-

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Ultimate Guide to the Stealth Forex System (stealthforexguide.com)

1 × $6.00

The Ultimate Guide to the Stealth Forex System (stealthforexguide.com)

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00 -

×

Capital Asset Investment with Anthony F.Herbst

1 × $6.00

Capital Asset Investment with Anthony F.Herbst

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Apple Way with Jeffrey Cruikshank

1 × $6.00

The Apple Way with Jeffrey Cruikshank

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Core Concepts Mastery with DreamsFX

1 × $5.00

Core Concepts Mastery with DreamsFX

1 × $5.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

TradeWithChris - TWC Forex Trading Course

1 × $6.00

TradeWithChris - TWC Forex Trading Course

1 × $6.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00 -

×

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00 -

×

Profitable Binary Options Strategies

1 × $5.00

Profitable Binary Options Strategies

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Floor Traders Edge Mentorship Program with Market Geeks

1 × $6.00

Floor Traders Edge Mentorship Program with Market Geeks

1 × $6.00 -

×

6 (The Proper BackGround)

1 × $6.00

6 (The Proper BackGround)

1 × $6.00 -

×

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Profit Power Seminar

1 × $23.00

Profit Power Seminar

1 × $23.00 -

×

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00 -

×

Professor Jeff Bierman's 15 Class Bundle (The Professor's Package)

1 × $6.00

Professor Jeff Bierman's 15 Class Bundle (The Professor's Package)

1 × $6.00 -

×

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00 -

×

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00 -

×

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Weekly Options Boot Camp with Price Headley

1 × $15.00

Weekly Options Boot Camp with Price Headley

1 × $15.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

How I Trade the QQQs with Don Miller

$6.00

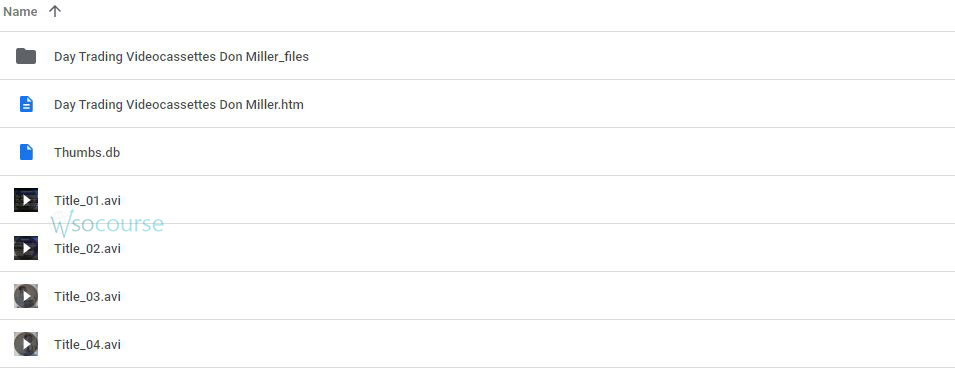

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.