-

×

Financial Astrology Course with Brian James Sklenka

1 × $6.00

Financial Astrology Course with Brian James Sklenka

1 × $6.00 -

×

Value Based Power Trading

1 × $6.00

Value Based Power Trading

1 × $6.00 -

×

Trade Queen Pro with Tamia Johnson

1 × $54.00

Trade Queen Pro with Tamia Johnson

1 × $54.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Divergence Super BluePrint with Bill Poulos

1 × $6.00

Divergence Super BluePrint with Bill Poulos

1 × $6.00 -

×

Trading Masterclass XVII with Wysetrade

1 × $6.00

Trading Masterclass XVII with Wysetrade

1 × $6.00 -

×

The Basics of the Wave Principle with Wayne Gorman

1 × $15.00

The Basics of the Wave Principle with Wayne Gorman

1 × $15.00 -

×

Defending Options with Simpler Options

1 × $6.00

Defending Options with Simpler Options

1 × $6.00 -

×

Chart Your Way to Profits (2nd Ed.) with Tim Knight

1 × $6.00

Chart Your Way to Profits (2nd Ed.) with Tim Knight

1 × $6.00 -

×

Explosive Growth Options & Stocks with Base Camp Trading

1 × $5.00

Explosive Growth Options & Stocks with Base Camp Trading

1 × $5.00 -

×

Stupid Trader – Play Safe!

1 × $6.00

Stupid Trader – Play Safe!

1 × $6.00 -

×

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Yarimi University Course

1 × $56.00

Yarimi University Course

1 × $56.00 -

×

Developing & Implementing Pattern-Based Trading Systems with Tushar S.Chande

1 × $6.00

Developing & Implementing Pattern-Based Trading Systems with Tushar S.Chande

1 × $6.00 -

×

Sure Fire Forex Trading with Mark McRae

1 × $6.00

Sure Fire Forex Trading with Mark McRae

1 × $6.00 -

×

Forex Candlestick System. High Profit Forex Trading with B.M.Davis

1 × $6.00

Forex Candlestick System. High Profit Forex Trading with B.M.Davis

1 × $6.00 -

×

Dominate Stocks (Swing Trading) 2023 with J. Bravo

1 × $5.00

Dominate Stocks (Swing Trading) 2023 with J. Bravo

1 × $5.00 -

×

Pristine - Cardinal Rules of Trading

1 × $6.00

Pristine - Cardinal Rules of Trading

1 × $6.00 -

×

Investment Strategies of Hedge Funds with Filippo Stefanini

1 × $6.00

Investment Strategies of Hedge Funds with Filippo Stefanini

1 × $6.00 -

×

ICT Mastery with Casper SMC

1 × $14.00

ICT Mastery with Casper SMC

1 × $14.00 -

×

Signals

1 × $6.00

Signals

1 × $6.00 -

×

Build Your Own Trading System with John Hill

1 × $6.00

Build Your Own Trading System with John Hill

1 × $6.00 -

×

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00 -

×

George Wollsten: Expert Stock and Grain Trader with George Bayer

1 × $6.00

George Wollsten: Expert Stock and Grain Trader with George Bayer

1 × $6.00 -

×

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00 -

×

Capital Flows and Crises with Barry Eichengreen

1 × $6.00

Capital Flows and Crises with Barry Eichengreen

1 × $6.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

eASCTrend Trading Manual (not including 6 trading methods) with Ablesys

1 × $6.00

eASCTrend Trading Manual (not including 6 trading methods) with Ablesys

1 × $6.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

Trend Trading My Way with Markay Latimer

1 × $15.00

Trend Trading My Way with Markay Latimer

1 × $15.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Simpler Options - Stock Trading Patterns

1 × $6.00

Simpler Options - Stock Trading Patterns

1 × $6.00 -

×

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00 -

×

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Advanced Options Trading with Lucas Downey

1 × $15.00

Advanced Options Trading with Lucas Downey

1 × $15.00 -

×

4 Class Bundle

1 × $31.00

4 Class Bundle

1 × $31.00 -

×

The New Science of Asset Allocation with Thomas Schneeweis

1 × $6.00

The New Science of Asset Allocation with Thomas Schneeweis

1 × $6.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00 -

×

Ichimokutrade - Ichimoku 101

1 × $15.00

Ichimokutrade - Ichimoku 101

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00 -

×

Buying and Selling Volatility with Kevin B.Connolly

1 × $6.00

Buying and Selling Volatility with Kevin B.Connolly

1 × $6.00 -

×

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Foundations of Forex Trading with TradeSmart University

