-

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Trading with Wave59 with Earik Beann

1 × $6.00

Trading with Wave59 with Earik Beann

1 × $6.00 -

×

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00 -

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

TraderSumo Academy Course

1 × $13.00

TraderSumo Academy Course

1 × $13.00 -

×

Trading Trainer - 6 Percent Protocol

1 × $39.00

Trading Trainer - 6 Percent Protocol

1 × $39.00 -

×

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00 -

×

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00 -

×

Andy’s EMini Bar – 60 Min System

1 × $6.00

Andy’s EMini Bar – 60 Min System

1 × $6.00 -

×

4 Strategies That Will Make You a Professional Day Trader with Jerremy Newsome

1 × $6.00

4 Strategies That Will Make You a Professional Day Trader with Jerremy Newsome

1 × $6.00 -

×

Activedaytrader - Mastering Technicals

1 × $15.00

Activedaytrader - Mastering Technicals

1 × $15.00 -

×

The Geography of Money with Benjamin J.Cohen

1 × $6.00

The Geography of Money with Benjamin J.Cohen

1 × $6.00 -

×

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00 -

×

Quant Edge with T3 Live

1 × $6.00

Quant Edge with T3 Live

1 × $6.00 -

×

Investor’s Guide to Charting By Alistair Blair

1 × $6.00

Investor’s Guide to Charting By Alistair Blair

1 × $6.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00 -

×

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00 -

×

Mastering Candlestick Charts II with Greg Capra

1 × $6.00

Mastering Candlestick Charts II with Greg Capra

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Forex Strategy Course with Angel Traders

1 × $6.00

Forex Strategy Course with Angel Traders

1 × $6.00 -

×

Price Action and Orderflow Course with Young Tilopa

1 × $17.00

Price Action and Orderflow Course with Young Tilopa

1 × $17.00 -

×

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00 -

×

Secrets of the Darvas Trading System

1 × $6.00

Secrets of the Darvas Trading System

1 × $6.00 -

×

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Traders World Past Issue Articles on CD with Magazine

1 × $6.00

Traders World Past Issue Articles on CD with Magazine

1 × $6.00 -

×

How I Day Trade Course with Traderade

1 × $15.00

How I Day Trade Course with Traderade

1 × $15.00 -

×

Trade the OEX with Arthur Darack

1 × $6.00

Trade the OEX with Arthur Darack

1 × $6.00 -

×

Cheatcode Trend System with Dominique Woodson

1 × $15.00

Cheatcode Trend System with Dominique Woodson

1 × $15.00 -

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Practical Handbook of Genetic Algorithms with Lance Chambers

1 × $6.00

The Practical Handbook of Genetic Algorithms with Lance Chambers

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00 -

×

MTI - Basics UTP

1 × $6.00

MTI - Basics UTP

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00 -

×

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00 -

×

The Practical Fractal with Bill Williams

1 × $6.00

The Practical Fractal with Bill Williams

1 × $6.00 -

×

30 Trading Classics with 3T Live

1 × $5.00

30 Trading Classics with 3T Live

1 × $5.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

D5 Render Course with Nuno Silva

1 × $27.00

D5 Render Course with Nuno Silva

1 × $27.00 -

×

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

$6.00

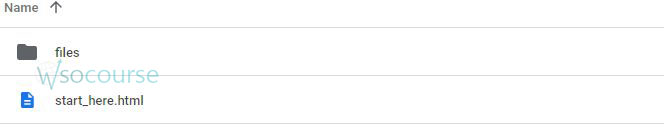

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers” below:

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

Introduction to First Time Investing

Investing for the first time can be a daunting experience. The second edition of “The First Time Investor: How to Start Safe, Invest Smart and Sleep Well” by Larry Chambers aims to ease this journey. This guide is designed to help new investors navigate the complex world of investing with confidence and peace of mind.

Why First Time Investing is Important

Building Financial Security

Investing is crucial for building long-term financial security. By starting early, you can take advantage of compound interest and grow your wealth over time.

