-

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

SPX All Put Flat ButterFly with Mark Fenton - Sheridan Options Mentoring

1 × $39.00

SPX All Put Flat ButterFly with Mark Fenton - Sheridan Options Mentoring

1 × $39.00 -

×

SnD SMC Course

1 × $10.00

SnD SMC Course

1 × $10.00 -

×

PayTrading with Eric Shawn

1 × $6.00

PayTrading with Eric Shawn

1 × $6.00 -

×

CFA Level 2 - Sample Item Sets 2003

1 × $6.00

CFA Level 2 - Sample Item Sets 2003

1 × $6.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

Wealth Management with Dimitris Chorafas

1 × $6.00

Wealth Management with Dimitris Chorafas

1 × $6.00 -

×

Activedaytrader - Workshop: Practical Money Management

1 × $23.00

Activedaytrader - Workshop: Practical Money Management

1 × $23.00 -

×

Evolve MasterClass with Irek Piekarski

1 × $13.00

Evolve MasterClass with Irek Piekarski

1 × $13.00 -

×

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Advanced Group Analysis Turorial with David Vomund

1 × $6.00

Advanced Group Analysis Turorial with David Vomund

1 × $6.00 -

×

How to Use Gann Techniques to Implement a Trading System

1 × $6.00

How to Use Gann Techniques to Implement a Trading System

1 × $6.00 -

×

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00 -

×

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Complete Short Course on Ripple Cryptocurrency with Saad Hameed

1 × $5.00

The Complete Short Course on Ripple Cryptocurrency with Saad Hameed

1 × $5.00 -

×

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00 -

×

Electronic Trading "TNT" III Technical Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" III Technical Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

Market Timing & Technical Analysis with Alan Shaw

1 × $6.00

Market Timing & Technical Analysis with Alan Shaw

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

CHARTCHAMPIONS Course

1 × $10.00

CHARTCHAMPIONS Course

1 × $10.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

Trading For Busy People with Josias Kere

1 × $6.00

Trading For Busy People with Josias Kere

1 × $6.00 -

×

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00 -

×

Pricing of Bond Options with Detlef Repplinger

1 × $6.00

Pricing of Bond Options with Detlef Repplinger

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Scientific Forex with Cristina Ciurea

1 × $6.00

Scientific Forex with Cristina Ciurea

1 × $6.00 -

×

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00 -

×

Strategic Swing Trader with Sami Abusaad

1 × $6.00

Strategic Swing Trader with Sami Abusaad

1 × $6.00 -

×

Capital Asset Investment with Anthony F.Herbst

1 × $6.00

Capital Asset Investment with Anthony F.Herbst

1 × $6.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

How To Flip All Those “Hard To Flip” Deals

1 × $6.00

How To Flip All Those “Hard To Flip” Deals

1 × $6.00 -

×

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00

Elliott Wave Indicator Suite for ThinkorSwim

1 × $15.00 -

×

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00 -

×

Raghee’s Winners Circle Course

1 × $6.00

Raghee’s Winners Circle Course

1 × $6.00 -

×

Catching the Bounce

1 × $6.00

Catching the Bounce

1 × $6.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

How I Trade the QQQs with Don Miller

$6.00

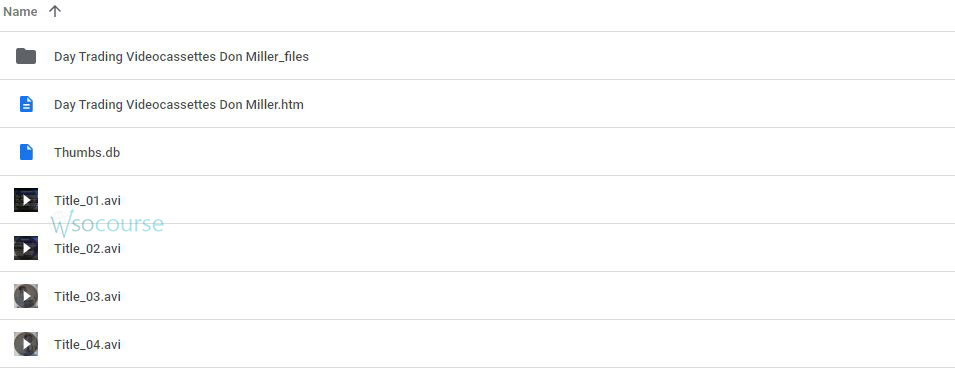

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.