-

×

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00 -

×

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00 -

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

Trading as a Business with Alexander Elder

1 × $6.00

Trading as a Business with Alexander Elder

1 × $6.00 -

×

Acclimation Course with Base Camp Trading

1 × $10.00

Acclimation Course with Base Camp Trading

1 × $10.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Computational Financial Mathematics with Mathematica

1 × $6.00

Computational Financial Mathematics with Mathematica

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Preview of Markets with George Bayer

1 × $6.00

Preview of Markets with George Bayer

1 × $6.00 -

×

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00 -

×

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00 -

×

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00 -

×

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Forex Secrets Exposed

1 × $15.00

Forex Secrets Exposed

1 × $15.00 -

×

Forex Strategy Course with Angel Traders

1 × $6.00

Forex Strategy Course with Angel Traders

1 × $6.00 -

×

Long-Term Secrets to Short-Term Trading with Larry Williams

1 × $6.00

Long-Term Secrets to Short-Term Trading with Larry Williams

1 × $6.00 -

×

Support and Resistance Trading with Rob Booker

1 × $6.00

Support and Resistance Trading with Rob Booker

1 × $6.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00 -

×

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00 -

×

Ron Wagner – Creating a Profitable Trading & Investing Plan. 6 Key Components with Pristine

1 × $4.00

Ron Wagner – Creating a Profitable Trading & Investing Plan. 6 Key Components with Pristine

1 × $4.00 -

×

Staying Out of Trouble Trading Currency with Channels - Barbara Rockefeller

1 × $6.00

Staying Out of Trouble Trading Currency with Channels - Barbara Rockefeller

1 × $6.00 -

×

7 Figures Forex Course

1 × $15.00

7 Figures Forex Course

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00 -

×

Financial Fortress with TradeSmart University

1 × $6.00

Financial Fortress with TradeSmart University

1 × $6.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Mastertrader – Mastering Swing Trading

1 × $31.00

Mastertrader – Mastering Swing Trading

1 × $31.00 -

×

Century Capital Group Course with Dylan Forexia

1 × $6.00

Century Capital Group Course with Dylan Forexia

1 × $6.00 -

×

Geometric Angles Applied To Modern Markets with Sean Avidar

1 × $39.00

Geometric Angles Applied To Modern Markets with Sean Avidar

1 × $39.00 -

×

The Compleat DayTrader I & II with Jack Bernstein

1 × $6.00

The Compleat DayTrader I & II with Jack Bernstein

1 × $6.00 -

×

Simple Forex Profits with Rayy Bannzz

1 × $31.00

Simple Forex Profits with Rayy Bannzz

1 × $31.00 -

×

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00

Neural Networks in the Capital Markets with Apostolos Paul Refenes

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00 -

×

Quarterly Theory with Trader Daye

1 × $20.00

Quarterly Theory with Trader Daye

1 × $20.00 -

×

Profit Power Seminar

1 × $23.00

Profit Power Seminar

1 × $23.00 -

×

Euro Trading Course with Bkforex

1 × $6.00

Euro Trading Course with Bkforex

1 × $6.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00 -

×

8 Strategies for Day Trading

1 × $31.00

8 Strategies for Day Trading

1 × $31.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Stochastic Calculus with Alan Bain

1 × $6.00

Stochastic Calculus with Alan Bain

1 × $6.00 -

×

Advanced Options Trading with Lucas Downey

1 × $15.00

Advanced Options Trading with Lucas Downey

1 × $15.00 -

×

Simple Smart Forex Renko Program with Nikos Mermigas

1 × $10.00

Simple Smart Forex Renko Program with Nikos Mermigas

1 × $10.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Trading Trainer - 6 Percent Protocol

1 × $39.00

Trading Trainer - 6 Percent Protocol

1 × $39.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00 -

×

7 Day FX Mastery Course with Market Masters

1 × $6.00

7 Day FX Mastery Course with Market Masters

1 × $6.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Profitable Strategies with Gemify Academy

1 × $10.00

Profitable Strategies with Gemify Academy

1 × $10.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Trading Masterclass with Chris Capre

1 × $23.00

The Trading Masterclass with Chris Capre

1 × $23.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

Pattern Picking with Charles Drummond

1 × $6.00

Pattern Picking with Charles Drummond

1 × $6.00 -

×

Smart Money Concepts with MFX Trading

1 × $13.00

Smart Money Concepts with MFX Trading

1 × $13.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Advanced Swing Trading with John Crane

