-

×

Investment Blunders with John Nofsinger

1 × $6.00

Investment Blunders with John Nofsinger

1 × $6.00 -

×

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00 -

×

Fractal Markets SFX with Tyson Bieniek

1 × $5.00

Fractal Markets SFX with Tyson Bieniek

1 × $5.00 -

×

Mastering Technical Analysis with Investi Share

1 × $23.00

Mastering Technical Analysis with Investi Share

1 × $23.00 -

×

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

Chart Pattern Profits

1 × $6.00

Chart Pattern Profits

1 × $6.00 -

×

Special Bootcamp with Smart Earners Academy

1 × $5.00

Special Bootcamp with Smart Earners Academy

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

MotiveWave Ultimate v5.1.3 (OFA, OFA AlgoX), (Aug 2017)

1 × $101.00

MotiveWave Ultimate v5.1.3 (OFA, OFA AlgoX), (Aug 2017)

1 × $101.00 -

×

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00 -

×

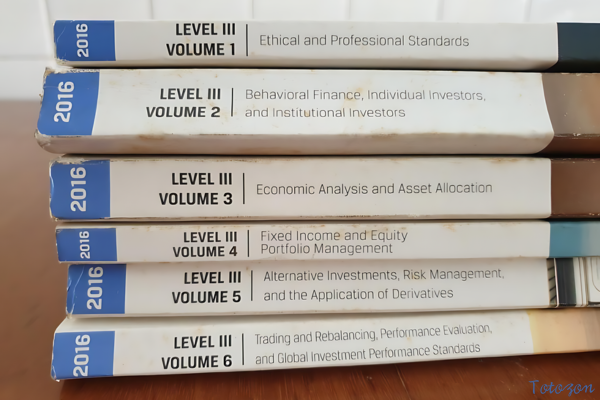

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00 -

×

Advanced Elliott Wave Analysis : Complex Patterns, Intermarket Relationships, and Global Cash Flow Analysis

1 × $6.00

Advanced Elliott Wave Analysis : Complex Patterns, Intermarket Relationships, and Global Cash Flow Analysis

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00 -

×

Tick By Tick By Alphonso Esposito - TradeSmart

1 × $6.00

Tick By Tick By Alphonso Esposito - TradeSmart

1 × $6.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

THE ART OF ADJUSTING IN 2017

1 × $6.00

THE ART OF ADJUSTING IN 2017

1 × $6.00 -

×

Level II Profit System with Sammy Chua

1 × $6.00

Level II Profit System with Sammy Chua

1 × $6.00 -

×

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00 -

×

Spotting Solid Short-Term Opportunities

1 × $6.00

Spotting Solid Short-Term Opportunities

1 × $6.00 -

×

SO FX Educational Course with SO FX

1 × $5.00

SO FX Educational Course with SO FX

1 × $5.00 -

×

Stock Trading Using Planetary Time Cycles – The Gann Method Volume I,II + Gann Astro Vol III Horoscopes and Trading Methods By Michael S. Jenkins – Stock Cycles Forecast

1 × $6.00

Stock Trading Using Planetary Time Cycles – The Gann Method Volume I,II + Gann Astro Vol III Horoscopes and Trading Methods By Michael S. Jenkins – Stock Cycles Forecast

1 × $6.00 -

×

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

MorningSwing Method with Austin Passamonte

1 × $6.00

MorningSwing Method with Austin Passamonte

1 × $6.00 -

×

Wyckoff Analytics Courses Collection

1 × $27.00

Wyckoff Analytics Courses Collection

1 × $27.00 -

×

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00 -

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Forex Time Machine with Bill Poulos

