-

×

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00 -

×

Open Trader Pro Training

1 × $23.00

Open Trader Pro Training

1 × $23.00 -

×

Real Motion Trading with MarketGauge

1 × $62.00

Real Motion Trading with MarketGauge

1 × $62.00 -

×

Bing CPA Bootcamp

1 × $15.00

Bing CPA Bootcamp

1 × $15.00 -

×

The Banks Code with Smart Money Trader

1 × $34.00

The Banks Code with Smart Money Trader

1 × $34.00 -

×

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00 -

×

Options Trading Workshop On Demand with Affordable Financial Education

1 × $69.00

Options Trading Workshop On Demand with Affordable Financial Education

1 × $69.00 -

×

ETF Profit Driver Course with Bill Poulos

1 × $6.00

ETF Profit Driver Course with Bill Poulos

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00 -

×

NYC REPLAYS 2018

1 × $6.00

NYC REPLAYS 2018

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

Modeling Financial Markets. Using Visual Basic Net & Databases To Create Pricing Trading & Risk Management Models

1 × $6.00

Modeling Financial Markets. Using Visual Basic Net & Databases To Create Pricing Trading & Risk Management Models

1 × $6.00 -

×

Forex Trading MasterClass with Torero Traders School

1 × $5.00

Forex Trading MasterClass with Torero Traders School

1 × $5.00 -

×

Strees Relief for Traders Workshop with Adrienne Laris Toghraie

1 × $6.00

Strees Relief for Traders Workshop with Adrienne Laris Toghraie

1 × $6.00 -

×

The Management of Equity Investments with Dimitris Chorafas

1 × $6.00

The Management of Equity Investments with Dimitris Chorafas

1 × $6.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

TradeGuider Education Package

1 × $54.00

TradeGuider Education Package

1 × $54.00 -

×

Activedaytrader - Bond Trading Bootcamp

1 × $8.00

Activedaytrader - Bond Trading Bootcamp

1 × $8.00 -

×

The Options Applications Handbook: Hedging and Speculating Techniques for Professional Investors - Erik Banks & Paul Siegel

1 × $6.00

The Options Applications Handbook: Hedging and Speculating Techniques for Professional Investors - Erik Banks & Paul Siegel

1 × $6.00 -

×

Ichimoku 101 Cloud Trading Secrets

1 × $24.00

Ichimoku 101 Cloud Trading Secrets

1 × $24.00 -

×

Trading Hub 3.0 (Ebook)

1 × $6.00

Trading Hub 3.0 (Ebook)

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Aspectos Generales del Mercado de Valores with A.Bachiller

1 × $6.00

Aspectos Generales del Mercado de Valores with A.Bachiller

1 × $6.00 -

×

Stocks with Strauss

1 × $31.00

Stocks with Strauss

1 × $31.00 -

×

Tape Reading Trader Program (Full 4 hours) with The Daytrading Room

1 × $6.00

Tape Reading Trader Program (Full 4 hours) with The Daytrading Room

1 × $6.00 -

×

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

Fractal Markets FX (SMC)

