Futures Commodity Trading with G. Scott Martin

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

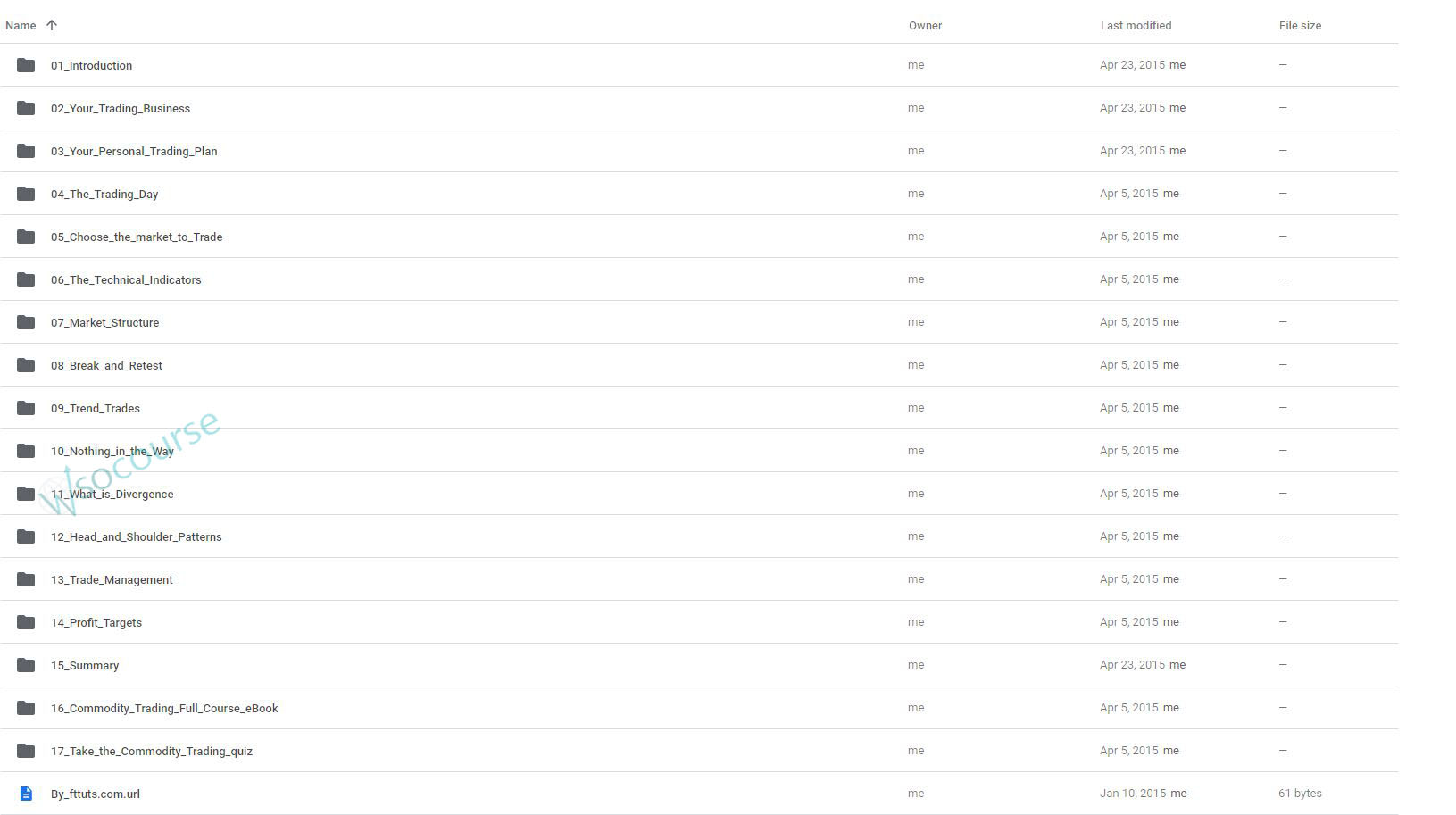

Content Proof: Watch Here!

