-

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

Objective Evaluation of Indicators with Constance Brown

$6.00

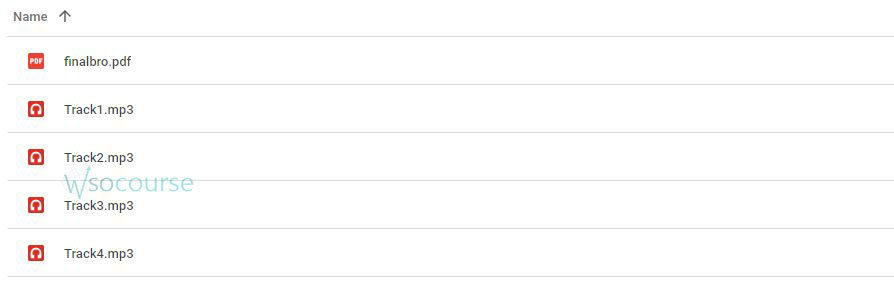

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Objective Evaluation of Indicators with Constance Brown” below:

Objective Evaluation of Indicators with Constance Brown

Introduction

Evaluating technical indicators objectively is crucial for successful trading, and Constance Brown is a master at this. Her methods provide a clear, unbiased view of market conditions, helping traders make informed decisions. In this article, we delve into the techniques and insights of Constance Brown, focusing on the objective evaluation of indicators.

Who is Constance Brown?

A Brief Overview

Constance Brown is a highly respected trader, author, and educator known for her expertise in technical analysis. Her innovative approaches have influenced many in the trading community.

Notable Achievements

Brown has written several influential books, including “Technical Analysis for the Trading Professional,” which have become essential reading for traders.

Understanding Technical Indicators

What are Technical Indicators?

Technical indicators are mathematical calculations based on historical price, volume, or open interest information that help traders predict future market movements.

Why Evaluate Indicators?

Evaluating indicators helps traders understand their effectiveness, optimize their trading strategies, and avoid relying on unreliable signals.

Constance Brown’s Approach

The Importance of Objectivity

Brown emphasizes the need for objectivity in evaluating indicators. This involves removing emotional biases and focusing solely on data and statistical evidence.

Adjustments to Common Indicators

Brown has made significant adjustments to popular indicators like the RSI (Relative Strength Index) to improve their accuracy and reliability.

Key Indicators Evaluated by Constance Brown

Relative Strength Index (RSI)

Traditional vs. Adjusted RSI

While the traditional RSI measures momentum, Brown’s adjusted RSI accounts for biases, providing a more accurate picture of market conditions.

Using RSI for Better Decisions

Her adjusted RSI helps traders identify overbought and oversold conditions more reliably, leading to better trading decisions.

Moving Averages

Simple Moving Average (SMA)

The SMA is a basic indicator that smooths out price data by creating a constantly updated average price.

Exponential Moving Average (EMA)

The EMA gives more weight to recent prices, making it more responsive to new information. Brown evaluates the effectiveness of both SMA and EMA in different market conditions.

MACD (Moving Average Convergence Divergence)

Understanding MACD

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

Brown’s Take on MACD

Brown emphasizes the importance of using MACD in conjunction with other indicators to confirm signals and avoid false positives.

Advanced Evaluation Techniques

Statistical Analysis

Brown uses statistical methods to evaluate the performance of indicators, ensuring they provide consistent and reliable signals.

Backtesting

Backtesting involves applying an indicator to historical data to see how it would have performed in the past. This helps in understanding its effectiveness and reliability.

Practical Applications

Day Trading

Brown’s evaluation techniques are particularly useful for day traders who need precise and reliable signals to make quick decisions.

Swing Trading

Swing traders can also benefit from Brown’s methods by using evaluated indicators to identify medium-term trading opportunities.

Common Mistakes to Avoid

Over-Reliance on Single Indicators

One common mistake is relying too heavily on a single indicator. Brown advises using a combination of indicators to confirm signals.

Ignoring Market Conditions

Indicators can behave differently in varying market conditions. It’s essential to consider the broader market context when using them.

Emotional Bias

Letting emotions drive trading decisions can lead to poor outcomes. Brown stresses the importance of staying objective and disciplined.

Developing a Robust Trading Plan

Setting Clear Goals

Establish specific, measurable goals for your trading activities. Clear objectives help maintain focus and direction.

Risk Management

Implementing effective risk management strategies is crucial. This includes setting stop-loss orders and managing position sizes to protect your capital.

Continuous Learning

Markets evolve, and so should your trading strategies. Continuously learning and adapting to new information is key to long-term success.

Conclusion

Constance Brown’s methods for objectively evaluating technical indicators provide traders with reliable tools to enhance their strategies. By understanding and applying her techniques, traders can make more informed decisions and improve their chances of success.

FAQs

1. What is the main advantage of Brown’s adjusted RSI?

The adjusted RSI corrects biases, providing a more accurate indication of overbought and oversold conditions.

2. How does Brown ensure the reliability of indicators?

Brown uses statistical analysis and backtesting to evaluate the performance and reliability of indicators.

3. Can beginners use Constance Brown’s methods?

Yes, her books and courses are designed to be accessible to both beginners and experienced traders.

4. Why is it important to use multiple indicators?

Using multiple indicators helps confirm signals and reduce the likelihood of false positives.

5. How can I start implementing Brown’s techniques?

Begin by reading her books and taking her courses to gain a thorough understanding of her evaluation methods.

Be the first to review “Objective Evaluation of Indicators with Constance Brown” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.