-

×

Wyckoff simplified from Michael Z

1 × $6.00

Wyckoff simplified from Michael Z

1 × $6.00 -

×

7 Things You MUST Know about Forex Candlesticks

1 × $4.00

7 Things You MUST Know about Forex Candlesticks

1 × $4.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00 -

×

BD FX Course with FX Learning

1 × $6.00

BD FX Course with FX Learning

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Stacey Pigmentation Mentorship

1 × $17.00

Stacey Pigmentation Mentorship

1 × $17.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

OPTIONS FOR BEGINNERS

1 × $6.00

OPTIONS FOR BEGINNERS

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Investing with Exchange Traded Funds Made Easy with Marvin Appel

1 × $6.00

Investing with Exchange Traded Funds Made Easy with Marvin Appel

1 × $6.00 -

×

Core Strategy Program with Ota Courses

1 × $174.00

Core Strategy Program with Ota Courses

1 × $174.00 -

×

Advance Gap Trading with Master Trader

1 × $39.00

Advance Gap Trading with Master Trader

1 × $39.00 -

×

Advanced Price Action Techniques with Andrew Jeken

1 × $6.00

Advanced Price Action Techniques with Andrew Jeken

1 × $6.00 -

×

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00 -

×

Wall Street Stories with Edwin Lefevre

1 × $6.00

Wall Street Stories with Edwin Lefevre

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00 -

×

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00 -

×

B.O.S.S. Swing with Pat Mitchell – Trick Trades

1 × $39.00

B.O.S.S. Swing with Pat Mitchell – Trick Trades

1 × $39.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Late-Start Investor with John Wasik

1 × $6.00

The Late-Start Investor with John Wasik

1 × $6.00 -

×

Yarimi University Course

1 × $56.00

Yarimi University Course

1 × $56.00 -

×

WealthFRX Trading Mastery Course 2.0

1 × $5.00

WealthFRX Trading Mastery Course 2.0

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Advanced Course with Jtrader

1 × $6.00

Advanced Course with Jtrader

1 × $6.00 -

×

Trading the Elliott Waves with Robert Prechter

1 × $15.00

Trading the Elliott Waves with Robert Prechter

1 × $15.00 -

×

The Future of Investing with Chris Skinner

1 × $6.00

The Future of Investing with Chris Skinner

1 × $6.00 -

×

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00 -

×

Trading in the Bluff with John Templeton

1 × $6.00

Trading in the Bluff with John Templeton

1 × $6.00 -

×

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00 -

×

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00 -

×

Annual Forecast Reports - Forecast 2023 with Larry Williams

1 × $8.00

Annual Forecast Reports - Forecast 2023 with Larry Williams

1 × $8.00 -

×

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00 -

×

Stock Market Science and Technique

1 × $15.00

Stock Market Science and Technique

1 × $15.00 -

×

Winning with Options with Michael Thomsett

1 × $6.00

Winning with Options with Michael Thomsett

1 × $6.00 -

×

Metastock Online Traders Summit

1 × $5.00

Metastock Online Traders Summit

1 × $5.00 -

×

The Power of the Hexagon

1 × $6.00

The Power of the Hexagon

1 × $6.00 -

×

Applying Fibonacci Analysis to Price Action

1 × $6.00

Applying Fibonacci Analysis to Price Action

1 × $6.00 -

×

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00 -

×

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

Jimdandym Ql4 Courses

1 × $15.00

Jimdandym Ql4 Courses

1 × $15.00 -

×

Ocean’s CPA Force (Ebook)

1 × $6.00

Ocean’s CPA Force (Ebook)

1 × $6.00 -

×

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00 -

×

Dan Sheridan 2011 Calendar Workshop

1 × $6.00

Dan Sheridan 2011 Calendar Workshop

1 × $6.00 -

×

Catching the Big Moves with Jack Bernstein

1 × $6.00

Catching the Big Moves with Jack Bernstein

1 × $6.00 -

×

Futures Trading Secrets Home Study Course 2004 with Bill McCready

1 × $7.00

Futures Trading Secrets Home Study Course 2004 with Bill McCready

1 × $7.00 -

×

Dividend Key Home Study Course with Hubb Financial

1 × $6.00

Dividend Key Home Study Course with Hubb Financial

1 × $6.00 -

×

The High probability Intraday Trading System with Doc Severson

1 × $6.00

The High probability Intraday Trading System with Doc Severson

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00 -

×

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00 -

×

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00 -

×

Bootcamp and eBook with Jjwurldin

1 × $24.00

Bootcamp and eBook with Jjwurldin

1 × $24.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

The Weekly Options Advantage with Chuck Hughes

1 × $6.00

The Weekly Options Advantage with Chuck Hughes

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

MMfx Course August 2011 + MT4 Ind. Jan 2012

1 × $15.00

MMfx Course August 2011 + MT4 Ind. Jan 2012

1 × $15.00 -

×

The Options Applications Handbook: Hedging and Speculating Techniques for Professional Investors - Erik Banks & Paul Siegel

