

×

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00 -

×

7 Day FX Mastery Course with Market Masters

1 × $6.00

7 Day FX Mastery Course with Market Masters

1 × $6.00 -

×

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00 -

×

Part-Time Day Trading Courses

1 × $54.00

Part-Time Day Trading Courses

1 × $54.00 -

×

Zap Seminar - Ablesys

1 × $6.00

Zap Seminar - Ablesys

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Larry Williams Newsletters (1994-1997)

1 × $6.00

Larry Williams Newsletters (1994-1997)

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

How to Create & Manage a Mutal Fund or ETF with Melinda Gerber

1 × $6.00

How to Create & Manage a Mutal Fund or ETF with Melinda Gerber

1 × $6.00 -

×

Foundations of Stock & Options. Home Study Course

1 × $6.00

Foundations of Stock & Options. Home Study Course

1 × $6.00 -

×

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00 -

×

Trade Australian Share CFDs with Brian Griffin

1 × $6.00

Trade Australian Share CFDs with Brian Griffin

1 × $6.00 -

×

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00 -

×

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00 -

×

The New Goldrush Of 2021 with Keith Dougherty

1 × $46.00

The New Goldrush Of 2021 with Keith Dougherty

1 × $46.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00 -

×

How to Make Money in Deflationary Markets with Gary Shilling

1 × $6.00

How to Make Money in Deflationary Markets with Gary Shilling

1 × $6.00 -

×

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00 -

×

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Introduction to Macro Investing with Mike Singleton

1 × $31.00

Introduction to Macro Investing with Mike Singleton

1 × $31.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The PPS Trading System with Curtis Arnold

1 × $6.00

The PPS Trading System with Curtis Arnold

1 × $6.00 -

×

Practical Introduction to Bollinger Bands 2013

1 × $6.00

Practical Introduction to Bollinger Bands 2013

1 × $6.00 -

×

FOREX STRATEGY #1 with Steven Primo

1 × $39.00

FOREX STRATEGY #1 with Steven Primo

1 × $39.00 -

×

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00 -

×

VagaFX Academy Course with VAGAFX

1 × $41.00

VagaFX Academy Course with VAGAFX

1 × $41.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Master Trader Course

1 × $23.00

Master Trader Course

1 × $23.00 -

×

Tandem Trader with Investors Underground

1 × $6.00

Tandem Trader with Investors Underground

1 × $6.00 -

×

E-mini Weekly Options Income with Peter Titus

1 × $15.00

E-mini Weekly Options Income with Peter Titus

1 × $15.00 -

×

Speculating with Futures and Traditional Commodities Part II (Liverpool Group) - Noble DraKoln

1 × $6.00

Speculating with Futures and Traditional Commodities Part II (Liverpool Group) - Noble DraKoln

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00 -

×

NJAT Trading Course with Not Just A Trade

1 × $6.00

NJAT Trading Course with Not Just A Trade

1 × $6.00 -

×

ACB Forex Trading Suite with ACB Forex Trading Solutions

1 × $6.00

ACB Forex Trading Suite with ACB Forex Trading Solutions

1 × $6.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

Numbers: Their Occult Power and Mystic Virtues

1 × $4.00

Numbers: Their Occult Power and Mystic Virtues

1 × $4.00 -

×

Info Product Mastery - Ron Douglas & Alice Seba

1 × $6.00

Info Product Mastery - Ron Douglas & Alice Seba

1 × $6.00 -

×

Gamma Options Boot Camp with Bigtrends

1 × $74.00

Gamma Options Boot Camp with Bigtrends

1 × $74.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

My Favorite Trades – Trading Mastery

1 × $6.00

My Favorite Trades – Trading Mastery

1 × $6.00 -

×

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00 -

×

An Introduction to Option Trading Success with James Bittman

1 × $6.00

An Introduction to Option Trading Success with James Bittman

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

VWAP Trading course with Trade With Trend

1 × $6.00

VWAP Trading course with Trade With Trend

1 × $6.00 -

×

Market Forecasting. Stocks and Grain

1 × $6.00

Market Forecasting. Stocks and Grain

1 × $6.00 -

×

The Master Indicator 2023 with Lance Ippolito

1 × $101.00

The Master Indicator 2023 with Lance Ippolito

1 × $101.00 -

×

Pattern Trader Pro with ForexStore

1 × $6.00

Pattern Trader Pro with ForexStore

1 × $6.00 -

×

CyberTrading University – Advanced Stock Course

1 × $31.00

CyberTrading University – Advanced Stock Course

1 × $31.00 -

×

Momentum Signals Training Course with Fulcum Trader

1 × $5.00

Momentum Signals Training Course with Fulcum Trader

1 × $5.00 -

×

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00 -

×

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00 -

×

Renko Mastery Intensive Program

1 × $85.00

Renko Mastery Intensive Program

1 × $85.00 -

×

MorningSwing Method with Austin Passamonte

1 × $6.00

MorningSwing Method with Austin Passamonte

1 × $6.00 -

×

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00 -

×

Mao, Marx & the Market: Capitalist Adventures in Russia and China with Dean LeBaro

