-

×

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00 -

×

No Bull Investing with Jack Bernstein

1 × $6.00

No Bull Investing with Jack Bernstein

1 × $6.00 -

×

Options Trading with Adam Grimes - MarketLife

1 × $5.00

Options Trading with Adam Grimes - MarketLife

1 × $5.00 -

×

Option Alpha Signals

1 × $15.00

Option Alpha Signals

1 × $15.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00 -

×

Mastering the Geometry of Market Energy with Charles Drummond

1 × $6.00

Mastering the Geometry of Market Energy with Charles Drummond

1 × $6.00 -

×

Chris Swaggy C Williams - The Swag Academy

1 × $6.00

Chris Swaggy C Williams - The Swag Academy

1 × $6.00 -

×

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00 -

×

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00 -

×

Trading Course 2024 with ZMC x BMO

1 × $17.00

Trading Course 2024 with ZMC x BMO

1 × $17.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00 -

×

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00 -

×

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00 -

×

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00

Measuring Market Risk (2nd Edition) with Kevin Dowd

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Timing the Market with Curtis Arnold

1 × $6.00

Timing the Market with Curtis Arnold

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Trade Execution with Yuri Shramenko

1 × $6.00

Trade Execution with Yuri Shramenko

1 × $6.00 -

×

Stochastic Calculus with Alan Bain

1 × $6.00

Stochastic Calculus with Alan Bain

1 × $6.00 -

×

CMT Association Entire Webinars

1 × $31.00

CMT Association Entire Webinars

1 × $31.00 -

×

Art & Science of Trend Trading Class with Jeff Bierman

1 × $6.00

Art & Science of Trend Trading Class with Jeff Bierman

1 × $6.00 -

×

Arcane 2.0 Course

1 × $6.00

Arcane 2.0 Course

1 × $6.00 -

×

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00 -

×

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00 -

×

The Complete 12 Week Transformation Course

1 × $31.00

The Complete 12 Week Transformation Course

1 × $31.00 -

×

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Simpler Options - Weekly Butterflies for Income

1 × $6.00

Simpler Options - Weekly Butterflies for Income

1 × $6.00 -

×

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00 -

×

Smart Money Concepts with MFX Trading

1 × $13.00

Smart Money Concepts with MFX Trading

1 × $13.00 -

×

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00 -

×

The Insider's Guide to Forex Trading with Kathy Lien

1 × $6.00

The Insider's Guide to Forex Trading with Kathy Lien

1 × $6.00 -

×

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00 -

×

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00 -

×

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00

Build A Solid Foundation For Trading Options with Corey Halliday

1 × $6.00 -

×

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00 -

×

Limitless FX Academy Course

1 × $5.00

Limitless FX Academy Course

1 × $5.00 -

×

Timing is Everything with Robert M.Barnes

1 × $6.00

Timing is Everything with Robert M.Barnes

1 × $6.00 -

×

ICT Charter Complete Course (2019)

1 × $13.00

ICT Charter Complete Course (2019)

1 × $13.00 -

×

Practical Astro with Ruth Miller & Iam Williams

1 × $6.00

Practical Astro with Ruth Miller & Iam Williams

1 × $6.00 -

×

Traders World Past Issue Articles on CD with Magazine

1 × $6.00

Traders World Past Issue Articles on CD with Magazine

1 × $6.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

Rocket Science for Traders with John Ehlers

1 × $6.00

Rocket Science for Traders with John Ehlers

1 × $6.00 -

×

Masterclass 3.0 with RockzFX Academy

1 × $6.00

Masterclass 3.0 with RockzFX Academy

1 × $6.00 -

×

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00 -

×

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Pricing of Bond Options with Detlef Repplinger

1 × $6.00

Pricing of Bond Options with Detlef Repplinger

1 × $6.00 -

×

Long-Term Secrets to Short-Term Trading (Ebook) with Larry Williams

1 × $6.00

Long-Term Secrets to Short-Term Trading (Ebook) with Larry Williams

1 × $6.00 -

×

Electronic Trading "TNT" IV Tips Tricks and Other Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" IV Tips Tricks and Other Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00 -