Achieving Financial Goals

Whether it’s buying a home, funding education, or planning for retirement, investing helps you achieve your financial goals more effectively than saving alone.

Understanding the Basics

What is Investing?

Investing involves putting money into financial instruments like stocks, bonds, and mutual funds with the expectation of generating returns.

Types of Investments

Stocks

Stocks represent ownership in a company. They offer high potential returns but come with higher risks.

Bonds

Bonds are debt securities issued by corporations or governments. They provide regular interest income and are generally considered safer than stocks.

Mutual Funds

Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities.

Starting Safe: Key Strategies

Educate Yourself

Before diving into the market, it’s essential to educate yourself. Books like Larry Chambers’ guide provide valuable insights and practical advice.

Set Clear Goals

Define your financial goals. Knowing what you want to achieve will help you make informed investment decisions.

Create a Budget

Establish a budget that includes savings for investments. Ensure that you only invest money you can afford to set aside for the long term.

Emergency Fund

Build an emergency fund with three to six months’ worth of expenses. This safety net ensures you don’t have to liquidate investments during financial crises.

Investing Smart: Practical Tips

Diversify Your Portfolio

What is Diversification?

Diversification involves spreading your investments across different asset classes to reduce risk.

How to Diversify

- Stocks and Bonds: Balance your portfolio with a mix of stocks and bonds.

- Geographical Diversification: Invest in international markets to mitigate regional risks.

- Sector Diversification: Invest in various sectors like technology, healthcare, and consumer goods.

Understand Risk Tolerance

Assess your risk tolerance before investing. Your risk tolerance depends on your financial situation, goals, and comfort level with market fluctuations.

Start with Low-Cost Index Funds

Index funds offer broad market exposure at a low cost. They are ideal for beginners due to their simplicity and diversification benefits.

Regularly Review Your Portfolio

Monitor your investments and make adjustments as needed. Regular reviews help ensure your portfolio remains aligned with your goals and risk tolerance.

Avoid Emotional Investing

Investing based on emotions can lead to poor decisions. Stick to your plan and avoid reacting to short-term market movements.

Sleep Well: Managing Investment Stress

Long-Term Perspective

Adopt a long-term perspective to reduce stress. Focus on your long-term goals rather than short-term market fluctuations.

Stay Informed but Not Obsessed

Keep yourself informed about the market, but avoid obsessing over daily changes. Regular updates are sufficient to stay on track.

Professional Advice

Consider seeking advice from a financial advisor. A professional can provide personalized guidance and help you make sound investment decisions.

Conclusion

Investing for the first time doesn’t have to be overwhelming. With the right knowledge and strategies, you can start safe, invest smart, and sleep well. Larry Chambers’ “The First Time Investor” provides a comprehensive guide to help you navigate this journey confidently. Remember to educate yourself, set clear goals, diversify your portfolio, and maintain a long-term perspective.

FAQs

What is the best way to start investing?

The best way to start investing is to educate yourself, set clear financial goals, and begin with low-cost index funds. Diversifying your portfolio and understanding your risk tolerance are also crucial steps.

How much money do I need to start investing?

You don’t need a large amount of money to start investing. Many brokerage firms offer accounts with no minimum balance, allowing you to start with whatever amount you are comfortable with.

What is the importance of an emergency fund?

An emergency fund provides a financial safety net, ensuring you don’t have to sell your investments during financial crises. It helps you manage unexpected expenses without disrupting your investment strategy.

How often should I review my investment portfolio?

It’s advisable to review your investment portfolio at least once a year. Regular reviews help ensure your investments remain aligned with your financial goals and risk tolerance.

Can I invest without a financial advisor?

Yes, you can invest without a financial advisor by educating yourself and using online brokerage platforms. However, if you prefer personalized guidance, a financial advisor can provide valuable insights and help you make informed decisions.

Be the first to review “The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.