1 × $6.00

Forex Time Machine with Bill Poulos

1 × $6.00 -

×

Cyber Trading University - Power Trading 7 CD

1 × $8.00

Cyber Trading University - Power Trading 7 CD

1 × $8.00 -

×

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00 -

×

Trade Like Warren Buffett with James Altucher

1 × $6.00

Trade Like Warren Buffett with James Altucher

1 × $6.00 -

×

Evidence Based Technical Analysis with David Aronson

1 × $6.00

Evidence Based Technical Analysis with David Aronson

1 × $6.00 -

×

Earnings Power Play with Dave Aquino

1 × $15.00

Earnings Power Play with Dave Aquino

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

PPC Lead Pro Training Program

1 × $31.00

PPC Lead Pro Training Program

1 × $31.00 -

×

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00 -

×

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00 -

×

Learn Plan Profit 2.0 with Ricky Gutierrez

1 × $39.00

Learn Plan Profit 2.0 with Ricky Gutierrez

1 × $39.00 -

×

Forecast 2012 Report with Larry Williams

1 × $6.00

Forecast 2012 Report with Larry Williams

1 × $6.00 -

×

Forex Courses Collection

1 × $55.00

Forex Courses Collection

1 × $55.00 -

×

The Liquidity Theory of Asset Prices with Gordon Pepper & Michael Oliver

1 × $6.00

The Liquidity Theory of Asset Prices with Gordon Pepper & Michael Oliver

1 × $6.00 -

×

The Art And Science Of Trading with Adam Grimes

1 × $6.00

The Art And Science Of Trading with Adam Grimes

1 × $6.00 -

×

Euro Error with Jean-Jacques Rosa

1 × $6.00

Euro Error with Jean-Jacques Rosa

1 × $6.00 -

×

VSA Advanced Mentorship Course

1 × $31.00

VSA Advanced Mentorship Course

1 × $31.00 -

×

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00 -

×

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00 -

×

The Traders Battle Plan

1 × $6.00

The Traders Battle Plan

1 × $6.00 -

×

FX Funding Mate Course

1 × $5.00

FX Funding Mate Course

1 × $5.00 -

×

Field of Vision Program – Digital Download

1 × $31.00

Field of Vision Program – Digital Download

1 × $31.00 -

×

Micro Bull Run Mentorship Program (Autumn 2023) with Brendan Viehman

1 × $23.00

Micro Bull Run Mentorship Program (Autumn 2023) with Brendan Viehman

1 × $23.00 -

×

Options Wizardry from A to Z (Video 2.80 GB) with Don Fishback

1 × $6.00

Options Wizardry from A to Z (Video 2.80 GB) with Don Fishback

1 × $6.00 -

×

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00 -

×

High Probability Trading with Marcel Link

1 × $6.00

High Probability Trading with Marcel Link

1 × $6.00 -

×

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00 -

×

Killmex Academy Education Course

1 × $5.00

Killmex Academy Education Course

1 × $5.00 -

×

Trade for Life 7-day Intensive Training Course - Oliver Velez & Dan Gibby

1 × $6.00

Trade for Life 7-day Intensive Training Course - Oliver Velez & Dan Gibby

1 × $6.00 -

×

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00 -

×

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00 -

×

Stocks and Bonds with Elaine Scott

1 × $6.00

Stocks and Bonds with Elaine Scott

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

NodeTrader (+ open code) (Nov 2014)

1 × $6.00

NodeTrader (+ open code) (Nov 2014)

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

High Probability Option Trading - Covered Calls and Credit Spreads

1 × $6.00

High Probability Option Trading - Covered Calls and Credit Spreads

1 × $6.00 -

×

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00 -

×

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00 -

×

Dan Sheridan Options Mentoring Weekly Webinars

1 × $6.00

Dan Sheridan Options Mentoring Weekly Webinars

1 × $6.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

Forex Profit Formula System with Jason Fielder

1 × $6.00

Forex Profit Formula System with Jason Fielder

1 × $6.00 -

×

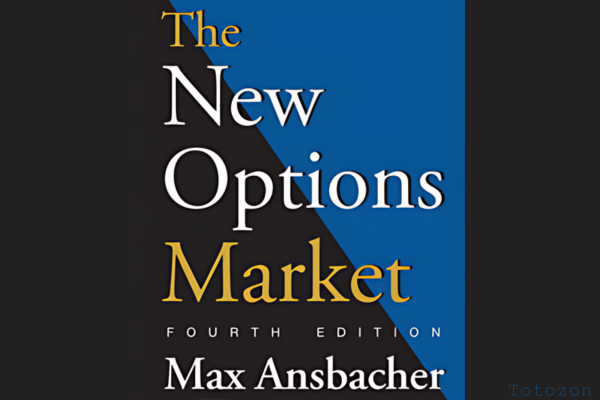

The New Options Market with Max Ansbacher

1 × $6.00

The New Options Market with Max Ansbacher

1 × $6.00 -

×

The MissionFX Compounding Course with Nick Shawn

1 × $5.00

The MissionFX Compounding Course with Nick Shawn

1 × $5.00 -

×

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00 -

×

The STRAT Execution Basics with Jermaine McGruder

1 × $31.00

The STRAT Execution Basics with Jermaine McGruder

1 × $31.00 -

×

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00 -

×

Project Gorilla

1 × $5.00

Project Gorilla

1 × $5.00 -

×

Exploring MetaStock Basic with Martin Pring

1 × $6.00

Exploring MetaStock Basic with Martin Pring

1 × $6.00 -

×

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00 -

×

VWAP Trading course with Trade With Trend

1 × $6.00

VWAP Trading course with Trade With Trend

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Gold & Silver Profit System with Bill Poulos

1 × $6.00

Gold & Silver Profit System with Bill Poulos

1 × $6.00 -

×

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00 -

×

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00 -

×

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

The Great Reflation with Anthony Boeckh

1 × $6.00

The Great Reflation with Anthony Boeckh

1 × $6.00 -

×

Capital Flows and Crises with Barry Eichengreen

1 × $6.00

Capital Flows and Crises with Barry Eichengreen

1 × $6.00 -

×

Investing Classroom 2022 with Danny Devan

1 × $15.00

Investing Classroom 2022 with Danny Devan

1 × $15.00 -

×

Market Energy Trader with Top Trade Tools

1 × $5.00

Market Energy Trader with Top Trade Tools

1 × $5.00 -

×

Power FX Xtreme BuySell EA

1 × $23.00

Power FX Xtreme BuySell EA

1 × $23.00 -

×

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00 -

×

Applying Fibonacci Analysis to Price Action

1 × $6.00

Applying Fibonacci Analysis to Price Action

1 × $6.00 -

×

The Connors Research Volatility Trading Strategy Summit

1 × $85.00

The Connors Research Volatility Trading Strategy Summit

1 × $85.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00 -

×

Mastering Momentum Gaps with Toni Hansen

1 × $6.00

Mastering Momentum Gaps with Toni Hansen

1 × $6.00 -

×

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Timing is Everything with Robert M.Barnes

1 × $6.00

Timing is Everything with Robert M.Barnes

1 × $6.00 -

×

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00 -

×

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

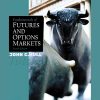

Fundamentals of Futures & Options Markets (4th Ed.)