×

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Dynamite TNT Forex System with Clarence Chee

1 × $6.00

Dynamite TNT Forex System with Clarence Chee

1 × $6.00 -

×

All Time High Trading Course with TRADEVERSITY

1 × $5.00

All Time High Trading Course with TRADEVERSITY

1 × $5.00 -

×

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00 -

×

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00 -

×

Annual Forecast Reports - Forecast 2023 with Larry Williams

1 × $8.00

Annual Forecast Reports - Forecast 2023 with Larry Williams

1 × $8.00 -

×

Football Hedging System with Tony Langley

1 × $54.00

Football Hedging System with Tony Langley

1 × $54.00 -

×

The Systematic Trader: Maximizing Trading Systems and Money Management with David Stendahl & John Boyer

1 × $6.00

The Systematic Trader: Maximizing Trading Systems and Money Management with David Stendahl & John Boyer

1 × $6.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

Perfect Strategy - SPX Daily Options Income with Peter Titus - Marwood Research

1 × $15.00

Perfect Strategy - SPX Daily Options Income with Peter Titus - Marwood Research

1 × $15.00 -

×

Professional Approaches to Directional Option Trading with Option Pit

1 × $23.00

Professional Approaches to Directional Option Trading with Option Pit

1 × $23.00 -

×

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Compleat DayTrader I & II with Jack Bernstein

1 × $6.00

The Compleat DayTrader I & II with Jack Bernstein

1 × $6.00 -

×

Mastering High Probability Chart Reading Methods with John Murphy

1 × $6.00

Mastering High Probability Chart Reading Methods with John Murphy

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

X-Factor Day-Trading

1 × $5.00

X-Factor Day-Trading

1 × $5.00 -

×

Trading Forex With Market Profile

1 × $15.00

Trading Forex With Market Profile

1 × $15.00 -

×

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00 -

×

Correct Stage for Average with Stan Weinstein

1 × $6.00

Correct Stage for Average with Stan Weinstein

1 × $6.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

Trading with Wave59 with Earik Beann

1 × $6.00

Trading with Wave59 with Earik Beann

1 × $6.00 -

×

Adz Trading Academy

1 × $5.00

Adz Trading Academy

1 × $5.00 -

×

Foundational Chart Analysis Series: Support / Resistance Techniques of Professional Traders 6 DVD Home Study Course

1 × $54.00

Foundational Chart Analysis Series: Support / Resistance Techniques of Professional Traders 6 DVD Home Study Course

1 × $54.00 -

×

Optimize Funding Program with Solo Network

1 × $5.00

Optimize Funding Program with Solo Network

1 × $5.00 -

×

Traders Positioning System with Lee Gettess

1 × $4.00

Traders Positioning System with Lee Gettess

1 × $4.00

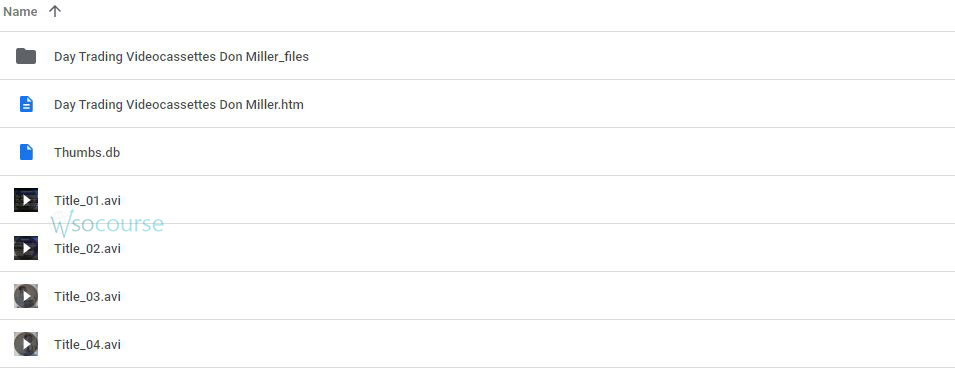

How I Trade the QQQs with Don Miller

$6.00

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.