-

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

7 Day FX Mastery Course with Market Masters

1 × $6.00

7 Day FX Mastery Course with Market Masters

1 × $6.00 -

×

The Inner Circle Seminar

1 × $15.00

The Inner Circle Seminar

1 × $15.00 -

×

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00 -

×

The Power of Beliefs in Trading with Gabriel Grammatidis - Van Tharp

1 × $13.00

The Power of Beliefs in Trading with Gabriel Grammatidis - Van Tharp

1 × $13.00 -

×

Portfolio Investing with Ron Bertino

1 × $54.00

Portfolio Investing with Ron Bertino

1 × $54.00 -

×

The Jupiter Effect with John Gribbin & Stephen Plagemann

1 × $6.00

The Jupiter Effect with John Gribbin & Stephen Plagemann

1 × $6.00 -

×

Advanced Strategy Design Techniques Bundle with NinjaTrader

1 × $20.00

Advanced Strategy Design Techniques Bundle with NinjaTrader

1 × $20.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Reedstrader 101: Mechanical Trading Strategy Workshop - REEDSTRADER

1 × $31.00

Reedstrader 101: Mechanical Trading Strategy Workshop - REEDSTRADER

1 × $31.00 -

×

ASFX Beginner Training Course & VIP Chat with ASFX Day Trading

1 × $31.00

ASFX Beginner Training Course & VIP Chat with ASFX Day Trading

1 × $31.00 -

×

What Products to Watch and Why Class with Don Kaufman

1 × $6.00

What Products to Watch and Why Class with Don Kaufman

1 × $6.00 -

×

Winning with Options with Michael Thomsett

1 × $6.00

Winning with Options with Michael Thomsett

1 × $6.00 -

×

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00

Mars Vesta Cycle in Stocks Markets (Article) with Bill Meridian

1 × $6.00 -

×

The Online Investing Book with Harry Domash

1 × $6.00

The Online Investing Book with Harry Domash

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Train & Trade Academy with Omar Agag

1 × $5.00

Train & Trade Academy with Omar Agag

1 × $5.00 -

×

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00 -

×

Broker Robbery University Course with Billi Richy FX

1 × $5.00

Broker Robbery University Course with Billi Richy FX

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Video Bundle - 4d & "Into The Abyss" with Blackrabbitfx

1 × $6.00

Video Bundle - 4d & "Into The Abyss" with Blackrabbitfx

1 × $6.00 -

×

4 Class Bundle

1 × $31.00

4 Class Bundle

1 × $31.00 -

×

Angel Capital How to Raise Early-Stage Private Equity Financing with Gerald A. Benjamin, Joel B. Margulis

1 × $6.00

Angel Capital How to Raise Early-Stage Private Equity Financing with Gerald A. Benjamin, Joel B. Margulis

1 × $6.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

CFA Level 2 - Sample Item Sets 2003

1 × $6.00

CFA Level 2 - Sample Item Sets 2003

1 × $6.00 -

×

Scalping Betfair For Daily Profits

1 × $6.00

Scalping Betfair For Daily Profits

1 × $6.00 -

×

Chaos and order in the Capital Markets with Edgar E.Peters

1 × $6.00

Chaos and order in the Capital Markets with Edgar E.Peters

1 × $6.00 -

×

The Nasdaq Investor with Max Isaacman

1 × $6.00

The Nasdaq Investor with Max Isaacman

1 × $6.00 -

×

The Ultimate Forex Structure Course

1 × $31.00

The Ultimate Forex Structure Course

1 × $31.00 -

×

WickOrTreat Trading Course with WickOrTreat

1 × $6.00

WickOrTreat Trading Course with WickOrTreat

1 × $6.00 -

×

The Complete Idiots Guide to Investing in Internet Stocks with Kenneth Little

1 × $6.00

The Complete Idiots Guide to Investing in Internet Stocks with Kenneth Little

1 × $6.00 -

×

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00 -

×

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00 -

×

Binary Defender

1 × $15.00

Binary Defender

1 × $15.00 -

×

Investment Blunders with John Nofsinger

1 × $6.00

Investment Blunders with John Nofsinger

1 × $6.00 -

×

Advanced Trading Course with DovyFX

1 × $5.00

Advanced Trading Course with DovyFX

1 × $5.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Lucci Method with Sang Lucci

