-

×

Patterns to Profits with Ryan Mallory - Share Planner

1 × $6.00

Patterns to Profits with Ryan Mallory - Share Planner

1 × $6.00 -

×

Learn To Fish Part III - How To Swing Trade for Consistent Gains with Daniel

1 × $15.00

Learn To Fish Part III - How To Swing Trade for Consistent Gains with Daniel

1 × $15.00 -

×

NQ Price Action Mastery with Trade Smart

1 × $15.00

NQ Price Action Mastery with Trade Smart

1 × $15.00 -

×

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00 -

×

Traders Forge with Ryan Litchfield

1 × $6.00

Traders Forge with Ryan Litchfield

1 × $6.00 -

×

Confidence Game. How a Hadge Fund Manager Called Wall Street’s Bluff with Christine Richard

1 × $6.00

Confidence Game. How a Hadge Fund Manager Called Wall Street’s Bluff with Christine Richard

1 × $6.00 -

×

The Active Investor Blueprint with Steve Nison - Candle Charts

1 × $23.00

The Active Investor Blueprint with Steve Nison - Candle Charts

1 × $23.00 -

×

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00 -

×

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00 -

×

Best of AM Review (Volume 1-3) with Peter Bain

1 × $6.00

Best of AM Review (Volume 1-3) with Peter Bain

1 × $6.00 -

×

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00 -

×

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00 -

×

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00 -

×

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00 -

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

Trading Academy 2024 with Tradeciety

1 × $5.00

Trading Academy 2024 with Tradeciety

1 × $5.00 -

×

Sami Abusaad Elite Mentorship

1 × $31.00

Sami Abusaad Elite Mentorship

1 × $31.00 -

×

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

T3 Live - The Simple Art of Trading

1 × $31.00

T3 Live - The Simple Art of Trading

1 × $31.00 -

×

Advanced Bond Trading Course

1 × $62.00

Advanced Bond Trading Course

1 × $62.00 -

×

Trading for a Living with Alexander Elder

1 × $6.00

Trading for a Living with Alexander Elder

1 × $6.00 -

×

Technical Trader Workshop with Jason Stapleton

1 × $5.00

Technical Trader Workshop with Jason Stapleton

1 × $5.00 -

×

Dynamic Time Cycles with Peter Eliades

1 × $6.00

Dynamic Time Cycles with Peter Eliades

1 × $6.00 -

×

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00 -

×

PFA SD Model Trading System (Apr 2013)

1 × $31.00

PFA SD Model Trading System (Apr 2013)

1 × $31.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

ICT Mentorship – 2019

1 × $13.00

ICT Mentorship – 2019

1 × $13.00 -

×

Market Structure Masterclass with Braveheart Trading

1 × $5.00

Market Structure Masterclass with Braveheart Trading

1 × $5.00 -

×

Fibonacci for the Active Trader with Derrik Hobbs

1 × $6.00

Fibonacci for the Active Trader with Derrik Hobbs

1 × $6.00 -

×

Sequence Trading Course with Kevin Haggerty

1 × $4.00

Sequence Trading Course with Kevin Haggerty

1 × $4.00 -

×

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00 -

×

Market Evolution

1 × $6.00

Market Evolution

1 × $6.00 -

×

Boomer Quick Profits Day Trading Course

1 × $23.00

Boomer Quick Profits Day Trading Course

1 × $23.00 -

×

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00 -

×

Pyrapoint with D.E.Hall

1 × $6.00

Pyrapoint with D.E.Hall

1 × $6.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00 -

×

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00

Pattern- Price & Time. Using Gann Theory in Trading Systems (2nd Ed.)

1 × $6.00 -

×

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00 -

×

TradingMind Course with Jack Bernstein

1 × $6.00

TradingMind Course with Jack Bernstein

1 × $6.00 -

×

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00 -

×

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00 -

×

MTI - Basics UTP

1 × $6.00

MTI - Basics UTP

1 × $6.00 -

×

Order Flow Trading Advanced Masterclass with The Forex Scalpers

1 × $24.00

Order Flow Trading Advanced Masterclass with The Forex Scalpers

1 × $24.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

Profit.ly - Bitcoin Basics

1 × $6.00

Profit.ly - Bitcoin Basics

1 × $6.00 -

×

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00

Investing Guide For New Investor with Alfred Scillitani

1 × $6.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

Secrets of Trading GBP, JPY, and CHF By Boris Schlossberg and Kathy Lien - Bkforex

1 × $6.00

Secrets of Trading GBP, JPY, and CHF By Boris Schlossberg and Kathy Lien - Bkforex

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

How I Trade the QQQs with Don Miller

$6.00

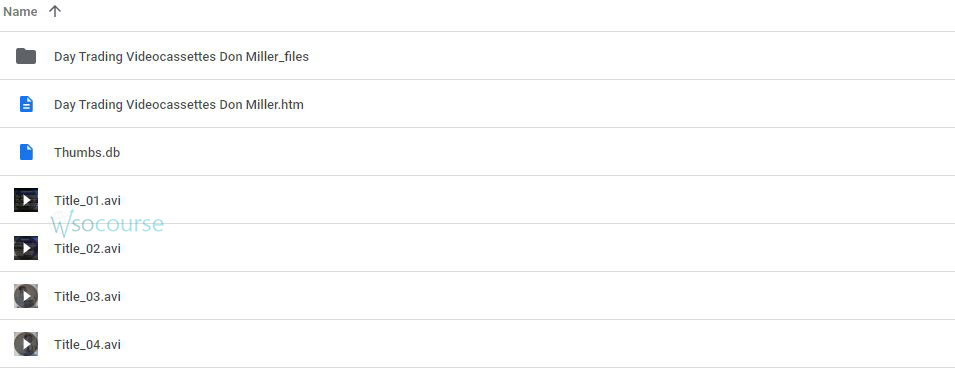

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.