You may check content proof of “Futures Commodity Trading with G. Scott Martin” below:

Navigating the Future Markets: Commodity Trading with G. Scott Martin

Introduction

In the dynamic world of commodity trading, futures contracts play a pivotal role. G. Scott Martin, an expert in the field, offers profound insights into the mechanisms and strategies essential for succeeding in futures commodity trading. Let’s dive into the key concepts and actionable strategies that can empower traders to navigate these turbulent markets successfully.

Understanding Futures Commodity Trading

What Are Futures?

Futures are standardized contracts to buy or sell a specific commodity at a predetermined price at a specified time in the future. These instruments are crucial for managing risk and discovering prices in commodity markets.

The Role of Commodities

Commodities typically include agricultural products, metals, and energy resources. Trading these commodities through futures contracts allows participants to hedge against price volatility.

G. Scott Martin’s Approach to Trading

Market Analysis Techniques

G. Scott Martin emphasizes the importance of both fundamental and technical analysis in understanding commodity markets:

- Fundamental Analysis: Examines supply, demand, and external economic factors.

- Technical Analysis: Focuses on charts and statistical indicators to predict price movements.

Risk Management Strategies

Effective risk management is crucial:

- Stop-Loss Orders: Limit potential losses by setting predetermined selling points.

- Diversification: Spread investments across various commodities to reduce risk.

Trading Strategies Explained

Long and Short Positions

- Going Long: Buying futures contracts to profit from rising prices.

- Going Short: Selling futures contracts anticipating a drop in prices.

Spread Trading

This involves taking simultaneous long and short positions in related futures contracts to benefit from changes in their price difference.

Tools for Futures Traders

Trading Platforms

Advanced trading platforms offer tools and analytics specifically designed for futures trading, enhancing decision-making capabilities.

Market Indicators

Key indicators used by traders include moving averages and Relative Strength Index (RSI), which help identify trends and potential turning points.

Benefits of Futures Trading

Leverage

Futures trading allows significant exposure with relatively low capital, thanks to leverage.

Liquidity

Commodity futures are highly liquid, enabling traders to enter and exit positions easily.

Common Pitfalls in Futures Trading

Overleveraging

While leverage can amplify gains, it also increases potential losses, making it a double-edged sword.

Market Volatility

Commodity prices can be highly volatile, influenced by myriad factors like geopolitical events and natural disasters.

G. Scott Martin’s Impact on Traders

Education and Mentoring

Through his courses and seminars, Martin educates traders on effective commodity trading tactics, enriching the trading community.

Strategic Insights

His strategies help traders develop a disciplined approach to the volatile world of commodity trading.

Case Studies: Success Stories

These real-life examples illustrate how adopting Martin’s methods has led to success in futures trading.

Conclusion

Futures commodity trading offers both significant opportunities and risks. Armed with G. Scott Martin’s insights, traders can navigate these waters with greater confidence and strategic acumen, aiming for consistent profitability in the complex commodity markets.

FAQs

What is futures commodity trading?

It involves buying or selling commodity futures contracts to profit from or hedge against price changes.

Who is G. Scott Martin?

A renowned expert in futures commodity trading known for his strategic approach to the market.

What are the main benefits of futures trading?

Leverage, liquidity, and the ability to hedge against price volatility.

What are common risks in futures trading?

High volatility and the potential for significant losses due to leverage.

How can one start trading in commodities?

By learning the basics, understanding market analysis, and practicing with simulated trading environments.

Be the first to review “Futures Commodity Trading with G. Scott Martin” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Indices Orderflow Masterclass with The Forex Scalpers

The Indices Orderflow Masterclass with The Forex Scalpers  The Prop Trading Code with Brannigan Barrett - Axia Futures

The Prop Trading Code with Brannigan Barrett - Axia Futures

Reviews

There are no reviews yet.