-

×

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00 -

×

ProfileTraders - 5 course bundle

1 × $23.00

ProfileTraders - 5 course bundle

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00 -

×

Definitive Guide to Order Execution Class with Don Kaufman

1 × $6.00

Definitive Guide to Order Execution Class with Don Kaufman

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00 -

×

Adx Mastery Complete Course

1 × $6.00

Adx Mastery Complete Course

1 × $6.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Consistently Profitable Trader with Pollinate Trading

1 × $13.00

Consistently Profitable Trader with Pollinate Trading

1 × $13.00 -

×

How To Buy with Justin Mamis

1 × $6.00

How To Buy with Justin Mamis

1 × $6.00 -

×

How to Value & Sell your Business with Andrew Heslop

1 × $6.00

How to Value & Sell your Business with Andrew Heslop

1 × $6.00 -

×

Forex Trading Like Banks - Step by Step by Live Examples with Taher Assaf

1 × $6.00

Forex Trading Like Banks - Step by Step by Live Examples with Taher Assaf

1 × $6.00 -

×

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

Elite Trader Package

1 × $31.00

Elite Trader Package

1 × $31.00 -

×

Profiletraders - Market Profile Day Trading

1 × $15.00

Profiletraders - Market Profile Day Trading

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Advanced Pattern Recognition with John Cameron

1 × $23.00

Advanced Pattern Recognition with John Cameron

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00 -

×

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00 -

×

Strategies for Profiting on Every Trade: Simple Lessons for Mastering the Market with Oliver L. Velez

1 × $6.00

Strategies for Profiting on Every Trade: Simple Lessons for Mastering the Market with Oliver L. Velez

1 × $6.00 -

×

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00 -

×

Technical Analysis for the Trading Professional with Constance Brown

1 × $6.00

Technical Analysis for the Trading Professional with Constance Brown

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

TradingWithBilz Course

1 × $10.00

TradingWithBilz Course

1 × $10.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

The Age of Turbulence with Alan Greenspan

1 × $6.00

The Age of Turbulence with Alan Greenspan

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Acme

1 × $6.00

Acme

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Profit.ly - Bitcoin Basics

1 × $6.00

Profit.ly - Bitcoin Basics

1 × $6.00 -

×

How To Become StressFree Trader with Jason Starzec

1 × $4.00

How To Become StressFree Trader with Jason Starzec

1 × $4.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

Profits in the Stock Market with Harold Gartley

1 × $6.00

Profits in the Stock Market with Harold Gartley

1 × $6.00 -

×

Active Beta Indexes with Khalid Ghayur

1 × $6.00

Active Beta Indexes with Khalid Ghayur

1 × $6.00 -

×

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00 -

×

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00 -

×

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00 -

×

Psycho-Paper 96 with Charles Drummond

1 × $6.00

Psycho-Paper 96 with Charles Drummond

1 × $6.00 -

×

Enhancing Trader Performance with Brett Steenbarger

1 × $6.00

Enhancing Trader Performance with Brett Steenbarger

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Confidence Game. How a Hadge Fund Manager Called Wall Street’s Bluff with Christine Richard

1 × $6.00

Confidence Game. How a Hadge Fund Manager Called Wall Street’s Bluff with Christine Richard

