-

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Support and Resistance Trading with Rob Booker

1 × $6.00

Support and Resistance Trading with Rob Booker

1 × $6.00 -

×

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00 -

×

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00 -

×

Path to Profits By Scott Redler - T3 Live

1 × $6.00

Path to Profits By Scott Redler - T3 Live

1 × $6.00 -

×

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00 -

×

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00 -

×

Quant Edge with T3 Live

1 × $6.00

Quant Edge with T3 Live

1 × $6.00 -

×

Market Profile Video with FutexLive

1 × $6.00

Market Profile Video with FutexLive

1 × $6.00 -

×

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00 -

×

Options, Futures, and Other Derivative Securities

1 × $6.00

Options, Futures, and Other Derivative Securities

1 × $6.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00 -

×

Advanced Calculus with Applications in Statistics

1 × $6.00

Advanced Calculus with Applications in Statistics

1 × $6.00 -

×

Advance Gap Trading with Master Trader

1 × $39.00

Advance Gap Trading with Master Trader

1 × $39.00 -

×

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00 -

×

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

Quant Edge Online Home Study Course with T3 Live

1 × $39.00

Quant Edge Online Home Study Course with T3 Live

1 × $39.00 -

×

Zap Seminar - Ablesys

1 × $6.00

Zap Seminar - Ablesys

1 × $6.00 -

×

Foundations of Technical Analysis (Article) with Andrew W.Lo

1 × $6.00

Foundations of Technical Analysis (Article) with Andrew W.Lo

1 × $6.00 -

×

Crash Profits Make Money When Stocks Sink and Soar with Martin D.Weiss

1 × $6.00

Crash Profits Make Money When Stocks Sink and Soar with Martin D.Weiss

1 × $6.00 -

×

The Art of Trading Covered Writes [1 video (AVI)]

1 × $15.00

The Art of Trading Covered Writes [1 video (AVI)]

1 × $15.00 -

×

Commodity Options: Trading and Hedging Volatility in the World’s Most Lucrative Market with Carley Garner & Paul Brittain

1 × $6.00

Commodity Options: Trading and Hedging Volatility in the World’s Most Lucrative Market with Carley Garner & Paul Brittain

1 × $6.00 -

×

The Ones That know

1 × $41.00

The Ones That know

1 × $41.00 -

×

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00 -

×

EURUSD Trading System with CopperChips

1 × $6.00

EURUSD Trading System with CopperChips

1 × $6.00 -

×

Arcane 2.0 Course

1 × $6.00

Arcane 2.0 Course

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

![ACD Method [Video (6 MP4s)] with Mark Fisher](https://www.totozon.com/wp-content/uploads/2024/05/ACD-Method-Video-6-MP4s-with-Mark-Fisher.jpg) ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00

ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00 -

×

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00 -

×

The Complete Turtle Trader with Michael Covel

1 × $6.00

The Complete Turtle Trader with Michael Covel

1 × $6.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

Fed Balance Sheet 201 with Joseph Wang - Central Banking 101

1 × $10.00

Fed Balance Sheet 201 with Joseph Wang - Central Banking 101

1 × $10.00 -

×

Secret Weapon to Trading Options on ETF's Class with Don Kaufman

1 × $6.00

Secret Weapon to Trading Options on ETF's Class with Don Kaufman

1 × $6.00 -

×

Secret $100k Meeting with Russell Brunson

1 × $6.00

Secret $100k Meeting with Russell Brunson

1 × $6.00 -

×

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00 -

×

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00 -

×

Confessions of a Street Addict with James Cramer

1 × $6.00

Confessions of a Street Addict with James Cramer

1 × $6.00 -

×

Masterclass 2.0 with Dave Teaches

1 × $31.00

Masterclass 2.0 with Dave Teaches

1 × $31.00 -

×

The Sweep Show with Scott Pulcini Trader

1 × $23.00

The Sweep Show with Scott Pulcini Trader

1 × $23.00 -

×

Cheat Code Trading System

1 × $13.00

Cheat Code Trading System

1 × $13.00 -

×

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

How to Spot a Trade Before it Happens (marketsmastered.com) with Markets Mastered

1 × $6.00

How to Spot a Trade Before it Happens (marketsmastered.com) with Markets Mastered

1 × $6.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

Full Credit Spreads with Ryan Litchfield

1 × $6.00

Full Credit Spreads with Ryan Litchfield

1 × $6.00 -

×

NASDAQ Level II Trading Strategies

1 × $6.00

NASDAQ Level II Trading Strategies

1 × $6.00 -

×

Timing the Market with Curtis Arnold

1 × $6.00

Timing the Market with Curtis Arnold

1 × $6.00 -

×

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00 -

×

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00 -

×

TradingMind Course with Jack Bernstein

1 × $6.00

TradingMind Course with Jack Bernstein

1 × $6.00 -

×

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00 -

×

Risk Management Toolkit with Peter Bain

1 × $6.00

Risk Management Toolkit with Peter Bain

1 × $6.00 -

×

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00 -

×

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00 -

×

How to Capture Big Profits from Explosive Markets with Glen Ring

1 × $6.00

How to Capture Big Profits from Explosive Markets with Glen Ring

1 × $6.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Market Fluidity

1 × $6.00

Market Fluidity

1 × $6.00 -

×

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Complete Day Trading Course with The Trading Floor

