-

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

US indices system with LaMartinatradingFx

1 × $10.00

US indices system with LaMartinatradingFx

1 × $10.00 -

×

Instant Profits System with Bill Poulos

1 × $6.00

Instant Profits System with Bill Poulos

1 × $6.00 -

×

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00 -

×

Market Trader Forecasting Modeling Course

1 × $6.00

Market Trader Forecasting Modeling Course

1 × $6.00 -

×

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00 -

×

The Options Handbook with Bernie Schaeffer

1 × $6.00

The Options Handbook with Bernie Schaeffer

1 × $6.00 -

×

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00 -

×

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Gold Treasure Map: The Path to Buried Treasure Trading Gold with David Starr & Neil Yeager

1 × $6.00

The Gold Treasure Map: The Path to Buried Treasure Trading Gold with David Starr & Neil Yeager

1 × $6.00 -

×

Aeron V5 Scalper+Grid

1 × $23.00

Aeron V5 Scalper+Grid

1 × $23.00 -

×

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00 -

×

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00 -

×

One Week S&P Workshop II with Linda Raschke

1 × $5.00

One Week S&P Workshop II with Linda Raschke

1 × $5.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trading Earnings Using Measured-Move Targets with Alphashark

1 × $6.00

Trading Earnings Using Measured-Move Targets with Alphashark

1 × $6.00 -

×

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00 -

×

Intermediate to Advanced Intensive Q and A with Rob Hoffman

1 × $6.00

Intermediate to Advanced Intensive Q and A with Rob Hoffman

1 × $6.00 -

×

War Room Technicals Vol 1 with Trick Traders

1 × $6.00

War Room Technicals Vol 1 with Trick Traders

1 × $6.00 -

×

Jtrader - Risk Management 1on1

1 × $23.00

Jtrader - Risk Management 1on1

1 × $23.00 -

×

Intermarket Technical Analysis with John J.Murphy

1 × $6.00

Intermarket Technical Analysis with John J.Murphy

1 × $6.00 -

×

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00

One-way Formula for Trading in Stocks and Commodities with William Dunnigan

1 × $6.00 -

×

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00 -

×

John Carter SimplerOptions John Trade TSLA Live on TOS Making 1.5 Million Dollars 2014-01-15

1 × $6.00

John Carter SimplerOptions John Trade TSLA Live on TOS Making 1.5 Million Dollars 2014-01-15

1 × $6.00 -

×

Trading Risk: Enhanced Profitability through Risk Control with Kenneth Grant

1 × $6.00

Trading Risk: Enhanced Profitability through Risk Control with Kenneth Grant

1 × $6.00 -

×

The Value Connection with Marc Gerstein

1 × $5.00

The Value Connection with Marc Gerstein

1 × $5.00 -

×

Calendar Spreads with Todd Mitchell

1 × $31.00

Calendar Spreads with Todd Mitchell

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Day Trade to Win E-Course with John Paul

1 × $6.00

Day Trade to Win E-Course with John Paul

1 × $6.00 -

×

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00 -

×

Credit Risk from Transaction to Portfolio Management with Andrew Kimber

1 × $6.00

Credit Risk from Transaction to Portfolio Management with Andrew Kimber

1 × $6.00 -

×

Trading the Pristine Method 2020 with T3 Live

1 × $39.00

Trading the Pristine Method 2020 with T3 Live

1 × $39.00 -

×

Intra-Day Trading Tactics with Greg Capra

1 × $6.00

Intra-Day Trading Tactics with Greg Capra

1 × $6.00 -

×

Workshop Metals Mastery

1 × $23.00

Workshop Metals Mastery

1 × $23.00 -

×

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00 -

×

Divergence Trading – Mastering Market Reversals

1 × $31.00

Divergence Trading – Mastering Market Reversals

1 × $31.00 -

×

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00 -

×

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00 -

×

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

Fractal Markets FX (SMC)

