-

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Ask the RiskDoctor Q and A [18 Videos (MP4) + 17 Documents (PDF)] with Charles Cottle (The Risk Doctor)

1 × $6.00

Ask the RiskDoctor Q and A [18 Videos (MP4) + 17 Documents (PDF)] with Charles Cottle (The Risk Doctor)

1 × $6.00 -

×

FX Utopia

1 × $6.00

FX Utopia

1 × $6.00 -

×

The Ultimate Option Guide When & How to Use Which Strategy for The Best Results with Larry Gaines - Power Cycle Trading

1 × $39.00

The Ultimate Option Guide When & How to Use Which Strategy for The Best Results with Larry Gaines - Power Cycle Trading

1 × $39.00 -

×

How to Make the Stock Market Make Money For You with Ted Warren

1 × $6.00

How to Make the Stock Market Make Money For You with Ted Warren

1 × $6.00 -

×

Inner Circle Course with Darius Fx

1 × $24.00

Inner Circle Course with Darius Fx

1 × $24.00 -

×

The Blueprint for Successful Stock Trading with Jeff Tompkins

1 × $6.00

The Blueprint for Successful Stock Trading with Jeff Tompkins

1 × $6.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00 -

×

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00 -

×

RTM + Suppy and Demand with Nora Bystra

1 × $6.00

RTM + Suppy and Demand with Nora Bystra

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Daryl Guppy Tutorials In Technical Analysis (2000-2001-2003-2004)

1 × $6.00

Daryl Guppy Tutorials In Technical Analysis (2000-2001-2003-2004)

1 × $6.00 -

×

How to Find a Trading Strategy with Mike Baehr

1 × $124.00

How to Find a Trading Strategy with Mike Baehr

1 × $124.00 -

×

Renko Mastery Intensive Program

1 × $85.00

Renko Mastery Intensive Program

1 × $85.00 -

×

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00 -

×

Forex Trading Course 101 & 201

1 × $54.00

Forex Trading Course 101 & 201

1 × $54.00 -

×

VectorVest - Options Course - 4 CD Course + PDF Workbook

1 × $6.00

VectorVest - Options Course - 4 CD Course + PDF Workbook

1 × $6.00 -

×

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00 -

×

Complete Gunner24 Trading & Forecasting Course

1 × $6.00

Complete Gunner24 Trading & Forecasting Course

1 × $6.00 -

×

DAY TRADING OPTIONS For Beginners: Strategies to INVEST and WIN with Dylan Parker

1 × $5.00

DAY TRADING OPTIONS For Beginners: Strategies to INVEST and WIN with Dylan Parker

1 × $5.00 -

×

Module I - Foundation with FX MindShift

1 × $6.00

Module I - Foundation with FX MindShift

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

ProfileTraders - 5 course bundle

1 × $23.00

ProfileTraders - 5 course bundle

1 × $23.00 -

×

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00 -

×

The Definitive Guide To Futures Trading (Volume II) with Larry Williams

1 × $6.00

The Definitive Guide To Futures Trading (Volume II) with Larry Williams

1 × $6.00 -

×

Shecantrade – Day Trading Options

1 × $23.00

Shecantrade – Day Trading Options

1 × $23.00 -

×

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

All Time High Trading Course with TRADEVERSITY

1 × $5.00

All Time High Trading Course with TRADEVERSITY

1 × $5.00 -

×

Stop Loss Secrets

1 × $6.00

Stop Loss Secrets

1 × $6.00 -

×

June 2010 Training Video

1 × $6.00

June 2010 Training Video

1 × $6.00 -

×

Supercharge your Options Spread Trading with John Summa

1 × $6.00

Supercharge your Options Spread Trading with John Summa

1 × $6.00 -

×

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00 -

×

Out of the Pits with Caitlin Zaloom

1 × $6.00

Out of the Pits with Caitlin Zaloom

1 × $6.00 -

×

How To Win 97% Of Your Options Trader with Jeff Tompkins

1 × $6.00

How To Win 97% Of Your Options Trader with Jeff Tompkins

1 × $6.00 -

×

Forex Meets the Market Profile with John Keppler

1 × $23.00

Forex Meets the Market Profile with John Keppler

1 × $23.00 -

×

Double Top Trader Trading System with Anthony Gibson

1 × $6.00

Double Top Trader Trading System with Anthony Gibson

1 × $6.00 -

×

Warrior Trading: Inside the Mind of an Elite Currency Trader with Clifford Bennett

1 × $6.00

Warrior Trading: Inside the Mind of an Elite Currency Trader with Clifford Bennett