1 × $6.00

Advanced Swing Trading with John Crane

1 × $6.00 -

×

30 Trading Classics with 3T Live

1 × $5.00

30 Trading Classics with 3T Live

1 × $5.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00 -

×

Optionetics 2007 - Home Study Course, MP3

1 × $6.00

Optionetics 2007 - Home Study Course, MP3

1 × $6.00 -

×

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00 -

×

BSAPPS FX Course with Ben Barker

1 × $6.00

BSAPPS FX Course with Ben Barker

1 × $6.00 -

×

Investment Performance Measurement with Bruce Feibel

1 × $6.00

Investment Performance Measurement with Bruce Feibel

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Complete Day Trading Course with The Trading Floor

1 × $13.00

Complete Day Trading Course with The Trading Floor

1 × $13.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Path to Profits By Scott Redler - T3 Live

1 × $6.00

Path to Profits By Scott Redler - T3 Live

1 × $6.00 -

×

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

6 (The Proper BackGround)

1 × $6.00

6 (The Proper BackGround)

1 × $6.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00 -

×

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00 -

×

Supercharge your Options Spread Trading with John Summa

1 × $6.00

Supercharge your Options Spread Trading with John Summa

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Traders Forge with Ryan Litchfield

1 × $6.00

Traders Forge with Ryan Litchfield

1 × $6.00 -

×

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00

Weekly Options Trading Advantage Class with Doc Severson

1 × $6.00 -

×

Options Academy Elevate with Simon Ree - Tao of Trading

1 × $109.00

Options Academy Elevate with Simon Ree - Tao of Trading

1 × $109.00 -

×

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00 -

×

All About Mutual Funds with Bruce Jacobs

1 × $6.00

All About Mutual Funds with Bruce Jacobs

1 × $6.00 -

×

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00 -

×

Psycho-Paper 96 with Charles Drummond

1 × $6.00

Psycho-Paper 96 with Charles Drummond

1 × $6.00 -

×

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00 -

×

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00 -

×

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

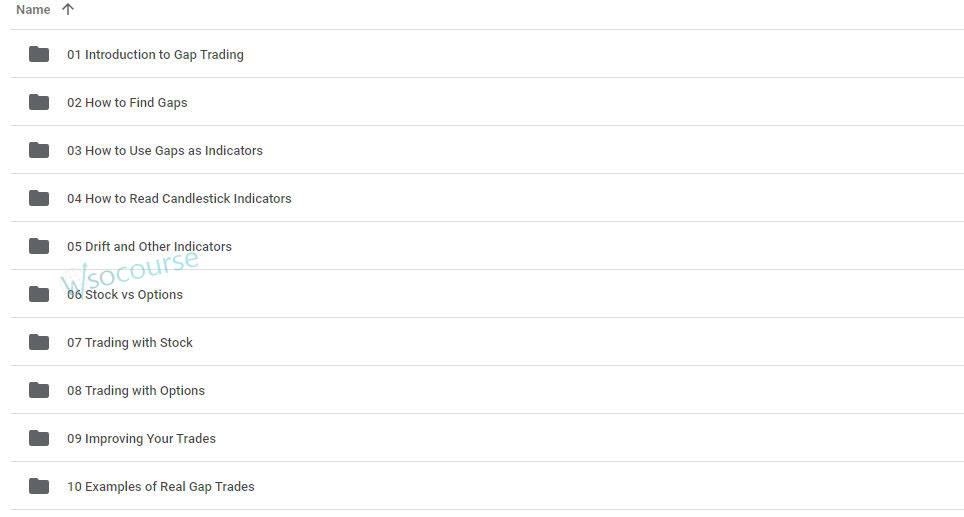

Gap Trading for Stock and Options Traders with Damon Verial

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Gap Trading for Stock and Options Traders with Damon Verial” below:

Gap Trading for Stock and Options Traders with Damon Verial

Gap trading is a strategy that takes advantage of price gaps in the stock market. These gaps can present lucrative opportunities for traders who know how to navigate them effectively. Damon Verial, a seasoned market analyst, provides insightful strategies for gap trading. In this article, we explore how stock and options traders can benefit from gap trading techniques taught by Damon Verial.

Introduction

Who is Damon Verial?

Damon Verial is a respected market analyst and financial educator known for his expertise in stock and options trading. His strategies focus on data-driven analysis and practical trading techniques.

What is Gap Trading?

Gap trading involves taking advantage of the price gaps that occur when a stock opens at a significantly different price than its previous closing price. These gaps can result from after-hours news, earnings reports, or other market-moving events.

