-

×

With All Odds Forex System I & II with Barry Thornton

1 × $6.00

With All Odds Forex System I & II with Barry Thornton

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Markets In Motion with Ned Davis

1 × $6.00

Markets In Motion with Ned Davis

1 × $6.00 -

×

Option Screening. Finding Profitable Trades with Lawrence Gavanagh

1 × $6.00

Option Screening. Finding Profitable Trades with Lawrence Gavanagh

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00 -

×

Falcon FX Pro

1 × $31.00

Falcon FX Pro

1 × $31.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Course (Video, PDF, MT4 Indicators)

1 × $6.00

Course (Video, PDF, MT4 Indicators)

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

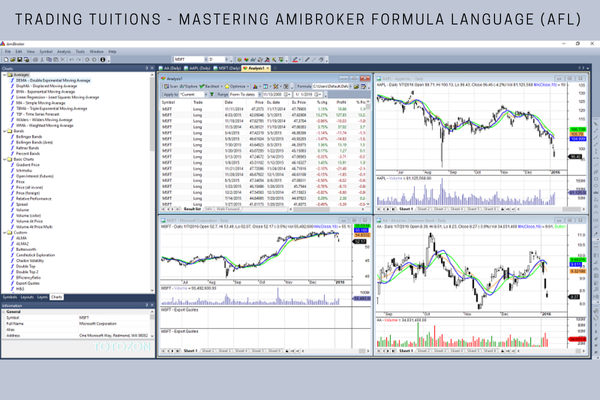

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00 -

×

Kase StatWare 9.7.3

1 × $23.00

Kase StatWare 9.7.3

1 × $23.00 -

×

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00 -

×

Quantum Swing Trader

1 × $6.00

Quantum Swing Trader

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

New Generation Market Profile (May 2014)

1 × $15.00

New Generation Market Profile (May 2014)

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

All Time High Trading Course with TRADEVERSITY

1 × $5.00

All Time High Trading Course with TRADEVERSITY

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00 -

×

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00 -

×

Price action profits formula v2

1 × $31.00

Price action profits formula v2

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00 -

×

ZR Trading Complete Program (Arabic + French)

1 × $10.00

ZR Trading Complete Program (Arabic + French)

1 × $10.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00 -

×

Market Consistency: Model Calibration in Imperfect Markets with Malcolm Kemp

1 × $6.00

Market Consistency: Model Calibration in Imperfect Markets with Malcolm Kemp

1 × $6.00 -

×

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Options Trading Business with The Daytrading Room

1 × $23.00

Options Trading Business with The Daytrading Room

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

CFA Level 1 – PassMaster 2004 CD with Stalla

1 × $6.00

CFA Level 1 – PassMaster 2004 CD with Stalla

1 × $6.00 -

×

Money Management Strategies for Futures Traders with Nauzer Balsara

1 × $6.00

Money Management Strategies for Futures Traders with Nauzer Balsara

1 × $6.00 -

×

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00 -

×

The Tickmaster Indicator

1 × $54.00

The Tickmaster Indicator

1 × $54.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Beginners Guide to How SimplerOptions Uses ThinkorSwim with Henry Gambell

1 × $15.00

Beginners Guide to How SimplerOptions Uses ThinkorSwim with Henry Gambell

1 × $15.00 -

×

Start Trading Stocks Using Technical Analysis Part 2 with Corey Halliday

1 × $15.00

Start Trading Stocks Using Technical Analysis Part 2 with Corey Halliday

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Option Income Stream System 2004

1 × $6.00

Option Income Stream System 2004

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Beginners Chart Patterns Trading for Penny Stocks

1 × $6.00

Beginners Chart Patterns Trading for Penny Stocks

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Dhia’s Journal 2022

1 × $6.00

Dhia’s Journal 2022

1 × $6.00 -

×

Market Magic: Riding the Greatest Bull Market of the Century with Louise Yamada

1 × $6.00

Market Magic: Riding the Greatest Bull Market of the Century with Louise Yamada

1 × $6.00 -

×

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00 -

×

Strategy Spotlight Series

1 × $15.00

Strategy Spotlight Series

1 × $15.00 -

×

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00

Levelator Automatic Trading Machines-Russ Horn’s

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

Elliott Wave Simplified with Clif Droke

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Elliott Wave Simplified with Clif Droke

Introduction: Unraveling the Waves

Welcome to the simplified world of Elliott Wave theory as interpreted by Clif Droke. This approach offers an accessible pathway into one of the most fascinating and complex theories in market analysis.

Who is Ralph Nelson Elliott?

Ralph Nelson Elliott discovered the Elliott Wave theory in the 1930s, proposing that stock market prices unfold in predictable patterns, which he termed “waves”.

Clif Droke’s Simplification of Elliott Wave Theory

Clif Droke has distilled Elliott’s complex ideas into manageable concepts that traders of any level can understand and implement.

The Basics of Elliott Wave Theory

The Motive Waves

Understanding the five-wave pattern in market trends is crucial, and Droke simplifies how to identify and interpret these movements.

The Corrective Waves

Alongside the motive waves, the three-wave corrective pattern completes the basic Elliott cycle. Droke breaks down these patterns to their core components.

Applying Elliott Wave Theory in Modern Markets

Tools for Today’s Traders

Droke recommends modern tools and software that enhance the application of Elliott Wave analysis.

Reading Market Sentiments

Elliott Wave is not just about patterns but also about market psychology. Droke’s interpretation helps traders gauge market sentiments effectively.

Key Concepts Simplified by Droke

Fibonacci Retracement

Droke explains the integration of Fibonacci numbers with Elliott Waves for precise market entry and exit points.

Wave Personality

Each wave has a “personality” or a specific set of characteristics. Droke’s work makes it easy to understand these personalities and their implications.

Practical Application: Case Studies

Droke provides examples of how Elliott Wave theory can be applied to predict market movements, with simplified analysis and predictions.

Challenges and Misconceptions

Common Misunderstandings

Droke addresses common pitfalls and misconceptions that traders encounter with Elliott Wave theory.

Advanced Techniques in Simple Terms

Droke introduces more complex aspects of Elliott Wave, such as diagonal triangles and complex corrections, in a simplified manner.

Resources for Further Learning

Droke suggests books, seminars, and online resources for traders who wish to delve deeper into the world of Elliott Wave.

Conclusion: Mastering the Waves

Clif Droke’s simplification of Elliott Wave theory provides a robust foundation for traders to understand and leverage market dynamics more effectively.

FAQs

1. How can beginners start using Elliott Wave Theory?

Begin with identifying basic wave patterns and understanding their contexts within market cycles.

2. Are Elliott Waves applicable to all markets?

Yes, Elliott Wave theory can be applied across different markets, including stocks, forex, and commodities.

3. What is the most crucial aspect to understand in Elliott Wave theory?

Recognizing the start and end points of waves is critical, as it determines the accuracy of subsequent predictions.

4. How does Fibonacci play into Elliott Wave analysis?

Fibonacci ratios help determine potential reversal points in the markets, closely tied with wave predictions.

5. Where can I find reliable resources on Elliott Wave Theory?

Droke recommends specific books and online platforms focused on Elliott Wave theory for deeper insights.

Be the first to review “Elliott Wave Simplified with Clif Droke” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.