-

×

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Ichimokutrade - Fibonacci 101

1 × $15.00

Ichimokutrade - Fibonacci 101

1 × $15.00 -

×

Mind Over Markets

1 × $6.00

Mind Over Markets

1 × $6.00 -

×

Mastering Intraday Trend Days with Corey Rosenbloom

1 × $6.00

Mastering Intraday Trend Days with Corey Rosenbloom

1 × $6.00 -

×

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00 -

×

The Box Strategy with Blue Capital Academy

1 × $23.00

The Box Strategy with Blue Capital Academy

1 × $23.00 -

×

RTM + Suppy and Demand with Nora Bystra

1 × $6.00

RTM + Suppy and Demand with Nora Bystra

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00 -

×

Simple Forex Profits with Rayy Bannzz

1 × $31.00

Simple Forex Profits with Rayy Bannzz

1 × $31.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00 -

×

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

Short and Simple Guide to Smart Investing with Alan Lavine

1 × $6.00

Short and Simple Guide to Smart Investing with Alan Lavine

1 × $6.00 -

×

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00 -

×

Smart Money Concepts with MFX Trading

1 × $13.00

Smart Money Concepts with MFX Trading

1 × $13.00 -

×

EURUSD Trading System with CopperChips

1 × $6.00

EURUSD Trading System with CopperChips

1 × $6.00 -

×

Million Dollar Stock Market Idea with Larry Williams

1 × $6.00

Million Dollar Stock Market Idea with Larry Williams

1 × $6.00 -

×

Maximum Lots Trading Course with Joe Wright

1 × $34.00

Maximum Lots Trading Course with Joe Wright

1 × $34.00 -

×

Profits in the Stock Market with Harold Gartley

1 × $6.00

Profits in the Stock Market with Harold Gartley

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Follow the Leader Trading System with Anthony Gibson

1 × $6.00

Follow the Leader Trading System with Anthony Gibson

1 × $6.00 -

×

Day Trading Insight with Al Brooks

1 × $10.00

Day Trading Insight with Al Brooks

1 × $10.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

ETF Profit Driver Course with Bill Poulos

1 × $6.00

ETF Profit Driver Course with Bill Poulos

1 × $6.00 -

×

Fractal Energy Trading with Doc Severson

1 × $6.00

Fractal Energy Trading with Doc Severson

1 × $6.00 -

×

Price Action Trading Volume 1 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

BookMap Advanced v6.1

1 × $6.00

BookMap Advanced v6.1

1 × $6.00 -

×

Professional Swing Trading College with Steven Primo

1 × $15.00

Professional Swing Trading College with Steven Primo

1 × $15.00 -

×

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00

The Cycles and The Codes with Myles Wilson-Walker

1 × $15.00 -

×

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00 -

×

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00 -

×

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00 -

×

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00 -

×

All About High-Frequency Trading with Michael Durbin

1 × $6.00

All About High-Frequency Trading with Michael Durbin

1 × $6.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

Future Energy with Bill Paul

1 × $6.00

Future Energy with Bill Paul

1 × $6.00 -

×

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00 -

×

What Works in Online Trading with Mark Etzkorn

1 × $6.00

What Works in Online Trading with Mark Etzkorn

1 × $6.00 -

×

The Traders Battle Plan

1 × $6.00

The Traders Battle Plan

1 × $6.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

Fundamentals Trading

1 × $6.00

Fundamentals Trading

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00 -

×

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00 -

×

Real-Time Course with Rich Swannell

1 × $6.00

Real-Time Course with Rich Swannell

1 × $6.00 -

×

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00 -

×

Systems Trading for Spread Betting: An end-to-end guide for developing spread betting systems with Gary Ford

1 × $6.00

Systems Trading for Spread Betting: An end-to-end guide for developing spread betting systems with Gary Ford

1 × $6.00 -

×

Trading Hub 4.0 with Mr. Khan

1 × $27.00

Trading Hub 4.0 with Mr. Khan

1 × $27.00 -

×

Trading by the Book (tradingeducators.com)

1 × $6.00

Trading by the Book (tradingeducators.com)

