-

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

2-Phase A.I. Trade Spy Total Immersion Experience with Jeff Bierman - The Quant Guy

1 × $209.00

2-Phase A.I. Trade Spy Total Immersion Experience with Jeff Bierman - The Quant Guy

1 × $209.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

“The Beast” Automated Trading System V2 (Feb 2015)

1 × $15.00

“The Beast” Automated Trading System V2 (Feb 2015)

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

MACK - PATS Simple ES Scalping Strategy

1 × $15.00

MACK - PATS Simple ES Scalping Strategy

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

'Smart Money' Institutional Forex Trading with Jeffrey Edahs

1 × $6.00

'Smart Money' Institutional Forex Trading with Jeffrey Edahs

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00

Investment Analysis and Portfolio Management with Frank Reilly

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

10 Best Swing Trading Patterns & Strategies with Dave Landry

1 × $4.00

10 Best Swing Trading Patterns & Strategies with Dave Landry

1 × $4.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00 -

×

Russell Futures Scalping Course with Bill McDowell

1 × $6.00

Russell Futures Scalping Course with Bill McDowell

1 × $6.00 -

×

14-Day Options Trading Bootcamp (Jule 2014)

1 × $15.00

14-Day Options Trading Bootcamp (Jule 2014)

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

”Trading With The Generals 2003-2004” Training Course with Kevin Haggerty

1 × $6.00

”Trading With The Generals 2003-2004” Training Course with Kevin Haggerty

1 × $6.00 -

×

24-Hour Un-Education Trading Course

1 × $54.00

24-Hour Un-Education Trading Course

1 × $54.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Art and Application of Technical Analysis with Cynthia Kase

1 × $6.00

The Art and Application of Technical Analysis with Cynthia Kase

1 × $6.00 -

×

2014 Advanced Swing Trading Summit

1 × $31.00

2014 Advanced Swing Trading Summit

1 × $31.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

2010 The Market Mastery Protégé Program

1 × $31.00

2010 The Market Mastery Protégé Program

1 × $31.00 -

×

$1,500 to $1 Million In 3 Years

1 × $39.00

$1,500 to $1 Million In 3 Years

1 × $39.00

Forex Candlestick System. High Profit Forex Trading with B.M.Davis

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

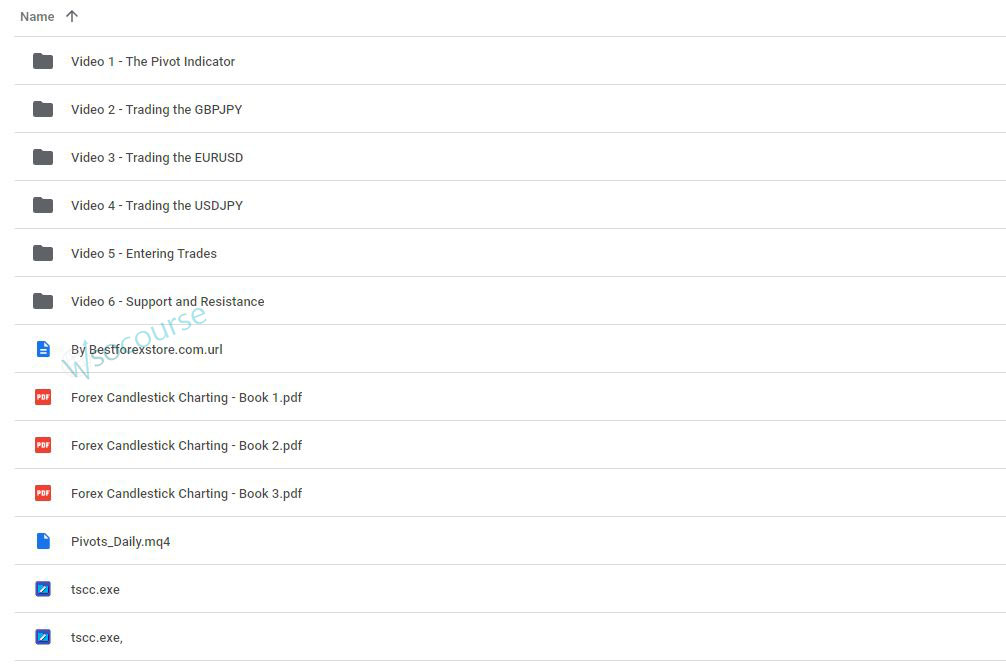

Content Proof: Watch Here!