1 × $6.00

The Options Applications Handbook: Hedging and Speculating Techniques for Professional Investors - Erik Banks & Paul Siegel

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Profit Magic of Stock Transaction Timing with J.M.Hurst

1 × $6.00

The Profit Magic of Stock Transaction Timing with J.M.Hurst

1 × $6.00 -

×

Trading Mastery For Financial Freedom with Marv Eisen

1 × $10.00

Trading Mastery For Financial Freedom with Marv Eisen

1 × $10.00 -

×

Activedaytrader - Bond Trading Bootcamp

1 × $8.00

Activedaytrader - Bond Trading Bootcamp

1 × $8.00 -

×

Pristine - Cardinal Rules of Trading

1 × $6.00

Pristine - Cardinal Rules of Trading

1 × $6.00 -

×

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00 -

×

Trendfans & Trendline Breaks with Albert Yang

1 × $6.00

Trendfans & Trendline Breaks with Albert Yang

1 × $6.00 -

×

The Taylor Trading Technique with G.Douglas Taylor

1 × $6.00

The Taylor Trading Technique with G.Douglas Taylor

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00

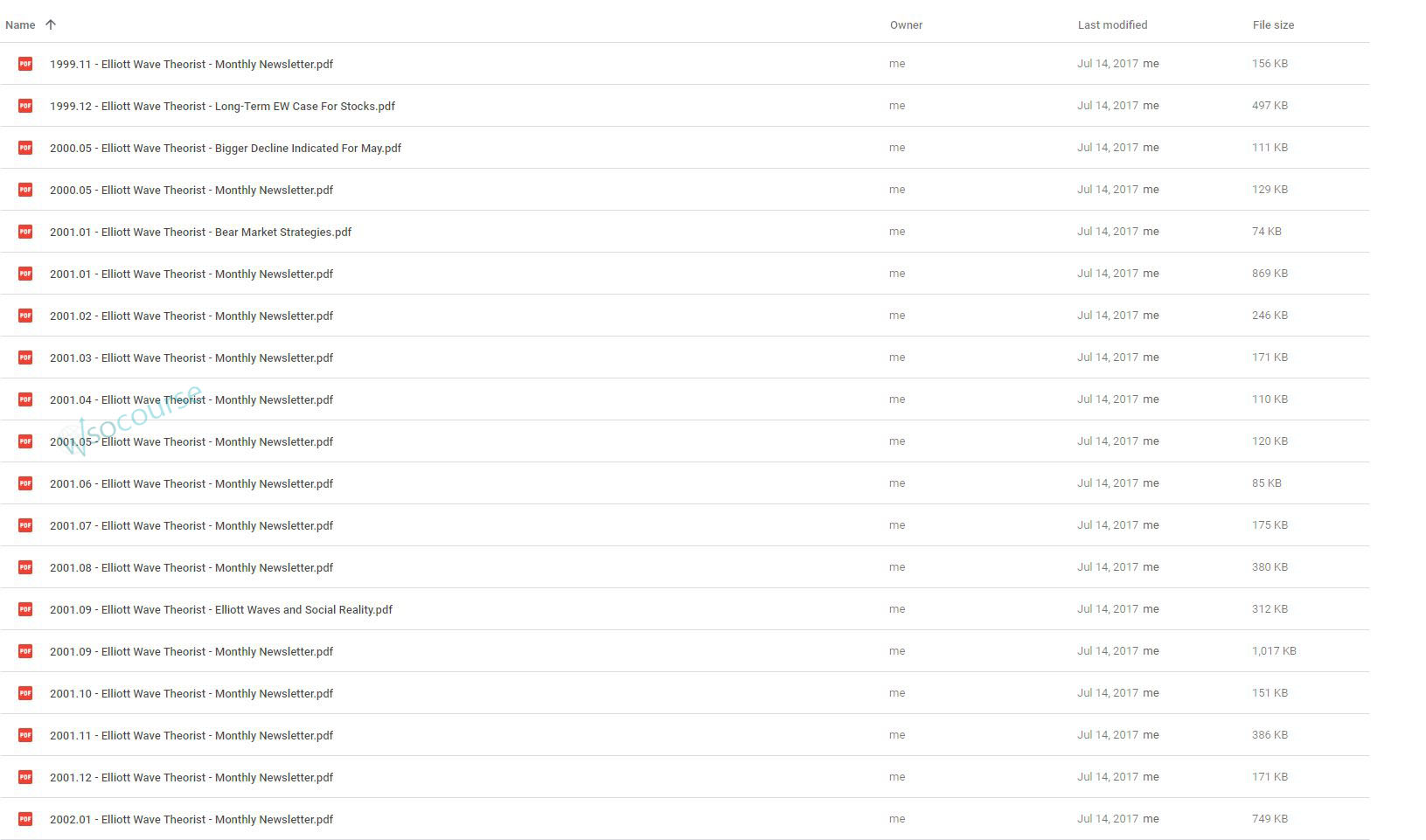

Monthly Newsletter 99-01 with Elliott Wave Theorist

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Monthly Newsletter 99-01 with Elliott Wave Theorist” below:

Exploring the Monthly Newsletter 99-01 with Elliott Wave Theorist

Introduction

In the late 90s, the Elliott Wave Theorist published a series of insightful newsletters that captured the essence of market dynamics through the lens of Elliott Wave Theory. This detailed look at the newsletters from 1999 to 2001 offers a unique glimpse into the application of this complex theory in understanding market trends.

The Basics of Elliott Wave Theory

Foundation and Principles

Elliott Wave Theory, developed by Ralph Nelson Elliott, is a method of technical analysis that looks at cyclic waves to predict stock market trends. The theory asserts that market movements are predictable in rhythmic patterns.

Application in Financial Markets

These newsletters utilized the theory to decode potential market movements, offering subscribers a strategic advantage.

Highlights from the 1999 Newsletters

Predicting the Tech Bubble

In 1999, as the tech bubble inflated, the newsletters provided crucial insights into its unsustainable nature, using Elliott Wave principles to forecast its burst.

Market Peaks and Troughs

Through meticulous analysis, the newsletters identified key turning points in the market, guiding investors on when to expect shifts.

The Year 2000: A Year of Volatility

Navigating Market Uncertainty

With the dot-com bubble’s burst imminent, the 2000 newsletters focused on strategies to handle the volatility, offering advice grounded in wave patterns.

Strategic Investment Tips