1 × $6.00

Mao, Marx & the Market: Capitalist Adventures in Russia and China with Dean LeBaro

1 × $6.00 -

×

SnD SMC Course

1 × $10.00

SnD SMC Course

1 × $10.00 -

×

Capital Asset Investment with Anthony F.Herbst

1 × $6.00

Capital Asset Investment with Anthony F.Herbst

1 × $6.00 -

×

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00 -

×

Fibonacci Analysis with Constance Brown

1 × $6.00

Fibonacci Analysis with Constance Brown

1 × $6.00 -

×

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00 -

×

SWING TRADING WITH CONFIDENCE

1 × $31.00

SWING TRADING WITH CONFIDENCE

1 × $31.00 -

×

PennyStocking with Timothy Sykes

1 × $5.00

PennyStocking with Timothy Sykes

1 × $5.00 -

×

Jeffrey Kennedy’s Package ( Discount 25% )

1 × $31.00

Jeffrey Kennedy’s Package ( Discount 25% )

1 × $31.00 -

×

How I Day Trade Course with Traderade

1 × $15.00

How I Day Trade Course with Traderade

1 × $15.00 -

×

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00 -

×

SI Indicator Course 2023 with Scott Pulcini

1 × $15.00

SI Indicator Course 2023 with Scott Pulcini

1 × $15.00 -

×

How to Find a Trading Strategy with Mike Baehr

1 × $124.00

How to Find a Trading Strategy with Mike Baehr

1 × $124.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Market Structure Masterclass with Braveheart Trading

1 × $5.00

Market Structure Masterclass with Braveheart Trading

1 × $5.00 -

×

Masterclass 5.0 with RockzFX

1 × $5.00

Masterclass 5.0 with RockzFX

1 × $5.00 -

×

The Michanics of Futures Trading - Roy Habben

1 × $6.00

The Michanics of Futures Trading - Roy Habben

1 × $6.00 -

×

Trade Execution with Yuri Shramenko

1 × $6.00

Trade Execution with Yuri Shramenko

1 × $6.00 -

×

Sell Premium & Minimize Risk Class with Don Kaufman

1 × $6.00

Sell Premium & Minimize Risk Class with Don Kaufman

1 × $6.00 -

×

DiNapoli Levels Training Course with Joe DiNapoli & Merrick Okamoto

1 × $6.00

DiNapoli Levels Training Course with Joe DiNapoli & Merrick Okamoto

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

Gap Trading for Stock and Options Traders with Damon Verial

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

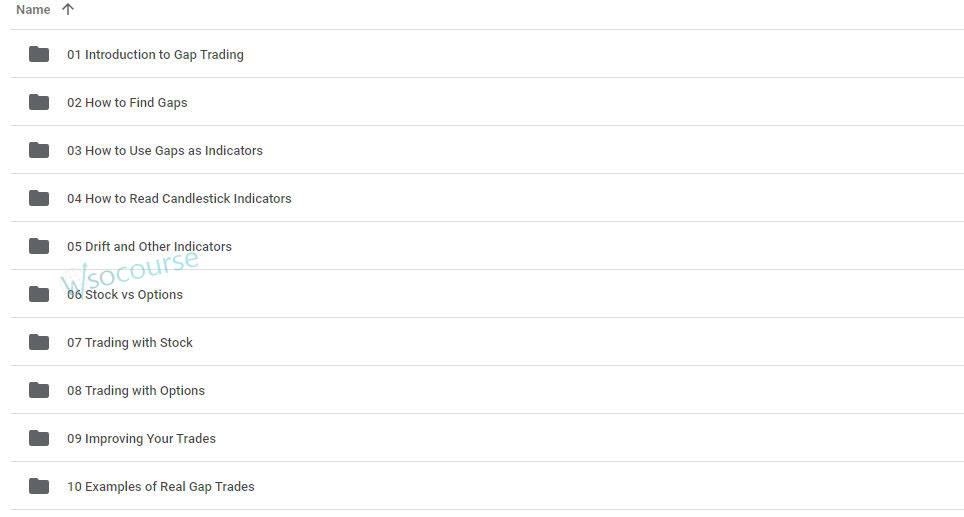

You may check content proof of “Gap Trading for Stock and Options Traders with Damon Verial” below:

Gap Trading for Stock and Options Traders with Damon Verial

Gap trading is a strategy that takes advantage of price gaps in the stock market. These gaps can present lucrative opportunities for traders who know how to navigate them effectively. Damon Verial, a seasoned market analyst, provides insightful strategies for gap trading. In this article, we explore how stock and options traders can benefit from gap trading techniques taught by Damon Verial.