You may check content proof of “Forex Candlestick System. High Profit Forex Trading with B.M.Davis” below:

High Profit Forex Trading with B.M.Davis

The realm of Forex trading offers vast opportunities for substantial returns, and mastering candlestick patterns is crucial to navigating this volatile market effectively. B.M.Davis, a renowned expert in Forex trading, shares strategies that leverage the power of Forex candlesticks to maximize profits. This comprehensive guide will explore various candlestick formations and their predictive capabilities in currency trading.

Introduction to Forex Candlestick Patterns

Understanding candlestick patterns is essential for any trader looking to gain an edge in the Forex market.

What Are Candlesticks?

Candlesticks are graphical representations of price movements within a specified time frame, offering insights into market sentiment and potential price directions.

The Anatomy of a Candlestick

Each candlestick consists of a body and wicks, indicating the open, close, high, and low prices during the trading period.

Basic Candlestick Patterns

Recognizing basic patterns is the first step to proficient Forex trading.

The Doji

A Doji occurs when the opening and closing prices are virtually equal, representing market indecision.

Bullish and Bearish Engulfing

These patterns signify potential market reversals, where bullish or bearish sentiments overpower previous sentiments.

Advanced Candlestick Patterns

For those looking to deepen their Forex analysis, advanced patterns provide more nuanced insights.

The Morning Star

A bullish reversal pattern that signals the end of a downtrend and the start of an uptrend.

The Evening Star

The opposite of the Morning Star, this pattern suggests a switch from an uptrend to a downtrend.

Candlesticks in Forex Trading Strategies

Integrating candlesticks into trading strategies can significantly enhance decision-making.

Trend Analysis

Using candlesticks to identify and confirm trends is a powerful method for securing profitable trades.

Entry and Exit Points

Candlestick patterns can help traders determine optimal moments to enter or exit trades, maximizing potential profits.

Risk Management with Candlesticks

Effective use of candlestick patterns also involves prudent risk management.

Stop-Loss Orders

Setting stop-loss orders based on candlestick formations can help protect against unforeseen market reversals.

Position Sizing

Adjusting position sizes based on the strength of candlestick signals can mitigate risk while maximizing returns.

Combining Candlesticks with Other Indicators

For best results, candlesticks should be used in conjunction with other technical analysis tools.

Moving Averages

Candlesticks combined with moving averages can confirm trend directions and strength.

RSI and MACD

These indicators, when used with candlestick patterns, can help validate potential buy or sell signals.

Psychological Aspects of Candlestick Trading

Understanding the psychology behind candlestick formations can provide deeper market insights.

Market Sentiment

Candlestick patterns reflect the psychological state of the market, influencing trader behavior.

Trader Behavior

Recognizing common psychological triggers can help predict market movements more accurately.

Conclusion

Forex trading using candlestick systems requires not only understanding the patterns but also integrating them into a comprehensive trading strategy. With insights from B.M.Davis, traders can utilize these patterns to enhance their trading decisions, manage risks effectively, and increase profitability.

Frequently Asked Questions:

- What is the best candlestick pattern for beginners?

The Doji and engulfing patterns are great starting points due to their simplicity and frequency of occurrence. - How reliable are candlestick patterns in Forex trading?

While highly informative, they should be used in conjunction with other analysis tools for best results. - Can candlestick patterns predict market turns?

Yes, patterns like the Morning Star and Evening Star are particularly good at indicating potential reversals. - How important is it to practice candlestick trading in a demo account?

Practicing in a demo account is crucial to gain confidence and refine strategies without financial risk. - What is a common mistake made by traders using candlesticks?

Relying solely on candlesticks without considering market context or other indicators can lead to misinformed decisions.

Be the first to review “Forex Candlestick System. High Profit Forex Trading with B.M.Davis” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.