1 × $6.00

Foundations of Forex Trading with TradeSmart University

1 × $6.00 -

×

Master Commodities Course

1 × $6.00

Master Commodities Course

1 × $6.00 -

×

How to Invest in ETFs By The Investors Podcast

1 × $6.00

How to Invest in ETFs By The Investors Podcast

1 × $6.00 -

×

Confessions of a Street Addict with James Cramer

1 × $6.00

Confessions of a Street Addict with James Cramer

1 × $6.00 -

×

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00 -

×

Simulating Continuous Fuzzy Systems with James Buckley & Leonard Jowers

1 × $6.00

Simulating Continuous Fuzzy Systems with James Buckley & Leonard Jowers

1 × $6.00 -

×

Inner Circle Trader

1 × $6.00

Inner Circle Trader

1 × $6.00 -

×

Developing the Psychological Trader’s Edge with Robin Dayne

1 × $6.00

Developing the Psychological Trader’s Edge with Robin Dayne

1 × $6.00 -

×

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00 -

×

Elliott Wave Swing High Low Indicator for ThinkorSwim with Fibonacci

1 × $6.00

Elliott Wave Swing High Low Indicator for ThinkorSwim with Fibonacci

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Derivate Instruments by Brian A.Eales

1 × $6.00

Derivate Instruments by Brian A.Eales

1 × $6.00 -

×

Andrews Pitchfork Basic

1 × $6.00

Andrews Pitchfork Basic

1 × $6.00 -

×

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00 -

×

The Way to Trade with John Piper

1 × $6.00

The Way to Trade with John Piper

1 × $6.00 -

×

FX Funding Mate Course

1 × $5.00

FX Funding Mate Course

1 × $5.00 -

×

A-Z Course with InvestiTrade Academy

1 × $5.00

A-Z Course with InvestiTrade Academy

1 × $5.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00 -

×

Technical Analysis for the Trading Professional with Constance Brown

1 × $6.00

Technical Analysis for the Trading Professional with Constance Brown

1 × $6.00 -

×

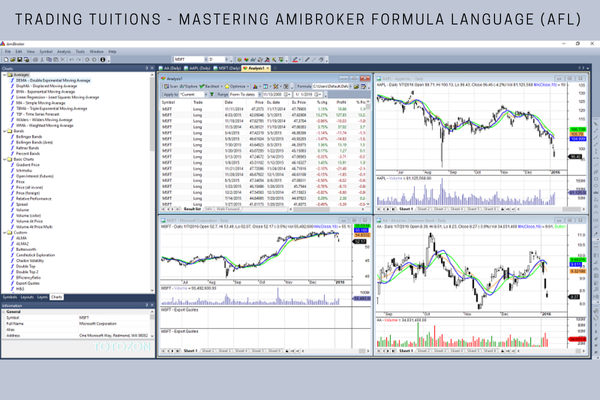

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Complete Price Action, Volume Profile and Orderflow Trading Bundle with Price Action Volume Trader

1 × $78.00

Complete Price Action, Volume Profile and Orderflow Trading Bundle with Price Action Volume Trader

1 × $78.00 -

×

The Hedge Bundle - SpotGamma Academy with Imran Lakha

1 × $8.00

The Hedge Bundle - SpotGamma Academy with Imran Lakha

1 × $8.00 -

×

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00 -

×

Catching the Bounce

1 × $6.00

Catching the Bounce

1 × $6.00 -

×

Investment Illusions with Martin S.Fridson

1 × $6.00

Investment Illusions with Martin S.Fridson

1 × $6.00 -

×

SOT Advanced Course (May 2014)

1 × $23.00

SOT Advanced Course (May 2014)

