-

×

The Realistic Trader - Crypto Currencies

1 × $31.00

The Realistic Trader - Crypto Currencies

1 × $31.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Real Options Analysis: Tools and Techniques for Valuing Strategic Investments and Decisions - Johnathan Mun

1 × $6.00

Real Options Analysis: Tools and Techniques for Valuing Strategic Investments and Decisions - Johnathan Mun

1 × $6.00 -

×

Chart Analysis Boot Camp Course Webinar with Mike Albright

1 × $6.00

Chart Analysis Boot Camp Course Webinar with Mike Albright

1 × $6.00 -

×

Toast FX Course

1 × $5.00

Toast FX Course

1 × $5.00 -

×

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00 -

×

Exploring MetaStock Advanced with Martin Pring

1 × $6.00

Exploring MetaStock Advanced with Martin Pring

1 × $6.00 -

×

The Top Tier Pro System Basic with Raghee Horner

1 × $41.00

The Top Tier Pro System Basic with Raghee Horner

1 × $41.00 -

×

TradingWithBilz Course

1 × $10.00

TradingWithBilz Course

1 × $10.00 -

×

Andy’s EMini Bar – 60 Min System

1 × $6.00

Andy’s EMini Bar – 60 Min System

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Market Evolution

1 × $6.00

Market Evolution

1 × $6.00 -

×

Inner Cicle Trader - ICT Methods with Michael Huddleston

1 × $5.00

Inner Cicle Trader - ICT Methods with Michael Huddleston

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The MMXM Traders Course - The MMXM Trader

1 × $5.00

The MMXM Traders Course - The MMXM Trader

1 × $5.00 -

×

Catching the Bounce

1 × $6.00

Catching the Bounce

1 × $6.00 -

×

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00 -

×

FestX Main Online video Course with Clint Fester

1 × $5.00

FestX Main Online video Course with Clint Fester

1 × $5.00 -

×

Introduction to Futures & Options Markets (2nd Ed.)

1 × $6.00

Introduction to Futures & Options Markets (2nd Ed.)

1 × $6.00 -

×

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00 -

×

Reading The Tape Trade Series with CompassFX

1 × $10.00

Reading The Tape Trade Series with CompassFX

1 × $10.00 -

×

Weekly Options Windfall and Bonus with James Preston

1 × $54.00

Weekly Options Windfall and Bonus with James Preston

1 × $54.00 -

×

The Box Strategy with Blue Capital Academy

1 × $23.00

The Box Strategy with Blue Capital Academy

1 × $23.00 -

×

Trade Your Way to Wealth with Bill Kraft

1 × $6.00

Trade Your Way to Wealth with Bill Kraft

1 × $6.00 -

×

Options, Futures & Other Derivatives (6th Ed.)

1 × $6.00

Options, Futures & Other Derivatives (6th Ed.)

1 × $6.00 -

×

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00 -

×

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00

Jack Corsellis Bundle 2021 Full Course with Jack Corsellis

1 × $5.00 -

×

Investment Science with David G.Luenberger

1 × $6.00

Investment Science with David G.Luenberger

1 × $6.00 -

×

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00 -

×

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00 -

×

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00 -

×

Financial Astrology Course with Brian James Sklenka

1 × $6.00

Financial Astrology Course with Brian James Sklenka

1 × $6.00 -

×

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Portfolio Management in Practice with Christine Brentani

1 × $6.00

Portfolio Management in Practice with Christine Brentani

1 × $6.00 -

×

Investors Live Textbook Trading DVD

1 × $15.00

Investors Live Textbook Trading DVD

1 × $15.00 -

×

The 2021 TraderLion Stock Trading Conference with Trader Lion

1 × $5.00

The 2021 TraderLion Stock Trading Conference with Trader Lion

1 × $5.00 -

×

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00 -

×

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00 -

×

Profiting With Forex: The Most Effective Tools and Techniques for Trading Currencies - John Jagerson & Wade Hansen

1 × $6.00

Profiting With Forex: The Most Effective Tools and Techniques for Trading Currencies - John Jagerson & Wade Hansen

