-

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

An Introduction to Option Trading Success with James Bittman

1 × $6.00

An Introduction to Option Trading Success with James Bittman

1 × $6.00 -

×

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Street-Smart Chart Reading – Volume 1 – The Rudiments with Donald G.Worden

1 × $6.00

Street-Smart Chart Reading – Volume 1 – The Rudiments with Donald G.Worden

1 × $6.00 -

×

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00

The Day Trading ES Futures Blueprint Class with Corey Rosenbloom

1 × $6.00 -

×

Learn Investing & Trading with Danny Devan

1 × $23.00

Learn Investing & Trading with Danny Devan

1 × $23.00 -

×

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00 -

×

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00 -

×

Technical Timing Patterns

1 × $6.00

Technical Timing Patterns

1 × $6.00 -

×

Peter Borish Online Trader Program

1 × $15.00

Peter Borish Online Trader Program

1 × $15.00 -

×

Forex Robotron (Unlocked)

1 × $6.00

Forex Robotron (Unlocked)

1 × $6.00 -

×

Fundamentals Trading

1 × $6.00

Fundamentals Trading

1 × $6.00 -

×

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00 -

×

Advanced Risk Reversals and Rolling Thunder with Stratagem Trade

1 × $54.00

Advanced Risk Reversals and Rolling Thunder with Stratagem Trade

1 × $54.00 -

×

Advent Forex Course with Cecil Robles

1 × $6.00

Advent Forex Course with Cecil Robles

1 × $6.00 -

×

Starter Guide to Investing Stocks, Crypto & Precious Metals with Ryan Hogue

1 × $5.00

Starter Guide to Investing Stocks, Crypto & Precious Metals with Ryan Hogue

1 × $5.00 -

×

George Wollsten: Expert Stock and Grain Trader with George Bayer

1 × $6.00

George Wollsten: Expert Stock and Grain Trader with George Bayer

1 × $6.00 -

×

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00 -

×

Naked Trading Part 1 with Base Camp Trading

1 × $6.00

Naked Trading Part 1 with Base Camp Trading

1 × $6.00 -

×

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00 -

×

Code 6 + 7 Course with Oil Trading Academy

1 × $41.00

Code 6 + 7 Course with Oil Trading Academy

1 × $41.00 -

×

VXX Made Easy By Option Pit

1 × $62.00

VXX Made Easy By Option Pit

1 × $62.00 -

×

Commodities for Dummies with Amine Bouchentouf

1 × $6.00

Commodities for Dummies with Amine Bouchentouf

1 × $6.00 -

×

European Members - March 2023 with Stockbee

1 × $5.00

European Members - March 2023 with Stockbee

1 × $5.00 -

×

Breakthroughs in Technical Analysis: New Thinking From the World's Top Minds (1st Edition) with David Keller

1 × $6.00

Breakthroughs in Technical Analysis: New Thinking From the World's Top Minds (1st Edition) with David Keller

1 × $6.00 -

×

Team Bull Trading Academy

1 × $5.00

Team Bull Trading Academy

1 × $5.00 -

×

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00 -

×

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00 -

×

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00 -

×

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00 -

×

The Great Depression with David Burg

1 × $6.00

The Great Depression with David Burg

1 × $6.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00 -

×

Small Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming Companies with George Angell

1 × $6.00

Small Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming Companies with George Angell

1 × $6.00 -

×

Multi Asset Class Investment Strategy with Guy Fraser-Sampson

1 × $6.00

Multi Asset Class Investment Strategy with Guy Fraser-Sampson

1 × $6.00 -

×

Opening Price Principle: Best Kept Secret on Wall Street - Larry Pesavento & Peggy MacKay

1 × $6.00

Opening Price Principle: Best Kept Secret on Wall Street - Larry Pesavento & Peggy MacKay

1 × $6.00 -

×

The Nasdaq Investor with Max Isaacman

1 × $6.00

The Nasdaq Investor with Max Isaacman

1 × $6.00 -

×

Intra-day Solar Trader with George Harrison

1 × $17.00

Intra-day Solar Trader with George Harrison

1 × $17.00 -

×

New Blueprints for Gains in Stocks and Grains & One-Way Formula for Trading in Stocks and Commodities (Traders' Masterclass) - William Dunnigan

1 × $6.00

New Blueprints for Gains in Stocks and Grains & One-Way Formula for Trading in Stocks and Commodities (Traders' Masterclass) - William Dunnigan

1 × $6.00 -

×

Traders Edge with Steven Dux

1 × $5.00

Traders Edge with Steven Dux

1 × $5.00 -

×

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00 -

×

Fractal Markets FX (SMC)

1 × $5.00

Fractal Markets FX (SMC)

1 × $5.00 -

×

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00 -

×

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00 -

×

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00 -

×

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

Manage the Greeks & the Risk of ODTE & 1-4 day Trades for October 2023 with Sheridan Options Mentoring

1 × $85.00

Manage the Greeks & the Risk of ODTE & 1-4 day Trades for October 2023 with Sheridan Options Mentoring

1 × $85.00 -

×

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00 -

×

High Yield Investments I & II with Lance Spicer

1 × $6.00

High Yield Investments I & II with Lance Spicer

1 × $6.00 -

×

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Signals

1 × $6.00

Signals

1 × $6.00 -

×

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00 -

×

Investment Mathematics with Andrew Adams

1 × $6.00

Investment Mathematics with Andrew Adams

1 × $6.00 -

×

TOP Gamma Bundle with TopTrade Tools

1 × $69.00

TOP Gamma Bundle with TopTrade Tools

1 × $69.00 -

×

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00 -

×

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00 -

×

Failure Rate Modelling for Reliabiliy & Risk with Maxim Finkelstein

1 × $6.00

Failure Rate Modelling for Reliabiliy & Risk with Maxim Finkelstein

1 × $6.00 -

×

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

How I Trade the QQQs with Don Miller

$6.00

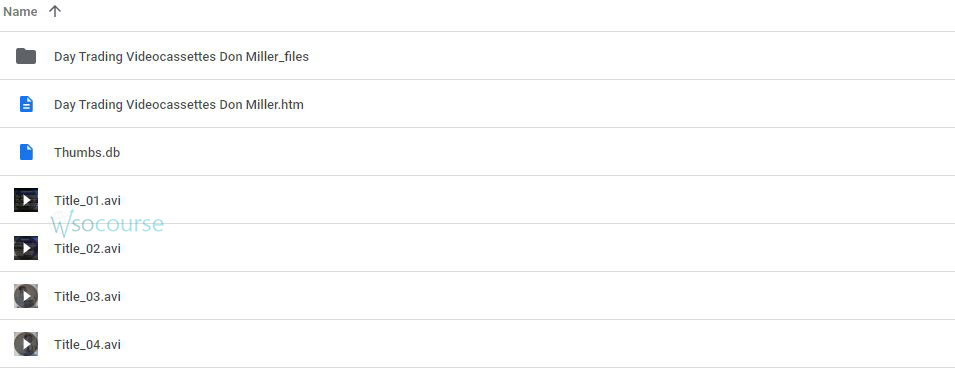

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.