-

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Advanced Iron Condor Course in 2021

1 × $6.00

Advanced Iron Condor Course in 2021

1 × $6.00 -

×

CarterFX Membership with Duran Carter

1 × $23.00

CarterFX Membership with Duran Carter

1 × $23.00 -

×

Active Investing courses notes with Alan Hull

1 × $6.00

Active Investing courses notes with Alan Hull

1 × $6.00 -

×

Small and Mighty Association with Ryan Lee

1 × $6.00

Small and Mighty Association with Ryan Lee

1 × $6.00 -

×

Charting Made Easy with John J.Murphy

1 × $6.00

Charting Made Easy with John J.Murphy

1 × $6.00 -

×

Mind Over Markets

1 × $6.00

Mind Over Markets

1 × $6.00 -

×

Power Income FUTURES Day Trading Course with Trade Out Loud

1 × $31.00

Power Income FUTURES Day Trading Course with Trade Out Loud

1 × $31.00 -

×

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00 -

×

Advanced Swing Trading with John Crane

1 × $6.00

Advanced Swing Trading with John Crane

1 × $6.00 -

×

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

TradingMind Course with Jack Bernstein

1 × $6.00

TradingMind Course with Jack Bernstein

1 × $6.00 -

×

A-Z Course with InvestiTrade Academy

1 × $5.00

A-Z Course with InvestiTrade Academy

1 × $5.00 -

×

Master Time Factor & Forecasting with Mathematical Rules

1 × $6.00

Master Time Factor & Forecasting with Mathematical Rules

1 × $6.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

The 10%ers with Trader Mike

1 × $5.00

The 10%ers with Trader Mike

1 × $5.00 -

×

The Whale Trade Workshop Plus One Week of Live Trading with Doc Severson

1 × $6.00

The Whale Trade Workshop Plus One Week of Live Trading with Doc Severson

1 × $6.00 -

×

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00 -

×

Arjoio’s MMT - Essential Package

1 × $5.00

Arjoio’s MMT - Essential Package

1 × $5.00 -

×

Forex Profit Multiplier with Bill & Greg Poulos

1 × $6.00

Forex Profit Multiplier with Bill & Greg Poulos

1 × $6.00 -

×

Build Your Own Trading System with John Hill

1 × $6.00

Build Your Own Trading System with John Hill

1 × $6.00 -

×

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00 -

×

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Predicting Market Trends with Alan S.Farley

1 × $6.00

Predicting Market Trends with Alan S.Farley

1 × $6.00 -

×

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00

The Dark Side Of Valuation with Aswath Damodaran

1 × $6.00 -

×

Day Trade Futures Online with Larry Williams

1 × $6.00

Day Trade Futures Online with Larry Williams

1 × $6.00 -

×

The Complete Guide to Market Breadth Indicators: How to Analyze and Evaluate market Direction and Strength - Greg Morris

1 × $6.00

The Complete Guide to Market Breadth Indicators: How to Analyze and Evaluate market Direction and Strength - Greg Morris

1 × $6.00 -

×

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00 -

×

Market Structure Matters with Haim Bodek

1 × $62.00

Market Structure Matters with Haim Bodek

1 × $62.00 -

×

Forex Retracement Theory with CopperChips

1 × $6.00

Forex Retracement Theory with CopperChips

1 × $6.00 -

×

Candlesticks Re-Ignited Workshop

1 × $23.00

Candlesticks Re-Ignited Workshop

1 × $23.00 -

×

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00 -

×

High Probability Option Trading - Seasonal Straddles

1 × $6.00

High Probability Option Trading - Seasonal Straddles

1 × $6.00 -

×

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

The Blockchain Bootcamp 2.0 with Gregory (Dapp University)

1 × $15.00

The Blockchain Bootcamp 2.0 with Gregory (Dapp University)

1 × $15.00 -

×

Trading for a Living with Alexander Elder

1 × $6.00

Trading for a Living with Alexander Elder

1 × $6.00 -

×

Pristine - Tom Willard – Creating The Ultimate Trading Psychology Using 3 Key Concepts

1 × $6.00

Pristine - Tom Willard – Creating The Ultimate Trading Psychology Using 3 Key Concepts

1 × $6.00 -

×

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00 -

×

The Michanics of Futures Trading - Roy Habben

1 × $6.00

The Michanics of Futures Trading - Roy Habben

1 × $6.00 -

×

Selected Articles by the Late by George Lindsay

1 × $6.00

Selected Articles by the Late by George Lindsay

1 × $6.00 -

×

ShadowTrader Weighted S&P Advance Decline Line thinkScript with Peter Reznicek - ShadowTrader

1 × $23.00

ShadowTrader Weighted S&P Advance Decline Line thinkScript with Peter Reznicek - ShadowTrader

1 × $23.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Trading for a Bright Future with Martin Cole

