-

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Learn to Trade Course with Mike Aston

1 × $6.00

Learn to Trade Course with Mike Aston

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Volcano Trading with Claytrader

1 × $15.00

Volcano Trading with Claytrader

1 × $15.00 -

×

Investment Management

1 × $6.00

Investment Management

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Mastering Amibroker Formula Language

1 × $15.00

Mastering Amibroker Formula Language

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Millionaire Playbook with Jeremy Lefebvre

1 × $62.00

Millionaire Playbook with Jeremy Lefebvre

1 × $62.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

LIVE TRADERS - TECHNICAL STOCK TRADING

1 × $23.00

LIVE TRADERS - TECHNICAL STOCK TRADING

1 × $23.00 -

×

Stock Market Forecast Tools SMFT-1 (Sept 2013)

1 × $6.00

Stock Market Forecast Tools SMFT-1 (Sept 2013)

1 × $6.00 -

×

Create Your Trade Plan with Yuri Shramenko

1 × $6.00

Create Your Trade Plan with Yuri Shramenko

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

Fibonacci Trading Course - Money Management & Trend Analysis

1 × $6.00

Fibonacci Trading Course - Money Management & Trend Analysis

1 × $6.00 -

×

Futures Trading Blueprint with Day Trader Next Door

1 × $5.00

Futures Trading Blueprint with Day Trader Next Door

1 × $5.00 -

×

TC Top & Bottom Finder with Trader Confident

1 × $93.00

TC Top & Bottom Finder with Trader Confident

1 × $93.00 -

×

Main Online Course with FestX

1 × $5.00

Main Online Course with FestX

1 × $5.00 -

×

Most Woke Trading Methods with Hunter FX

1 × $5.00

Most Woke Trading Methods with Hunter FX

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Learn To Fish Part II - Generating Consistent Income Through Day Trading with Daniel

1 × $6.00

Learn To Fish Part II - Generating Consistent Income Through Day Trading with Daniel

1 × $6.00 -

×

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Metastock Online Traders Summit

1 × $5.00

Metastock Online Traders Summit

1 × $5.00 -

×

Shawn Sharma Mentorship Program

1 × $34.00

Shawn Sharma Mentorship Program

1 × $34.00 -

×

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00 -

×

Million Dollar Stock Market Idea with Larry Williams

1 × $6.00

Million Dollar Stock Market Idea with Larry Williams

1 × $6.00 -

×

Secret Income with James Altucher

1 × $62.00

Secret Income with James Altucher

1 × $62.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Price Action Trading Volume 3 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 3 with Fractal Flow Pro

1 × $6.00 -

×

Tandem Trader with Investors Underground

1 × $6.00

Tandem Trader with Investors Underground

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Freedom Challenge ( May 2018 – May 2019)

1 × $54.00

Freedom Challenge ( May 2018 – May 2019)

1 × $54.00 -

×

One Shot One Kill Trading with John Netto

1 × $6.00

One Shot One Kill Trading with John Netto

1 × $6.00 -

×

FX Capital Online

1 × $5.00

FX Capital Online

1 × $5.00 -

×

Elliott Wave Forex Course

1 × $6.00

Elliott Wave Forex Course

1 × $6.00 -

×

How to Trade Better with Larry Williams

1 × $6.00

How to Trade Better with Larry Williams

1 × $6.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

Forex Meets the Market Profile with John Keppler

1 × $23.00

Forex Meets the Market Profile with John Keppler

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Launchpad Trading

1 × $23.00

Launchpad Trading

1 × $23.00 -

×

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00 -

×

Evolution Course with Kevin Trades

1 × $15.00

Evolution Course with Kevin Trades

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Complete Dividend Investing Course (Updated 2019) with Wealthy Education

1 × $6.00

The Complete Dividend Investing Course (Updated 2019) with Wealthy Education

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

PennyStocking with Timothy Sykes

1 × $5.00

PennyStocking with Timothy Sykes

1 × $5.00

How I Trade the QQQs with Don Miller

$6.00

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

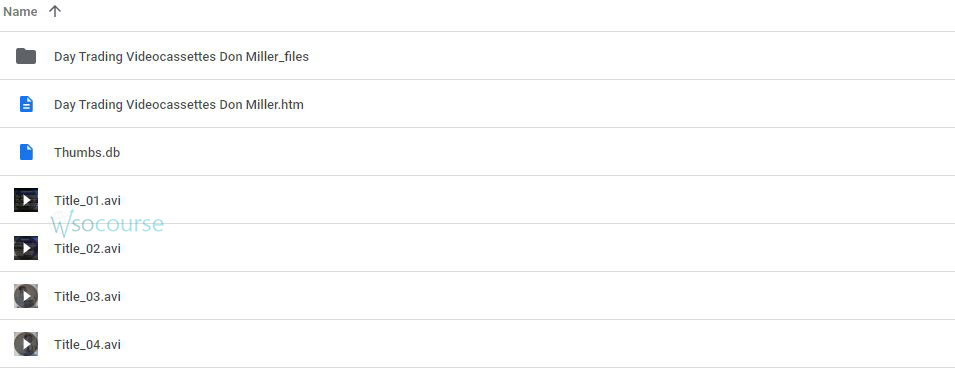

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.