1 × $6.00 -

×

Forex Mastery with Willis University

1 × $6.00

Forex Mastery with Willis University

1 × $6.00 -

×

Trading MoneyTides & Chaos in the Stock Market with Hans Hannula

1 × $6.00

Trading MoneyTides & Chaos in the Stock Market with Hans Hannula

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

9-Pack of TOS Indicators

1 × $6.00

9-Pack of TOS Indicators

1 × $6.00 -

×

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00 -

×

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00 -

×

The Key to Profits in Tough Times

1 × $6.00

The Key to Profits in Tough Times

1 × $6.00 -

×

Become A Quant Trader Bundle with Lachezar Haralampiev & Radoslav Haralampiev - Quant Factory

1 × $17.00

Become A Quant Trader Bundle with Lachezar Haralampiev & Radoslav Haralampiev - Quant Factory

1 × $17.00 -

×

The Hedge Bundle - SpotGamma Academy with Imran Lakha

1 × $8.00

The Hedge Bundle - SpotGamma Academy with Imran Lakha

1 × $8.00 -

×

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00 -

×

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00 -

×

Trading Academy 2024 with Tradeciety

1 × $5.00

Trading Academy 2024 with Tradeciety

1 × $5.00 -

×

Tom Busby – DAX Supplement Trading Course 2007 with DTI

1 × $6.00

Tom Busby – DAX Supplement Trading Course 2007 with DTI

1 × $6.00 -

×

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00 -

×

Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition with John Bogle

1 × $6.00

Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition with John Bogle

1 × $6.00 -

×

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Capital Flows and Crises with Barry Eichengreen

1 × $6.00

Capital Flows and Crises with Barry Eichengreen

1 × $6.00 -

×

Elliott Wave Simplified with Clif Droke

1 × $6.00

Elliott Wave Simplified with Clif Droke

1 × $6.00 -

×

Mechanising Some of the World’s Classic Trading Systems with Murray Ruggiero

1 × $7.00

Mechanising Some of the World’s Classic Trading Systems with Murray Ruggiero

1 × $7.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Outsmarting the Smart Money with Lawrence A.Cunningham

1 × $6.00

Outsmarting the Smart Money with Lawrence A.Cunningham

1 × $6.00 -

×

The Apple Way with Jeffrey Cruikshank

1 × $6.00

The Apple Way with Jeffrey Cruikshank

1 × $6.00 -

×

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00 -

×

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00 -

×

Module IV - Day Trading to Short Term Swing Trades with FX MindShift

1 × $6.00

Module IV - Day Trading to Short Term Swing Trades with FX MindShift

1 × $6.00 -

×

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00 -

×

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00 -

×

The Banks Code with Smart Money Trader

1 × $34.00

The Banks Code with Smart Money Trader

1 × $34.00 -

×

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

How I Trade the QQQs with Don Miller

$6.00

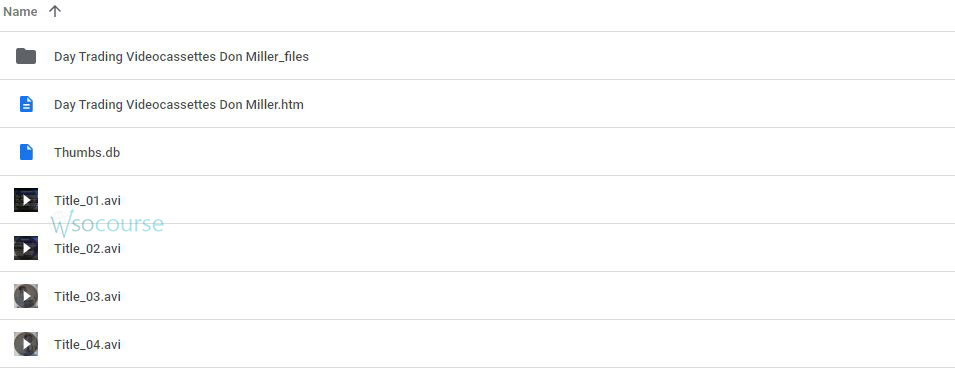

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Reviews

There are no reviews yet.