-

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Advanced Day Trading Course with Doyle Exchange

1 × $8.00

Advanced Day Trading Course with Doyle Exchange

1 × $8.00 -

×

Tradeonix 2.0 + Maxinator Trade Assistant (Full Version)

1 × $54.00

Tradeonix 2.0 + Maxinator Trade Assistant (Full Version)

1 × $54.00 -

×

Low Stress Options Trading with Low Stress Training

1 × $23.00

Low Stress Options Trading with Low Stress Training

1 × $23.00 -

×

Frank Kern Courses Collection (23+ Courses)

1 × $20.00

Frank Kern Courses Collection (23+ Courses)

1 × $20.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00 -

×

Zap Seminar - Ablesys

1 × $6.00

Zap Seminar - Ablesys

1 × $6.00 -

×

The Decision-Making Process and Forward with Peter Steidlmayer

1 × $4.00

The Decision-Making Process and Forward with Peter Steidlmayer

1 × $4.00 -

×

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00 -

×

Analysis & Interpretation in Qualitative Market Research with Gill Ereaut

1 × $6.00

Analysis & Interpretation in Qualitative Market Research with Gill Ereaut

1 × $6.00 -

×

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00 -

×

Jigsaw Orderflow Training Course with Jigsaw Trading

1 × $6.00

Jigsaw Orderflow Training Course with Jigsaw Trading

1 × $6.00 -

×

Management Consultancy & Banking in a Era of Globalization

1 × $6.00

Management Consultancy & Banking in a Era of Globalization

1 × $6.00 -

×

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00 -

×

Market Trading Tactics: Beating the Odds Through Technical Analysis and Money Management with Daryl Guppy

1 × $6.00

Market Trading Tactics: Beating the Odds Through Technical Analysis and Money Management with Daryl Guppy

1 × $6.00 -

×

Indian Time Cycles and Market Forecasting with Barry William Rosen

1 × $7.00

Indian Time Cycles and Market Forecasting with Barry William Rosen

1 × $7.00 -

×

Options Trading RD3 Webinar Series

1 × $31.00

Options Trading RD3 Webinar Series

1 × $31.00 -

×

Trading Earnings Using Measured-Move Targets with AlphaShark

1 × $23.00

Trading Earnings Using Measured-Move Targets with AlphaShark

1 × $23.00 -

×

Oil & Gas Modeling Course with Wall Street Prep

1 × $27.00

Oil & Gas Modeling Course with Wall Street Prep

1 × $27.00 -

×

Securities Industry Essentials (SIE) with Brian Lee

1 × $6.00

Securities Industry Essentials (SIE) with Brian Lee

1 × $6.00 -

×

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00 -

×

TTM Trend Anchor Indicator for Tradestation & MultiCharts

1 × $6.00

TTM Trend Anchor Indicator for Tradestation & MultiCharts

1 × $6.00 -

×

Understanding Spreads with Edward Dobson & Roger Reimer

1 × $6.00

Understanding Spreads with Edward Dobson & Roger Reimer

1 × $6.00 -

×

The Wizard Training Course with Mitch King

1 × $6.00

The Wizard Training Course with Mitch King

1 × $6.00 -

×

Evolution Markets (Full Main Course)

1 × $5.00

Evolution Markets (Full Main Course)

1 × $5.00 -

×

Lifetime Membership

1 × $840.00

Lifetime Membership

1 × $840.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Into The Abbys with Black Rabbit

1 × $18.00

Into The Abbys with Black Rabbit

1 × $18.00 -

×

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00 -

×

Big Fish: Mako Momentum Strategy

1 × $23.00

Big Fish: Mako Momentum Strategy

1 × $23.00 -

×

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00 -

×

Profitable Binary Options Strategies

1 × $5.00

Profitable Binary Options Strategies

1 × $5.00 -

×

Weekly Credit Spreads for Income

1 × $6.00

Weekly Credit Spreads for Income

1 × $6.00 -

×

Trading Indicators for the 21st Century

1 × $6.00

Trading Indicators for the 21st Century

1 × $6.00 -

×

The 10 Year Trading Formula with Todd Mitchell

1 × $62.00

The 10 Year Trading Formula with Todd Mitchell

1 × $62.00 -

×

Build a Professional Trading System using Amibroker with Trading Tuitions - Marwood Research

1 × $23.00

Build a Professional Trading System using Amibroker with Trading Tuitions - Marwood Research

