-

×

The Winning Watch-List with Ryan Mallory

1 × $31.00

The Winning Watch-List with Ryan Mallory

1 × $31.00 -

×

Renko Mastery Intensive Program

1 × $85.00

Renko Mastery Intensive Program

1 × $85.00 -

×

Nico FX Journal (SMC)

1 × $5.00

Nico FX Journal (SMC)

1 × $5.00 -

×

Inside the House of Money (2006) with Steven Drobny

1 × $6.00

Inside the House of Money (2006) with Steven Drobny

1 × $6.00 -

×

The Complete 32 Plus Hour Video Course Bundle with Rob Hoffman - Become a Better Trader

1 × $6.00

The Complete 32 Plus Hour Video Course Bundle with Rob Hoffman - Become a Better Trader

1 × $6.00 -

×

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00 -

×

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00 -

×

Option Strategies with Courtney Smith

1 × $6.00

Option Strategies with Courtney Smith

1 × $6.00 -

×

The Tickmaster Indicator with Alphashark

1 × $54.00

The Tickmaster Indicator with Alphashark

1 × $54.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

My Favorite Trades – Trading Mastery

1 × $6.00

My Favorite Trades – Trading Mastery

1 × $6.00 -

×

Super CD Companion for Metastock with Martin Pring

1 × $6.00

Super CD Companion for Metastock with Martin Pring

1 × $6.00 -

×

Intermediate Stock Course

1 × $54.00

Intermediate Stock Course

1 × $54.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Private Ephemeris 1941-1950

1 × $23.00

Private Ephemeris 1941-1950

1 × $23.00 -

×

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00 -

×

Day & Position Trading Using DiNapoli Levels with Joe Dinapoli & Merrick Okamoto

1 × $6.00

Day & Position Trading Using DiNapoli Levels with Joe Dinapoli & Merrick Okamoto

1 × $6.00 -

×

Supply and Demand 2023 with Willy Jay

1 × $5.00

Supply and Demand 2023 with Willy Jay

1 × $5.00 -

×

Gann Simplified with Clif Droke

1 × $6.00

Gann Simplified with Clif Droke

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00 -

×

Shecantrade – Day Trading Options

1 × $23.00

Shecantrade – Day Trading Options

1 × $23.00 -

×

Futures Masterclass with Market Flow Trader

1 × $17.00

Futures Masterclass with Market Flow Trader

1 × $17.00 -

×

Building Wealth In Stock Market with David Novac

1 × $6.00

Building Wealth In Stock Market with David Novac

1 × $6.00 -

×

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

News FX Strategy with Zain Agha

1 × $6.00

News FX Strategy with Zain Agha

1 × $6.00 -

×

Momentum Signals Training Course with Fulcum Trader

1 × $5.00

Momentum Signals Training Course with Fulcum Trader

1 × $5.00 -

×

Credit Risk from Transaction to Portfolio Management with Andrew Kimber

1 × $6.00

Credit Risk from Transaction to Portfolio Management with Andrew Kimber

1 × $6.00 -

×

Stop Being the Stock Market Plankton with Idan Gabrieli

1 × $6.00

Stop Being the Stock Market Plankton with Idan Gabrieli

1 × $6.00 -

×

Reality Based Trading with Matt Petrallia - Trading Equilibrium

1 × $17.00

Reality Based Trading with Matt Petrallia - Trading Equilibrium

1 × $17.00 -

×

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00 -

×

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00 -

×

Butterflies For Monthly Income 2016 with Dan Sheridan

1 × $15.00

Butterflies For Monthly Income 2016 with Dan Sheridan

1 × $15.00 -

×

Stock Detective Investor: Finding Market Gems Online with Kevin Lichtman & Lynn Duke

1 × $6.00

Stock Detective Investor: Finding Market Gems Online with Kevin Lichtman & Lynn Duke

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Statistics of Extremes: Theory and Applications with Jan Beirlant, Yuri Goegebeur, Jozef Teugels & Johan Segers

1 × $6.00

Statistics of Extremes: Theory and Applications with Jan Beirlant, Yuri Goegebeur, Jozef Teugels & Johan Segers

1 × $6.00 -

×

Support and Resistance Trading with Rob Booker

1 × $6.00

Support and Resistance Trading with Rob Booker

1 × $6.00 -

×

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00 -

×

Beat The Market Maker

1 × $62.00

Beat The Market Maker

1 × $62.00 -

×

We Trade Waves

1 × $5.00

We Trade Waves

1 × $5.00 -

×

Accumulation & Distribution with Larry Williams

1 × $4.00

Accumulation & Distribution with Larry Williams

1 × $4.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Modern Darvas Trading