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

IRON CONDORS FOR INCOME 2017 with Sheridan Options Mentoring

1 × $6.00

IRON CONDORS FOR INCOME 2017 with Sheridan Options Mentoring

1 × $6.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Mastering Trading Stress with Ari Kiev

1 × $6.00

Mastering Trading Stress with Ari Kiev

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Sacredscience - R.N.Elliott – Nature’s Law. The secret of the Universe

1 × $6.00

Sacredscience - R.N.Elliott – Nature’s Law. The secret of the Universe

1 × $6.00 -

×

Risk Management Toolkit with Peter Bain

1 × $6.00

Risk Management Toolkit with Peter Bain

1 × $6.00 -

×

Momentum Signals Training Course with Fulcum Trader

1 × $5.00

Momentum Signals Training Course with Fulcum Trader

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

George Bayer Soft 1.02

1 × $6.00

George Bayer Soft 1.02

1 × $6.00 -

×

Selling Options For A Living Class with Don Kaufman

1 × $6.00

Selling Options For A Living Class with Don Kaufman

1 × $6.00 -

×

Targeting Profitable Entry & Exit Points with Alan Farley

1 × $6.00

Targeting Profitable Entry & Exit Points with Alan Farley

1 × $6.00 -

×

DAY TRADING COURSE 2018

1 × $6.00

DAY TRADING COURSE 2018

1 × $6.00 -

×

FXjake Daily Trader Program

1 × $31.00

FXjake Daily Trader Program

1 × $31.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Secrets of An Electronic Futures Trader with Larry Levin

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

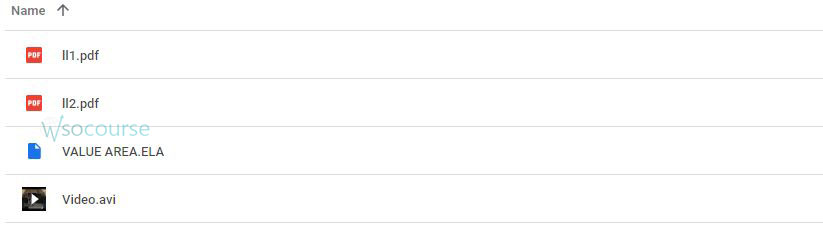

Content Proof: Watch Here!

You may check content proof of “Secrets of An Electronic Futures Trader with Larry Levin” below:

Secrets of An Electronic Futures Trader with Larry Levin

Introduction

In the fast-paced world of electronic futures trading, understanding the nuances and secrets of successful trading can make all the difference. Larry Levin, a seasoned futures trader, has shared his insights and strategies for thriving in this competitive market. This article explores the secrets of electronic futures trading with Larry Levin, providing practical tips and strategies to enhance your trading success.

Who is Larry Levin?

Background and Experience

Larry Levin is a renowned electronic futures trader with over 30 years of experience. He has traded millions of contracts and developed a keen understanding of the markets.

Levin’s Approach to Trading

Levin’s approach to trading is methodical and disciplined, focusing on technical analysis, market psychology, and risk management.

Understanding Electronic Futures Trading

What is Electronic Futures Trading?

Electronic futures trading involves buying and selling futures contracts via electronic trading platforms. This method offers speed, efficiency, and access to global markets.

Benefits of Electronic Trading

- Speed and Efficiency: Instant execution of trades.

- Access to Global Markets: Trade across various time zones.

- Transparency: Real-time data and pricing.

Key Secrets of Successful Futures Trading

1. Mastering Technical Analysis

Importance of Technical Analysis

Technical analysis is the study of price charts and patterns to predict future market movements. It is a cornerstone of Levin’s trading strategy.

Essential Tools and Indicators

- Moving Averages: Identify trends and potential reversal points.

- Relative Strength Index (RSI): Measure market momentum.

- Bollinger Bands: Indicate volatility and potential price breakouts.

2. Understanding Market Psychology

The Role of Emotions in Trading

Market psychology refers to the collective emotions and behaviors of market participants. Recognizing these can provide valuable insights into market movements.

Managing Your Emotions

- Stay Disciplined: Stick to your trading plan.

