-

×

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00 -

×

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Advanced Fibonacci Trading with Neal Hughes

1 × $6.00

Advanced Fibonacci Trading with Neal Hughes

1 × $6.00 -

×

Options Trading with Adam Grimes - MarketLife

1 × $5.00

Options Trading with Adam Grimes - MarketLife

1 × $5.00 -

×

Value Investing Bootcamp with Nick Kraakman

1 × $15.00

Value Investing Bootcamp with Nick Kraakman

1 × $15.00 -

×

CyberTrading University – Advanced Stock Course

1 × $31.00

CyberTrading University – Advanced Stock Course

1 × $31.00 -

×

Catching Trend Reversals

1 × $6.00

Catching Trend Reversals

1 × $6.00 -

×

Trader University with Matthew Kratter

1 × $6.00

Trader University with Matthew Kratter

1 × $6.00 -

×

The Late-Start Investor with John Wasik

1 × $6.00

The Late-Start Investor with John Wasik

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Workshop Earnings Powerplay with Base Camp Trading

1 × $17.00

Workshop Earnings Powerplay with Base Camp Trading

1 × $17.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Wysetrade Forex Masterclass 3.0

1 × $6.00

Wysetrade Forex Masterclass 3.0

1 × $6.00 -

×

Relentless Trading Course Advanced with Ryan Relentless

1 × $5.00

Relentless Trading Course Advanced with Ryan Relentless

1 × $5.00 -

×

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00 -

×

Advanced Trading Strategies with Larry Connors

1 × $6.00

Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

IncomeMax Spreads with Hari Swaminathan

1 × $23.00

IncomeMax Spreads with Hari Swaminathan

1 × $23.00 -

×

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00 -

×

Van Tharp Courses Collection

1 × $41.00

Van Tharp Courses Collection

1 × $41.00 -

×

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00 -

×

Original Charting 1936 with W.D.Gann

1 × $6.00

Original Charting 1936 with W.D.Gann

1 × $6.00 -

×

How to Trade Forex & Cryptocurrency with Bitraged

1 × $5.00

How to Trade Forex & Cryptocurrency with Bitraged

1 × $5.00 -

×

CFA Core Video on Quantitative Finance with Connel Fullenkamp

1 × $6.00

CFA Core Video on Quantitative Finance with Connel Fullenkamp

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The New Reality Of Wall Street with Donald Coxe

1 × $6.00

The New Reality Of Wall Street with Donald Coxe

1 × $6.00 -

×

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00 -

×

Acme

1 × $6.00

Acme

1 × $6.00 -

×

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Tradingconceptsinc - Calendar Spreads

1 × $23.00

Tradingconceptsinc - Calendar Spreads

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Mean Reversion Strategy with The Chartist

1 × $78.00

Mean Reversion Strategy with The Chartist

1 × $78.00 -

×

Pit Bull with Martin Schwartz

1 × $6.00

Pit Bull with Martin Schwartz

1 × $6.00 -

×

The Nature of Risk with Justin Mamis

1 × $6.00

The Nature of Risk with Justin Mamis

1 × $6.00 -

×

Field of Vision Program – Digital Download

1 × $31.00

Field of Vision Program – Digital Download

1 × $31.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Volatility Position Risk Management with Cynthia Kase

1 × $6.00

Volatility Position Risk Management with Cynthia Kase

1 × $6.00 -

×

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Dynamic Time Cycles with Peter Eliades

1 × $6.00

Dynamic Time Cycles with Peter Eliades

1 × $6.00 -

×

The Handbook of Technical Analysis: A Comprehensive Guide to Analytical Methods, Trading Systems and Technical Indicators with Darrell R. Jobman

1 × $6.00

The Handbook of Technical Analysis: A Comprehensive Guide to Analytical Methods, Trading Systems and Technical Indicators with Darrell R. Jobman