1 × $23.00 -

×

How the Stock Market Works with Ramon DeGennaro

1 × $5.00

How the Stock Market Works with Ramon DeGennaro

1 × $5.00 -

×

Snapbacks CD

1 × $6.00

Snapbacks CD

1 × $6.00 -

×

Technical Trading: System and Design Testing Class with Jeff Bierman

1 × $6.00

Technical Trading: System and Design Testing Class with Jeff Bierman

1 × $6.00 -

×

The Insider's Guide to Forex Trading with Kathy Lien

1 × $6.00

The Insider's Guide to Forex Trading with Kathy Lien

1 × $6.00 -

×

Forex Millionaire Course with Willis University

1 × $6.00

Forex Millionaire Course with Willis University

1 × $6.00 -

×

High Rollers Mega Course Bundle - 13 Market Moves

1 × $39.00

High Rollers Mega Course Bundle - 13 Market Moves

1 × $39.00 -

×

TheoTrade - Maximum Returns with Infinity Spreads

1 × $23.00

TheoTrade - Maximum Returns with Infinity Spreads

1 × $23.00 -

×

The MissionFX Compounding Course with Nick Shawn

1 × $5.00

The MissionFX Compounding Course with Nick Shawn

1 × $5.00 -

×

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00 -

×

The City Traders Course with Andrew Lockwood

1 × $10.00

The City Traders Course with Andrew Lockwood

1 × $10.00 -

×

AnkhFX Academy Course

1 × $17.00

AnkhFX Academy Course

1 × $17.00 -

×

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00 -

×

Bing CPA Bootcamp

1 × $15.00

Bing CPA Bootcamp

1 × $15.00 -

×

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Hands On Training Bundle with Talkin Options

1 × $23.00

Hands On Training Bundle with Talkin Options

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00 -

×

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00 -

×

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00 -

×

NQ Price Action Mastery with Trade Smart

1 × $15.00

NQ Price Action Mastery with Trade Smart

1 × $15.00 -

×

Advance Gap Trading with Master Trader

1 × $39.00

Advance Gap Trading with Master Trader

1 × $39.00 -

×

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00

The Chaos Course. Cash in on Chaos with Hans Hannula

1 × $6.00 -

×

Day trading master class with BKForex

1 × $6.00

Day trading master class with BKForex

1 × $6.00 -

×

Getting Started in Stocks with Alvin D.Hall

1 × $6.00

Getting Started in Stocks with Alvin D.Hall

1 × $6.00 -

×

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00 -

×

Chaos. The New Map for Traders

1 × $15.00

Chaos. The New Map for Traders

1 × $15.00 -

×

The Banker’s Edge Webinar & Extras

1 × $6.00

The Banker’s Edge Webinar & Extras

1 × $6.00 -

×

How To Buy with Justin Mamis

1 × $6.00

How To Buy with Justin Mamis

1 × $6.00 -

×

Forex Trader Package 2010

1 × $15.00

Forex Trader Package 2010

1 × $15.00 -

×

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00 -

×

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00 -

×

Trade The Price Action with Thomas Wood (Valuecharts)

1 × $15.00

Trade The Price Action with Thomas Wood (Valuecharts)

1 × $15.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

Kickstart Course with Tradelikerocket

1 × $46.00

Kickstart Course with Tradelikerocket

1 × $46.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

The TFDW Bundle – Tradingfanatic

1 × $15.00

The TFDW Bundle – Tradingfanatic

1 × $15.00 -

×

How to Lose Money Profitably with Mark D.Cook

1 × $6.00

How to Lose Money Profitably with Mark D.Cook

1 × $6.00 -

×

Strategic Swing Trader with Sami Abusaad

1 × $6.00

Strategic Swing Trader with Sami Abusaad

1 × $6.00 -

×

The Handbook of Risk with Ben Warwick

1 × $6.00

The Handbook of Risk with Ben Warwick

1 × $6.00 -

×

Squeeze the Markets with Markay Latimer

1 × $6.00

Squeeze the Markets with Markay Latimer

1 × $6.00 -

×

Trading Earnings Formula Class with Don Kaufman

1 × $6.00

Trading Earnings Formula Class with Don Kaufman

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

The TrendAdvisor Guide to Breakthrough Profits with Chuck Dukas

1 × $6.00

The TrendAdvisor Guide to Breakthrough Profits with Chuck Dukas

1 × $6.00 -

×

Stochastic Calculus with Alan Bain

1 × $6.00

Stochastic Calculus with Alan Bain

1 × $6.00 -

×

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00 -

×

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00 -

×

Stock Detective Investor: Finding Market Gems Online with Kevin Lichtman & Lynn Duke

1 × $6.00

Stock Detective Investor: Finding Market Gems Online with Kevin Lichtman & Lynn Duke

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman” below:

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

Introduction

Navigating the complexities of financial markets can be challenging, but understanding Exchange Traded Funds (ETFs) and E-Mini Stock Index Futures can provide significant advantages. David Lerman, a seasoned financial expert, offers invaluable insights into these instruments. In this article, we explore the nuances of ETFs and E-Mini Stock Index Futures, guided by Lerman’s expertise.

What are Exchange Traded Funds (ETFs)?

ETFs are investment funds traded on stock exchanges, much like stocks. They hold assets such as stocks, commodities, or bonds and generally operate with an arbitrage mechanism designed to keep trading close to its net asset value.

Benefits of ETFs

ETFs offer several advantages:

- Diversification: Spread investments across a wide range of assets.

- Liquidity: Easily tradable on stock exchanges.

- Cost Efficiency: Lower expense ratios compared to mutual funds.

