-

×

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00 -

×

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00 -

×

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00

Wheels of Gann. Top Secret Forecast Guide with Pat Reda

1 × $6.00 -

×

Oliver Velez - Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

1 × $23.00

Oliver Velez - Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

1 × $23.00 -

×

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00 -

×

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00 -

×

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00 -

×

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00 -

×

Scalping Master Class with Day One Traders

1 × $5.00

Scalping Master Class with Day One Traders

1 × $5.00 -

×

The Tickmaster Indicator

1 × $54.00

The Tickmaster Indicator

1 × $54.00 -

×

Fractal Markets FX (SMC)

1 × $5.00

Fractal Markets FX (SMC)

1 × $5.00 -

×

Options, Futures & Other Derivatives (5th Ed.)

1 × $6.00

Options, Futures & Other Derivatives (5th Ed.)

1 × $6.00 -

×

Order Flow Trading Advanced Masterclass with The Forex Scalpers

1 × $24.00

Order Flow Trading Advanced Masterclass with The Forex Scalpers

1 × $24.00 -

×

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00 -

×

TrimTabs Investing with Charles Biderman & David Santschi

1 × $6.00

TrimTabs Investing with Charles Biderman & David Santschi

1 × $6.00 -

×

Ultimate MT4 Course

1 × $15.00

Ultimate MT4 Course

1 × $15.00 -

×

A Bull in China with Jim Rogers

1 × $6.00

A Bull in China with Jim Rogers

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Marber on Markets – How to Make Money from Charts with Brian Marber

1 × $6.00

Marber on Markets – How to Make Money from Charts with Brian Marber

1 × $6.00 -

×

Stock Cycles with Michael Alexander

1 × $6.00

Stock Cycles with Michael Alexander

1 × $6.00 -

×

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00 -

×

Investing for the Long Term with Peter Bernstein

1 × $6.00

Investing for the Long Term with Peter Bernstein

1 × $6.00 -

×

Planetary Economic Forecasting with Bill Meridian

1 × $6.00

Planetary Economic Forecasting with Bill Meridian

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00 -

×

Manage By The Greeks 2016 with Sheridan

1 × $6.00

Manage By The Greeks 2016 with Sheridan

1 × $6.00 -

×

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00 -

×

Short Swing Trading v6.0 with David Smith

1 × $6.00

Short Swing Trading v6.0 with David Smith

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00 -

×

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00 -

×

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00 -

×

Andrews Pitchfork Basic

1 × $6.00

Andrews Pitchfork Basic

1 × $6.00 -

×

Gann Masters II with Hallikers Inc

1 × $6.00

Gann Masters II with Hallikers Inc

1 × $6.00 -

×

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00 -

×

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00 -

×

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00 -

×

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00 -

×

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Forex Trading Course with Mike Norman

1 × $17.00

Forex Trading Course with Mike Norman

1 × $17.00 -

×

Professional Swing Trading College with Steven Primo

1 × $15.00

Professional Swing Trading College with Steven Primo

1 × $15.00 -

×

Options Made Easy: Learn to Trade Stock Options

1 × $6.00

Options Made Easy: Learn to Trade Stock Options

1 × $6.00 -

×

Professional Training Program with OpenTrader

1 × $6.00

Professional Training Program with OpenTrader

1 × $6.00 -

×

Building Winning Trading Systems

1 × $6.00

Building Winning Trading Systems

1 × $6.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

DNA Wealth Blueprint 3 (Complete)

1 × $54.00

DNA Wealth Blueprint 3 (Complete)

1 × $54.00 -

×

Scalping the Forex

1 × $6.00

Scalping the Forex

1 × $6.00 -

×

Financial Astrology Course with Brian James Sklenka

1 × $6.00

Financial Astrology Course with Brian James Sklenka

1 × $6.00 -

×

Ultimate Options with Andy Tanner & Corey Halliday - The Cashflow Academy

1 × $139.00

Ultimate Options with Andy Tanner & Corey Halliday - The Cashflow Academy

1 × $139.00 -

×

MTI - Basics UTP

1 × $6.00

MTI - Basics UTP

1 × $6.00 -

×

Market Consistency: Model Calibration in Imperfect Markets with Malcolm Kemp

1 × $6.00

Market Consistency: Model Calibration in Imperfect Markets with Malcolm Kemp

1 × $6.00 -

×

How I Trade Major First-Hour Reversals For Rapid Gains with Kevin Haggerty

1 × $6.00

How I Trade Major First-Hour Reversals For Rapid Gains with Kevin Haggerty

1 × $6.00 -

×

All About Mutual Funds with Bruce Jacobs

1 × $6.00

All About Mutual Funds with Bruce Jacobs

1 × $6.00 -

×

FOREX UNLIMITED WEALTH EA

1 × $6.00

FOREX UNLIMITED WEALTH EA

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Power Combo with Random Walk Trading