1 × $6.00

Modern Darvas Trading

1 × $6.00 -

×

High Yield Investments I & II with Lance Spicer

1 × $6.00

High Yield Investments I & II with Lance Spicer

1 × $6.00 -

×

Fractal Markets SFX with Tyson Bieniek

1 × $5.00

Fractal Markets SFX with Tyson Bieniek

1 × $5.00 -

×

Meeting of the Minds (Video ) with Larry Connors

1 × $6.00

Meeting of the Minds (Video ) with Larry Connors

1 × $6.00 -

×

Derivates with Philip McBride Johnson

1 × $6.00

Derivates with Philip McBride Johnson

1 × $6.00 -

×

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00 -

×

Trident. A Trading Strategy with Charles L.Lindsay

1 × $6.00

Trident. A Trading Strategy with Charles L.Lindsay

1 × $6.00 -

×

Value Investing Today with Charles Brandes

1 × $6.00

Value Investing Today with Charles Brandes

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00 -

×

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Intra-Day Trading with Market Internals I with Greg Capra

1 × $6.00

Intra-Day Trading with Market Internals I with Greg Capra

1 × $6.00 -

×

Trend Trading: Timing Market Tides with Kedrick Brown

1 × $6.00

Trend Trading: Timing Market Tides with Kedrick Brown

1 × $6.00 -

×

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00 -

×

Use the News with Maria Bartiromo

1 × $6.00

Use the News with Maria Bartiromo

1 × $6.00 -

×

Introduction To Advanced Options Trading 201

1 × $23.00

Introduction To Advanced Options Trading 201

1 × $23.00 -

×

Forex Mentor Seminar with Peter Bain

1 × $6.00

Forex Mentor Seminar with Peter Bain

1 × $6.00 -

×

Tape Reading Trader Program (Full 4 hours) with The Daytrading Room

1 × $6.00

Tape Reading Trader Program (Full 4 hours) with The Daytrading Room

1 × $6.00 -

×

Golden Pips Generator - DMA HACK with Hooman

1 × $62.00

Golden Pips Generator - DMA HACK with Hooman

1 × $62.00 -

×

MorningSwing Method with Austin Passamonte

1 × $6.00

MorningSwing Method with Austin Passamonte

1 × $6.00 -

×

Learning How to Successfully Trade the E-mini & S&P 500 Markets

1 × $6.00

Learning How to Successfully Trade the E-mini & S&P 500 Markets

1 × $6.00 -

×

Option Hydra - June 2020 Edition - Basics By Rajandran R

1 × $23.00

Option Hydra - June 2020 Edition - Basics By Rajandran R

1 × $23.00 -

×

Candlestick - Training Videos (Videos 1.2 GB)

1 × $15.00

Candlestick - Training Videos (Videos 1.2 GB)

1 × $15.00 -

×

Secrets of Swiss Banking with Hoyt Barber

1 × $6.00

Secrets of Swiss Banking with Hoyt Barber

1 × $6.00 -

×

Learn to Trade Course with Mike Aston

1 × $6.00

Learn to Trade Course with Mike Aston

1 × $6.00 -

×

Day Trading MasterClass with Tyrone Abela - FX Evolution

1 × $139.00

Day Trading MasterClass with Tyrone Abela - FX Evolution

1 × $139.00 -

×

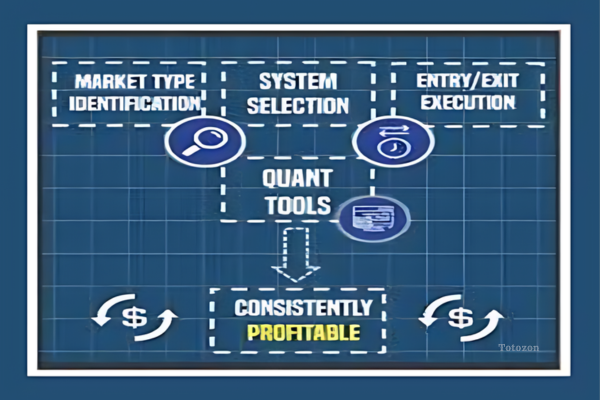

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00 -

×

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00

Trade Hot IPOs-The Promise Of The Future (IPO Course) with Dave Landry

1 × $78.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Theotrade - Essential Skills for Consistency in Trading Class

1 × $15.00

Theotrade - Essential Skills for Consistency in Trading Class

1 × $15.00 -

×

Beginner Boot Camp with Optionpit

1 × $62.00

Beginner Boot Camp with Optionpit

1 × $62.00 -

×

CFA Level 3- Examination Morning Session – Essay (2004)

1 × $6.00

CFA Level 3- Examination Morning Session – Essay (2004)

1 × $6.00 -

×

Bear Market Strategies eLearning Course - Kirk - Van Tharp Institute

1 × $85.00

Bear Market Strategies eLearning Course - Kirk - Van Tharp Institute

1 × $85.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00 -

×

Master Trader with InvestingSimple

1 × $15.00

Master Trader with InvestingSimple

1 × $15.00 -

×

The Way of the Turtle with Curtis Faith

1 × $6.00

The Way of the Turtle with Curtis Faith

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Special Webinars Module 2 with Trader Dante

