-

×

Value Investing King of Trading Methods in the Commodity Markets - Hal Masover

1 × $6.00

Value Investing King of Trading Methods in the Commodity Markets - Hal Masover

1 × $6.00 -

×

Compound Stock Earnings Advanced Charting (Video 1.19 GB)

1 × $15.00

Compound Stock Earnings Advanced Charting (Video 1.19 GB)

1 × $15.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

Options University - FX Technical Analysis

1 × $6.00

Options University - FX Technical Analysis

1 × $6.00 -

×

Market Expectations & Option Prices with Martin Mandler

1 × $6.00

Market Expectations & Option Prices with Martin Mandler

1 × $6.00 -

×

ValueCharts Ultimate Bundle with Base Camp Trading

1 × $54.00

ValueCharts Ultimate Bundle with Base Camp Trading

1 × $54.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Currency Trading Seminar with Peter Bain

1 × $6.00

Currency Trading Seminar with Peter Bain

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Trading Course 2024 with ZMC x BMO

1 × $17.00

Trading Course 2024 with ZMC x BMO

1 × $17.00 -

×

Forex Income Engine 1.0 with Bill Poulos

1 × $6.00

Forex Income Engine 1.0 with Bill Poulos

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Vajex Trading Mentorship Program

1 × $13.00

Vajex Trading Mentorship Program

1 × $13.00 -

×

Winning With The Market with Douglas R.Sease

1 × $6.00

Winning With The Market with Douglas R.Sease

1 × $6.00 -

×

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00 -

×

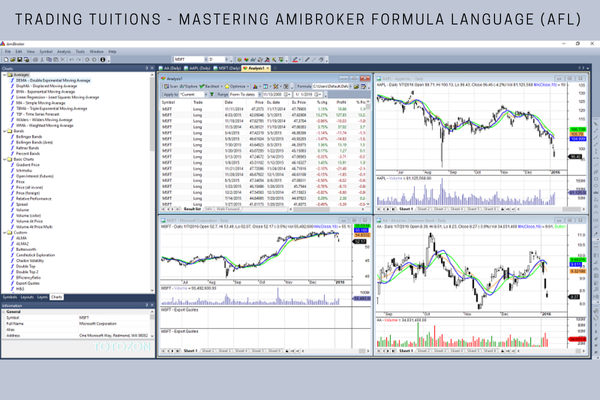

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00 -

×

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Trading Against the Crowd with John Summa

1 × $6.00

Trading Against the Crowd with John Summa

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

Be Smart, Act Fast, Get Rich with Charles Payne

1 × $6.00

Be Smart, Act Fast, Get Rich with Charles Payne

1 × $6.00 -

×

The Taylor Trading Technique with G.Douglas Taylor

1 × $6.00

The Taylor Trading Technique with G.Douglas Taylor

1 × $6.00 -

×

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

1 × $6.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

1 × $6.00 -

×

Bond Trading Success

1 × $6.00

Bond Trading Success

1 × $6.00 -

×

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Market Wizards with Jack Schwager

1 × $6.00

Market Wizards with Jack Schwager

1 × $6.00 -

×

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00 -

×

Strategy Factory Workshop with Kevin Davey - KJ Trading Systems

1 × $5.00

Strategy Factory Workshop with Kevin Davey - KJ Trading Systems

1 × $5.00 -

×

Pro9Trader 2016 Ultimate Suite v3.7

1 × $62.00

Pro9Trader 2016 Ultimate Suite v3.7

1 × $62.00 -

×

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00 -

×

Option Trader Magazine (optionstradermag.com) with Magazine

1 × $6.00

Option Trader Magazine (optionstradermag.com) with Magazine

1 × $6.00 -

×

Market Fluidity

1 × $6.00

Market Fluidity

1 × $6.00 -

×

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

iMarketsLive Academy Course

1 × $5.00

iMarketsLive Academy Course

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Wyckoff Analysis Series. Module 1. Wyckoff Volume Analysis

1 × $6.00

Wyckoff Analysis Series. Module 1. Wyckoff Volume Analysis

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Trading Full Circle with Jea Yu