$5.00

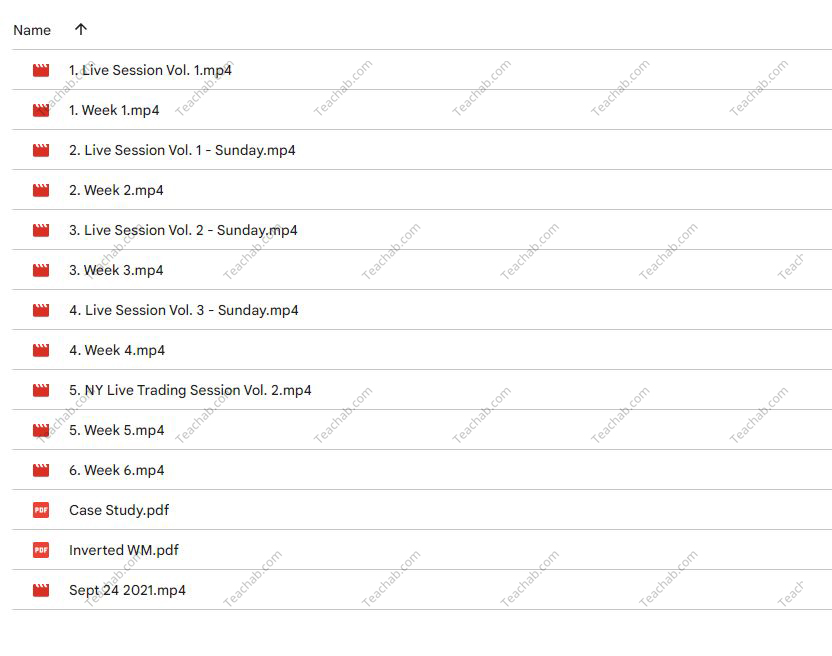

File Size: 4.34 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Fractal Markets FX (SMC)” below:

Understanding Fractal Markets FX (SMC): A Comprehensive Guide

Introduction to Fractal Markets FX (SMC)

Welcome to our deep dive into Fractal Markets FX, also known as SMC. If you’re intrigued by the complexities of financial markets and how patterns emerge, you’ve come to the right place. In this article, we will explore the intriguing world of fractal markets, particularly focusing on the Fractal Markets FX (SMC) strategy.

What Are Fractal Markets?

Defining Fractals in Financial Terms

Fractals are patterns that repeat at various scales, creating self-similar and infinitely complex patterns. In finance, these are used to understand and predict market movements more accurately.

The Significance of Fractal Analysis in Forex

Fractal analysis in Forex involves looking for repeating patterns that can offer predictions about future market movements. This method is rooted in the idea that markets are chaotic systems with underlying patterns.

The SMC Approach to Fractal Markets

What Does SMC Stand For?

SMC stands for Signal, Momentum, and Condition, the three pillars of this trading strategy. Each component plays a vital role in making informed trading decisions.

Integrating SMC into Forex Trading

By integrating these components, traders can better interpret fractal signals, enhancing their strategic approach to the forex market.

Benefits of Using Fractal Markets FX (SMC)

Improved Prediction Accuracy

One of the most significant advantages of using Fractal Markets FX is the improvement in prediction accuracy. The SMC model helps in identifying reliable signals that can lead to successful trades.

Risk Management

Effective risk management is crucial in trading. The SMC strategy aids traders in identifying safer entry and exit points, reducing potential losses.

How to Implement Fractal Markets FX (SMC) in Your Trading

Step-by-Step Guide

- Identify the Signal: Look for patterns that have historically led to predictable outcomes.

- Assess the Momentum: Determine if the current market momentum supports the signal.

- Check Market Conditions: Ensure that external market conditions are favorable before executing a trade.

Tools and Resources

Several tools and resources can help in implementing the Fractal Markets FX strategy. Software that identifies fractal patterns can be particularly useful.

Case Studies and Success Stories

Real-Life Applications

We will explore a few case studies where traders have successfully applied the Fractal Markets FX (SMC) methodology to secure profitable returns.

Testimonials from Traders

Hear directly from traders who have benefited from incorporating the SMC strategy into their trading routines.

Challenges and Considerations

Learning Curve

While the benefits are significant, there is a learning curve involved in mastering fractal market strategies.

Market Volatility

Market volatility can affect the reliability of fractal patterns, making it crucial to stay informed and adaptable.

Conclusion

Fractal Markets FX (SMC) offers a fascinating and potentially lucrative approach to forex trading. By understanding and applying the principles of fractals and the SMC strategy, traders can enhance their market predictions and manage risks more effectively. Remember, while no strategy is foolproof, Fractal Markets FX provides a robust framework for navigating the complexities of forex trading.

FAQs About Fractal Markets FX (SMC)

- What is the basic concept of fractal markets?

- Fractal markets theory posits that financial markets exhibit self-similar patterns and scaling properties that can be modeled and predicted.

- How does the SMC strategy enhance forex trading?

- It integrates signal detection, momentum analysis, and condition checks to improve decision-making and risk management.

- What tools are recommended for fractal trading?

- Traders should use software that can identify and analyze fractal patterns effectively.

- Can fractal analysis predict all market movements?

- While fractal analysis provides valuable insights, it cannot predict all market movements due to inherent market unpredictability.

- Is the SMC strategy suitable for beginners?

- While beneficial, it requires a fundamental understanding of forex trading and fractal analysis, which may be challenging for beginners.

Be the first to review “Fractal Markets FX (SMC)” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.