-

×

The Realistic Trader - Crypto Currencies

1 × $31.00

The Realistic Trader - Crypto Currencies

1 × $31.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Real Options Analysis: Tools and Techniques for Valuing Strategic Investments and Decisions - Johnathan Mun

1 × $6.00

Real Options Analysis: Tools and Techniques for Valuing Strategic Investments and Decisions - Johnathan Mun

1 × $6.00 -

×

Chart Analysis Boot Camp Course Webinar with Mike Albright

1 × $6.00

Chart Analysis Boot Camp Course Webinar with Mike Albright

1 × $6.00 -

×

Toast FX Course

1 × $5.00

Toast FX Course

1 × $5.00 -

×

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00 -

×

Exploring MetaStock Advanced with Martin Pring

1 × $6.00

Exploring MetaStock Advanced with Martin Pring

1 × $6.00 -

×

The Top Tier Pro System Basic with Raghee Horner

1 × $41.00

The Top Tier Pro System Basic with Raghee Horner

1 × $41.00 -

×

TradingWithBilz Course

1 × $10.00

TradingWithBilz Course

1 × $10.00 -

×

Andy’s EMini Bar – 60 Min System

1 × $6.00

Andy’s EMini Bar – 60 Min System

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Market Evolution

1 × $6.00

Market Evolution

1 × $6.00 -

×

Inner Cicle Trader - ICT Methods with Michael Huddleston

1 × $5.00

Inner Cicle Trader - ICT Methods with Michael Huddleston

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The MMXM Traders Course - The MMXM Trader

1 × $5.00

The MMXM Traders Course - The MMXM Trader

1 × $5.00 -

×

Catching the Bounce

1 × $6.00

Catching the Bounce

1 × $6.00 -

×

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00 -

×

FestX Main Online video Course with Clint Fester

1 × $5.00

FestX Main Online video Course with Clint Fester

1 × $5.00 -

×

Introduction to Futures & Options Markets (2nd Ed.)

1 × $6.00

Introduction to Futures & Options Markets (2nd Ed.)

1 × $6.00 -

×

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00 -

×

Reading The Tape Trade Series with CompassFX

1 × $10.00

Reading The Tape Trade Series with CompassFX

1 × $10.00 -

×

Weekly Options Windfall and Bonus with James Preston

1 × $54.00

Weekly Options Windfall and Bonus with James Preston

1 × $54.00 -

×

The Box Strategy with Blue Capital Academy

1 × $23.00

The Box Strategy with Blue Capital Academy

1 × $23.00 -

×

Trade Your Way to Wealth with Bill Kraft

1 × $6.00

Trade Your Way to Wealth with Bill Kraft

1 × $6.00 -

×

Options, Futures & Other Derivatives (6th Ed.)

1 × $6.00

Options, Futures & Other Derivatives (6th Ed.)

1 × $6.00 -

×

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00 -

×

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00 -

×

Investment Science with David G.Luenberger

1 × $6.00

Investment Science with David G.Luenberger

1 × $6.00 -

×

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00 -

×

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00 -

×

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00 -

×

Financial Astrology Course with Brian James Sklenka

1 × $6.00

Financial Astrology Course with Brian James Sklenka

1 × $6.00 -

×

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Portfolio Management in Practice with Christine Brentani

1 × $6.00

Portfolio Management in Practice with Christine Brentani

1 × $6.00 -

×

Investors Live Textbook Trading DVD

1 × $15.00

Investors Live Textbook Trading DVD

1 × $15.00 -

×

The 2021 TraderLion Stock Trading Conference with Trader Lion

1 × $5.00

The 2021 TraderLion Stock Trading Conference with Trader Lion

1 × $5.00 -

×

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00 -

×

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00 -

×

Profiting With Forex: The Most Effective Tools and Techniques for Trading Currencies - John Jagerson & Wade Hansen

1 × $6.00

Profiting With Forex: The Most Effective Tools and Techniques for Trading Currencies - John Jagerson & Wade Hansen

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Speculating with Foreign Currencies with Liverpool Group

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

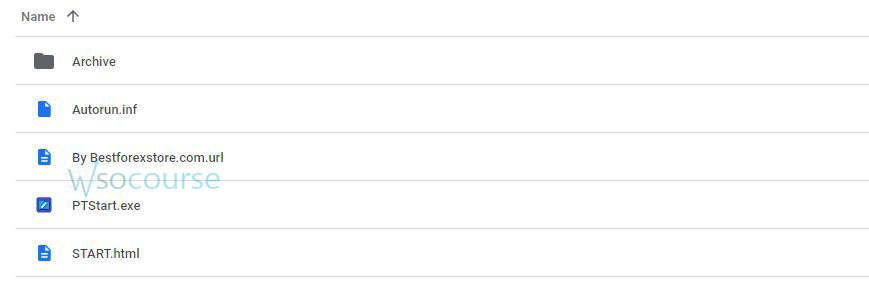

Content Proof: Watch Here!