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

Trade Your Way to Wealth with Bill Kraft

1 × $6.00

Trade Your Way to Wealth with Bill Kraft

1 × $6.00 -

×

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00 -

×

Currency Trading for Dummies with Mark Galant

1 × $6.00

Currency Trading for Dummies with Mark Galant

1 × $6.00 -

×

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00 -

×

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00

Trade Setups And Strategies Program with The Daytrading Room

1 × $23.00 -

×

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00 -

×

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00 -

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

FX Childs Play System

1 × $6.00

FX Childs Play System

1 × $6.00 -

×

Mindover Markets Enhanced: The Intensive Series 2 with Jim Dalton

1 × $20.00

Mindover Markets Enhanced: The Intensive Series 2 with Jim Dalton

1 × $20.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00 -

×

The Practical Guide to Wall Street with Matthew Tagliani

1 × $6.00

The Practical Guide to Wall Street with Matthew Tagliani

1 × $6.00 -

×

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Jimdandym Ql4 Courses

1 × $15.00

Jimdandym Ql4 Courses

1 × $15.00 -

×

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00 -

×

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00 -

×

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00 -

×

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

TradingMind Course with Jack Bernstein

1 × $6.00

TradingMind Course with Jack Bernstein

1 × $6.00 -

×

TradingWithBilz Course

1 × $10.00

TradingWithBilz Course

1 × $10.00 -

×

WD Gann’s Master Time Factor DVD With Miles Wilson Walker

1 × $6.00

WD Gann’s Master Time Factor DVD With Miles Wilson Walker

1 × $6.00 -

×

Wyckoff Stock Market Institute

1 × $5.00

Wyckoff Stock Market Institute

1 × $5.00 -

×

CrewFX Group Course Package with Language Of The Markets

1 × $6.00

CrewFX Group Course Package with Language Of The Markets

1 × $6.00 -

×

Analysis of Equity Investments: Valuation with John Stowe, Thomas Robinson, Jerald Pinto & Dennis McLeavey

1 × $6.00

Analysis of Equity Investments: Valuation with John Stowe, Thomas Robinson, Jerald Pinto & Dennis McLeavey

