-

×

Traders Secret Code Complete Course with Mark McRae

1 × $6.00

Traders Secret Code Complete Course with Mark McRae

1 × $6.00 -

×

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00 -

×

Dan Sheridan Volatility Class

1 × $6.00

Dan Sheridan Volatility Class

1 × $6.00 -

×

Freak Forex Fundamentals with Ken FX Freak

1 × $6.00

Freak Forex Fundamentals with Ken FX Freak

1 × $6.00 -

×

Stock Market Trading Systems with Gerald Appel

1 × $6.00

Stock Market Trading Systems with Gerald Appel

1 × $6.00 -

×

Altcoin Investing Course with Rekt Capital

1 × $5.00

Altcoin Investing Course with Rekt Capital

1 × $5.00 -

×

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00

Equity Research and Valuation Techniques with Kemp Dolliver

1 × $6.00 -

×

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00 -

×

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00 -

×

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00 -

×

Price Action Trader Training

1 × $6.00

Price Action Trader Training

1 × $6.00 -

×

Gann Masters II with Hallikers Inc

1 × $6.00

Gann Masters II with Hallikers Inc

1 × $6.00 -

×

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00 -

×

Researching your Trade

1 × $6.00

Researching your Trade

1 × $6.00 -

×

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00 -

×

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Signals

1 × $6.00

Signals

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00 -

×

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00 -

×

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00 -

×

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00 -

×

The Sweep Show with Scott Pulcini Trader

1 × $23.00

The Sweep Show with Scott Pulcini Trader

1 × $23.00 -

×

Fundamental Analysis with CA Rachana Ranade

1 × $5.00

Fundamental Analysis with CA Rachana Ranade

1 × $5.00 -

×

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00 -

×

Startup Trading Masterclass with Jack Gleason

1 × $93.00

Startup Trading Masterclass with Jack Gleason

1 × $93.00 -

×

How To Trade Forex Using Support & Resistance Levels with Vic Noble

1 × $6.00

How To Trade Forex Using Support & Resistance Levels with Vic Noble

1 × $6.00 -

×

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00 -

×

Preview of Markets with George Bayer

1 × $6.00

Preview of Markets with George Bayer

1 × $6.00 -

×

Advanced Iron Condor Course in 2021

1 × $6.00

Advanced Iron Condor Course in 2021

1 × $6.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00 -

×

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00 -

×

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00 -

×

Murrey Math Trading System Book with Murrey Math

1 × $6.00

Murrey Math Trading System Book with Murrey Math

1 × $6.00 -

×

Rule Based Price Action with Trader Divergent

1 × $5.00

Rule Based Price Action with Trader Divergent

1 × $5.00 -

×

8 Strategies for Day Trading

1 × $31.00

8 Strategies for Day Trading

1 × $31.00 -

×

The Traders Battle Plan

1 × $6.00

The Traders Battle Plan

1 × $6.00 -

×

Advent Forex Course with Cecil Robles

1 × $6.00

Advent Forex Course with Cecil Robles

1 × $6.00 -

×

Advanced Bond Trading Course

1 × $62.00

Advanced Bond Trading Course

1 × $62.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Traders Forge with Ryan Litchfield

1 × $6.00

Traders Forge with Ryan Litchfield

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Options Academy Elevate with Simon Ree - Tao of Trading

1 × $109.00

Options Academy Elevate with Simon Ree - Tao of Trading

1 × $109.00 -

×

The First Time Investors Workbook with Joe Jonh Duran & Larry Chambers

1 × $6.00

The First Time Investors Workbook with Joe Jonh Duran & Larry Chambers

1 × $6.00 -

×

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00 -

×

Hedge Fund Investment Management with Izze Nelken

1 × $6.00

Hedge Fund Investment Management with Izze Nelken

1 × $6.00 -

×

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00 -

×

Swing Trader Pro with Top Trade Tools

1 × $54.00

Swing Trader Pro with Top Trade Tools

1 × $54.00 -

×

Capital Asset Investment with Anthony F.Herbst

1 × $6.00

Capital Asset Investment with Anthony F.Herbst

1 × $6.00 -

×

Guide to Getting Short and Collecting Income with Don Kaufman

1 × $6.00

Guide to Getting Short and Collecting Income with Don Kaufman

1 × $6.00 -

×

Private Seminar with Alan Andrew

1 × $6.00

Private Seminar with Alan Andrew

1 × $6.00 -

×

How To Build An Automated Trading Robot In Excel with Peter Titus - Marwood Research

1 × $15.00

How To Build An Automated Trading Robot In Excel with Peter Titus - Marwood Research

1 × $15.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

The Precision Profit Float Indicator (TS Code & Setups) with Steve Woods

1 × $6.00

The Precision Profit Float Indicator (TS Code & Setups) with Steve Woods

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Emini Bonds

1 × $23.00

Emini Bonds

1 × $23.00 -

×

Day Trading Futures, Stocks, and Crypto

1 × $5.00

Day Trading Futures, Stocks, and Crypto

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00 -

×

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00 -

×

Momentum Mastery with Traderlion Richard Moglen & Ben Bennett

1 × $15.00

Momentum Mastery with Traderlion Richard Moglen & Ben Bennett

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

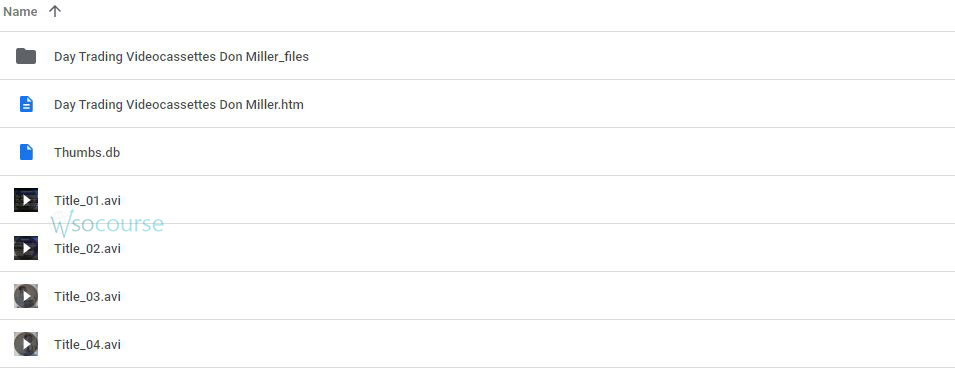

How I Trade the QQQs with Don Miller

$6.00

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.