You may check content proof of “Speculating with Foreign Currencies with Liverpool Group” below:

Speculating with Foreign Currencies with Liverpool Group

In the fast-paced world of foreign currency trading, or forex, speculating can be both thrilling and lucrative. The Liverpool Group, renowned for its expertise in financial markets, provides valuable insights and strategies for investors aiming to succeed in forex trading. This article delves into the nuances of speculating with foreign currencies, offering a comprehensive guide to enhance your investment experience.

Understanding Forex Trading

What is Forex Trading?

Forex trading involves buying and selling currencies with the aim of making a profit. It’s the largest financial market globally, with trillions of dollars traded daily.

Why Trade Forex?

Forex offers high liquidity, 24-hour trading, and the potential for significant returns. It’s an appealing market for both novice and experienced traders.

Liverpool Group’s Approach to Forex Trading

Who is Liverpool Group?

Liverpool Group is a leading financial advisory firm specializing in forex trading. They offer tailored strategies and insights to help investors navigate the forex market.

Liverpool Group’s Forex Strategy

Their strategy combines technical analysis, fundamental analysis, and risk management to maximize returns while minimizing risks.

Key Concepts in Forex Trading

Currency Pairs

Forex trading is done in pairs, such as EUR/USD or GBP/JPY. Each pair consists of a base currency and a quote currency.

Leverage in Forex

Leverage allows traders to control large positions with a relatively small capital investment. While it can amplify gains, it also increases potential losses.

Pips and Pipettes

A pip is the smallest price move in a forex pair. A pipette is one-tenth of a pip, providing even finer measurement of price movements.

Market Analysis Techniques

Technical Analysis

Technical analysis involves studying price charts and using indicators like moving averages and RSI to predict future price movements.

Fundamental Analysis

Fundamental analysis examines economic indicators, interest rates, and geopolitical events to assess currency value.

Sentiment Analysis

Sentiment analysis gauges the mood of the market, often using data from news sources and trader positioning.

Trading Strategies with Liverpool Group

Scalping

Scalping involves making multiple trades throughout the day to profit from small price movements. It’s a high-frequency trading strategy.

Day Trading

Day trading involves buying and selling currencies within the same trading day to capitalize on intraday price movements.

Swing Trading

Swing trading aims to capture price swings over several days or weeks, making it a longer-term strategy compared to scalping and day trading.

Risk Management in Forex Trading

Setting Stop-Loss Orders

Stop-loss orders limit potential losses by automatically closing a position at a predetermined price level.

Position Sizing

Position sizing involves determining the amount of capital to risk on each trade, ensuring that losses do not exceed a specified percentage of the trading account.

Diversification

Diversifying investments across various currency pairs can reduce risk and increase the chances of profitable trades.

Common Challenges in Forex Trading

Market Volatility

Forex markets can be highly volatile, leading to rapid and significant price movements. Traders must be prepared for sudden changes.

Emotional Trading

Trading decisions driven by emotions, such as fear and greed, can lead to significant losses. Maintaining a disciplined approach is crucial.

Overtrading

Making too many trades in a short period can lead to poor decision-making and increased transaction costs. Traders should focus on quality over quantity.

Success Stories with Liverpool Group

Case Study: EUR/USD Trading

Liverpool Group guided an investor through a volatile period in the EUR/USD pair, leveraging technical and fundamental analysis to achieve impressive returns.

Case Study: Diversification Strategy

By diversifying across multiple currency pairs, Liverpool Group helped an investor mitigate risks associated with market volatility, resulting in steady portfolio growth.

Conclusion

Speculating with foreign currencies offers both opportunities and challenges. The Liverpool Group provides valuable expertise, helping investors navigate the forex market with confidence. By combining thorough market analysis with disciplined risk management, investors can enhance their chances of achieving superior returns.

FAQs

1. What is the main advantage of forex trading?

The primary advantage is high liquidity, allowing traders to enter and exit positions quickly.

2. How does Liverpool Group manage risk in forex trading?

They use techniques like stop-loss orders, position sizing, and diversification to manage risk effectively.

3. What are some common forex trading strategies?

Common strategies include scalping, day trading, and swing trading.

4. What factors influence currency prices?

Currency prices are influenced by economic indicators, interest rates, and geopolitical events.

5. Can beginners succeed in forex trading?

Yes, but it’s recommended to seek guidance from experienced professionals like Liverpool Group to navigate the complexities of the forex market.

Be the first to review “Speculating with Foreign Currencies with Liverpool Group” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.