-

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00 -

×

Flipping Markets Video Course (2022)

1 × $5.00

Flipping Markets Video Course (2022)

1 × $5.00 -

×

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Cotton Trading Manual with Terry Townsend

1 × $6.00

Cotton Trading Manual with Terry Townsend

1 × $6.00 -

×

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00

All About Stock Market Strategies: The Easy Way To Get Started (All About Series) with David Brown

1 × $6.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

X-Factor Day-Trading

1 × $5.00

X-Factor Day-Trading

1 × $5.00 -

×

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00 -

×

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00 -

×

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00 -

×

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00 -

×

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00 -

×

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00

How to Trade the New Single Stock Futures with Jack Bernstein

1 × $6.00 -

×

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00 -

×

SE ELITE COURSE with SE TRADINGX

1 × $5.00

SE ELITE COURSE with SE TRADINGX

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Rocket Science for Traders with John Ehlers

1 × $6.00

Rocket Science for Traders with John Ehlers

1 × $6.00 -

×

Candlestick Charting Explained with Greg Morris

1 × $8.00

Candlestick Charting Explained with Greg Morris

1 × $8.00 -

×

High Rollers Mega Course Bundle - 13 Market Moves

1 × $39.00

High Rollers Mega Course Bundle - 13 Market Moves

1 × $39.00 -

×

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00 -

×

Royal Exchange Forex with Jan Teslar

1 × $6.00

Royal Exchange Forex with Jan Teslar

1 × $6.00 -

×

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00 -

×

Signals

1 × $6.00

Signals

1 × $6.00 -

×

Rocking Wall Street with Gary Marks

1 × $6.00

Rocking Wall Street with Gary Marks

1 × $6.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

Dynamic Time Cycles with Peter Eliades

1 × $6.00

Dynamic Time Cycles with Peter Eliades

1 × $6.00 -

×

Preview of Markets with George Bayer

1 × $6.00

Preview of Markets with George Bayer

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00

Stock Market Strategies That Work with Jack Bernstein

1 × $6.00 -

×

PayTrading with Eric Shawn

1 × $6.00

PayTrading with Eric Shawn

1 × $6.00 -

×

Level II Trading Warfare - The Undergroundtrader's Powerful Weapons for Winning - Jea Yu

1 × $6.00

Level II Trading Warfare - The Undergroundtrader's Powerful Weapons for Winning - Jea Yu

1 × $6.00 -

×

Simpler Options - Weekly Butterflies for Income

1 × $6.00

Simpler Options - Weekly Butterflies for Income

1 × $6.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

Rounded Bottom Breakout Multimedia Course

1 × $31.00

Rounded Bottom Breakout Multimedia Course

1 × $31.00 -

×

Short-Term Trading, Long-Term Profits with John Leizman - McGraw-Hill

1 × $6.00

Short-Term Trading, Long-Term Profits with John Leizman - McGraw-Hill

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00 -

×

Behavioral Trading with Woody Dorsey

1 × $6.00

Behavioral Trading with Woody Dorsey

1 × $6.00 -

×

Exacttrading - Price Action Trader Course

1 × $15.00

Exacttrading - Price Action Trader Course

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00 -

×

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00 -

×

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00 -

×

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00 -

×

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

Futures & Options Course with Talkin Options

1 × $15.00

Futures & Options Course with Talkin Options

1 × $15.00 -

×

Scalping Master Course with Dayonetraders

1 × $6.00

Scalping Master Course with Dayonetraders

1 × $6.00 -

×

How to Invest in ETFs By The Investors Podcast

1 × $6.00

How to Invest in ETFs By The Investors Podcast

1 × $6.00 -

×

Mastertrader – Mastering Swing Trading

1 × $31.00

Mastertrader – Mastering Swing Trading

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Exploring MetaStock Basic with Martin Pring

1 × $6.00

Exploring MetaStock Basic with Martin Pring

1 × $6.00 -

×

Master Commodities Course

1 × $6.00

Master Commodities Course

1 × $6.00 -

×

7 Things You MUST Know about Forex Candlesticks

1 × $4.00

7 Things You MUST Know about Forex Candlesticks

1 × $4.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00 -

×

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00

How I Trade the QQQs with Don Miller

$6.00

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

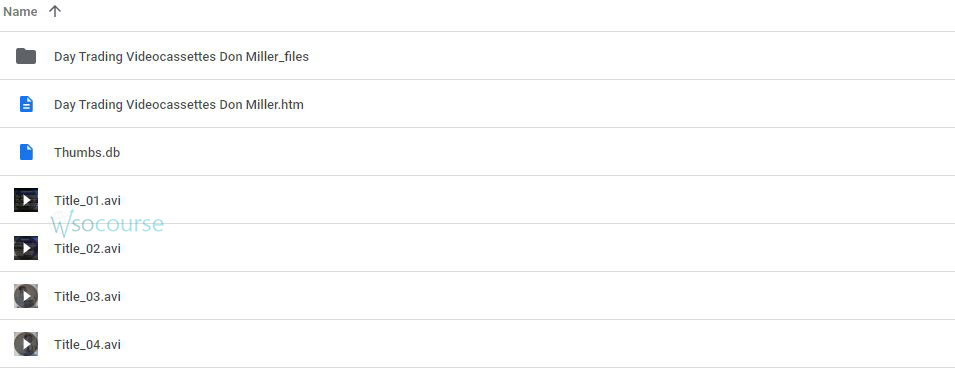

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.