-

×

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00 -

×

Vertex Investing Course

1 × $6.00

Vertex Investing Course

1 × $6.00 -

×

WealthFRX Trading Mastery Course 2.0

1 × $5.00

WealthFRX Trading Mastery Course 2.0

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Nasdaq Investor with Max Isaacman

1 × $6.00

The Nasdaq Investor with Max Isaacman

1 × $6.00 -

×

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

Bear Market Success Workshop with Base Camp Trading

1 × $15.00

Bear Market Success Workshop with Base Camp Trading

1 × $15.00 -

×

Options Bootcamp with Sid Woolfolk

1 × $6.00

Options Bootcamp with Sid Woolfolk

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Valuation of Internet & Technology Stocks with Brian Kettell

1 × $6.00

Valuation of Internet & Technology Stocks with Brian Kettell

1 × $6.00 -

×

The Professional Risk Manager Handbook with Carol Alexander

1 × $6.00

The Professional Risk Manager Handbook with Carol Alexander

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Banker’s Edge Webinar & Extras

1 × $6.00

The Banker’s Edge Webinar & Extras

1 × $6.00 -

×

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00 -

×

Advanced Symmetrics Mental Harmonics Course

1 × $15.00

Advanced Symmetrics Mental Harmonics Course

1 × $15.00 -

×

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00 -

×

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00 -

×

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00 -

×

Virtual Intensive Trader Training

1 × $31.00

Virtual Intensive Trader Training

1 × $31.00 -

×

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00 -

×

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00 -

×

Matrix Options

1 × $6.00

Matrix Options

1 × $6.00 -

×

A Day Trading Guide

1 × $54.00

A Day Trading Guide

1 × $54.00 -

×

CFA Level 1,2 & 3 Complete Course 2010 48 CD’s with Schweser

1 × $6.00

CFA Level 1,2 & 3 Complete Course 2010 48 CD’s with Schweser

1 × $6.00 -

×

The Complete Foundation Stock Trading Course

1 × $62.00

The Complete Foundation Stock Trading Course

1 × $62.00 -

×

AstroFX Course

1 × $6.00

AstroFX Course

1 × $6.00 -

×

Profitable Binary Options Strategies

1 × $5.00

Profitable Binary Options Strategies

1 × $5.00 -

×

Trade Australian Share CFDs with Brian Griffin

1 × $6.00

Trade Australian Share CFDs with Brian Griffin

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Value Investing King of Trading Methods in the Commodity Markets - Hal Masover

1 × $6.00

Value Investing King of Trading Methods in the Commodity Markets - Hal Masover

1 × $6.00 -

×

Pristine - Noble DraKoln – The Complete Liverpool Futures Seminar Series

1 × $6.00

Pristine - Noble DraKoln – The Complete Liverpool Futures Seminar Series

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

War Room Psychology Package (Volume 1-4) with Pat Mitchell – Trick Trades

1 × $112.00

War Room Psychology Package (Volume 1-4) with Pat Mitchell – Trick Trades

1 × $112.00 -

×

AstroFibonacci 7.3722 magisociety

1 × $6.00

AstroFibonacci 7.3722 magisociety

1 × $6.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

Trading MasterMind Course

1 × $23.00

Trading MasterMind Course

1 × $23.00 -

×

iMF Tracker – Order Flow Program 2023

1 × $5.00

iMF Tracker – Order Flow Program 2023

1 × $5.00 -

×

The Ultimate Investor with Dean LeBaron

1 × $4.00

The Ultimate Investor with Dean LeBaron

1 × $4.00 -

×

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00 -

×

Create Your Own ETF Hedge Fund: A Do-It-Yourself ETF Strategy for Private Wealth Management with David Fry

1 × $6.00

Create Your Own ETF Hedge Fund: A Do-It-Yourself ETF Strategy for Private Wealth Management with David Fry

1 × $6.00 -

×

The Pitbull Investor (2009 Ed.)

1 × $6.00

The Pitbull Investor (2009 Ed.)

1 × $6.00 -

×

The Offshore Money Book with Arnold Cornez

1 × $6.00

The Offshore Money Book with Arnold Cornez

1 × $6.00 -

×

The One Trading Secret That Could Make You Rich Inside Days

1 × $6.00

The One Trading Secret That Could Make You Rich Inside Days

1 × $6.00 -

×

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00 -

×

The Psychology of the Foreign Exchange Market with Thomas Oberlechner

1 × $6.00

The Psychology of the Foreign Exchange Market with Thomas Oberlechner

1 × $6.00 -

×

Empirical Market Microstructure

1 × $6.00

Empirical Market Microstructure

1 × $6.00 -

×

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00 -

×

Vertex Investing Course (2023)

1 × $8.00

Vertex Investing Course (2023)

1 × $8.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trading For Busy People with Josias Kere

