-

×

Traders World Past Issue Articles on CD with Magazine

1 × $6.00

Traders World Past Issue Articles on CD with Magazine

1 × $6.00 -

×

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00 -

×

How I Trade for a Living with Gary Smith

1 × $6.00

How I Trade for a Living with Gary Smith

1 × $6.00 -

×

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00 -

×

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00 -

×

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00 -

×

Consistently Profitable Trader with Pollinate Trading

1 × $13.00

Consistently Profitable Trader with Pollinate Trading

1 × $13.00 -

×

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00 -

×

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Forex Mentor Seminar with Peter Bain

1 × $6.00

Forex Mentor Seminar with Peter Bain

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

Pristine - Noble DraKoln – The Complete Liverpool Futures Seminar Series

1 × $6.00

Pristine - Noble DraKoln – The Complete Liverpool Futures Seminar Series

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Master Trader with InvestingSimple

1 × $15.00

Master Trader with InvestingSimple

1 × $15.00 -

×

Emini Bonds

1 × $23.00

Emini Bonds

1 × $23.00 -

×

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

ENG Renko Mastery with International Scalpers

1 × $10.00

ENG Renko Mastery with International Scalpers

1 × $10.00 -

×

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00 -

×

Master Trader Technical Strategies with Greg Capra - Master Trader

1 × $5.00

Master Trader Technical Strategies with Greg Capra - Master Trader

1 × $5.00 -

×

Change Happens. Do You Profit Or Does Someone Else (Traders Expo Las Vegas Dec 2005) by Tobin Smith

1 × $6.00

Change Happens. Do You Profit Or Does Someone Else (Traders Expo Las Vegas Dec 2005) by Tobin Smith

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

eASCTrend Pro 6.0 Video Tutorials with Ablesys

1 × $6.00

eASCTrend Pro 6.0 Video Tutorials with Ablesys

1 × $6.00 -

×

Sovereign Man Confidential

1 × $6.00

Sovereign Man Confidential

1 × $6.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

Day Trading Stocks - Gap Trading

1 × $23.00

Day Trading Stocks - Gap Trading

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Trading Strategies with Larry Sanders

1 × $6.00

Trading Strategies with Larry Sanders

1 × $6.00 -

×

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Technical Timing Patterns

1 × $6.00

Technical Timing Patterns

1 × $6.00 -

×

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00 -

×

Forex Robotron (Unlocked)

1 × $6.00

Forex Robotron (Unlocked)

1 × $6.00 -

×

SNR Trader Course with Ariff T

1 × $6.00

SNR Trader Course with Ariff T

1 × $6.00 -

×

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00 -

×

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00 -

×

How to Value & Sell your Business with Andrew Heslop

1 × $6.00

How to Value & Sell your Business with Andrew Heslop

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Developing & Implementing Pattern-Based Trading Systems with Tushar S.Chande

1 × $6.00

Developing & Implementing Pattern-Based Trading Systems with Tushar S.Chande

1 × $6.00 -

×

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00 -

×

The Michanics of Futures Trading - Roy Habben

1 × $6.00

The Michanics of Futures Trading - Roy Habben

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

How I Trade the QQQs with Don Miller

$6.00

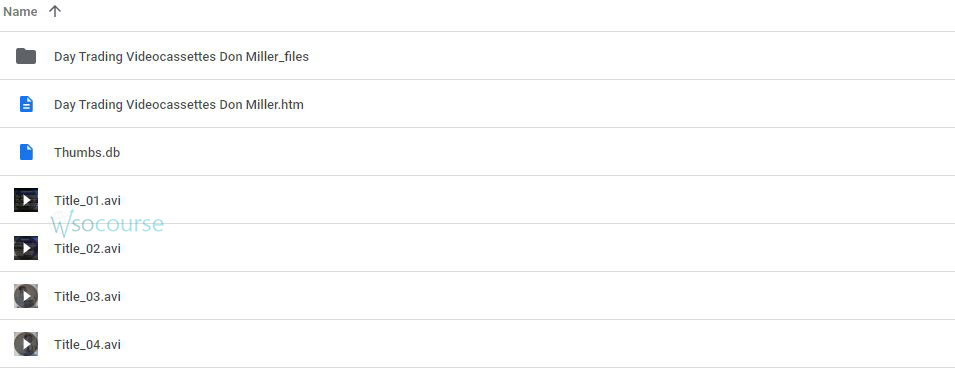

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.