$5.00

File Size: 4.34 GB

Delivery Time: 1–12 hours

Media Type: Online Course

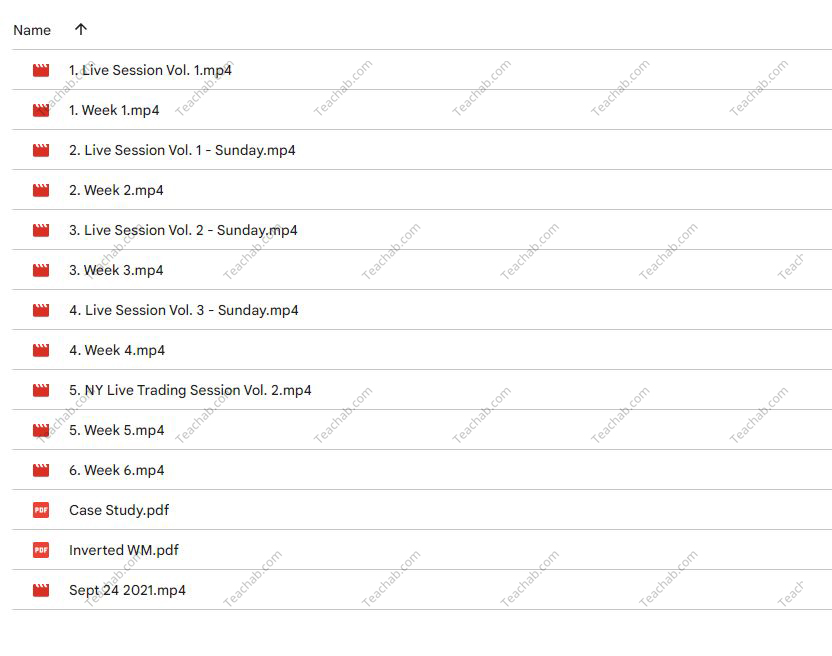

Content Proof: Watch Here!

You may check content proof of “Fractal Markets FX (SMC)” below:

Understanding Fractal Markets FX (SMC): A Comprehensive Guide

Introduction to Fractal Markets FX (SMC)

Welcome to our deep dive into Fractal Markets FX, also known as SMC. If you’re intrigued by the complexities of financial markets and how patterns emerge, you’ve come to the right place. In this article, we will explore the intriguing world of fractal markets, particularly focusing on the Fractal Markets FX (SMC) strategy.

What Are Fractal Markets?

Defining Fractals in Financial Terms

Fractals are patterns that repeat at various scales, creating self-similar and infinitely complex patterns. In finance, these are used to understand and predict market movements more accurately.

The Significance of Fractal Analysis in Forex

Fractal analysis in Forex involves looking for repeating patterns that can offer predictions about future market movements. This method is rooted in the idea that markets are chaotic systems with underlying patterns.

The SMC Approach to Fractal Markets

What Does SMC Stand For?

SMC stands for Signal, Momentum, and Condition, the three pillars of this trading strategy. Each component plays a vital role in making informed trading decisions.

Integrating SMC into Forex Trading

By integrating these components, traders can better interpret fractal signals, enhancing their strategic approach to the forex market.

Benefits of Using Fractal Markets FX (SMC)

Improved Prediction Accuracy

One of the most significant advantages of using Fractal Markets FX is the improvement in prediction accuracy. The SMC model helps in identifying reliable signals that can lead to successful trades.

Risk Management

Effective risk management is crucial in trading. The SMC strategy aids traders in identifying safer entry and exit points, reducing potential losses.

How to Implement Fractal Markets FX (SMC) in Your Trading

Step-by-Step Guide

- Identify the Signal: Look for patterns that have historically led to predictable outcomes.

- Assess the Momentum: Determine if the current market momentum supports the signal.

- Check Market Conditions: Ensure that external market conditions are favorable before executing a trade.

Tools and Resources

Several tools and resources can help in implementing the Fractal Markets FX strategy. Software that identifies fractal patterns can be particularly useful.

Case Studies and Success Stories

Real-Life Applications

We will explore a few case studies where traders have successfully applied the Fractal Markets FX (SMC) methodology to secure profitable returns.

Testimonials from Traders

Hear directly from traders who have benefited from incorporating the SMC strategy into their trading routines.

Challenges and Considerations

Learning Curve

While the benefits are significant, there is a learning curve involved in mastering fractal market strategies.

Market Volatility

Market volatility can affect the reliability of fractal patterns, making it crucial to stay informed and adaptable.

Conclusion

Fractal Markets FX (SMC) offers a fascinating and potentially lucrative approach to forex trading. By understanding and applying the principles of fractals and the SMC strategy, traders can enhance their market predictions and manage risks more effectively. Remember, while no strategy is foolproof, Fractal Markets FX provides a robust framework for navigating the complexities of forex trading.

FAQs About Fractal Markets FX (SMC)

- What is the basic concept of fractal markets?

- Fractal markets theory posits that financial markets exhibit self-similar patterns and scaling properties that can be modeled and predicted.

- How does the SMC strategy enhance forex trading?

- It integrates signal detection, momentum analysis, and condition checks to improve decision-making and risk management.

- What tools are recommended for fractal trading?

- Traders should use software that can identify and analyze fractal patterns effectively.

- Can fractal analysis predict all market movements?

- While fractal analysis provides valuable insights, it cannot predict all market movements due to inherent market unpredictability.

- Is the SMC strategy suitable for beginners?

- While beneficial, it requires a fundamental understanding of forex trading and fractal analysis, which may be challenging for beginners.

Be the first to review “Fractal Markets FX (SMC)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.