1 × $15.00

Power Combo with Random Walk Trading

1 × $15.00 -

×

In Jeremy's Stock Market Brain

1 × $62.00

In Jeremy's Stock Market Brain

1 × $62.00 -

×

Pablo Order Flow Education with Pablo

1 × $6.00

Pablo Order Flow Education with Pablo

1 × $6.00 -

×

AutoTrader-Fully Automated Trading System with Trading123

1 × $46.00

AutoTrader-Fully Automated Trading System with Trading123

1 × $46.00 -

×

4D Bootcamp with Black Rabbit

1 × $10.00

4D Bootcamp with Black Rabbit

1 × $10.00 -

×

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00 -

×

Market Mindfields. Dancing with Gorilla

1 × $6.00

Market Mindfields. Dancing with Gorilla

1 × $6.00 -

×

Examination Morning Session – Essay (2003) with CFA Level 3

1 × $6.00

Examination Morning Session – Essay (2003) with CFA Level 3

1 × $6.00 -

×

Lazy Emini Trader Master Class

1 × $15.00

Lazy Emini Trader Master Class

1 × $15.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00 -

×

WealthFRX Trading Mastery Course 2.0

1 × $5.00

WealthFRX Trading Mastery Course 2.0

1 × $5.00 -

×

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

$297.00 Original price was: $297.00.$6.00Current price is: $6.00.

File Size: 0.99 GB

Delivery Time: 1–12 hours

Media Type: Online Course

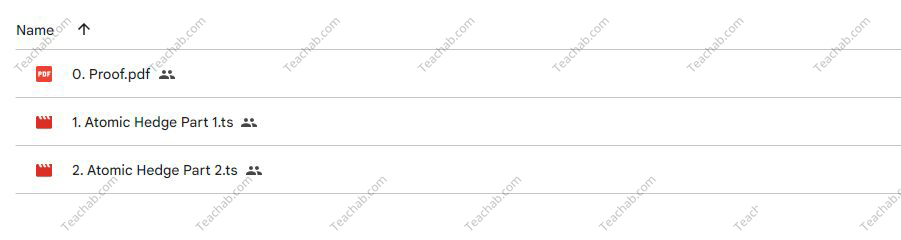

Content Proof: Watch Here!

You may check content proof of “The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman” below:

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

Introduction

In the volatile world of investing, balancing risk and return is a crucial skill. Don Kaufman’s “Reducing Risk and Maximizing Returns Blueprint,” featuring the Atomic Hedge Strategy, offers a sophisticated approach to achieving this balance. This guide delves into the method and practical applications taught in Kaufman’s groundbreaking class.

Understanding the Atomic Hedge Strategy

What is the Atomic Hedge Strategy?

The Atomic Hedge Strategy is an investment approach designed to minimize risk while enhancing potential returns through strategic asset allocation and derivatives use.

Core Principles of the Strategy

This strategy integrates principles of hedging, diversification, and leverage to protect and grow capital.

Components of the Strategy

Risk Assessment Techniques

Tools and methods for assessing potential risks in investment portfolios.

Derivative Instruments

Overview of the derivative instruments used in the Atomic Hedge Strategy, such as options and futures.

Building a Diversified Portfolio

Asset Allocation

How to allocate assets effectively to balance risk and return.

Sector Rotation

Utilizing sector rotation to capitalize on market cycles and economic indicators.

Implementing Hedge Techniques

Options Strategies

Detailed exploration of options strategies used to hedge positions and reduce portfolio volatility.

Using Futures for Hedging

How to use futures contracts as a hedge against market downturns and volatility.

Optimizing the Strategy

Backtesting

The importance of backtesting the strategy to ensure its effectiveness across different market conditions.

Adjustments and Tweaks

How to make necessary adjustments to the strategy as market conditions change.

Risk Management

Setting Stop Losses

Guidance on setting stop losses to protect against significant losses.

Risk/Reward Ratios

Calculating and utilizing risk/reward ratios to make informed trading decisions.

Performance Monitoring

Tracking and Analysis

Methods for monitoring the performance of your investments under the Atomic Hedge Strategy.

Key Performance Indicators (KPIs)

Identifying which KPIs to track to assess the success of your strategy.

Advanced Applications

Leveraging Machine Learning

Exploring how machine learning can enhance prediction accuracy and investment decisions.

Global Macro Strategies

Incorporating global macroeconomic factors into the Atomic Hedge Strategy to improve its robustness and return potential.

Real-World Case Studies

Successful Implementations

Analysis of successful real-world applications of the Atomic Hedge Strategy.

Lessons Learned from Failures

What can be learned from less successful attempts and how to avoid common pitfalls.

Continued Education and Resources

Ongoing Learning

Opportunities for further education through workshops, webinars, and advanced courses offered by Don Kaufman.

Supplementary Materials

Recommendations for books, articles, and online resources to enhance understanding and application of the strategy.

Conclusion

Don Kaufman’s Atomic Hedge Strategy provides a systematic approach to reducing risk while striving for higher returns. By applying the principles outlined in his class, investors can develop a more resilient and dynamic investment portfolio.

FAQs

1. Is the Atomic Hedge Strategy suitable for all types of investors?

The strategy is best suited for investors who have a basic understanding of derivatives and are comfortable with a moderate level of risk.

2. How much capital is needed to effectively implement this strategy?

While there is no set minimum, having a substantial capital base allows for more flexibility in diversification and hedging techniques.

3. Can the Atomic Hedge Strategy be applied during market downturns?

Yes, one of the key strengths of this strategy is its potential to hedge against market downturns effectively.

4. How often should the strategy be reviewed or adjusted?

Regular review, at least quarterly, is recommended to adjust for market changes and rebalance the portfolio as necessary.

5. What are the first steps to take if interested in learning this strategy?

Enrolling in Don Kaufman’s class is an excellent start, providing both foundational knowledge and practical insights.

Be the first to review “The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.