1 × $15.00

The Lucci Method with Sang Lucci

1 × $15.00 -

×

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00 -

×

Volatility Trading with Euan Sinclair

1 × $6.00

Volatility Trading with Euan Sinclair

1 × $6.00 -

×

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00 -

×

Value, Price & Profit with Karl Marx

1 × $6.00

Value, Price & Profit with Karl Marx

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Value Investing Today with Charles Brandes

1 × $6.00

Value Investing Today with Charles Brandes

1 × $6.00 -

×

AstroScan Regulus 4.1E newastro.net

1 × $6.00

AstroScan Regulus 4.1E newastro.net

1 × $6.00 -

×

Weekly Power Options Strategies

1 × $6.00

Weekly Power Options Strategies

1 × $6.00

Monthly Newsletter 99-01 with Elliott Wave Theorist

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

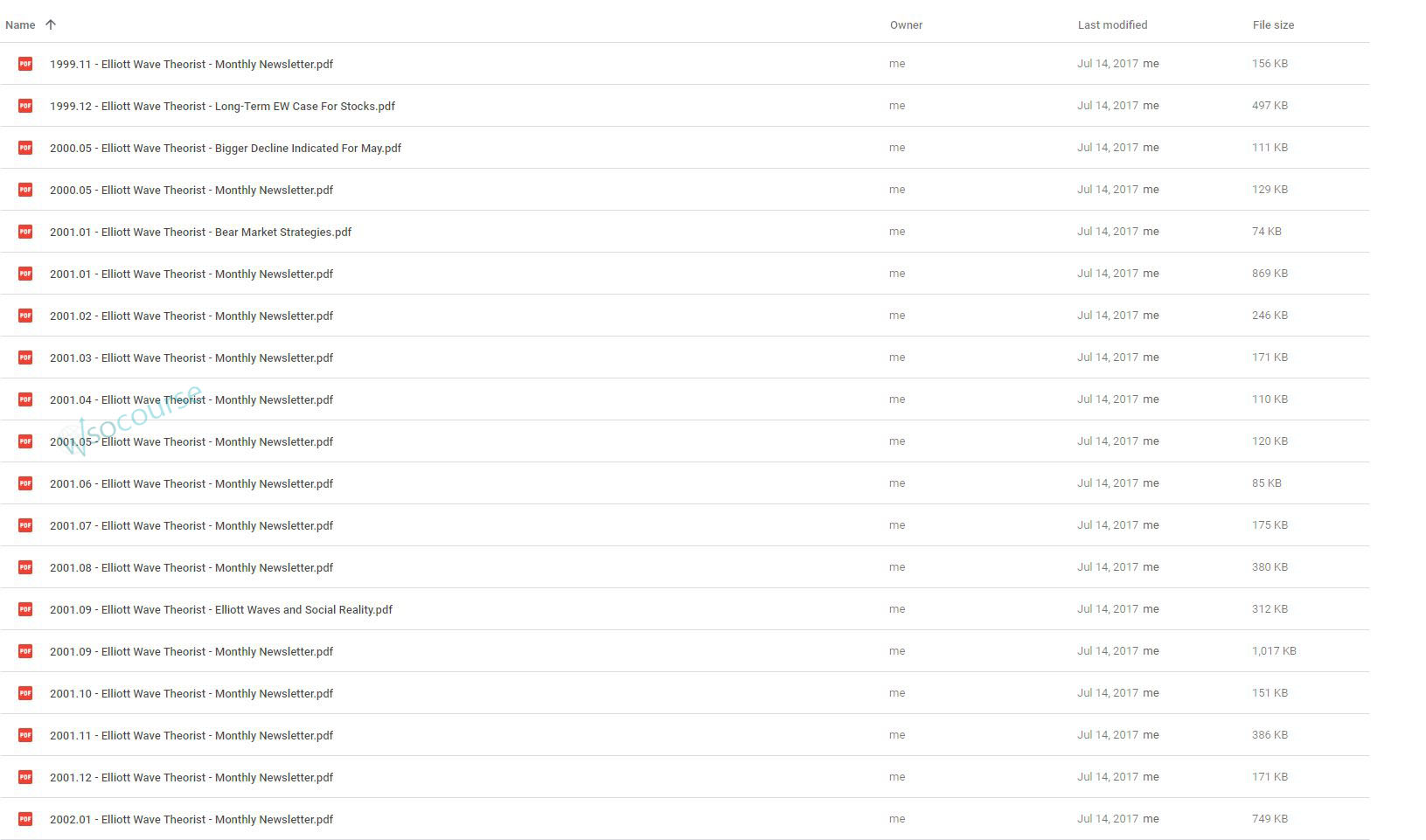

You may check content proof of “Monthly Newsletter 99-01 with Elliott Wave Theorist” below:

Exploring the Monthly Newsletter 99-01 with Elliott Wave Theorist

Introduction

In the late 90s, the Elliott Wave Theorist published a series of insightful newsletters that captured the essence of market dynamics through the lens of Elliott Wave Theory. This detailed look at the newsletters from 1999 to 2001 offers a unique glimpse into the application of this complex theory in understanding market trends.

The Basics of Elliott Wave Theory

Foundation and Principles

Elliott Wave Theory, developed by Ralph Nelson Elliott, is a method of technical analysis that looks at cyclic waves to predict stock market trends. The theory asserts that market movements are predictable in rhythmic patterns.

Application in Financial Markets

These newsletters utilized the theory to decode potential market movements, offering subscribers a strategic advantage.

Highlights from the 1999 Newsletters

Predicting the Tech Bubble

In 1999, as the tech bubble inflated, the newsletters provided crucial insights into its unsustainable nature, using Elliott Wave principles to forecast its burst.

Market Peaks and Troughs

Through meticulous analysis, the newsletters identified key turning points in the market, guiding investors on when to expect shifts.

The Year 2000: A Year of Volatility

Navigating Market Uncertainty

With the dot-com bubble’s burst imminent, the 2000 newsletters focused on strategies to handle the volatility, offering advice grounded in wave patterns.

Strategic Investment Tips

Subscribers received tips on safeguarding investments against the impending market corrections.

Insights from 2001

Post-Bubble Market Analysis

