-

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Art and Application of Technical Analysis with Cynthia Kase

1 × $6.00

The Art and Application of Technical Analysis with Cynthia Kase

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Freak Forex Technicals with Ken FX Freak

1 × $6.00

Freak Forex Technicals with Ken FX Freak

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

10 Pips System. The 3rd Candle with Abner Gelin

1 × $6.00

10 Pips System. The 3rd Candle with Abner Gelin

1 × $6.00 -

×

2010 The Market Mastery Protégé Program

1 × $31.00

2010 The Market Mastery Protégé Program

1 × $31.00 -

×

11 Elements of Prudent Investing with Andy Karabinos

1 × $6.00

11 Elements of Prudent Investing with Andy Karabinos

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

10 Best Swing Trading Patterns & Strategies with Dave Landry

1 × $4.00

10 Best Swing Trading Patterns & Strategies with Dave Landry

1 × $4.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

3 Day Bootcamp EXPERT LEVEL with FX Savages

1 × $6.00

3 Day Bootcamp EXPERT LEVEL with FX Savages

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

2 Trades A Day with Jason Hale

1 × $15.00

2 Trades A Day with Jason Hale

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

101 Option Trading Secrets with Kenneth Trester

1 × $6.00

101 Option Trading Secrets with Kenneth Trester

1 × $6.00 -

×

(SU281) Complex & Organic Modeling

1 × $85.00

(SU281) Complex & Organic Modeling

1 × $85.00 -

×

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Volume Cycles in the stock Market

1 × $6.00

Volume Cycles in the stock Market

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

2 Day Personal Training Course (Seminar Package) with Martin Pring

1 × $6.00

2 Day Personal Training Course (Seminar Package) with Martin Pring

1 × $6.00 -

×

11 Paper with Charles Drummond

1 × $6.00

11 Paper with Charles Drummond

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Full-Day Premium Pitchfork Class with Forex Pitchfork Master Trader

1 × $15.00

Full-Day Premium Pitchfork Class with Forex Pitchfork Master Trader

1 × $15.00 -

×

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

2017 Plan or Get Slaughtered Class with Doc Severson

1 × $6.00

2017 Plan or Get Slaughtered Class with Doc Severson

1 × $6.00 -

×

10-Week Stock Trading Program with Stock Market Lab

1 × $6.00

10-Week Stock Trading Program with Stock Market Lab

1 × $6.00 -

×

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

12 Strategies for Picking Tops & Bottoms

1 × $23.00

12 Strategies for Picking Tops & Bottoms

1 × $23.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00 -

×

Forex Trading with Ed Ponsi

1 × $6.00

Forex Trading with Ed Ponsi

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

2-Phase A.I. Trade Spy Total Immersion Experience with Jeff Bierman - The Quant Guy

1 × $209.00

2-Phase A.I. Trade Spy Total Immersion Experience with Jeff Bierman - The Quant Guy

