-

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Learn To Fish Part II - Generating Consistent Income Through Day Trading with Daniel

1 × $6.00

Learn To Fish Part II - Generating Consistent Income Through Day Trading with Daniel

1 × $6.00 -

×

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00 -

×

The Works (Full Educational Course) with Waves 618

1 × $39.00

The Works (Full Educational Course) with Waves 618

1 × $39.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The Profit Magic of Stock Transaction Timing with J.M.Hurst

1 × $6.00

The Profit Magic of Stock Transaction Timing with J.M.Hurst

1 × $6.00 -

×

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00

Fractal Flow Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Project Manager’s Spotlight on Risk Management with Kim Heldman

1 × $5.00

Project Manager’s Spotlight on Risk Management with Kim Heldman

1 × $5.00 -

×

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00 -

×

Micro Bull Run Mentorship Program (Autumn 2023) with Brendan Viehman

1 × $23.00

Micro Bull Run Mentorship Program (Autumn 2023) with Brendan Viehman

1 × $23.00 -

×

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00 -

×

Forex Advanced with Prophetic Pips Academy

1 × $5.00

Forex Advanced with Prophetic Pips Academy

1 × $5.00 -

×

Indicators & BWT Bar Types for NT7

1 × $139.00

Indicators & BWT Bar Types for NT7

1 × $139.00 -

×

Detecting Trend Direction & Strength (Article) with Barbara Star

1 × $6.00

Detecting Trend Direction & Strength (Article) with Barbara Star

1 × $6.00 -

×

Jeffrey Kennedy’s Package ( Discount 25% )

1 × $31.00

Jeffrey Kennedy’s Package ( Discount 25% )

1 × $31.00 -

×

Online Course: Forex Trading By Fxtc.co

1 × $5.00

Online Course: Forex Trading By Fxtc.co

1 × $5.00 -

×

Hedge Fund Investment Management with Izze Nelken

1 × $6.00

Hedge Fund Investment Management with Izze Nelken

1 × $6.00 -

×

Professor Jeff Bierman's 15 Class Bundle (The Professor's Package)

1 × $6.00

Professor Jeff Bierman's 15 Class Bundle (The Professor's Package)

1 × $6.00 -

×

Selected Articles by the Late by George Lindsay

1 × $6.00

Selected Articles by the Late by George Lindsay

1 × $6.00 -

×

Price Action Trading Volume 3 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 3 with Fractal Flow Pro

1 × $6.00 -

×

The 1% Club with Trader Mike

1 × $5.00

The 1% Club with Trader Mike

1 × $5.00 -

×

Module II - Signature Trades with FX MindShift

1 × $6.00

Module II - Signature Trades with FX MindShift

1 × $6.00 -

×

Japenese Candlesticks Charting, Analysis & Trading with Irwin Porter

1 × $6.00

Japenese Candlesticks Charting, Analysis & Trading with Irwin Porter

1 × $6.00 -

×

Reading The Tape Trade Series with CompassFX

1 × $10.00

Reading The Tape Trade Series with CompassFX

1 × $10.00 -

×

Technical Analysis: Power Tools for Active Investors with Gerald Appel

1 × $6.00

Technical Analysis: Power Tools for Active Investors with Gerald Appel

1 × $6.00 -

×

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

FX At One Glance - Ichimoku First Glance Video Course

1 × $23.00

FX At One Glance - Ichimoku First Glance Video Course

1 × $23.00 -

×

Marber on Markets – How to Make Money from Charts with Brian Marber

1 × $6.00

Marber on Markets – How to Make Money from Charts with Brian Marber

1 × $6.00 -

×

Elliott Wave Swing High Low Indicator for ThinkorSwim with Fibonacci

1 × $6.00

Elliott Wave Swing High Low Indicator for ThinkorSwim with Fibonacci

1 × $6.00 -

×

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00 -

×

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00 -

×

Hit & Run Trading: The Short-Term Stock Traders Bible (1996) with Jeff Cooper

1 × $6.00

Hit & Run Trading: The Short-Term Stock Traders Bible (1996) with Jeff Cooper

1 × $6.00 -

×

Master Class with Gerald Appel

1 × $6.00

Master Class with Gerald Appel

1 × $6.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $179.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $179.00 -