Subscribers received tips on safeguarding investments against the impending market corrections.

Insights from 2001

Post-Bubble Market Analysis

The aftermath of the bubble saw a confused market. The newsletters from 2001 helped demystify the direction of the market recovery.

Long-term Financial Planning

Advice extended beyond immediate market reactions, focusing on long-term investment strategies during uncertain times.

Methodology Behind the Analysis

Technical Analysis Techniques

The newsletters didn’t just preach theory; they demonstrated the application of various technical analysis tools to complement Elliott Wave predictions.

Case Studies

Real-time case studies provided subscribers with practical examples of how to apply theory to market activities.

Impact and Legacy

Influencing Traders and Analysts

These newsletters significantly influenced the strategies of many traders and analysts who subscribe to wave theory.

Educational Value

They also served an educational purpose, enhancing understanding of a complex theory through real-world applications.

Challenges and Criticisms

Skepticism in the Financial Community

Despite its advantages, Elliott Wave Theory—and by extension, the newsletters—faced skepticism for its perceived subjectivity in wave interpretation.

Addressing the Criticisms

The newsletters often tackled these criticisms head-on, defending the theory’s validity with empirical evidence.

Conclusion

The Monthly Newsletter 99-01 with Elliott Wave Theorist represents a critical piece of financial literature that offered timely, theory-backed insights during one of the most tumultuous periods in modern financial history. Their legacy is a testament to the enduring value of combining theory with practical market analysis.

FAQs

- What is Elliott Wave Theory?

- Elliott Wave Theory is a form of technical analysis that predicts market trends by identifying recurring wave patterns.

- How did the newsletters use Elliott Wave Theory?

- They applied the theory to analyze and predict market movements, offering strategic advice to subscribers.

- What was significant about the newsletters during the tech bubble?

- They provided foresight into the bubble’s burst, using wave patterns to predict when the market would turn.

- Can Elliott Wave Theory be applied today?

- Yes, it remains a valuable tool for technical analysts and traders looking to understand and predict market trends.

- What were some criticisms faced by the newsletters?

- Critics argued that the theory is too subjective, relying heavily on the analyst’s interpretation of wave patterns.

Be the first to review “Monthly Newsletter 99-01 with Elliott Wave Theorist” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.