1 × $13.00

Complete Day Trading Course with The Trading Floor

1 × $13.00 -

×

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

1 × $6.00

How To Successfully Trade The Haggerty Slim Jim Strategy for Explosive Gains with Kevin Haggerty

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00

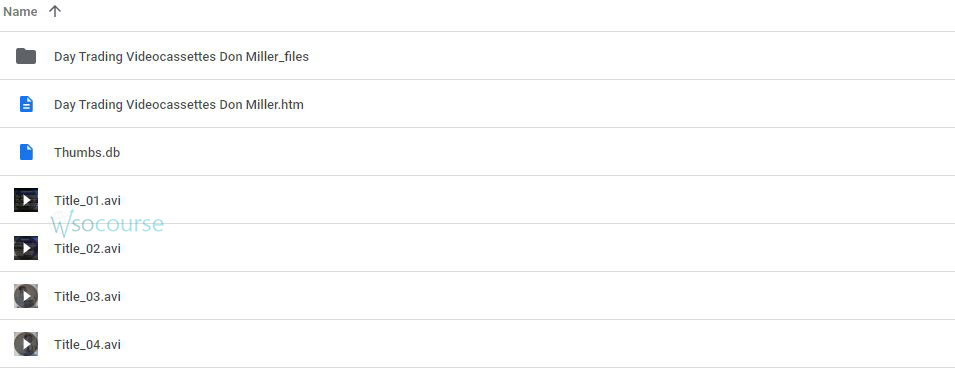

How I Trade the QQQs with Don Miller

$6.00

File Size: 3.26 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How I Trade the QQQs with Don Miller” below:

How I Trade the QQQs with Don Miller

Introduction

In the bustling world of finance, trading the QQQs stands out as a compelling strategy for many investors. This article draws on the insights of seasoned trader Don Miller to unveil a comprehensive approach to trading this popular ETF. Our journey into the nuances of QQQ trading will not only enlighten but also empower you to take your trading skills to the next level.

Understanding the QQQs

The Invesco QQQ Trust (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Why Trade QQQs?

- Diversification: Exposure to leading tech giants like Apple, Google, and Microsoft.

- Liquidity: High trading volumes ensure easy entry and exit.

- Growth Potential: Historically strong performance with tech-driven growth.

Don Miller’s Trading Philosophy

Don Miller’s approach to trading QQQs is built on a solid foundation of discipline and a profound understanding of market dynamics. He emphasizes the importance of a well-thought-out trading plan and risk management strategies.

Key Components of Miller’s Strategy

- Market Analysis:

- Fundamental analysis to gauge economic indicators.

- Technical analysis to identify trends and patterns.

- Position Sizing:

- Calculating risk before entering a trade.

- Adjusting positions according to market volatility.

- Risk Management:

- Setting stop-loss orders.

- Regularly monitoring and adjusting trades as necessary.

Day-to-Day Trading with QQQs

Pre-Market Routine

Every trading day, Don starts by analyzing overnight market changes, news, and economic reports. This helps in adjusting his strategies according to market conditions.

Entry and Exit Points

Don’s tactics involve precise entry and exit points based on technical indicators like moving averages and RSI, ensuring he maximizes gains and minimizes losses.

Using Leverage Wisely

Don utilizes leverage cautiously to amplify his returns on QQQ trades, while always being mindful of the increased risk that comes with borrowing.

Challenges in Trading QQQs

Even for experienced traders like Don Miller, the QQQs present certain challenges:

- Volatility: Swift price changes can lead to significant losses.

- Market Sensitivity: The QQQs are highly sensitive to tech sector dynamics and broader market sentiments.

Tools and Resources

To effectively trade QQQs, Don relies on various tools:

- Trading platforms that offer real-time data and advanced charting capabilities.

- Economic calendars to track important events.

- Trading journals to reflect on past trades and refine strategies.

Conclusion

Trading QQQs, as guided by Don Miller, offers a structured and strategic approach to navigating the complexities of the stock market. By understanding the fundamentals, adhering to disciplined trading practices, and continuously learning, you too can aspire to achieve trading success with QQQs.

FAQs

- What are QQQs? QQQs are ETFs that track the Nasdaq-100 Index, comprising major tech companies.

- Why does Don Miller prefer trading QQQs? For their liquidity, diversification benefits, and growth potential.

- What is a critical aspect of Don Miller’s trading strategy? Emphasis on thorough market analysis and rigorous risk management.

- How does Don Miller handle market volatility? By setting strict stop-loss orders and constantly adjusting his strategies.

- Can beginners trade QQQs effectively? Yes, with proper education and adherence to sound trading principles.

Be the first to review “How I Trade the QQQs with Don Miller” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.