-

×

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00 -

×

Pristine - Noble DraKoln – The Complete Liverpool Futures Seminar Series

1 × $6.00

Pristine - Noble DraKoln – The Complete Liverpool Futures Seminar Series

1 × $6.00 -

×

Change Happens. Do You Profit Or Does Someone Else (Traders Expo Las Vegas Dec 2005) by Tobin Smith

1 × $6.00

Change Happens. Do You Profit Or Does Someone Else (Traders Expo Las Vegas Dec 2005) by Tobin Smith

1 × $6.00 -

×

The Systematic Trader: Maximizing Trading Systems and Money Management with David Stendahl & John Boyer

1 × $6.00

The Systematic Trader: Maximizing Trading Systems and Money Management with David Stendahl & John Boyer

1 × $6.00 -

×

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00 -

×

Essentials Of Payroll Management & Accounting with Steven M.Bragg

1 × $6.00

Essentials Of Payroll Management & Accounting with Steven M.Bragg

1 × $6.00 -

×

Selected Articles by the Late by George Lindsay

1 × $6.00

Selected Articles by the Late by George Lindsay

1 × $6.00 -

×

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Buying and Selling Volatility with Kevin B.Connolly

1 × $6.00

Buying and Selling Volatility with Kevin B.Connolly

1 × $6.00 -

×

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Dynamic Gann Levels with Don Fisher

1 × $6.00

Dynamic Gann Levels with Don Fisher

1 × $6.00 -

×

Butterfly's Guide to Weekly Returns with Don Kaufman

1 × $6.00

Butterfly's Guide to Weekly Returns with Don Kaufman

1 × $6.00 -

×

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00 -

×

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00 -

×

Planetary Stock Trading with Bill Meridian

1 × $6.00

Planetary Stock Trading with Bill Meridian

1 × $6.00 -

×

Order Flow Mastery Course with OrderFlowForex

1 × $6.00

Order Flow Mastery Course with OrderFlowForex

1 × $6.00 -

×

My Forex League - The Course

1 × $5.00

My Forex League - The Course

1 × $5.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00 -

×

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Momentum Mastery with Traderlion Richard Moglen & Ben Bennett

1 × $15.00

Momentum Mastery with Traderlion Richard Moglen & Ben Bennett

1 × $15.00 -

×

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00

Advanced Strategies for Option Trading Success with James Bittman

1 × $6.00 -

×

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00 -

×

Advanced Nasdaq Trading Techniques with Alan Rich

1 × $6.00

Advanced Nasdaq Trading Techniques with Alan Rich

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

TOP Gamma Bundle with TopTrade Tools

1 × $69.00

TOP Gamma Bundle with TopTrade Tools

1 × $69.00 -

×

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00 -

×

Elliott Wave Forex Course

1 × $6.00

Elliott Wave Forex Course

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Researching your Trade

1 × $6.00

Researching your Trade

1 × $6.00 -

×

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

Live in London (5 DVD) with Martin Pring

1 × $6.00

Live in London (5 DVD) with Martin Pring

1 × $6.00 -

×

Month 01 to 08 2018

1 × $62.00

Month 01 to 08 2018

1 × $62.00 -

×

Whats In Your Name – The Science of Letters and Numbers (1916)

1 × $6.00

Whats In Your Name – The Science of Letters and Numbers (1916)

1 × $6.00 -

×

Jeffrey Kennedy’s Package ( Discount 25% )

1 × $31.00

Jeffrey Kennedy’s Package ( Discount 25% )

1 × $31.00 -

×

Mastering Fundamental Analysis with Michael Thomsett

1 × $6.00

Mastering Fundamental Analysis with Michael Thomsett

1 × $6.00 -

×

Warrior Trading: Inside the Mind of an Elite Currency Trader with Clifford Bennett

1 × $6.00

Warrior Trading: Inside the Mind of an Elite Currency Trader with Clifford Bennett

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

How I Trade the QQQs with Don Miller

$6.00

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

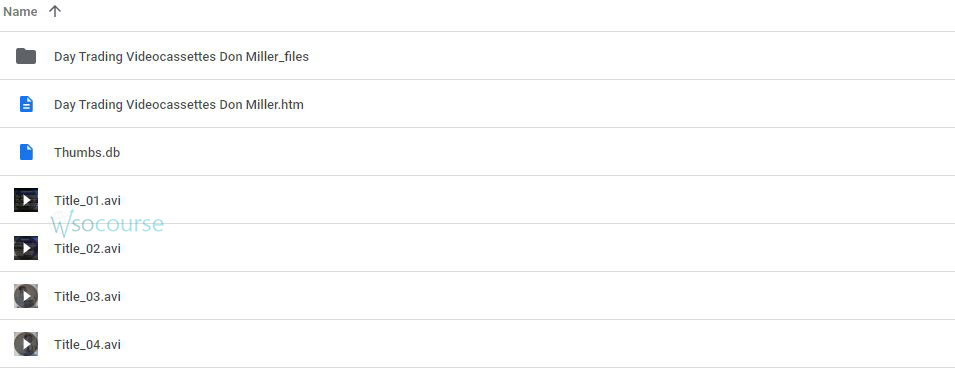

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.