-

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00 -

×

Investing in the stock market

1 × $6.00

Investing in the stock market

1 × $6.00 -

×

Access All Areas with Marwood Research

1 × $54.00

Access All Areas with Marwood Research

1 × $54.00 -

×

Myths of the Free Market with Kenneth Friedman

1 × $6.00

Myths of the Free Market with Kenneth Friedman

1 × $6.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

AstroScan Regulus 4.1E newastro.net

1 × $6.00

AstroScan Regulus 4.1E newastro.net

1 × $6.00 -

×

Quantitative Business Valuation with Jay Abrams

1 × $6.00

Quantitative Business Valuation with Jay Abrams

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00 -

×

With All Odds Forex System I & II with Barry Thornton

1 × $6.00

With All Odds Forex System I & II with Barry Thornton

1 × $6.00 -

×

Forex Avenger Trading System with David Curran

1 × $6.00

Forex Avenger Trading System with David Curran

1 × $6.00 -

×

Study Guide for Technical Analysis Explained (1st Edition) with Martin Pring

1 × $6.00

Study Guide for Technical Analysis Explained (1st Edition) with Martin Pring

1 × $6.00 -

×

7 Days Options Masters Course with John Carter

1 × $54.00

7 Days Options Masters Course with John Carter

1 × $54.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00 -

×

BSAPPS FX Course with Ben Barker

1 × $6.00

BSAPPS FX Course with Ben Barker

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00 -

×

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Sample and Mock Exams 2008 with CFA Institute

1 × $6.00

Sample and Mock Exams 2008 with CFA Institute

1 × $6.00 -

×

The Hindenburg Strategy with Todd Mitchell

1 × $23.00

The Hindenburg Strategy with Todd Mitchell

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

A New Look at Exit Strategies with Charles LeBeau

1 × $6.00

A New Look at Exit Strategies with Charles LeBeau

1 × $6.00 -

×

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Systematic Trader: Maximizing Trading Systems and Money Management with David Stendahl & John Boyer

1 × $6.00

The Systematic Trader: Maximizing Trading Systems and Money Management with David Stendahl & John Boyer

1 × $6.00 -

×

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00

Alternative Beta Strategies & Hedge Fund Replication with Lars Jaeger & Jeffrey Pease

1 × $6.00 -

×

AstroFX Course

1 × $6.00

AstroFX Course

1 × $6.00 -

×

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Astro Models (techedgecycles.com) with Yuri Shramenko

1 × $6.00

Astro Models (techedgecycles.com) with Yuri Shramenko

1 × $6.00 -

×

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00 -

×

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00 -

×

VWAP Trading course with Trade With Trend

1 × $6.00

VWAP Trading course with Trade With Trend

1 × $6.00 -

×

Forex Mentor Seminar with Peter Bain

1 × $6.00

Forex Mentor Seminar with Peter Bain

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The Insider's Guide to Forex Trading with Kathy Lien

1 × $6.00

The Insider's Guide to Forex Trading with Kathy Lien

1 × $6.00 -

×

Unsorted Articles about the Psychology of Trading with Brett N.Steenbarger

1 × $6.00

Unsorted Articles about the Psychology of Trading with Brett N.Steenbarger

1 × $6.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

X-Factor Day-Trading

1 × $5.00

X-Factor Day-Trading

1 × $5.00 -

×

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00 -

×

Trend Commandments with Michael Covel

1 × $6.00

Trend Commandments with Michael Covel

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Best of AM Review (Volume 1-3) with Peter Bain

1 × $6.00

Best of AM Review (Volume 1-3) with Peter Bain

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Monthly Newsletter 99-01 with Elliott Wave Theorist