1 × $6.00 -

×

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00 -

×

Bulletproof Butterflies 2.0 2022 (PREMIUM) with Bruce Marshall

1 × $23.00

Bulletproof Butterflies 2.0 2022 (PREMIUM) with Bruce Marshall

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00

Monthly Newsletter 99-01 with Elliott Wave Theorist

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

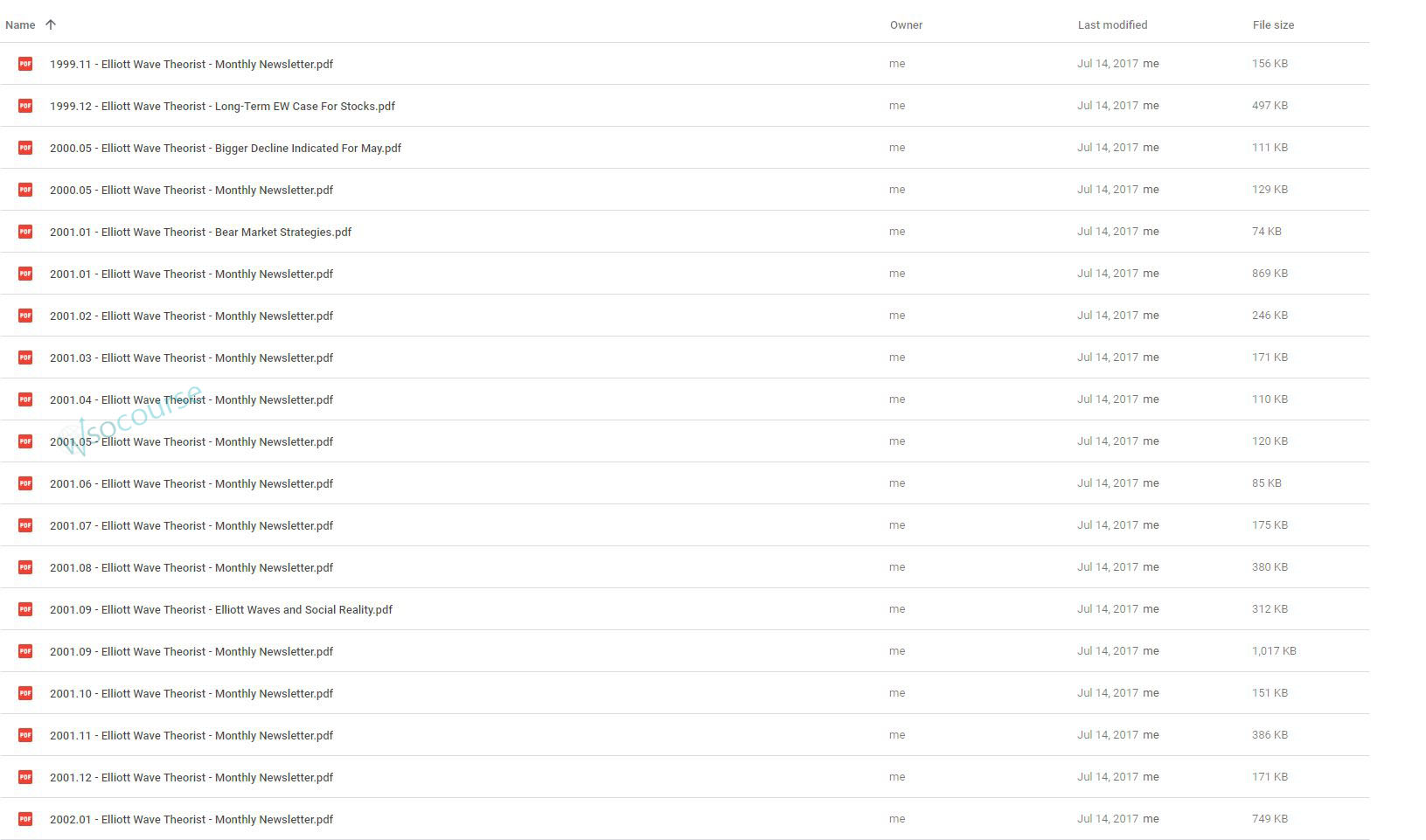

You may check content proof of “Monthly Newsletter 99-01 with Elliott Wave Theorist” below:

Exploring the Monthly Newsletter 99-01 with Elliott Wave Theorist

Introduction

In the late 90s, the Elliott Wave Theorist published a series of insightful newsletters that captured the essence of market dynamics through the lens of Elliott Wave Theory. This detailed look at the newsletters from 1999 to 2001 offers a unique glimpse into the application of this complex theory in understanding market trends.

The Basics of Elliott Wave Theory

Foundation and Principles

Elliott Wave Theory, developed by Ralph Nelson Elliott, is a method of technical analysis that looks at cyclic waves to predict stock market trends. The theory asserts that market movements are predictable in rhythmic patterns.

Application in Financial Markets

These newsletters utilized the theory to decode potential market movements, offering subscribers a strategic advantage.

Highlights from the 1999 Newsletters

Predicting the Tech Bubble

In 1999, as the tech bubble inflated, the newsletters provided crucial insights into its unsustainable nature, using Elliott Wave principles to forecast its burst.

Market Peaks and Troughs

Through meticulous analysis, the newsletters identified key turning points in the market, guiding investors on when to expect shifts.

The Year 2000: A Year of Volatility

Navigating Market Uncertainty

With the dot-com bubble’s burst imminent, the 2000 newsletters focused on strategies to handle the volatility, offering advice grounded in wave patterns.

Strategic Investment Tips

Subscribers received tips on safeguarding investments against the impending market corrections.

Insights from 2001

Post-Bubble Market Analysis

The aftermath of the bubble saw a confused market. The newsletters from 2001 helped demystify the direction of the market recovery.

Long-term Financial Planning

Advice extended beyond immediate market reactions, focusing on long-term investment strategies during uncertain times.

Methodology Behind the Analysis

Technical Analysis Techniques

The newsletters didn’t just preach theory; they demonstrated the application of various technical analysis tools to complement Elliott Wave predictions.

Case Studies

Real-time case studies provided subscribers with practical examples of how to apply theory to market activities.

Impact and Legacy

Influencing Traders and Analysts

These newsletters significantly influenced the strategies of many traders and analysts who subscribe to wave theory.

Educational Value

They also served an educational purpose, enhancing understanding of a complex theory through real-world applications.

Challenges and Criticisms

Skepticism in the Financial Community

Despite its advantages, Elliott Wave Theory—and by extension, the newsletters—faced skepticism for its perceived subjectivity in wave interpretation.

Addressing the Criticisms

The newsletters often tackled these criticisms head-on, defending the theory’s validity with empirical evidence.

Conclusion

The Monthly Newsletter 99-01 with Elliott Wave Theorist represents a critical piece of financial literature that offered timely, theory-backed insights during one of the most tumultuous periods in modern financial history. Their legacy is a testament to the enduring value of combining theory with practical market analysis.

FAQs

- What is Elliott Wave Theory?

- Elliott Wave Theory is a form of technical analysis that predicts market trends by identifying recurring wave patterns.

- How did the newsletters use Elliott Wave Theory?

- They applied the theory to analyze and predict market movements, offering strategic advice to subscribers.

- What was significant about the newsletters during the tech bubble?

- They provided foresight into the bubble’s burst, using wave patterns to predict when the market would turn.

- Can Elliott Wave Theory be applied today?

- Yes, it remains a valuable tool for technical analysts and traders looking to understand and predict market trends.

- What were some criticisms faced by the newsletters?

- Critics argued that the theory is too subjective, relying heavily on the analyst’s interpretation of wave patterns.

Be the first to review “Monthly Newsletter 99-01 with Elliott Wave Theorist” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.