- Transparency: Holdings are publicly disclosed on a daily basis.

Types of ETFs

- Equity ETFs: Invest in stocks.

- Bond ETFs: Invest in bonds.

- Commodity ETFs: Invest in commodities like gold or oil.

- Sector and Industry ETFs: Focus on specific sectors like technology or healthcare.

How to Invest in ETFs

Investing in ETFs involves selecting the right funds that match your investment goals. Consider factors like expense ratios, liquidity, and the fund’s performance history.

Understanding E-Mini Stock Index Futures

E-Mini Stock Index Futures are electronically traded futures contracts that represent a fraction of the value of standard futures contracts. They offer a way to gain exposure to stock market indices.

Benefits of E-Mini Futures

E-Mini Futures provide several advantages:

- Leverage: Control a large position with a relatively small amount of capital.

- Liquidity: High trading volume ensures easy entry and exit.

- Flexibility: Trade nearly 24 hours a day.

- Cost Efficiency: Lower margin requirements compared to full-sized contracts.

Popular E-Mini Contracts

- E-Mini S&P 500: Tracks the S&P 500 Index.

- E-Mini NASDAQ-100: Tracks the NASDAQ-100 Index.

- E-Mini Dow: Tracks the Dow Jones Industrial Average.

Trading Strategies for E-Mini Futures

Developing effective trading strategies is crucial for success with E-Mini Futures. Consider both technical and fundamental analysis.

Technical Analysis Tools

- Moving Averages: Identify trends and reversals.

- Relative Strength Index (RSI): Measure the speed and change of price movements.

- Fibonacci Retracement: Identify potential support and resistance levels.

Fundamental Analysis

Understanding economic indicators and market news can provide insights into the underlying factors driving price movements in E-Mini Futures.

David Lerman’s Approach to ETFs and E-Mini Futures

David Lerman advocates a balanced approach, combining both ETFs and E-Mini Futures to achieve diversified exposure and leverage market opportunities.

Integrating ETFs and E-Mini Futures

Lerman suggests using ETFs for long-term investments and E-Mini Futures for short-term trading strategies, capitalizing on market volatility.

Benefits of Integration

- Diversification: Spread risk across different asset classes.

- Leverage: Use E-Mini Futures to amplify returns.

- Flexibility: Adapt to changing market conditions with a mix of long-term and short-term positions.

Risk Management Techniques

Lerman emphasizes the importance of risk management in trading.

Setting Stop-Loss Orders

Stop-loss orders help limit potential losses by automatically closing a position at a predetermined price.

Position Sizing

Determine the appropriate size for each trade based on your risk tolerance and account size.

Practical Applications

Applying Lerman’s strategies can enhance your trading performance and investment outcomes.

Building a Diversified Portfolio

Use ETFs to build a diversified portfolio that aligns with your investment goals. Combine different types of ETFs to balance risk and return.

Active Trading with E-Mini Futures

Utilize E-Mini Futures for active trading strategies, taking advantage of short-term market movements. Apply technical and fundamental analysis to make informed trading decisions.

Common Mistakes to Avoid

Avoiding common pitfalls can improve your trading success.

Overleveraging

Excessive use of leverage can amplify losses. Use leverage judiciously and within your risk tolerance.

Ignoring Risk Management

Neglecting risk management can lead to significant losses. Always use stop-loss orders and position sizing to manage risk effectively.

Emotional Trading

Avoid making trading decisions based on emotions. Stick to your trading plan and strategies.

Conclusion

Understanding ETFs and E-Mini Stock Index Futures with guidance from David Lerman can significantly enhance your trading and investment strategies. By combining these instruments, employing effective risk management techniques, and avoiding common mistakes, you can achieve diversified exposure and leverage market opportunities for better financial outcomes.

FAQs

1. What are the main benefits of ETFs?

ETFs offer diversification, liquidity, cost efficiency, and transparency, making them an attractive option for investors.

2. How do E-Mini Stock Index Futures work?

E-Mini Futures are electronically traded contracts that represent a fraction of the value of standard futures contracts, providing leveraged exposure to stock market indices.

3. What strategies does David Lerman recommend for E-Mini Futures?

Lerman recommends using a combination of technical and fundamental analysis to develop effective trading strategies for E-Mini Futures.

4. How can I manage risk when trading ETFs and E-Mini Futures?

Risk management techniques include setting stop-loss orders, using appropriate position sizing, and avoiding overleveraging.

5. Why is diversification important in investing?

Diversification helps spread risk across different asset classes, reducing the impact of any single investment on your overall portfolio.

Be the first to review “Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.