1 × $23.00 -

×

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00 -

×

We Trade Waves

1 × $5.00

We Trade Waves

1 × $5.00 -

×

QuantZilla

1 × $39.00

QuantZilla

1 × $39.00 -

×

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00 -

×

Dynamic Trading Multimedia E-Learning Workshop - 6 CD with Robert Miner

1 × $39.00

Dynamic Trading Multimedia E-Learning Workshop - 6 CD with Robert Miner

1 × $39.00 -

×

Edges For Ledges 2 with Trader Dante

1 × $5.00

Edges For Ledges 2 with Trader Dante

1 × $5.00 -

×

Gann’s Secret with Jeanne Long

1 × $4.00

Gann’s Secret with Jeanne Long

1 × $4.00 -

×

Bond Markets, Analysis and Strategies with Frank Fabozzi

1 × $6.00

Bond Markets, Analysis and Strategies with Frank Fabozzi

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Foreign Exchange

1 × $6.00

Foreign Exchange

1 × $6.00 -

×

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00 -

×

The Triple Bottom Line

1 × $6.00

The Triple Bottom Line

1 × $6.00 -

×

Valuing Employee Stock Options with Johnathan Mun

1 × $6.00

Valuing Employee Stock Options with Johnathan Mun

1 × $6.00 -

×

BearProof Investing with Kenneth Little

1 × $6.00

BearProof Investing with Kenneth Little

1 × $6.00 -

×

Generating Consistent Profits On Smaller Accounts

1 × $23.00

Generating Consistent Profits On Smaller Accounts

1 × $23.00 -

×

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00 -

×

Profiting With Forex: The Most Effective Tools and Techniques for Trading Currencies - John Jagerson & Wade Hansen

1 × $6.00

Profiting With Forex: The Most Effective Tools and Techniques for Trading Currencies - John Jagerson & Wade Hansen

1 × $6.00 -

×

Toolkit For Thinkorswim with Bigtrends

1 × $54.00

Toolkit For Thinkorswim with Bigtrends

1 × $54.00

Secrets of An Electronic Futures Trader with Larry Levin

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

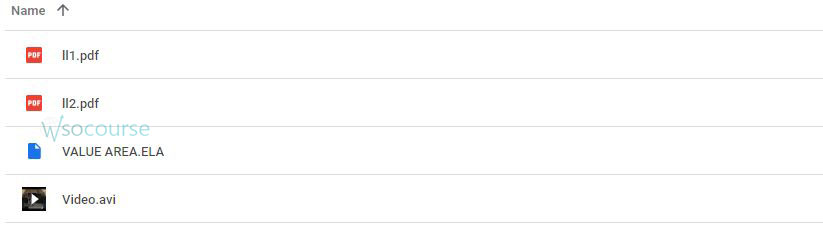

You may check content proof of “Secrets of An Electronic Futures Trader with Larry Levin” below:

Secrets of An Electronic Futures Trader with Larry Levin

Introduction

In the fast-paced world of electronic futures trading, understanding the nuances and secrets of successful trading can make all the difference. Larry Levin, a seasoned futures trader, has shared his insights and strategies for thriving in this competitive market. This article explores the secrets of electronic futures trading with Larry Levin, providing practical tips and strategies to enhance your trading success.

Who is Larry Levin?

Background and Experience

Larry Levin is a renowned electronic futures trader with over 30 years of experience. He has traded millions of contracts and developed a keen understanding of the markets.

Levin’s Approach to Trading

Levin’s approach to trading is methodical and disciplined, focusing on technical analysis, market psychology, and risk management.

Understanding Electronic Futures Trading

What is Electronic Futures Trading?

Electronic futures trading involves buying and selling futures contracts via electronic trading platforms. This method offers speed, efficiency, and access to global markets.

Benefits of Electronic Trading

- Speed and Efficiency: Instant execution of trades.

- Access to Global Markets: Trade across various time zones.

- Transparency: Real-time data and pricing.

Key Secrets of Successful Futures Trading

1. Mastering Technical Analysis

Importance of Technical Analysis

Technical analysis is the study of price charts and patterns to predict future market movements. It is a cornerstone of Levin’s trading strategy.

Essential Tools and Indicators

- Moving Averages: Identify trends and potential reversal points.

- Relative Strength Index (RSI): Measure market momentum.