Introduction

Who is Damon Verial?

Damon Verial is a respected market analyst and financial educator known for his expertise in stock and options trading. His strategies focus on data-driven analysis and practical trading techniques.

What is Gap Trading?

Gap trading involves taking advantage of the price gaps that occur when a stock opens at a significantly different price than its previous closing price. These gaps can result from after-hours news, earnings reports, or other market-moving events.

Understanding Price Gaps

Types of Gaps

Common Gaps

Common gaps occur in the middle of a trading range and are usually insignificant in terms of price movement.

Breakaway Gaps

Breakaway gaps happen at the beginning of a trend and indicate a strong movement in the direction of the gap.

Runaway Gaps

Runaway gaps, also known as continuation gaps, occur in the middle of a trend and indicate strong ongoing momentum.

Exhaustion Gaps

Exhaustion gaps appear near the end of a trend and suggest a possible reversal or slowdown in the price movement.

Identifying Gaps

Chart Patterns

Using chart patterns and technical analysis tools helps identify potential gaps. Verial emphasizes the importance of understanding these patterns for successful gap trading.

Volume Analysis

Volume analysis can confirm the significance of a gap. High trading volume typically accompanies more meaningful gaps.

Strategies for Gap Trading

Pre-Market Preparation

Monitoring Pre-Market Activity

Check pre-market trading activity to identify potential gaps. News, earnings reports, and economic data released before the market opens can create significant gaps.

Setting Up Alerts

Set up alerts for stocks you are monitoring to get notified of significant pre-market price changes.

Trading Breakaway Gaps

Entry Points

For breakaway gaps, enter trades in the direction of the gap. If a stock gaps up, consider buying; if it gaps down, consider shorting.

Stop-Loss Orders

Set stop-loss orders to manage risk. Place them just below the gap for long positions and just above the gap for short positions.

Trading Runaway Gaps

Following the Trend

Trade in the direction of the existing trend. Runaway gaps indicate strong momentum, so align your trades with this movement.

Adjusting Positions

As the trend continues, adjust your positions to lock in profits and manage risk.

Trading Exhaustion Gaps

Recognizing Reversals

Exhaustion gaps often signal reversals. Look for confirmation through volume analysis and other technical indicators before entering a trade.

Short-Term Opportunities

Exhaustion gaps can provide short-term trading opportunities. Be prepared to enter and exit trades quickly to capitalize on these movements.

Gap Trading with Options

Advantages of Options in Gap Trading

Leverage

Options provide leverage, allowing you to control a larger position with a smaller investment.

Defined Risk

Options have predefined risk, making them suitable for volatile gap trading scenarios.

Options Strategies for Gaps

Buying Calls and Puts

Buy calls if you expect the stock to gap up and puts if you expect it to gap down. This strategy allows you to capitalize on significant price movements.

Straddles and Strangles

Use straddles and strangles to profit from significant price movements in either direction. These strategies involve buying both call and put options.

Risk Management

Setting Stop-Loss Orders

Importance of Stop-Losses

Stop-loss orders protect your capital by limiting potential losses. Always use them when trading gaps.

Adjusting Stop-Losses

Adjust stop-loss levels as the trade progresses to lock in profits and minimize risk.

Position Sizing

Calculating Position Size

Determine the appropriate position size based on your risk tolerance and the potential size of the gap.

Diversifying Trades

Avoid putting all your capital into a single gap trade. Diversify your trades to spread risk.

Tools and Resources for Gap Trading

Trading Platforms

Choose a trading platform that offers real-time data, advanced charting tools, and customizable alerts.

Educational Resources

Leverage books, articles, and online courses to deepen your understanding of gap trading strategies.

Market Analysis Tools

Use market analysis tools to monitor news, earnings reports, and other events that can create gaps.

Conclusion

Why Practice Gap Trading?

Gap trading offers unique opportunities for significant profits by capitalizing on price movements caused by market events. With Damon Verial’s strategies, traders can effectively navigate these gaps and enhance their trading performance.

FAQs

1. What is gap trading?

Gap trading involves taking advantage of price gaps that occur when a stock opens at a different price than its previous close, usually due to market-moving events.

2. What are the different types of gaps?

The different types of gaps include common gaps, breakaway gaps, runaway gaps, and exhaustion gaps, each indicating different market conditions.

3. How can options be used in gap trading?

Options can be used in gap trading to provide leverage and defined risk. Strategies like buying calls and puts, and using straddles and strangles, can be effective.

4. Why is risk management important in gap trading?

Risk management is crucial in gap trading to protect your capital and minimize potential losses. This includes setting stop-loss orders and diversifying trades.

5. What tools are helpful for gap trading?

Helpful tools for gap trading include advanced trading platforms, market analysis tools, and educational resources to stay informed about potential gaps and trading strategies.

Be the first to review “Gap Trading for Stock and Options Traders with Damon Verial” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.