1 × $6.00

Special Webinars Module 2 with Trader Dante

1 × $6.00 -

×

Trading Secrets of the Inner Circle with Andrew Goodwin

1 × $6.00

Trading Secrets of the Inner Circle with Andrew Goodwin

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00

Expectations Investing with Alfred Rappaport

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Expectations Investing with Alfred Rappaport” below:

Expectations Investing with Alfred Rappaport

Introduction

Investing can often seem like a game of chance, but with the right strategies, it becomes a disciplined approach to building wealth. Alfred Rappaport’s concept of Expectations Investing is one such strategy that can help investors make informed decisions. This guide will delve into the principles of Expectations Investing and how you can apply them to enhance your investment portfolio.

Understanding Expectations Investing

What is Expectations Investing?

Expectations Investing is a methodology developed by Alfred Rappaport that focuses on understanding the expectations embedded in stock prices. It helps investors to anticipate the market’s future expectations and to make informed investment decisions accordingly.

Why is Expectations Investing Important?

This approach shifts the focus from traditional valuation metrics to understanding market expectations. By analyzing these expectations, investors can identify mispriced stocks and capitalize on market inefficiencies.

Core Principles of Expectations Investing

1. Analyzing Market Expectations

The first step is to determine the market’s expectations for a company’s future performance. This involves analyzing the stock price to uncover the growth and profitability assumptions embedded in it.

2. Identifying Gaps

Next, investors should identify any gaps between market expectations and their own forecasts. These gaps can indicate potential investment opportunities.

3. Making Informed Decisions

Finally, investors use this information to make informed investment decisions, buying undervalued stocks and selling overvalued ones.

Steps to Implement Expectations Investing

1. Conduct Thorough Research

Begin by gathering information about the company’s financial health, industry position, and competitive advantages. Look at historical performance and future growth prospects.

2. Understand the Current Stock Price

Analyze the current stock price to determine the market’s expectations. This includes examining price-to-earnings ratios, revenue growth rates, and other financial metrics.

3. Develop Your Own Forecast

Based on your research, develop your own forecasts for the company’s future performance. Compare these forecasts with the market’s expectations to identify any discrepancies.

4. Identify Mispriced Stocks

Look for stocks where your expectations differ significantly from the market’s. These mispriced stocks can offer profitable investment opportunities.

5. Make Investment Decisions

Use the insights gained to make informed investment decisions. Buy stocks that are undervalued according to your expectations and consider selling those that are overvalued.

Benefits of Expectations Investing

Enhanced Decision-Making

By focusing on market expectations, investors can make more informed decisions, reducing the risk of emotional investing.

Identifying Opportunities

This approach helps in identifying investment opportunities that might be overlooked by traditional valuation methods.

Improved Portfolio Performance

By capitalizing on mispriced stocks, investors can potentially improve their portfolio performance and achieve better returns.

Challenges of Expectations Investing

Complex Analysis

This methodology requires a deep understanding of financial analysis and forecasting, which can be challenging for novice investors.

Market Volatility

Market expectations can change rapidly due to various factors, making it essential to stay updated with market trends and news.

Data-Driven Approach

A significant amount of data analysis is required, which might be time-consuming and requires access to reliable financial information.

Real-World Application of Expectations Investing

Case Study: Tech Industry

In the tech industry, market expectations are often high due to rapid innovation and growth. Using Expectations Investing, investors can analyze whether these high expectations are justified or if there are opportunities for investment.

Analyzing a Company

For instance, by analyzing a leading tech company’s stock price and market expectations, investors can determine if the current price reflects overly optimistic growth prospects or if the stock is undervalued.

Making Investment Decisions

Based on this analysis, investors can make informed decisions, such as buying undervalued stocks or avoiding overpriced ones.

Conclusion

Expectations Investing with Alfred Rappaport provides a robust framework for making informed investment decisions. By understanding market expectations and identifying discrepancies, investors can uncover valuable opportunities and enhance their portfolio performance. This approach requires thorough research and analysis but offers significant benefits for those willing to invest the time and effort.

Frequently Asked Questions

1. What is the main advantage of Expectations Investing?

The main advantage is the ability to make informed investment decisions based on market expectations rather than solely on traditional valuation metrics.

2. How can I start with Expectations Investing?

Begin by conducting thorough research on the company’s financials and market expectations. Develop your own forecasts and compare them with the market’s.

3. What tools are needed for Expectations Investing?

Tools for financial analysis, forecasting, and access to reliable financial data are essential for implementing this methodology.

4. Can Expectations Investing be applied to all industries?

Yes, this approach can be applied to any industry, though the analysis might differ based on the industry’s specific characteristics.

5. How often should I review my investments?

Regular reviews, at least annually or more frequently if there are significant market changes, are recommended to stay aligned with market expectations.

Be the first to review “Expectations Investing with Alfred Rappaport” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.