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Fundamentals of Futures & Options Markets (4th Ed.)

Introduction to Derivatives

What Are Derivatives?

Derivatives are financial instruments whose value depends on the value of other underlying financial assets. They are essential tools for risk management and speculation.

Importance in Financial Markets

Derivatives such as futures and options play a pivotal role in global financial markets, providing mechanisms for price discovery, hedging risks, and enhancing liquidity.

Overview of the 4th Edition

Author’s Insights

The 4th edition of “Fundamentals of Futures & Options Markets” by John Hull offers a comprehensive introduction to the fundamental concepts and applications of these financial instruments.

Key Updates and Enhancements

This edition includes the latest updates on market practices, regulatory changes, and new financial instruments, making it an indispensable resource for both novices and experienced traders.

Futures Markets

Definition and Function

Futures markets involve standardized contracts to buy or sell assets at a future date. These contracts help in managing price risk and speculation.

Types of Futures Contracts

- Commodity Futures: Cover physical goods like oil, gold, and agricultural products.

- Financial Futures: Include contracts on currencies, interest rates, and stock indices.

Participants in Futures Markets

- Hedgers: Use futures to mitigate risk.

- Speculators: Aim to profit from price movements.

- Arbitrageurs: Exploit price differences for profit.

Options Markets

Definition and Function

Options markets offer contracts that provide the right, but not the obligation, to buy or sell an asset at a specified price before the contract expires.

Types of Options

- Call Options: Grants the right to buy an asset.

- Put Options: Grants the right to sell an asset.

Key Concepts in Options Trading

- Strike Price: The price at which the option can be exercised.

- Expiration Date: The last date the option can be exercised.

- Premium: The cost of purchasing the option.

Pricing and Valuation

Pricing Models

The 4th edition delves into various pricing models, including the Black-Scholes model for options and the cost-of-carry model for futures, which are crucial for accurate valuation.

The Greeks

Understanding the Greeks—delta, gamma, theta, vega, and rho—is vital for managing options portfolios and assessing risk.

Practical Applications

Hedging Strategies

Hedging is a technique used to protect against potential losses by taking an offsetting position in a related security, essential for businesses and investors alike.

Speculation and Arbitrage

Speculators aim to profit from market fluctuations, while arbitrageurs seek risk-free profits through price discrepancies across different markets.

Case Studies

The book includes practical case studies that demonstrate the application of futures and options strategies in real-world scenarios, enhancing practical knowledge.

Regulatory Environment

Importance of Regulation

Regulation ensures market integrity and protects participants. The 4th edition discusses significant regulatory changes and their impacts on market practices.

Key Regulatory Bodies

- Commodity Futures Trading Commission (CFTC)

- Securities and Exchange Commission (SEC)

- Financial Industry Regulatory Authority (FINRA)

Learning Futures and Options

Structured Learning Approach

A systematic approach to learning involves starting with basic concepts and progressing to more complex topics, reinforced through practical exercises and case studies.

Practical Exercises

Engage with the end-of-chapter exercises to reinforce learning and test comprehension, ensuring a solid grasp of fundamental concepts.

Utilizing Additional Resources

Leverage additional resources such as online tutorials, market simulations, and professional courses to deepen understanding and enhance practical skills.

Conclusion

“Fundamentals of Futures & Options Markets (4th Ed.)” by John Hull is a vital resource for anyone looking to understand the intricacies of financial derivatives. It offers comprehensive insights and practical knowledge essential for navigating these complex markets, making it a must-read for students, professionals, and individual investors.

FAQs

What are the primary uses of futures and options?

Futures and options are primarily used for hedging risk, speculating on price movements, and engaging in arbitrage.

How do futures contracts differ from options contracts?

Futures contracts obligate the holder to buy or sell an asset at a set price on a future date, while options contracts give the holder the right, but not the obligation, to buy or sell at a predetermined price before the expiration date.

Why is understanding the Greeks important in options trading?

The Greeks measure the sensitivity of an option’s price to various factors, helping traders manage risk and make informed trading decisions.

What updates are included in the 4th edition of this book?

The 4th edition includes updates on market practices, regulatory changes, and new financial instruments, providing a current and comprehensive understanding of the markets.

How can this book help beginners in the financial markets?

The book provides a structured introduction to futures and options, covering fundamental concepts, practical applications, and advanced strategies, making it an ideal resource for beginners.

Be the first to review “Fundamentals of Futures & Options Markets (4th Ed.)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.