1 × $6.00

Trading For Busy People with Josias Kere

1 × $6.00 -

×

The New Technical Trader with Chande Kroll

1 × $6.00

The New Technical Trader with Chande Kroll

1 × $6.00 -

×

WickOrTreat Trading Course with WickOrTreat

1 × $6.00

WickOrTreat Trading Course with WickOrTreat

1 × $6.00 -

×

XLT - Forex Trading Course

1 × $6.00

XLT - Forex Trading Course

1 × $6.00 -

×

Advanced Option Trading with Broken Wing Butterflys with Greg Loehr

1 × $9.00

Advanced Option Trading with Broken Wing Butterflys with Greg Loehr

1 × $9.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Trading Like You’ve Never Heard Before – Digital Download

1 × $15.00

Trading Like You’ve Never Heard Before – Digital Download

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Bar Ipro v9.1 for MT4 11XX

1 × $23.00

Bar Ipro v9.1 for MT4 11XX

1 × $23.00 -

×

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00 -

×

Broker Robbery University Course with Billi Richy FX

1 × $5.00

Broker Robbery University Course with Billi Richy FX

1 × $5.00 -

×

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00 -

×

What Ranks Schema Course with Clint Butler

1 × $23.00

What Ranks Schema Course with Clint Butler

1 × $23.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Trade Stocks and Commodities with the Insiders. Secrets of the COT Report with Larry Williams

1 × $6.00

Trade Stocks and Commodities with the Insiders. Secrets of the COT Report with Larry Williams

