-

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Trading as a Business with Alexander Elder

1 × $6.00

Trading as a Business with Alexander Elder

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Investment Madness with John Nofsinger

1 × $6.00

Investment Madness with John Nofsinger

1 × $6.00 -

×

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00 -

×

The 10%ers with Trader Mike

1 × $5.00

The 10%ers with Trader Mike

1 × $5.00 -

×

The Trading Masterclass with Chris Capre

1 × $23.00

The Trading Masterclass with Chris Capre

1 × $23.00 -

×

How Stocks Work with David L.Scott

1 × $6.00

How Stocks Work with David L.Scott

1 × $6.00 -

×

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00 -

×

Sixpart Study Guide to Market Profile

1 × $6.00

Sixpart Study Guide to Market Profile

1 × $6.00 -

×

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00

Stock Market Investing for Financial Independence & Retiring Early with Amon & Christina

1 × $15.00 -

×

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00 -

×

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00 -

×

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Researching your Trade

1 × $6.00

Researching your Trade

1 × $6.00 -

×

How I've Achieved Triple-Digit Returns Daytrading: 4 Hours A Day with David Floyd

1 × $6.00

How I've Achieved Triple-Digit Returns Daytrading: 4 Hours A Day with David Floyd

1 × $6.00 -

×

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

HunterFX Video Course with HunterFX

1 × $6.00

HunterFX Video Course with HunterFX

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Cash Flow Investing Course

1 × $20.00

Cash Flow Investing Course

1 × $20.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Complete Times Course with Afshin Taghechian

1 × $6.00

Complete Times Course with Afshin Taghechian

1 × $6.00 -

×

Candlestick Charts with Clive Lambert

1 × $6.00

Candlestick Charts with Clive Lambert

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Trade the OEX with Arthur Darack

1 × $6.00

Trade the OEX with Arthur Darack

1 × $6.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00

How I use Technical Analysis & Orderflow with Adam Webb - Traderskew

1 × $54.00 -

×

CarterFX Membership with Duran Carter

1 × $23.00

CarterFX Membership with Duran Carter

1 × $23.00 -

×

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00

Getting Started in Forex Trading Strategies with Michael Duane Archer

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Investment Fables with Aswath Damodaran

1 × $6.00

Investment Fables with Aswath Damodaran

1 × $6.00 -

×

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

No Bull Investing with Jack Bernstein

1 × $6.00

No Bull Investing with Jack Bernstein

1 × $6.00 -

×

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00

Double Calendars & Double Diagonals 2022 with Sheridan Options Mentoring

$597.00 Original price was: $597.00.$109.00Current price is: $109.00.

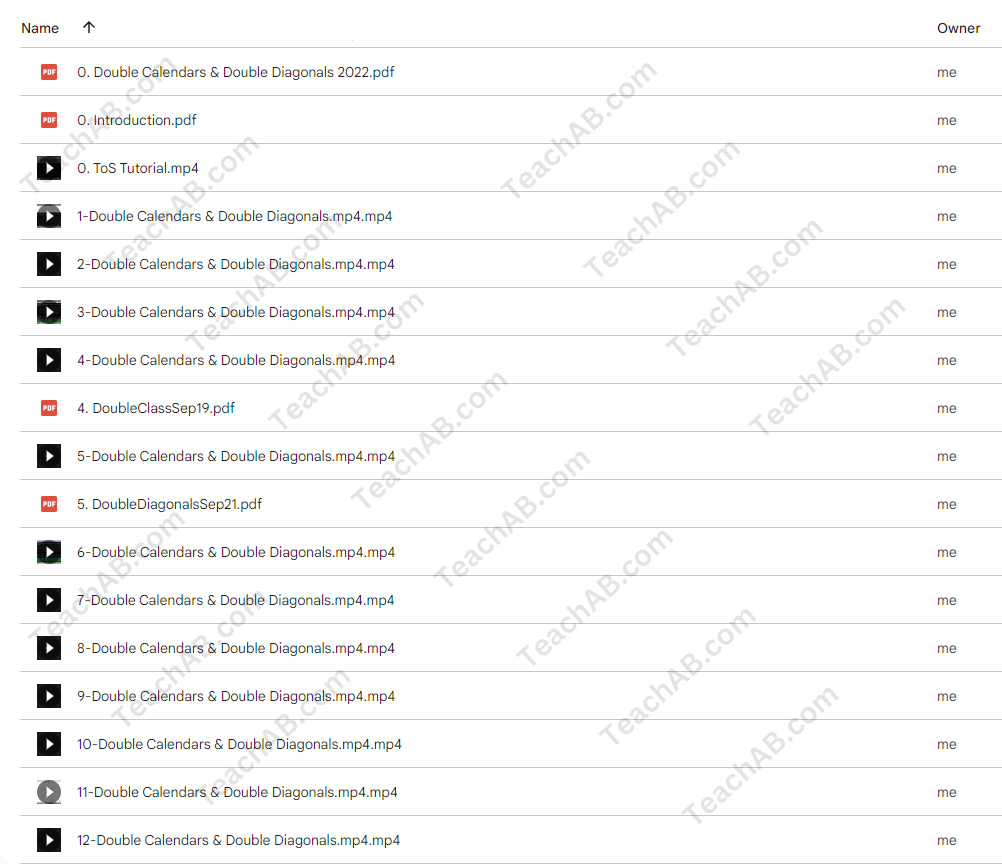

File Size: 5.59 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Double Calendars & Double Diagonals 2022 with Sheridan Options Mentoring” below:

Mastering Double Calendars & Double Diagonals 2022 with Sheridan Options Mentoring

In the dynamic world of options trading, mastering strategies such as double calendars and double diagonals can significantly enhance your trading acumen. In 2022, Sheridan Options Mentoring introduces an updated curriculum focused on these powerful strategies, offering traders new insights and methods for navigating the options market.

Introduction to Options Strategies

Options trading offers a versatile toolkit for investors seeking to capitalize on various market conditions. Double calendars and double diagonals are advanced strategies that target efficiency and profitability under specific market scenarios.

What are Double Calendars and Double Diagonals?

Understanding Double Calendars

- Double calendars involve placing two calendar spreads at different strike prices, optimizing exposure to time decay and volatility shifts.

Exploring Double Diagonals

- Double diagonals combine features of diagonal spreads with straddles or strangles, making them suitable for capturing profits from volatility and time decay in a less directional market.

2022 Strategy Update at Sheridan Options Mentoring

What’s New in 2022

- The latest enhancements to double calendar and double diagonal strategies include refined risk management techniques and entry/exit criteria.

Why Update the Strategy?

- Continuous strategy improvement ensures traders can adapt to changes in market conditions and volatility.

Implementing Double Calendars

Optimal Market Conditions

- Identifying the best market conditions for deploying double calendars to maximize their effectiveness.

Setting Up the Trade

- Step-by-step guidance on how to set up a double calendar spread, from selecting strikes to adjusting for market movements.

Mastering Double Diagonals

Choosing the Right Environment

- How to determine the ideal market scenarios for double diagonals, focusing on volatility patterns.

Trade Management

- Effective management techniques for double diagonals, including adjustments and rolling strategies.

Tools and Software for Trading

Recommended Platforms

- Overview of the best trading platforms that offer robust analytics tools for managing complex options strategies.

Charting and Analysis Tools

- Essential software for charting and analyzing market trends pertinent to double calendars and double diagonals.

Risk Management Strategies

Mitigating Risks with Precision

- Detailed risk management protocols specifically tailored for managing the unique exposure associated with these strategies.

Portfolio Integration

- How to integrate these strategies into a broader trading portfolio while maintaining balanced exposure and risk.

Learning from the Experts

Dan Sheridan’s Teaching Methodology

- Insight into Dan Sheridan’s approach to teaching complex options strategies, blending theory with practical, real-world application.

Live Trading Sessions

- Participating in live trading sessions that demonstrate the strategies in action, providing practical insights and immediate feedback.

Advanced Concepts and Techniques

Beyond the Basics

- Exploring advanced concepts in volatility trading and how they apply to double calendars and double diagonals.

Leveraging Market Inefficiencies

- Techniques for identifying and exploiting market inefficiencies through sophisticated options strategies.

Success Stories from Traders

Testimonials

- Stories from traders who have successfully implemented these strategies and seen significant improvements in their trading outcomes.

Case Studies

- Analyzing specific case studies that highlight the application and success of double calendars and double diagonals in various market conditions.

Getting Started with Double Calendars and Double Diagonals

Enrollment and Course Details

- How to enroll in Sheridan Options Mentoring’s program and what to expect from the course.

Continued Education and Support

- Ongoing educational opportunities and support provided by Sheridan Options Mentoring to ensure continuous learning and improvement.

Conclusion

With Sheridan Options Mentoring’s 2022 updates, traders have at their disposal refined strategies and enhanced educational resources for mastering double calendars and double diagonals. By dedicating time to learn and implement these strategies, traders can position themselves to take full advantage of options trading in changing markets.

FAQs

1. Are double calendars and double diagonals suitable for beginners?

- These strategies are advanced and typically recommended for traders with some experience in options trading.

2. How much capital is required to start trading these strategies?

- Capital requirements can vary, but starting with sufficient capital to manage risk and cover multiple trades is advisable.

3. What is the average duration of trades for these strategies?

- Trades can last from a few days to several weeks, depending on market conditions and the specific setup of the strategy.

4. Can these strategies be applied in any market environment?

- While versatile, double calendars and double diagonals perform best in markets with predictable volatility patterns.

5. How does Sheridan Options Mentoring support traders in learning these strategies?

- Through detailed coursework, live trading sessions, and continuous access to mentoring and support channels.

Be the first to review “Double Calendars & Double Diagonals 2022 with Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.