1 × $209.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

15 Minutes to Financial Freedom with The Better Traders

1 × $20.00

15 Minutes to Financial Freedom with The Better Traders

1 × $20.00 -

×

Euro Trading Course with Bkforex

1 × $6.00

Euro Trading Course with Bkforex

1 × $6.00 -

×

Module 4 Elliot Wave and Identify Wave Count

1 × $31.00

Module 4 Elliot Wave and Identify Wave Count

1 × $31.00 -

×

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00

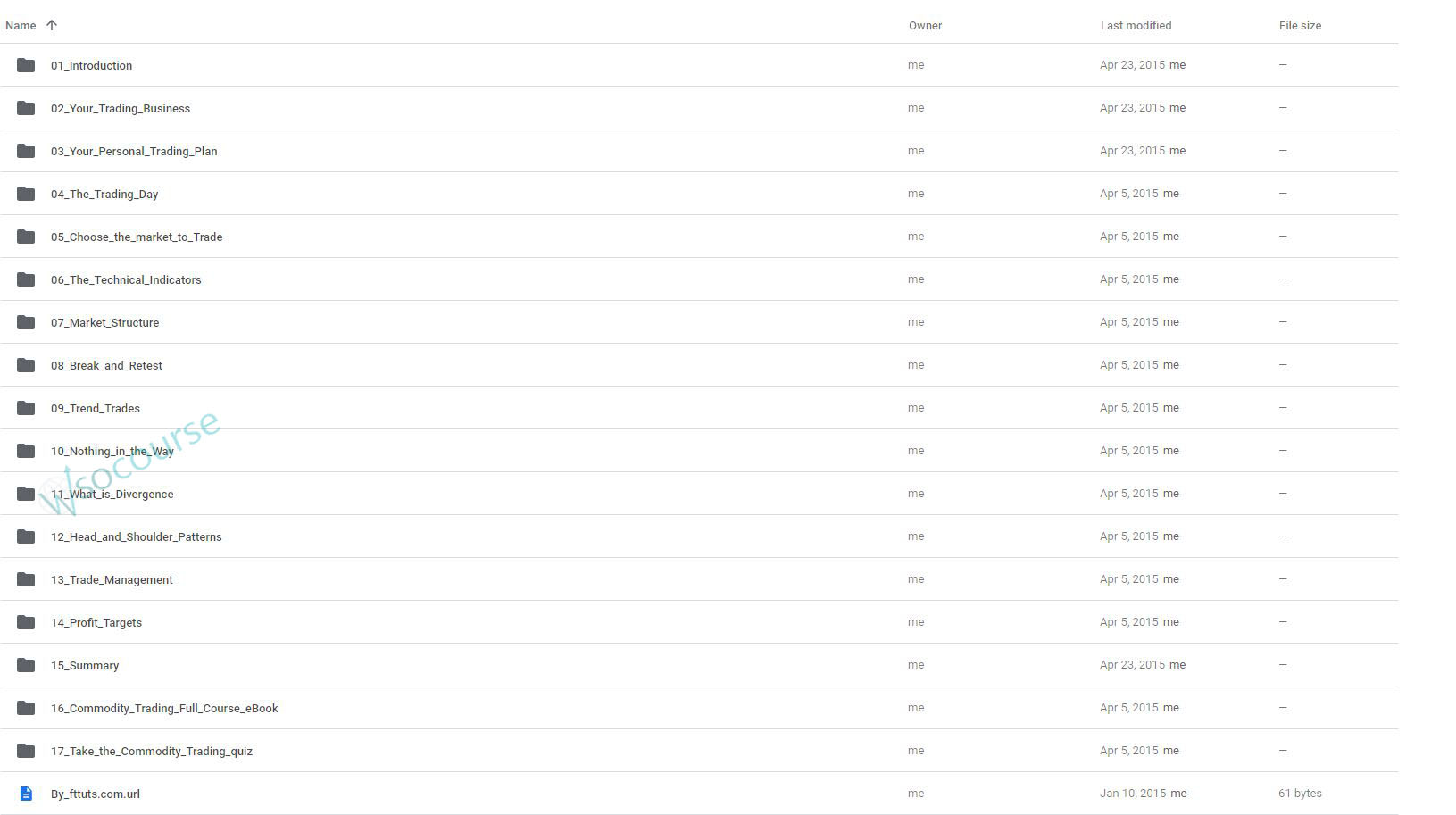

Futures Commodity Trading with G. Scott Martin

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz-25874a26S8uRu

Category: Forex Trading

You may check content proof of “Futures Commodity Trading with G. Scott Martin” below:

Navigating the Future Markets: Commodity Trading with G. Scott Martin

Introduction

In the dynamic world of commodity trading, futures contracts play a pivotal role. G. Scott Martin, an expert in the field, offers profound insights into the mechanisms and strategies essential for succeeding in futures commodity trading. Let’s dive into the key concepts and actionable strategies that can empower traders to navigate these turbulent markets successfully.

Understanding Futures Commodity Trading

What Are Futures?

Futures are standardized contracts to buy or sell a specific commodity at a predetermined price at a specified time in the future. These instruments are crucial for managing risk and discovering prices in commodity markets.

The Role of Commodities

Commodities typically include agricultural products, metals, and energy resources. Trading these commodities through futures contracts allows participants to hedge against price volatility.

G. Scott Martin’s Approach to Trading

Market Analysis Techniques

G. Scott Martin emphasizes the importance of both fundamental and technical analysis in understanding commodity markets:

- Fundamental Analysis: Examines supply, demand, and external economic factors.

- Technical Analysis: Focuses on charts and statistical indicators to predict price movements.

Risk Management Strategies

Effective risk management is crucial:

- Stop-Loss Orders: Limit potential losses by setting predetermined selling points.

- Diversification: Spread investments across various commodities to reduce risk.

Trading Strategies Explained

Long and Short Positions

- Going Long: Buying futures contracts to profit from rising prices.

- Going Short: Selling futures contracts anticipating a drop in prices.

Spread Trading

This involves taking simultaneous long and short positions in related futures contracts to benefit from changes in their price difference.

Tools for Futures Traders

Trading Platforms

Advanced trading platforms offer tools and analytics specifically designed for futures trading, enhancing decision-making capabilities.

Market Indicators

Key indicators used by traders include moving averages and Relative Strength Index (RSI), which help identify trends and potential turning points.

Benefits of Futures Trading

Leverage

Futures trading allows significant exposure with relatively low capital, thanks to leverage.

Liquidity

Commodity futures are highly liquid, enabling traders to enter and exit positions easily.

Common Pitfalls in Futures Trading

Overleveraging

While leverage can amplify gains, it also increases potential losses, making it a double-edged sword.

Market Volatility

Commodity prices can be highly volatile, influenced by myriad factors like geopolitical events and natural disasters.

G. Scott Martin’s Impact on Traders

Education and Mentoring

Through his courses and seminars, Martin educates traders on effective commodity trading tactics, enriching the trading community.

Strategic Insights

His strategies help traders develop a disciplined approach to the volatile world of commodity trading.

Case Studies: Success Stories

These real-life examples illustrate how adopting Martin’s methods has led to success in futures trading.

Conclusion

Futures commodity trading offers both significant opportunities and risks. Armed with G. Scott Martin’s insights, traders can navigate these waters with greater confidence and strategic acumen, aiming for consistent profitability in the complex commodity markets.

FAQs

What is futures commodity trading?

It involves buying or selling commodity futures contracts to profit from or hedge against price changes.

Who is G. Scott Martin?

A renowned expert in futures commodity trading known for his strategic approach to the market.

What are the main benefits of futures trading?

Leverage, liquidity, and the ability to hedge against price volatility.

What are common risks in futures trading?

High volatility and the potential for significant losses due to leverage.

How can one start trading in commodities?

By learning the basics, understanding market analysis, and practicing with simulated trading environments.

Be the first to review “Futures Commodity Trading with G. Scott Martin” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.