-

×

Fractal Markets SFX with Tyson Bieniek

1 × $5.00

Fractal Markets SFX with Tyson Bieniek

1 × $5.00 -

×

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00 -

×

Forex Strategy Master with Russ Horn

1 × $6.00

Forex Strategy Master with Russ Horn

1 × $6.00 -

×

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

HunterFX Video Course with HunterFX

1 × $6.00

HunterFX Video Course with HunterFX

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Big Fish Trading Strategy with Dave Aquino

1 × $6.00

Big Fish Trading Strategy with Dave Aquino

1 × $6.00 -

×

T. Harv Eker’s All-Access

1 × $39.00

T. Harv Eker’s All-Access

1 × $39.00 -

×

The Noise Trader Approach to Finance (Article) with Andrei Schleifer, Laurence H.Summers

1 × $6.00

The Noise Trader Approach to Finance (Article) with Andrei Schleifer, Laurence H.Summers

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Fundamentals Trading

1 × $6.00

Fundamentals Trading

1 × $6.00 -

×

Advanced Pattern Recognition with John Cameron

1 × $23.00

Advanced Pattern Recognition with John Cameron

1 × $23.00 -

×

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00 -

×

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00 -

×

How to avoid the GAP

1 × $6.00

How to avoid the GAP

1 × $6.00 -

×

Getting Started in Stocks with Alvin D.Hall

1 × $6.00

Getting Started in Stocks with Alvin D.Hall

1 × $6.00 -

×

FasTrack Premium with Note Conference

1 × $78.00

FasTrack Premium with Note Conference

1 × $78.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

Secret Day - Swing Trading Strategy For Stock, Forex, Crypto with Value Stocks

1 × $5.00

Secret Day - Swing Trading Strategy For Stock, Forex, Crypto with Value Stocks

1 × $5.00 -

×

Sample and Mock Exams 2008 with CFA Institute

1 × $6.00

Sample and Mock Exams 2008 with CFA Institute

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00 -

×

Learn Investing & Trading with Danny Devan

1 × $23.00

Learn Investing & Trading with Danny Devan

1 × $23.00 -

×

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00 -

×

Dan Sheridan Butterfly Course (Sep 2012)

1 × $6.00

Dan Sheridan Butterfly Course (Sep 2012)

1 × $6.00 -

×

Currency Strategy with Callum Henderson

1 × $6.00

Currency Strategy with Callum Henderson

1 × $6.00 -

×

Inner Circle Course with Darius Fx

1 × $24.00

Inner Circle Course with Darius Fx

1 × $24.00 -

×

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00 -

×

Gann Masters II with Hallikers Inc

1 × $6.00

Gann Masters II with Hallikers Inc

1 × $6.00 -

×

How to Lose Money Profitably with Mark D.Cook

1 × $6.00

How to Lose Money Profitably with Mark D.Cook

1 × $6.00 -

×

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00 -

×

Trading by the Book (tradingeducators.com)

1 × $6.00

Trading by the Book (tradingeducators.com)

1 × $6.00 -

×

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00 -

×

Game-Maker Forex Trading System

1 × $6.00

Game-Maker Forex Trading System

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Forex Never Lose Trade & Forex Unknown Secret with Karl Dittmann

1 × $6.00

Forex Never Lose Trade & Forex Unknown Secret with Karl Dittmann

1 × $6.00 -

×

Traders Edge with Steven Dux

1 × $5.00

Traders Edge with Steven Dux

1 × $5.00 -

×

Trade Stocks and Commodities with the Insiders. Secrets of the COT Report with Larry Williams

1 × $6.00

Trade Stocks and Commodities with the Insiders. Secrets of the COT Report with Larry Williams

1 × $6.00 -

×

Value, Price & Profit with Karl Marx

1 × $6.00

Value, Price & Profit with Karl Marx

1 × $6.00 -

×

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00 -

×

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00 -

×

Futures Commodity Trading with G. Scott Martin

1 × $6.00

Futures Commodity Trading with G. Scott Martin

1 × $6.00 -

×

The Age of Turbulence with Alan Greenspan

1 × $6.00

The Age of Turbulence with Alan Greenspan

1 × $6.00 -

×

ALGO™ Online Retail - Version 2.9

1 × $155.00

ALGO™ Online Retail - Version 2.9

1 × $155.00 -

×

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00 -

×

Inefficient Markets with Andrei Shleifer

1 × $6.00

Inefficient Markets with Andrei Shleifer

1 × $6.00 -

×

Preview of Markets with George Bayer

1 × $6.00

Preview of Markets with George Bayer

1 × $6.00 -

×

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00 -

×

Foundation & Application of the Market with Jim Dalton - JimDalton Trading

1 × $5.00

Foundation & Application of the Market with Jim Dalton - JimDalton Trading

1 × $5.00 -

×

Trading 3SMA System with Hector DeVille

1 × $6.00

Trading 3SMA System with Hector DeVille

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00 -

×

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00 -

×

Renko Profits Accelerator

1 × $15.00

Renko Profits Accelerator

1 × $15.00 -

×

The Great Divergence: China, Europe, and the Making of the Modern World Economy with Kenneth Pomeranz

1 × $6.00

The Great Divergence: China, Europe, and the Making of the Modern World Economy with Kenneth Pomeranz