1 × $6.00 -

×

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00 -

×

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00 -

×

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00 -

×

TradingMind Course with Jack Bernstein

1 × $6.00

TradingMind Course with Jack Bernstein

1 × $6.00 -

×

Phantom of the Pit BY Art Simpson

1 × $6.00

Phantom of the Pit BY Art Simpson

1 × $6.00 -

×

CrewFX Group Course Package with Language Of The Markets

1 × $6.00

CrewFX Group Course Package with Language Of The Markets

1 × $6.00 -

×

Catching Trend Reversals

1 × $6.00

Catching Trend Reversals

1 × $6.00 -

×

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

CarterFX Membership with Duran Carter

1 × $23.00

CarterFX Membership with Duran Carter

1 × $23.00 -

×

ZipTraderU 2023 with ZipTrader

1 × $5.00

ZipTraderU 2023 with ZipTrader

1 × $5.00 -

×

Strategies for Profiting on Every Trade: Simple Lessons for Mastering the Market with Oliver L. Velez

1 × $6.00

Strategies for Profiting on Every Trade: Simple Lessons for Mastering the Market with Oliver L. Velez

1 × $6.00 -

×

Brian James Sklenka Package

1 × $31.00

Brian James Sklenka Package

1 × $31.00 -

×

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00 -

×

Member Only Videos with Henry W Steele

1 × $27.00

Member Only Videos with Henry W Steele

1 × $27.00 -

×

Momentum Signals Training Course with Fulcum Trader

1 × $5.00

Momentum Signals Training Course with Fulcum Trader

1 × $5.00 -

×

Volume Profile Video Course with Trader Dale

1 × $8.00

Volume Profile Video Course with Trader Dale

1 × $8.00 -

×

Trading Online

1 × $6.00

Trading Online

1 × $6.00 -

×

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00 -

×

Commodity Spreads: Techniques and Methods for Spreading Financial Futures, Grains, Meats & Other Commodities with Courtney Smith

1 × $6.00

Commodity Spreads: Techniques and Methods for Spreading Financial Futures, Grains, Meats & Other Commodities with Courtney Smith

1 × $6.00 -

×

Bodhi, Lighthouse, Truckin by Brian James Sklenka

1 × $6.00

Bodhi, Lighthouse, Truckin by Brian James Sklenka

1 × $6.00 -

×

RadioActive Trading Home Study Kit with Power Options

1 × $31.00

RadioActive Trading Home Study Kit with Power Options

1 × $31.00 -

×

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00 -

×

Footprint Day Trading Blueprint with Futures Flow

1 × $5.00

Footprint Day Trading Blueprint with Futures Flow

1 × $5.00 -

×

Building Cryptocurrencies with JavaScript By Stone River eLearning

1 × $6.00

Building Cryptocurrencies with JavaScript By Stone River eLearning

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

Secrets of An Electronic Futures Trader with Larry Levin

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

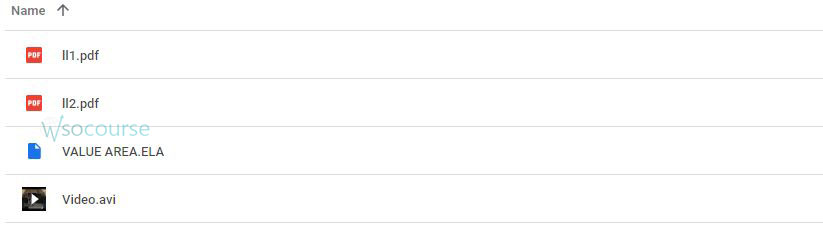

You may check content proof of “Secrets of An Electronic Futures Trader with Larry Levin” below:

Secrets of An Electronic Futures Trader with Larry Levin

Introduction

In the fast-paced world of electronic futures trading, understanding the nuances and secrets of successful trading can make all the difference. Larry Levin, a seasoned futures trader, has shared his insights and strategies for thriving in this competitive market. This article explores the secrets of electronic futures trading with Larry Levin, providing practical tips and strategies to enhance your trading success.

Who is Larry Levin?

Background and Experience

Larry Levin is a renowned electronic futures trader with over 30 years of experience. He has traded millions of contracts and developed a keen understanding of the markets.

Levin’s Approach to Trading

Levin’s approach to trading is methodical and disciplined, focusing on technical analysis, market psychology, and risk management.

Understanding Electronic Futures Trading

What is Electronic Futures Trading?

Electronic futures trading involves buying and selling futures contracts via electronic trading platforms. This method offers speed, efficiency, and access to global markets.

Benefits of Electronic Trading

- Speed and Efficiency: Instant execution of trades.

- Access to Global Markets: Trade across various time zones.

- Transparency: Real-time data and pricing.

