-

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Get Rich with Dividends

1 × $6.00

Get Rich with Dividends

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Vega Modified Butterfly Class with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Vega Modified Butterfly Class with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Renko Profits Accelerator

1 × $15.00

Renko Profits Accelerator

1 × $15.00

Analysis Of Entry Signals Part Two (Fundamentals) with Joe Marwood

$145.00 Original price was: $145.00.$23.00Current price is: $23.00.

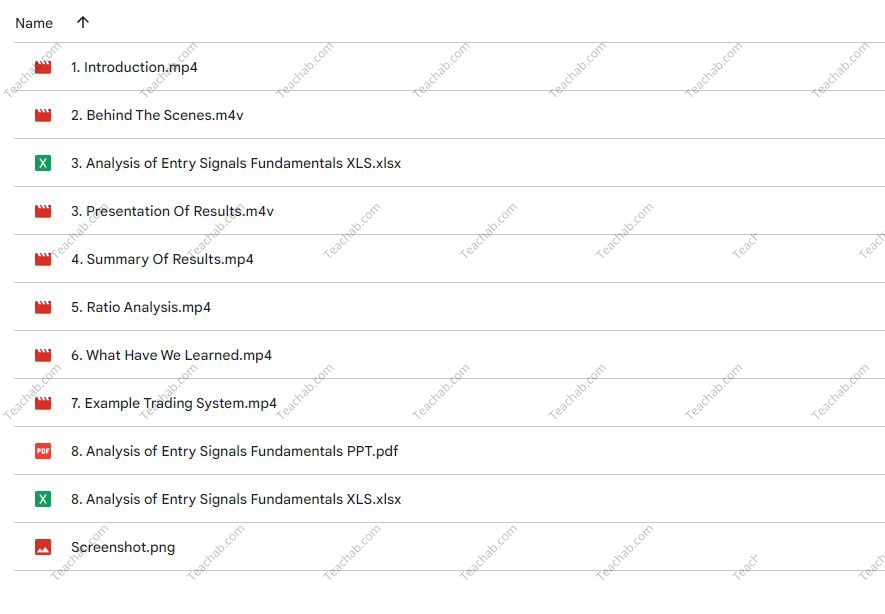

File Size: 533 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Analysis Of Entry Signals Part Two (Fundamentals) with Joe Marwood” below:

Analysis of Entry Signals Part Two (Fundamentals) with Joe Marwood

Welcome to Part Two of our deep dive into the fundamentals of entry signals in trading, expertly guided by renowned financial strategist Joe Marwood. This session is designed to enhance your understanding of market entry points and how to effectively apply them in your trading strategy.

Introduction to Entry Signals

Learn the essential components of successful trading entry signals and why they are crucial in making informed trading decisions.

Who is Joe Marwood?

Experience and Expertise

- Joe Marwood is a seasoned trader and educator known for his practical approach to stock trading and technical analysis.

Overview of Entry Signals

Understanding the Basics

- What are entry signals?

- The role of entry signals in trading strategies.

Types of Entry Signals

Classifying Signals for Better Execution

- Technical Signals: Based on price action and technical indicators.

- Fundamental Signals: Derived from economic data releases and news events.

Technical Analysis for Identifying Entry Points

Tools and Techniques

- How to use moving averages and trend lines.

- The importance of volume in confirming entry signals.

Fundamental Analysis in Entry Signals

Economic Indicators and Their Impact

- Key economic reports that influence market behavior.

- How to interpret news and events for trading signals.

Psychological Aspects of Trading

Understanding Trader Behavior

- The psychological triggers that can affect entry signal effectiveness.

- How to overcome emotional trading decisions.

Risk Management Strategies

Minimizing Losses and Maximizing Gains

- Effective stop-loss techniques.

- Risk/reward ratio considerations.

The Importance of Timing

Optimizing Entry and Exit Points

- Best times of day for trading based on volatility and liquidity.

- Seasonal trends that affect market movements.

Advanced Entry Signal Strategies

Going Beyond the Basics

- Multi-time frame analysis for entry signals.

- Combining different analytical methods for robust signals.

Backtesting Entry Signals

Verifying Your Strategy

- How to backtest your entry signals to ensure reliability.

- Tools and software recommendations for backtesting.

Adapting to Market Changes

Staying Flexible and Responsive

- Adjusting entry signals in response to market dynamics.

- Continuous learning and strategy refinement.

Real-World Applications

Applying What You’ve Learned

- Case studies and examples of successful entry signal applications.

- Common mistakes to avoid in signal analysis.

Conclusion

Mastering the art of entry signals with Joe Marwood’s guidance offers you a strategic advantage in the markets. By understanding and applying these principles, you can enhance your trading precision and success rate.

FAQs

1. Can beginners benefit from learning about entry signals?

- Yes, understanding entry signals is fundamental for all traders, regardless of experience level.

2. How important is technical analysis in defining entry signals?

- Technical analysis is crucial as it provides a visual representation of market

trends and patterns, essential for making informed decisions.

3. Can entry signals be used for all types of trading?

- Absolutely, entry signals are versatile and can be adapted to day trading, swing trading, and even long-term investment strategies.

4. How do I know if my entry signals are effective?

- The effectiveness of entry signals can be measured through backtesting with historical data and by tracking the performance of your trades.

5. Are there any tools that can help identify entry signals?

- Many trading platforms offer tools like charting software, indicators, and automated signal services that can assist in identifying potential entry points.

Be the first to review “Analysis Of Entry Signals Part Two (Fundamentals) with Joe Marwood” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.