The aftermath of the bubble saw a confused market. The newsletters from 2001 helped demystify the direction of the market recovery.

Long-term Financial Planning

Advice extended beyond immediate market reactions, focusing on long-term investment strategies during uncertain times.

Methodology Behind the Analysis

Technical Analysis Techniques

The newsletters didn’t just preach theory; they demonstrated the application of various technical analysis tools to complement Elliott Wave predictions.

Case Studies

Real-time case studies provided subscribers with practical examples of how to apply theory to market activities.

Impact and Legacy

Influencing Traders and Analysts

These newsletters significantly influenced the strategies of many traders and analysts who subscribe to wave theory.

Educational Value

They also served an educational purpose, enhancing understanding of a complex theory through real-world applications.

Challenges and Criticisms

Skepticism in the Financial Community

Despite its advantages, Elliott Wave Theory—and by extension, the newsletters—faced skepticism for its perceived subjectivity in wave interpretation.

Addressing the Criticisms

The newsletters often tackled these criticisms head-on, defending the theory’s validity with empirical evidence.

Conclusion

The Monthly Newsletter 99-01 with Elliott Wave Theorist represents a critical piece of financial literature that offered timely, theory-backed insights during one of the most tumultuous periods in modern financial history. Their legacy is a testament to the enduring value of combining theory with practical market analysis.

FAQs

- What is Elliott Wave Theory?

- Elliott Wave Theory is a form of technical analysis that predicts market trends by identifying recurring wave patterns.

- How did the newsletters use Elliott Wave Theory?

- They applied the theory to analyze and predict market movements, offering strategic advice to subscribers.

- What was significant about the newsletters during the tech bubble?

- They provided foresight into the bubble’s burst, using wave patterns to predict when the market would turn.

- Can Elliott Wave Theory be applied today?

- Yes, it remains a valuable tool for technical analysts and traders looking to understand and predict market trends.

- What were some criticisms faced by the newsletters?

- Critics argued that the theory is too subjective, relying heavily on the analyst’s interpretation of wave patterns.

Be the first to review “Monthly Newsletter 99-01 with Elliott Wave Theorist” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.