1 × $6.00

Trading Full Circle with Jea Yu

1 × $6.00 -

×

Trend Commandments with Michael Covel

1 × $6.00

Trend Commandments with Michael Covel

1 × $6.00 -

×

Part-Time Day Trading Courses

1 × $54.00

Part-Time Day Trading Courses

1 × $54.00 -

×

CHARTCHAMPIONS Course

1 × $10.00

CHARTCHAMPIONS Course

1 × $10.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00 -

×

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00 -

×

Complete Set of Members Area Files

1 × $6.00

Complete Set of Members Area Files

1 × $6.00 -

×

The Weekly Options Advantage with Chuck Hughes

1 × $6.00

The Weekly Options Advantage with Chuck Hughes

1 × $6.00 -

×

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff” below:

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

In the ever-evolving landscape of financial investments, the rise of e-bonds stands out as a remarkable innovation. These online bond markets have opened new doors for investors, combining the traditional security of bonds with the cutting-edge technology of digital transactions. In this comprehensive guide, we’ll explore the world of e-bonds through the insights of finance expert Jake Wengroff, helping you understand how these instruments work and why they might be a valuable addition to your investment portfolio.

Understanding E-Bonds

What Are E-Bonds?

E-bonds refer to electronic bonds, which are simply traditional bonds that are bought and sold through online platforms. These bonds are issued by governments or corporations to raise funds for various projects or operational needs.

The Shift to Digital

The transition from physical to digital bonds represents a significant shift in how individuals and institutions invest in debt securities. This digitization offers enhanced accessibility, transparency, and efficiency in bond trading.

Benefits of Investing in E-Bonds

Accessibility

One of the most significant advantages of e-bonds is their accessibility. Investors can purchase bonds from the comfort of their own homes, without the need to go through traditional physical channels.

Diversification

E-bonds provide an excellent opportunity for portfolio diversification. By including bonds in your investment mix, you can reduce overall portfolio risk and achieve more stable returns.

Lower Costs

Online platforms often reduce the costs associated with bond trading, including lower transaction fees and minimal need for intermediaries.

How E-Bonds Work

Buying E-Bonds

Purchasing e-bonds is straightforward. Investors can use online platforms to browse available bonds, assess their features, and execute purchases with just a few clicks.

Interest Payments

Like traditional bonds, e-bonds pay interest to holders, typically on a fixed schedule. This makes them an attractive option for income-seeking investors.

Redemption

Upon maturity, e-bonds can be redeemed for their principal amount, providing a predictable return on investment.

Jake Wengroff on E-Bonds

Market Trends

According to Jake Wengroff, the market for e-bonds is growing rapidly, driven by the demand for more flexible and accessible investment options.

Investor Sentiment

Wengroff notes that investor sentiment around e-bonds is increasingly positive, reflecting confidence in the security and potential returns of these digital investments.

Risks and Considerations

While e-bonds offer numerous benefits, investors should also be aware of the risks, such as interest rate fluctuations and the creditworthiness of the issuer.

Future of E-Bonds

Technological Innovations

As technology advances, we can expect even greater enhancements in how e-bonds are issued and traded, potentially leading to more personalized and efficient investment experiences.

Regulatory Changes

Regulatory developments could also shape the future landscape of e-bonds, influencing everything from trading practices to investor protections.

Conclusion

E-bonds represent a significant evolution in the bond market, offering both seasoned and novice investors a versatile and accessible way to diversify their investment portfolios. With the insights provided by experts like Jake Wengroff, it’s clear that the future of e-bonds is bright, marked by continuous innovation and growth.

FAQs

- What are the main advantages of e-bonds over traditional bonds?

- E-bonds offer enhanced accessibility, lower transaction costs, and the convenience of online trading.

- Can e-bonds be purchased by international investors?

- Yes, many platforms allow international investors to purchase e-bonds, subject to local regulatory restrictions.

- What are the risks associated with investing in e-bonds?

- Risks include interest rate changes, the credit risk of the issuer, and potential technological issues with trading platforms.

- How do I start investing in e-bonds?

- Begin by researching online platforms that offer e-bond investments and ensure they are reputable and secure.

- Are e-bonds suitable for all types of investors?

- E-bonds can be suitable for a wide range of investors, but it’s essential to understand your own financial goals and risk tolerance before investing.

Be the first to review “E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.