Key Secrets of Successful Futures Trading

1. Mastering Technical Analysis

Importance of Technical Analysis

Technical analysis is the study of price charts and patterns to predict future market movements. It is a cornerstone of Levin’s trading strategy.

Essential Tools and Indicators

- Moving Averages: Identify trends and potential reversal points.

- Relative Strength Index (RSI): Measure market momentum.

- Bollinger Bands: Indicate volatility and potential price breakouts.

2. Understanding Market Psychology

The Role of Emotions in Trading

Market psychology refers to the collective emotions and behaviors of market participants. Recognizing these can provide valuable insights into market movements.

Managing Your Emotions

- Stay Disciplined: Stick to your trading plan.

- Avoid Overtrading: Be selective with your trades.

- Keep a Trading Journal: Document your trades and emotions.

3. Implementing Risk Management Strategies

Why Risk Management is Crucial

Effective risk management protects your capital and ensures long-term trading success. Levin emphasizes its importance in his trading approach.

Key Risk Management Techniques

- Set Stop-Loss Orders: Limit potential losses.

- Diversify Your Portfolio: Spread risk across different assets.

- Use Position Sizing: Control the size of your trades relative to your capital.

Developing a Winning Trading Strategy

1. Define Your Trading Goals

Set clear, achievable goals for your trading. Whether it’s daily, weekly, or monthly targets, having specific goals will guide your strategy.

2. Create a Trading Plan

A well-defined trading plan includes your entry and exit criteria, risk management rules, and performance evaluation metrics.

3. Backtest Your Strategy

Before applying your strategy in live markets, backtest it using historical data to evaluate its effectiveness and reliability.

4. Stay Updated with Market News

Keep abreast of global economic events and news that can impact the markets. This will help you make informed trading decisions.

Advanced Trading Techniques

1. Scalping

What is Scalping?

Scalping involves making numerous small trades to capitalize on minor price movements. It’s a high-frequency trading strategy.

How to Scalp Successfully

- Focus on Liquid Markets: Ensure quick entry and exit.

- Use Tight Stop-Losses: Protect your capital from significant losses.

- Monitor the Market Closely: Be prepared to act quickly.

2. Swing Trading

Understanding Swing Trading

Swing trading aims to capture short- to medium-term gains by holding positions for several days or weeks.

Steps to Successful Swing Trading

- Identify Swing Points: Use technical analysis to find potential reversals.

- Set Entry and Exit Points: Determine where to enter and exit trades.

- Manage Risk: Use stop-loss orders to limit losses.

3. Trend Following

What is Trend Following?

Trend following involves trading in the direction of the prevailing market trend. It’s a strategy that capitalizes on sustained price movements.

Implementing Trend Following

- Identify the Trend: Use moving averages and trend lines.

- Confirm with Indicators: Combine with other indicators for accuracy.

- Stay Disciplined: Follow the trend until it shows signs of reversal.

Common Mistakes to Avoid

1. Overtrading

Trading too frequently can lead to unnecessary losses. Focus on quality trades rather than quantity.

2. Ignoring Risk Management

Always prioritize risk management. Failing to do so can result in significant financial losses.

3. Letting Emotions Drive Decisions

Avoid making trading decisions based on fear or greed. Stick to your trading plan and remain disciplined.

Tools and Resources for Electronic Futures Trading

1. Trading Platforms

Choose a reliable trading platform that offers advanced charting tools, real-time data, and efficient execution.

2. Educational Resources

Read books, take online courses, and attend seminars to deepen your trading knowledge and skills.

3. Trading Communities

Join trading forums and communities to share insights and learn from other experienced traders.

Conclusion

Electronic futures trading requires a combination of technical knowledge, discipline, and psychological resilience. Larry Levin’s insights and strategies offer valuable guidance for both novice and experienced traders. By mastering technical analysis, understanding market psychology, and implementing robust risk management techniques, you can enhance your trading performance and achieve long-term success.

FAQs

1. Who is Larry Levin?

Larry Levin is a seasoned electronic futures trader with over 30 years of experience, known for his disciplined and methodical approach to trading.

2. What is electronic futures trading?

Electronic futures trading involves buying and selling futures contracts via electronic trading platforms, offering speed, efficiency, and access to global markets.

3. Why is risk management important in trading?

Risk management protects your capital and ensures long-term trading success by limiting potential losses and diversifying risk.

4. What are some common trading mistakes to avoid?

Common mistakes include overtrading, ignoring risk management, and making decisions based on emotions rather than a disciplined trading plan.

5. How can I improve my trading skills?

Improve your trading skills by mastering technical analysis, staying updated with market news, using reliable trading platforms, and learning from educational resources and trading communities.

Be the first to review “Secrets of An Electronic Futures Trader with Larry Levin” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.