×

Black Gold Strategies

1 × $23.00

Black Gold Strategies

1 × $23.00 -

×

Selling Options For A Living Class with Don Kaufman

1 × $6.00

Selling Options For A Living Class with Don Kaufman

1 × $6.00 -

×

Rocket Science for Traders with John Ehlers

1 × $6.00

Rocket Science for Traders with John Ehlers

1 × $6.00 -

×

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00 -

×

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00 -

×

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00 -

×

Symmetry Wave Theory with Michael Gur

1 × $6.00

Symmetry Wave Theory with Michael Gur

1 × $6.00 -

×

The BULLFx Forex Trading Course

1 × $5.00

The BULLFx Forex Trading Course

1 × $5.00 -

×

Trading With Venus

1 × $31.00

Trading With Venus

1 × $31.00 -

×

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00 -

×

Mathematical Problems in Image Processing with Charles E.Chidume

1 × $6.00

Mathematical Problems in Image Processing with Charles E.Chidume

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00 -

×

Square The Range Trading System with Michael Jenkins

1 × $6.00

Square The Range Trading System with Michael Jenkins

1 × $6.00 -

×

Trading with Wave59 with Earik Beann

1 × $6.00

Trading with Wave59 with Earik Beann

1 × $6.00 -

×

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00 -

×

Strategy Factory Workshop with Kevin Davey - KJ Trading Systems

1 × $5.00

Strategy Factory Workshop with Kevin Davey - KJ Trading Systems

1 × $5.00 -

×

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00 -

×

Hit The Mark Trading - Boot Camp 2016 Courses

1 × $23.00

Hit The Mark Trading - Boot Camp 2016 Courses

1 × $23.00 -

×

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00 -

×

Inner Circle Course with Darius Fx

1 × $24.00

Inner Circle Course with Darius Fx

1 × $24.00 -

×

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00 -

×

Naked Trading Mastery

1 × $39.00

Naked Trading Mastery

1 × $39.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Scalping Master Course with Dayonetraders

1 × $6.00

Scalping Master Course with Dayonetraders

1 × $6.00 -

×

Edge Trading Group with Edge Elite

1 × $6.00

Edge Trading Group with Edge Elite

1 × $6.00 -

×

CFA Level 1,2 & 3 Complete Course 2010 48 CD’s with Schweser

1 × $6.00

CFA Level 1,2 & 3 Complete Course 2010 48 CD’s with Schweser

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

How I Trade the QQQs with Don Miller

$6.00

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

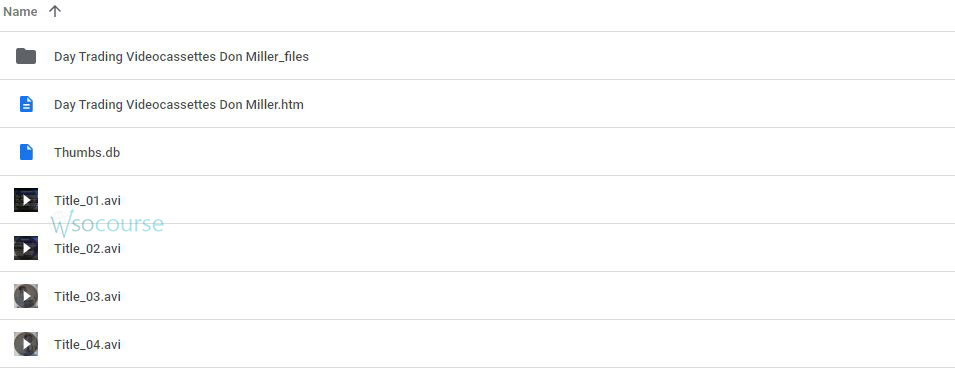

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.