1 × $6.00

Trading for a Bright Future with Martin Cole

1 × $6.00 -

×

Fractal Energy Trading with Doc Severson

1 × $6.00

Fractal Energy Trading with Doc Severson

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

$6.00

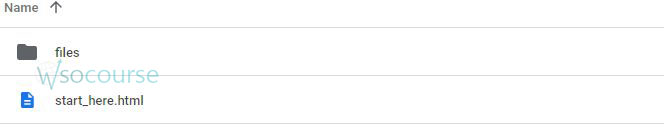

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers” below:

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

Introduction to First Time Investing

Investing for the first time can be a daunting experience. The second edition of “The First Time Investor: How to Start Safe, Invest Smart and Sleep Well” by Larry Chambers aims to ease this journey. This guide is designed to help new investors navigate the complex world of investing with confidence and peace of mind.

Why First Time Investing is Important

Building Financial Security

Investing is crucial for building long-term financial security. By starting early, you can take advantage of compound interest and grow your wealth over time.

Achieving Financial Goals

Whether it’s buying a home, funding education, or planning for retirement, investing helps you achieve your financial goals more effectively than saving alone.

Understanding the Basics

What is Investing?

Investing involves putting money into financial instruments like stocks, bonds, and mutual funds with the expectation of generating returns.

Types of Investments

Stocks

Stocks represent ownership in a company. They offer high potential returns but come with higher risks.

Bonds

Bonds are debt securities issued by corporations or governments. They provide regular interest income and are generally considered safer than stocks.

Mutual Funds

Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities.

Starting Safe: Key Strategies

Educate Yourself

Before diving into the market, it’s essential to educate yourself. Books like Larry Chambers’ guide provide valuable insights and practical advice.

Set Clear Goals

Define your financial goals. Knowing what you want to achieve will help you make informed investment decisions.

Create a Budget

Establish a budget that includes savings for investments. Ensure that you only invest money you can afford to set aside for the long term.

Emergency Fund

Build an emergency fund with three to six months’ worth of expenses. This safety net ensures you don’t have to liquidate investments during financial crises.

Investing Smart: Practical Tips

Diversify Your Portfolio

What is Diversification?

Diversification involves spreading your investments across different asset classes to reduce risk.

How to Diversify

- Stocks and Bonds: Balance your portfolio with a mix of stocks and bonds.

- Geographical Diversification: Invest in international markets to mitigate regional risks.

- Sector Diversification: Invest in various sectors like technology, healthcare, and consumer goods.

Understand Risk Tolerance

Assess your risk tolerance before investing. Your risk tolerance depends on your financial situation, goals, and comfort level with market fluctuations.

Start with Low-Cost Index Funds

Index funds offer broad market exposure at a low cost. They are ideal for beginners due to their simplicity and diversification benefits.

Regularly Review Your Portfolio

Monitor your investments and make adjustments as needed. Regular reviews help ensure your portfolio remains aligned with your goals and risk tolerance.

Avoid Emotional Investing

Investing based on emotions can lead to poor decisions. Stick to your plan and avoid reacting to short-term market movements.

Sleep Well: Managing Investment Stress

Long-Term Perspective

Adopt a long-term perspective to reduce stress. Focus on your long-term goals rather than short-term market fluctuations.

Stay Informed but Not Obsessed

Keep yourself informed about the market, but avoid obsessing over daily changes. Regular updates are sufficient to stay on track.

Professional Advice

Consider seeking advice from a financial advisor. A professional can provide personalized guidance and help you make sound investment decisions.

Conclusion

Investing for the first time doesn’t have to be overwhelming. With the right knowledge and strategies, you can start safe, invest smart, and sleep well. Larry Chambers’ “The First Time Investor” provides a comprehensive guide to help you navigate this journey confidently. Remember to educate yourself, set clear goals, diversify your portfolio, and maintain a long-term perspective.

FAQs

What is the best way to start investing?

The best way to start investing is to educate yourself, set clear financial goals, and begin with low-cost index funds. Diversifying your portfolio and understanding your risk tolerance are also crucial steps.

How much money do I need to start investing?

You don’t need a large amount of money to start investing. Many brokerage firms offer accounts with no minimum balance, allowing you to start with whatever amount you are comfortable with.

What is the importance of an emergency fund?

An emergency fund provides a financial safety net, ensuring you don’t have to sell your investments during financial crises. It helps you manage unexpected expenses without disrupting your investment strategy.

How often should I review my investment portfolio?

It’s advisable to review your investment portfolio at least once a year. Regular reviews help ensure your investments remain aligned with your financial goals and risk tolerance.

Can I invest without a financial advisor?

Yes, you can invest without a financial advisor by educating yourself and using online brokerage platforms. However, if you prefer personalized guidance, a financial advisor can provide valuable insights and help you make informed decisions.

Be the first to review “The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.