- Bollinger Bands: Indicate volatility and potential price breakouts.

2. Understanding Market Psychology

The Role of Emotions in Trading

Market psychology refers to the collective emotions and behaviors of market participants. Recognizing these can provide valuable insights into market movements.

Managing Your Emotions

- Stay Disciplined: Stick to your trading plan.

- Avoid Overtrading: Be selective with your trades.

- Keep a Trading Journal: Document your trades and emotions.

3. Implementing Risk Management Strategies

Why Risk Management is Crucial

Effective risk management protects your capital and ensures long-term trading success. Levin emphasizes its importance in his trading approach.

Key Risk Management Techniques

- Set Stop-Loss Orders: Limit potential losses.

- Diversify Your Portfolio: Spread risk across different assets.

- Use Position Sizing: Control the size of your trades relative to your capital.

Developing a Winning Trading Strategy

1. Define Your Trading Goals

Set clear, achievable goals for your trading. Whether it’s daily, weekly, or monthly targets, having specific goals will guide your strategy.

2. Create a Trading Plan

A well-defined trading plan includes your entry and exit criteria, risk management rules, and performance evaluation metrics.

3. Backtest Your Strategy

Before applying your strategy in live markets, backtest it using historical data to evaluate its effectiveness and reliability.

4. Stay Updated with Market News

Keep abreast of global economic events and news that can impact the markets. This will help you make informed trading decisions.

Advanced Trading Techniques

1. Scalping

What is Scalping?

Scalping involves making numerous small trades to capitalize on minor price movements. It’s a high-frequency trading strategy.

How to Scalp Successfully

- Focus on Liquid Markets: Ensure quick entry and exit.

- Use Tight Stop-Losses: Protect your capital from significant losses.

- Monitor the Market Closely: Be prepared to act quickly.

2. Swing Trading

Understanding Swing Trading

Swing trading aims to capture short- to medium-term gains by holding positions for several days or weeks.

Steps to Successful Swing Trading

- Identify Swing Points: Use technical analysis to find potential reversals.

- Set Entry and Exit Points: Determine where to enter and exit trades.

- Manage Risk: Use stop-loss orders to limit losses.

3. Trend Following

What is Trend Following?

Trend following involves trading in the direction of the prevailing market trend. It’s a strategy that capitalizes on sustained price movements.

Implementing Trend Following

- Identify the Trend: Use moving averages and trend lines.

- Confirm with Indicators: Combine with other indicators for accuracy.

- Stay Disciplined: Follow the trend until it shows signs of reversal.

Common Mistakes to Avoid

1. Overtrading

Trading too frequently can lead to unnecessary losses. Focus on quality trades rather than quantity.

2. Ignoring Risk Management

Always prioritize risk management. Failing to do so can result in significant financial losses.

3. Letting Emotions Drive Decisions

Avoid making trading decisions based on fear or greed. Stick to your trading plan and remain disciplined.

Tools and Resources for Electronic Futures Trading

1. Trading Platforms

Choose a reliable trading platform that offers advanced charting tools, real-time data, and efficient execution.

2. Educational Resources

Read books, take online courses, and attend seminars to deepen your trading knowledge and skills.

3. Trading Communities

Join trading forums and communities to share insights and learn from other experienced traders.

Conclusion

Electronic futures trading requires a combination of technical knowledge, discipline, and psychological resilience. Larry Levin’s insights and strategies offer valuable guidance for both novice and experienced traders. By mastering technical analysis, understanding market psychology, and implementing robust risk management techniques, you can enhance your trading performance and achieve long-term success.

FAQs

1. Who is Larry Levin?

Larry Levin is a seasoned electronic futures trader with over 30 years of experience, known for his disciplined and methodical approach to trading.

2. What is electronic futures trading?

Electronic futures trading involves buying and selling futures contracts via electronic trading platforms, offering speed, efficiency, and access to global markets.

3. Why is risk management important in trading?

Risk management protects your capital and ensures long-term trading success by limiting potential losses and diversifying risk.

4. What are some common trading mistakes to avoid?

Common mistakes include overtrading, ignoring risk management, and making decisions based on emotions rather than a disciplined trading plan.

5. How can I improve my trading skills?

Improve your trading skills by mastering technical analysis, staying updated with market news, using reliable trading platforms, and learning from educational resources and trading communities.

Be the first to review “Secrets of An Electronic Futures Trader with Larry Levin” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.