- Avoid Overtrading: Be selective with your trades.

- Keep a Trading Journal: Document your trades and emotions.

3. Implementing Risk Management Strategies

Why Risk Management is Crucial

Effective risk management protects your capital and ensures long-term trading success. Levin emphasizes its importance in his trading approach.

Key Risk Management Techniques

- Set Stop-Loss Orders: Limit potential losses.

- Diversify Your Portfolio: Spread risk across different assets.

- Use Position Sizing: Control the size of your trades relative to your capital.

Developing a Winning Trading Strategy

1. Define Your Trading Goals

Set clear, achievable goals for your trading. Whether it’s daily, weekly, or monthly targets, having specific goals will guide your strategy.

2. Create a Trading Plan

A well-defined trading plan includes your entry and exit criteria, risk management rules, and performance evaluation metrics.

3. Backtest Your Strategy

Before applying your strategy in live markets, backtest it using historical data to evaluate its effectiveness and reliability.

4. Stay Updated with Market News

Keep abreast of global economic events and news that can impact the markets. This will help you make informed trading decisions.

Advanced Trading Techniques

1. Scalping

What is Scalping?

Scalping involves making numerous small trades to capitalize on minor price movements. It’s a high-frequency trading strategy.

How to Scalp Successfully

- Focus on Liquid Markets: Ensure quick entry and exit.

- Use Tight Stop-Losses: Protect your capital from significant losses.

- Monitor the Market Closely: Be prepared to act quickly.

2. Swing Trading

Understanding Swing Trading

Swing trading aims to capture short- to medium-term gains by holding positions for several days or weeks.

Steps to Successful Swing Trading

- Identify Swing Points: Use technical analysis to find potential reversals.

- Set Entry and Exit Points: Determine where to enter and exit trades.

- Manage Risk: Use stop-loss orders to limit losses.

3. Trend Following

What is Trend Following?

Trend following involves trading in the direction of the prevailing market trend. It’s a strategy that capitalizes on sustained price movements.

Implementing Trend Following

- Identify the Trend: Use moving averages and trend lines.

- Confirm with Indicators: Combine with other indicators for accuracy.

- Stay Disciplined: Follow the trend until it shows signs of reversal.

Common Mistakes to Avoid

1. Overtrading

Trading too frequently can lead to unnecessary losses. Focus on quality trades rather than quantity.

2. Ignoring Risk Management

Always prioritize risk management. Failing to do so can result in significant financial losses.

3. Letting Emotions Drive Decisions

Avoid making trading decisions based on fear or greed. Stick to your trading plan and remain disciplined.

Tools and Resources for Electronic Futures Trading

1. Trading Platforms

Choose a reliable trading platform that offers advanced charting tools, real-time data, and efficient execution.

2. Educational Resources

Read books, take online courses, and attend seminars to deepen your trading knowledge and skills.

3. Trading Communities

Join trading forums and communities to share insights and learn from other experienced traders.

Conclusion

Electronic futures trading requires a combination of technical knowledge, discipline, and psychological resilience. Larry Levin’s insights and strategies offer valuable guidance for both novice and experienced traders. By mastering technical analysis, understanding market psychology, and implementing robust risk management techniques, you can enhance your trading performance and achieve long-term success.

FAQs

1. Who is Larry Levin?

Larry Levin is a seasoned electronic futures trader with over 30 years of experience, known for his disciplined and methodical approach to trading.

2. What is electronic futures trading?

Electronic futures trading involves buying and selling futures contracts via electronic trading platforms, offering speed, efficiency, and access to global markets.

3. Why is risk management important in trading?

Risk management protects your capital and ensures long-term trading success by limiting potential losses and diversifying risk.

4. What are some common trading mistakes to avoid?

Common mistakes include overtrading, ignoring risk management, and making decisions based on emotions rather than a disciplined trading plan.

5. How can I improve my trading skills?

Improve your trading skills by mastering technical analysis, staying updated with market news, using reliable trading platforms, and learning from educational resources and trading communities.

Be the first to review “Secrets of An Electronic Futures Trader with Larry Levin” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.