Understanding Price Gaps

Types of Gaps

Common Gaps

Common gaps occur in the middle of a trading range and are usually insignificant in terms of price movement.

Breakaway Gaps

Breakaway gaps happen at the beginning of a trend and indicate a strong movement in the direction of the gap.

Runaway Gaps

Runaway gaps, also known as continuation gaps, occur in the middle of a trend and indicate strong ongoing momentum.

Exhaustion Gaps

Exhaustion gaps appear near the end of a trend and suggest a possible reversal or slowdown in the price movement.

Identifying Gaps

Chart Patterns

Using chart patterns and technical analysis tools helps identify potential gaps. Verial emphasizes the importance of understanding these patterns for successful gap trading.

Volume Analysis

Volume analysis can confirm the significance of a gap. High trading volume typically accompanies more meaningful gaps.

Strategies for Gap Trading

Pre-Market Preparation

Monitoring Pre-Market Activity

Check pre-market trading activity to identify potential gaps. News, earnings reports, and economic data released before the market opens can create significant gaps.

Setting Up Alerts

Set up alerts for stocks you are monitoring to get notified of significant pre-market price changes.

Trading Breakaway Gaps

Entry Points

For breakaway gaps, enter trades in the direction of the gap. If a stock gaps up, consider buying; if it gaps down, consider shorting.

Stop-Loss Orders

Set stop-loss orders to manage risk. Place them just below the gap for long positions and just above the gap for short positions.

Trading Runaway Gaps

Following the Trend

Trade in the direction of the existing trend. Runaway gaps indicate strong momentum, so align your trades with this movement.

Adjusting Positions

As the trend continues, adjust your positions to lock in profits and manage risk.

Trading Exhaustion Gaps

Recognizing Reversals

Exhaustion gaps often signal reversals. Look for confirmation through volume analysis and other technical indicators before entering a trade.

Short-Term Opportunities

Exhaustion gaps can provide short-term trading opportunities. Be prepared to enter and exit trades quickly to capitalize on these movements.

Gap Trading with Options

Advantages of Options in Gap Trading

Leverage

Options provide leverage, allowing you to control a larger position with a smaller investment.

Defined Risk

Options have predefined risk, making them suitable for volatile gap trading scenarios.

Options Strategies for Gaps

Buying Calls and Puts

Buy calls if you expect the stock to gap up and puts if you expect it to gap down. This strategy allows you to capitalize on significant price movements.

Straddles and Strangles

Use straddles and strangles to profit from significant price movements in either direction. These strategies involve buying both call and put options.

Risk Management

Setting Stop-Loss Orders

Importance of Stop-Losses

Stop-loss orders protect your capital by limiting potential losses. Always use them when trading gaps.

Adjusting Stop-Losses

Adjust stop-loss levels as the trade progresses to lock in profits and minimize risk.

Position Sizing

Calculating Position Size

Determine the appropriate position size based on your risk tolerance and the potential size of the gap.

Diversifying Trades

Avoid putting all your capital into a single gap trade. Diversify your trades to spread risk.

Tools and Resources for Gap Trading

Trading Platforms

Choose a trading platform that offers real-time data, advanced charting tools, and customizable alerts.

Educational Resources

Leverage books, articles, and online courses to deepen your understanding of gap trading strategies.

Market Analysis Tools

Use market analysis tools to monitor news, earnings reports, and other events that can create gaps.

Conclusion

Why Practice Gap Trading?

Gap trading offers unique opportunities for significant profits by capitalizing on price movements caused by market events. With Damon Verial’s strategies, traders can effectively navigate these gaps and enhance their trading performance.

FAQs

1. What is gap trading?

Gap trading involves taking advantage of price gaps that occur when a stock opens at a different price than its previous close, usually due to market-moving events.

2. What are the different types of gaps?

The different types of gaps include common gaps, breakaway gaps, runaway gaps, and exhaustion gaps, each indicating different market conditions.

3. How can options be used in gap trading?

Options can be used in gap trading to provide leverage and defined risk. Strategies like buying calls and puts, and using straddles and strangles, can be effective.

4. Why is risk management important in gap trading?

Risk management is crucial in gap trading to protect your capital and minimize potential losses. This includes setting stop-loss orders and diversifying trades.

5. What tools are helpful for gap trading?

Helpful tools for gap trading include advanced trading platforms, market analysis tools, and educational resources to stay informed about potential gaps and trading strategies.

Be the first to review “Gap Trading for Stock and Options Traders with Damon Verial” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.