-

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00

Getting Started in Technical Analysis with Jack Schwager

1 × $6.00 -

×

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00 -

×

Forex Trading Course with Mike Norman

1 × $17.00

Forex Trading Course with Mike Norman

1 × $17.00 -

×

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

8 Strategies for Day Trading

1 × $31.00

8 Strategies for Day Trading

1 × $31.00 -

×

Investment Mathematics with Andrew Adams

1 × $6.00

Investment Mathematics with Andrew Adams

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Market Profile Video with FutexLive

1 × $6.00

Market Profile Video with FutexLive

1 × $6.00 -

×

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00 -

×

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Capital with Charles D.Ellis

1 × $6.00

Capital with Charles D.Ellis

1 × $6.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

Trading Against the Crowd with John Summa

1 × $6.00

Trading Against the Crowd with John Summa

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Royal Exchange Forex with Jan Teslar

1 × $6.00

Royal Exchange Forex with Jan Teslar

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Starting Out in Futures Trading with Mark Powers

1 × $6.00

Starting Out in Futures Trading with Mark Powers

1 × $6.00 -

×

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00 -

×

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00 -

×

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00 -

×

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00 -

×

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00

Candlestick Trading for Maximum Profitsn with B.M.Davis

1 × $6.00 -

×

Trading Books with Michael Harris

1 × $6.00

Trading Books with Michael Harris

1 × $6.00 -

×

Better Trading with the Guppy Multiple Moving Average WorkBook with Daryl Guppy

1 × $6.00

Better Trading with the Guppy Multiple Moving Average WorkBook with Daryl Guppy

1 × $6.00 -

×

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00 -

×

How to Value & Sell your Business with Andrew Heslop

1 × $6.00

How to Value & Sell your Business with Andrew Heslop

1 × $6.00 -

×

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00

Swift Trader, Perfecting the Art of DayTrading with Charles Kim

1 × $6.00 -

×

Advanced Pattern Recognition with John Cameron

1 × $23.00

Advanced Pattern Recognition with John Cameron

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Best of AM Review (Volume 1-3) with Peter Bain

1 × $6.00

Best of AM Review (Volume 1-3) with Peter Bain

1 × $6.00 -

×

5-Week Portfolio (No Bonus) - Criticaltrading

1 × $39.00

5-Week Portfolio (No Bonus) - Criticaltrading

1 × $39.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00

How I Trade the QQQs with Don Miller

$6.00

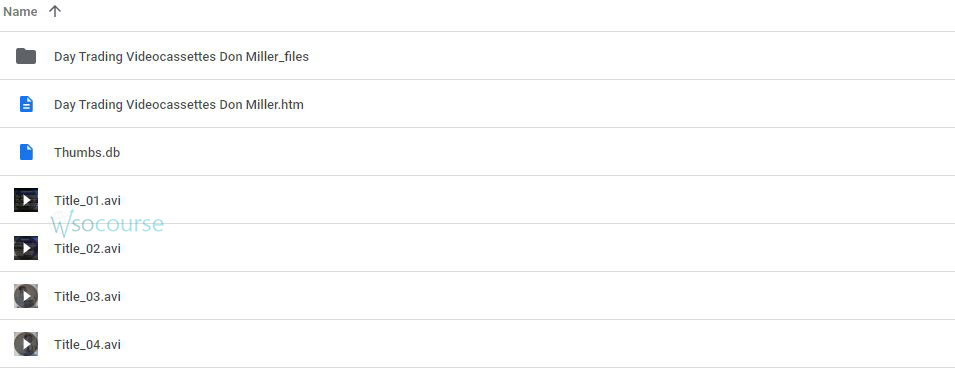

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.