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

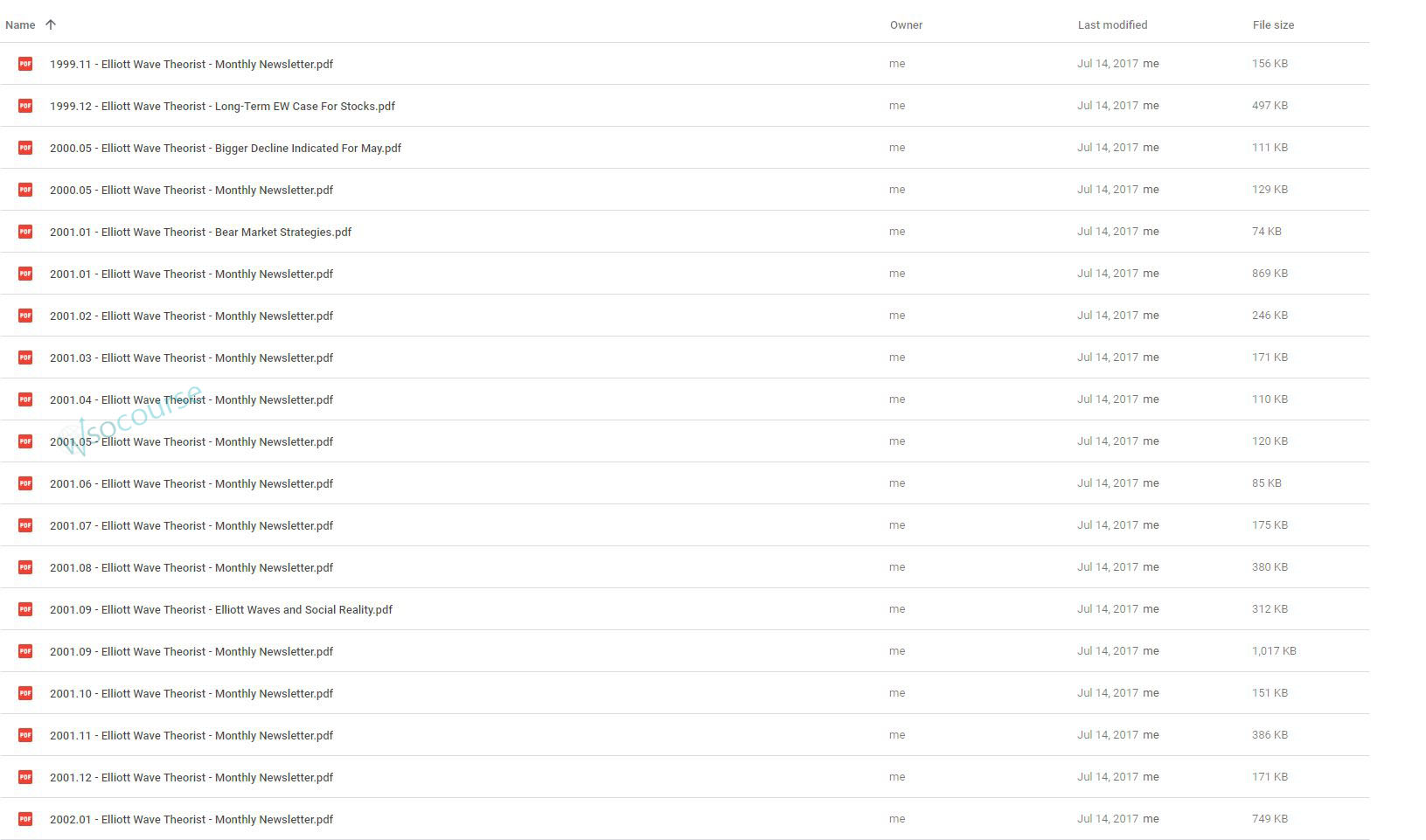

You may check content proof of “Monthly Newsletter 99-01 with Elliott Wave Theorist” below:

Exploring the Monthly Newsletter 99-01 with Elliott Wave Theorist

Introduction

In the late 90s, the Elliott Wave Theorist published a series of insightful newsletters that captured the essence of market dynamics through the lens of Elliott Wave Theory. This detailed look at the newsletters from 1999 to 2001 offers a unique glimpse into the application of this complex theory in understanding market trends.

The Basics of Elliott Wave Theory

Foundation and Principles

Elliott Wave Theory, developed by Ralph Nelson Elliott, is a method of technical analysis that looks at cyclic waves to predict stock market trends. The theory asserts that market movements are predictable in rhythmic patterns.

Application in Financial Markets

These newsletters utilized the theory to decode potential market movements, offering subscribers a strategic advantage.

Highlights from the 1999 Newsletters

Predicting the Tech Bubble

In 1999, as the tech bubble inflated, the newsletters provided crucial insights into its unsustainable nature, using Elliott Wave principles to forecast its burst.

Market Peaks and Troughs

Through meticulous analysis, the newsletters identified key turning points in the market, guiding investors on when to expect shifts.

The Year 2000: A Year of Volatility

Navigating Market Uncertainty

With the dot-com bubble’s burst imminent, the 2000 newsletters focused on strategies to handle the volatility, offering advice grounded in wave patterns.

Strategic Investment Tips

Subscribers received tips on safeguarding investments against the impending market corrections.

Insights from 2001

Post-Bubble Market Analysis

The aftermath of the bubble saw a confused market. The newsletters from 2001 helped demystify the direction of the market recovery.

Long-term Financial Planning

Advice extended beyond immediate market reactions, focusing on long-term investment strategies during uncertain times.

Methodology Behind the Analysis

Technical Analysis Techniques

The newsletters didn’t just preach theory; they demonstrated the application of various technical analysis tools to complement Elliott Wave predictions.

Case Studies

Real-time case studies provided subscribers with practical examples of how to apply theory to market activities.

Impact and Legacy

Influencing Traders and Analysts

These newsletters significantly influenced the strategies of many traders and analysts who subscribe to wave theory.

Educational Value

They also served an educational purpose, enhancing understanding of a complex theory through real-world applications.

Challenges and Criticisms

Skepticism in the Financial Community

Despite its advantages, Elliott Wave Theory—and by extension, the newsletters—faced skepticism for its perceived subjectivity in wave interpretation.

Addressing the Criticisms

The newsletters often tackled these criticisms head-on, defending the theory’s validity with empirical evidence.

Conclusion

The Monthly Newsletter 99-01 with Elliott Wave Theorist represents a critical piece of financial literature that offered timely, theory-backed insights during one of the most tumultuous periods in modern financial history. Their legacy is a testament to the enduring value of combining theory with practical market analysis.

FAQs

- What is Elliott Wave Theory?

- Elliott Wave Theory is a form of technical analysis that predicts market trends by identifying recurring wave patterns.

- How did the newsletters use Elliott Wave Theory?

- They applied the theory to analyze and predict market movements, offering strategic advice to subscribers.

- What was significant about the newsletters during the tech bubble?

- They provided foresight into the bubble’s burst, using wave patterns to predict when the market would turn.

- Can Elliott Wave Theory be applied today?

- Yes, it remains a valuable tool for technical analysts and traders looking to understand and predict market trends.

- What were some criticisms faced by the newsletters?

- Critics argued that the theory is too subjective, relying heavily on the analyst’s interpretation of wave patterns.

Be the first to review “Monthly Newsletter 99-01 with Elliott Wave Theorist” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.