1 × $6.00 -

×

Advanced Bond Trading Course

1 × $62.00

Advanced Bond Trading Course

1 × $62.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

Elliott Wave Simplified with Clif Droke

1 × $6.00

Elliott Wave Simplified with Clif Droke

1 × $6.00 -

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

System Building Masterclass

1 × $31.00

System Building Masterclass

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

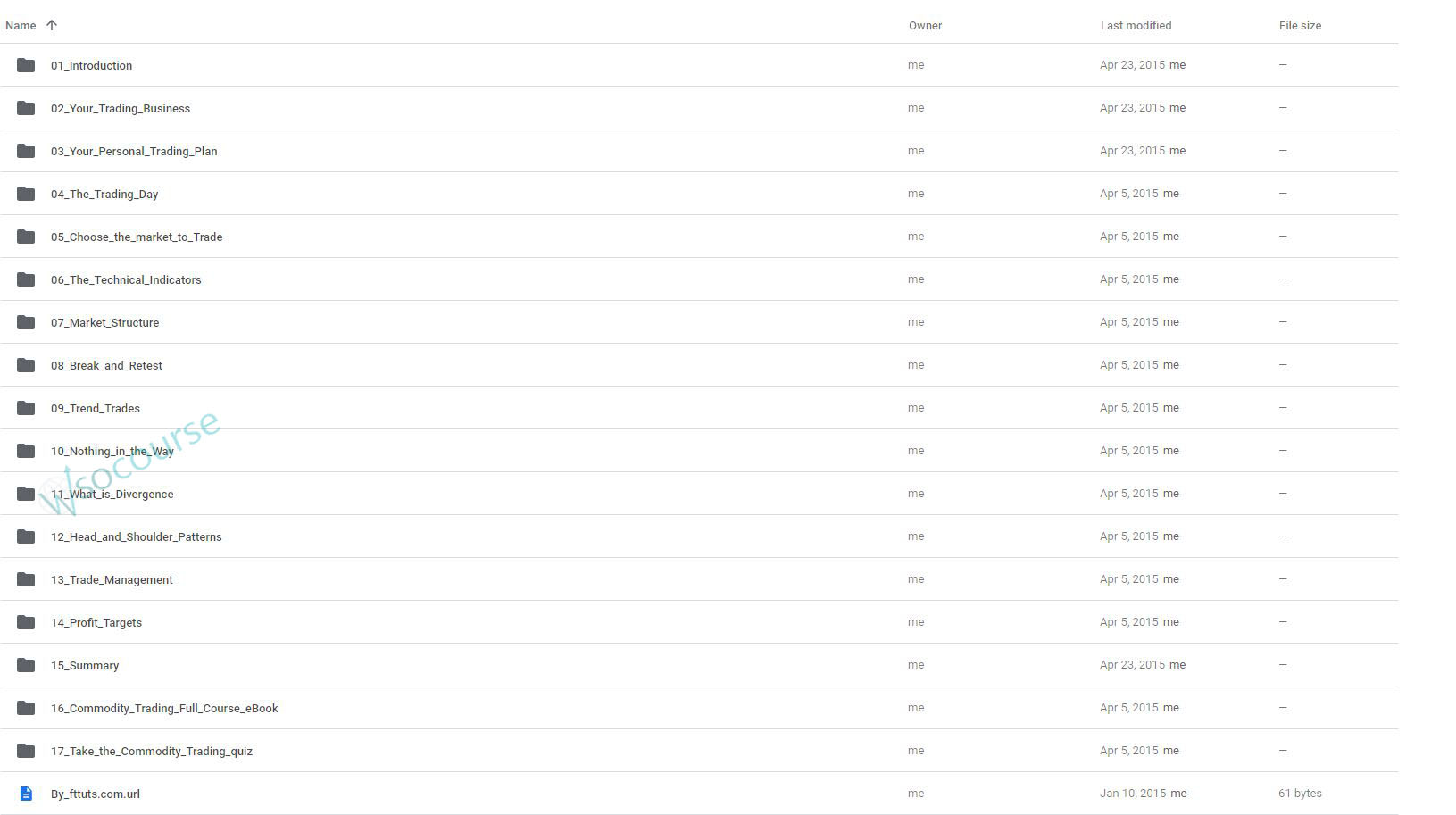

Futures Commodity Trading with G. Scott Martin

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz-25874a26S8uRu

Category: Forex Trading

You may check content proof of “Futures Commodity Trading with G. Scott Martin” below:

Navigating the Future Markets: Commodity Trading with G. Scott Martin

Introduction

In the dynamic world of commodity trading, futures contracts play a pivotal role. G. Scott Martin, an expert in the field, offers profound insights into the mechanisms and strategies essential for succeeding in futures commodity trading. Let’s dive into the key concepts and actionable strategies that can empower traders to navigate these turbulent markets successfully.

Understanding Futures Commodity Trading

What Are Futures?

Futures are standardized contracts to buy or sell a specific commodity at a predetermined price at a specified time in the future. These instruments are crucial for managing risk and discovering prices in commodity markets.

The Role of Commodities

Commodities typically include agricultural products, metals, and energy resources. Trading these commodities through futures contracts allows participants to hedge against price volatility.

G. Scott Martin’s Approach to Trading

Market Analysis Techniques

G. Scott Martin emphasizes the importance of both fundamental and technical analysis in understanding commodity markets:

- Fundamental Analysis: Examines supply, demand, and external economic factors.

- Technical Analysis: Focuses on charts and statistical indicators to predict price movements.

Risk Management Strategies

Effective risk management is crucial:

- Stop-Loss Orders: Limit potential losses by setting predetermined selling points.

- Diversification: Spread investments across various commodities to reduce risk.

Trading Strategies Explained

Long and Short Positions

- Going Long: Buying futures contracts to profit from rising prices.

- Going Short: Selling futures contracts anticipating a drop in prices.

Spread Trading

This involves taking simultaneous long and short positions in related futures contracts to benefit from changes in their price difference.

Tools for Futures Traders

Trading Platforms

Advanced trading platforms offer tools and analytics specifically designed for futures trading, enhancing decision-making capabilities.

Market Indicators

Key indicators used by traders include moving averages and Relative Strength Index (RSI), which help identify trends and potential turning points.

Benefits of Futures Trading

Leverage

Futures trading allows significant exposure with relatively low capital, thanks to leverage.

Liquidity

Commodity futures are highly liquid, enabling traders to enter and exit positions easily.

Common Pitfalls in Futures Trading

Overleveraging

While leverage can amplify gains, it also increases potential losses, making it a double-edged sword.

Market Volatility

Commodity prices can be highly volatile, influenced by myriad factors like geopolitical events and natural disasters.

G. Scott Martin’s Impact on Traders

Education and Mentoring

Through his courses and seminars, Martin educates traders on effective commodity trading tactics, enriching the trading community.

Strategic Insights

His strategies help traders develop a disciplined approach to the volatile world of commodity trading.

Case Studies: Success Stories

These real-life examples illustrate how adopting Martin’s methods has led to success in futures trading.

Conclusion

Futures commodity trading offers both significant opportunities and risks. Armed with G. Scott Martin’s insights, traders can navigate these waters with greater confidence and strategic acumen, aiming for consistent profitability in the complex commodity markets.

FAQs

What is futures commodity trading?

It involves buying or selling commodity futures contracts to profit from or hedge against price changes.

Who is G. Scott Martin?

A renowned expert in futures commodity trading known for his strategic approach to the market.

What are the main benefits of futures trading?

Leverage, liquidity, and the ability to hedge against price volatility.

What are common risks in futures trading?

High volatility and the potential for significant losses due to leverage.

How can one start trading in commodities?

By learning the basics, understanding market analysis, and practicing with simulated trading environments.

Be the first to review “Futures Commodity Trading with G. Scott Martin” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.