1 × $6.00 -

×

The Zone Trader Training Series with Timon Weller

1 × $8.00

The Zone Trader Training Series with Timon Weller

1 × $8.00 -

×

Exchange-Traded Derivatives with Erik Banks

1 × $6.00

Exchange-Traded Derivatives with Erik Banks

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Pete Fader VSA Course

1 × $6.00

Pete Fader VSA Course

1 × $6.00 -

×

PayTrading with Eric Shawn

1 × $6.00

PayTrading with Eric Shawn

1 × $6.00 -

×

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00 -

×

The Day Traders Fast Track Program

1 × $23.00

The Day Traders Fast Track Program

1 × $23.00 -

×

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00 -

×

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

Forex Time Machine with Bill Poulos

1 × $6.00

Forex Time Machine with Bill Poulos

1 × $6.00 -

×

The Telecoms Trade War with Mark Naftel

1 × $6.00

The Telecoms Trade War with Mark Naftel

1 × $6.00 -

×

The Ultimate Forex Structure Course

1 × $31.00

The Ultimate Forex Structure Course

1 × $31.00

Module 4 Elliot Wave and Identify Wave Count

$399.00 Original price was: $399.00.$31.00Current price is: $31.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

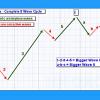

CryptosClass – Module 4: Elliott Wave and Identify Wave Count

Introduction

Navigating the turbulent waters of cryptocurrency trading can be daunting. Enter Elliott Wave Theory, a robust tool designed to decode market trends. Module 4 of CryptosClass delves deep into this theory, providing traders with the skills to identify and leverage wave counts effectively.

What is Elliott Wave Theory?

Elliott Wave Theory, formulated by Ralph Nelson Elliott, posits that market prices move in predictable patterns or “waves.” These waves reflect the collective psychology of market participants and can be analyzed to forecast future price movements.

Core Principles of Elliott Wave Theory

- Wave Patterns

- Impulse Waves: Move in the direction of the trend

- Corrective Waves: Move against the trend

- Wave Structure

- Five-Wave Sequence: Three impulse waves (1, 3, 5) and two corrective waves (2, 4)

- Fractals

- Smaller waves form the same patterns as larger waves, creating a fractal structure

Importance of Identifying Wave Count

Accurate wave counting is essential for applying Elliott Wave Theory. It involves labeling the waves within a price movement to predict future trends.

Steps to Identify Wave Count

- Identify the Starting Point

- Find the beginning of the wave sequence

- Label the Impulse Waves

- Mark the five waves moving in the trend direction

- Label the Corrective Waves

- Identify the three waves moving against the trend

- Validate the Wave Count

- Ensure the wave count follows Elliott Wave rules and guidelines

Applying Elliott Wave Theory in Crypto Trading

Understanding and applying Elliott Wave Theory can significantly enhance your cryptocurrency trading strategy.

Step-by-Step Application

- Analyze Historical Data

- Review historical price charts to identify wave patterns

- Determine Current Wave Position

- Assess where the current price is within the wave sequence

- Forecast Future Movements

- Use the wave count to predict upcoming price movements

- Make Informed Decisions

- Apply your wave analysis to execute strategic trades

Common Challenges in Wave Counting

Wave counting can be complex, but understanding these challenges can help you overcome them.

Challenges

- Subjectivity

- Wave counting can vary between analysts

- Complex Patterns

- Market movements can be intricate, making wave identification difficult

- Frequent Adjustments

- Wave counts may need adjustments as new data emerges

Tips for Overcoming Challenges

- Practice Regularly

- Consistent practice with historical data improves accuracy

- Use Multiple Timeframes

- Analyze wave patterns across different timeframes

- Stay Informed

- Keep updated with market trends and news

Tools for Elliott Wave Analysis

Several tools can aid in Elliott Wave analysis, enhancing your accuracy and efficiency.

Elliott Wave Software

- Elliott Wave International

- Provides advanced tools for wave analysis

- TradingView

- Offers charting tools and Elliott Wave indicators

Manual Charting

- Paper and Pencil

- Traditional method for practicing wave counts

- Digital Tools

- Use digital drawing tools for marking wave patterns on charts

Integrating Elliott Wave with Other Strategies

Combining Elliott Wave Theory with other trading strategies can improve its effectiveness.

Technical Analysis

- Indicators

- Utilize RSI, MACD, and moving averages to confirm wave counts

- Chart Patterns

- Integrate head and shoulders, double tops, and other patterns with wave analysis

Fundamental Analysis

- Economic Indicators

- Consider economic data and news events to support wave analysis

- Market Sentiment

- Analyze sentiment to validate wave counts and predictions

Case Study: Applying Elliott Wave in a Bull Market

Let’s explore a real-world example to illustrate the application of Elliott Wave Theory in a bullish cryptocurrency market.

Identifying Impulse Waves

- Wave 1: Initial uptrend driven by positive market sentiment

- Wave 2: Minor correction as traders take profits

- Wave 3: Strong uptrend fueled by significant news or developments

- Wave 4: Brief pullback due to market consolidation

- Wave 5: Final surge as optimism peaks

Identifying Corrective Waves

- Wave A: Initial decline as early adopters exit positions

- Wave B: Temporary rebound due to renewed optimism

- Wave C: Continued decline as the market corrects further

Conclusion

Elliott Wave Theory offers a powerful framework for understanding and predicting market movements in cryptocurrency trading. By mastering wave counting and integrating it with other analytical methods, traders can enhance their market insights and make more informed decisions.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Module 4 Elliot Wave and Identify Wave Count” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.