1 × $6.00 -

×

Option, Futures and Other Derivates 9th Edition

1 × $6.00

Option, Futures and Other Derivates 9th Edition

1 × $6.00 -

×

Affinity Foundation Option Course with Affinitytrading

1 × $6.00

Affinity Foundation Option Course with Affinitytrading

1 × $6.00 -

×

Option Hydra - Mar 2020 Edition - Basics with Rajandran R

1 × $23.00

Option Hydra - Mar 2020 Edition - Basics with Rajandran R

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

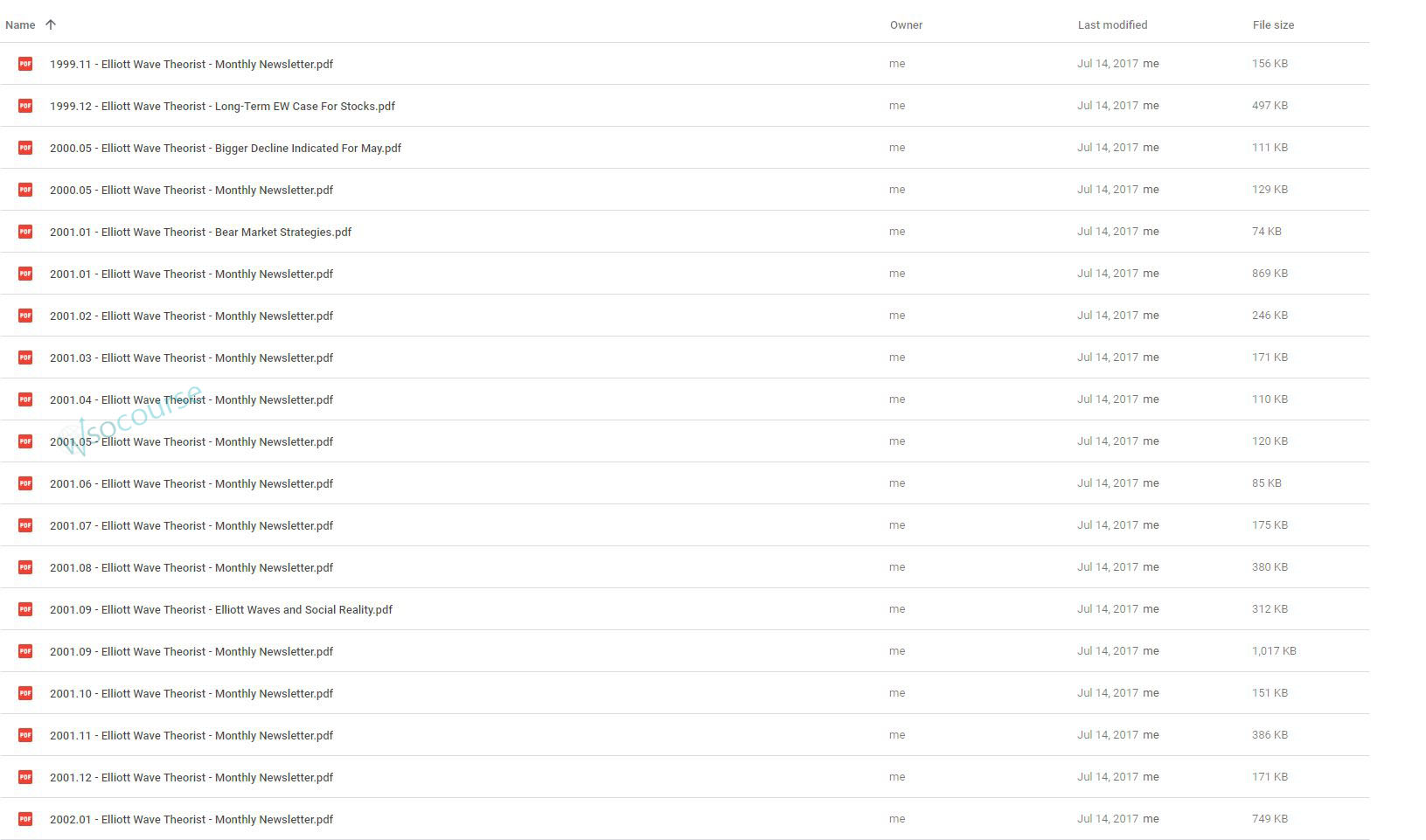

Monthly Newsletter 99-01 with Elliott Wave Theorist

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Monthly Newsletter 99-01 with Elliott Wave Theorist” below:

Exploring the Monthly Newsletter 99-01 with Elliott Wave Theorist

Introduction

In the late 90s, the Elliott Wave Theorist published a series of insightful newsletters that captured the essence of market dynamics through the lens of Elliott Wave Theory. This detailed look at the newsletters from 1999 to 2001 offers a unique glimpse into the application of this complex theory in understanding market trends.

The Basics of Elliott Wave Theory

Foundation and Principles

Elliott Wave Theory, developed by Ralph Nelson Elliott, is a method of technical analysis that looks at cyclic waves to predict stock market trends. The theory asserts that market movements are predictable in rhythmic patterns.

Application in Financial Markets

These newsletters utilized the theory to decode potential market movements, offering subscribers a strategic advantage.

Highlights from the 1999 Newsletters

Predicting the Tech Bubble

In 1999, as the tech bubble inflated, the newsletters provided crucial insights into its unsustainable nature, using Elliott Wave principles to forecast its burst.

Market Peaks and Troughs

Through meticulous analysis, the newsletters identified key turning points in the market, guiding investors on when to expect shifts.

The Year 2000: A Year of Volatility

Navigating Market Uncertainty

With the dot-com bubble’s burst imminent, the 2000 newsletters focused on strategies to handle the volatility, offering advice grounded in wave patterns.

Strategic Investment Tips

Subscribers received tips on safeguarding investments against the impending market corrections.

Insights from 2001

Post-Bubble Market Analysis

The aftermath of the bubble saw a confused market. The newsletters from 2001 helped demystify the direction of the market recovery.

Long-term Financial Planning

Advice extended beyond immediate market reactions, focusing on long-term investment strategies during uncertain times.

Methodology Behind the Analysis

Technical Analysis Techniques

The newsletters didn’t just preach theory; they demonstrated the application of various technical analysis tools to complement Elliott Wave predictions.

Case Studies

Real-time case studies provided subscribers with practical examples of how to apply theory to market activities.

Impact and Legacy

Influencing Traders and Analysts

These newsletters significantly influenced the strategies of many traders and analysts who subscribe to wave theory.

Educational Value

They also served an educational purpose, enhancing understanding of a complex theory through real-world applications.

Challenges and Criticisms

Skepticism in the Financial Community

Despite its advantages, Elliott Wave Theory—and by extension, the newsletters—faced skepticism for its perceived subjectivity in wave interpretation.

Addressing the Criticisms

The newsletters often tackled these criticisms head-on, defending the theory’s validity with empirical evidence.

Conclusion

The Monthly Newsletter 99-01 with Elliott Wave Theorist represents a critical piece of financial literature that offered timely, theory-backed insights during one of the most tumultuous periods in modern financial history. Their legacy is a testament to the enduring value of combining theory with practical market analysis.

FAQs

- What is Elliott Wave Theory?

- Elliott Wave Theory is a form of technical analysis that predicts market trends by identifying recurring wave patterns.

- How did the newsletters use Elliott Wave Theory?

- They applied the theory to analyze and predict market movements, offering strategic advice to subscribers.

- What was significant about the newsletters during the tech bubble?

- They provided foresight into the bubble’s burst, using wave patterns to predict when the market would turn.

- Can Elliott Wave Theory be applied today?

- Yes, it remains a valuable tool for technical analysts and traders looking to understand and predict market trends.

- What were some criticisms faced by the newsletters?

- Critics argued that the theory is too subjective, relying heavily on the analyst’s interpretation of wave patterns.

Be the first to review “Monthly Newsletter 99-01 with Elliott Wave Theorist” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.