-

×

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00 -

×

The Full EMA Strategy with King Of Forex

1 × $5.00

The Full EMA Strategy with King Of Forex

1 × $5.00 -

×

The Money Flow Trading System: A Profitable Trend Following System So Easy You Can Run it On Your Phone! (English Edition) (Kindle) - Bernd Traxl

1 × $6.00

The Money Flow Trading System: A Profitable Trend Following System So Easy You Can Run it On Your Phone! (English Edition) (Kindle) - Bernd Traxl

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00 -

×

Romeo’s University of Turtle Soup with Romeo

1 × $6.00

Romeo’s University of Turtle Soup with Romeo

1 × $6.00 -

×

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00 -

×

The Truth About Day Trading Stocks with Josh DiPietro

1 × $6.00

The Truth About Day Trading Stocks with Josh DiPietro

1 × $6.00 -

×

XLT– Option Trading Course

1 × $6.00

XLT– Option Trading Course

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Top Ultimate Breakout with Top Trade Tools

1 × $6.00

Top Ultimate Breakout with Top Trade Tools

1 × $6.00 -

×

The Lucci Method with Sang Lucci

1 × $15.00

The Lucci Method with Sang Lucci

1 × $15.00 -

×

Trading Connors VIX Reversals & Tradestation Files with Larry Connors

1 × $6.00

Trading Connors VIX Reversals & Tradestation Files with Larry Connors

1 × $6.00 -

×

Video On Demand Pathway with Trade With Profile

1 × $5.00

Video On Demand Pathway with Trade With Profile

1 × $5.00 -

×

VectorVest - Options Course - 4 CD Course + PDF Workbook

1 × $6.00

VectorVest - Options Course - 4 CD Course + PDF Workbook

1 × $6.00 -

×

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00 -

×

Trading the E-Minis Successfully For A Living 3 Day with Chris Curran with Chris Curran's Live Web Seminar

1 × $6.00

Trading the E-Minis Successfully For A Living 3 Day with Chris Curran with Chris Curran's Live Web Seminar

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

Trading Signals And Training 100

1 × $6.00

Trading Signals And Training 100

1 × $6.00 -

×

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00 -

×

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00 -

×

The MMXM Traders Course - The MMXM Trader

1 × $5.00

The MMXM Traders Course - The MMXM Trader

1 × $5.00 -

×

Amazing Day Trading Ninjatrader Indicator Perfect For Stocks, Futures And Forex

1 × $15.00

Amazing Day Trading Ninjatrader Indicator Perfect For Stocks, Futures And Forex

1 × $15.00 -

×

Online Forex University Course

1 × $10.00

Online Forex University Course

1 × $10.00 -

×

The GBP USD Trading System with A.Heuscher

1 × $6.00

The GBP USD Trading System with A.Heuscher

1 × $6.00 -

×

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00 -

×

Tomorrow's Gold: Asia's Age of Discovery with Marc Faber

1 × $6.00

Tomorrow's Gold: Asia's Age of Discovery with Marc Faber

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Mechanics of Trading Module

1 × $6.00

Mechanics of Trading Module

1 × $6.00 -

×

Art of Yen Course (Feb 2014)

1 × $23.00

Art of Yen Course (Feb 2014)

1 × $23.00 -

×

One Week S&P Workshop II with Linda Raschke

1 × $5.00

One Week S&P Workshop II with Linda Raschke

1 × $5.00 -

×

Trading Plan with Andrew Baxter

1 × $6.00

Trading Plan with Andrew Baxter

1 × $6.00 -

×

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

If You Are So Smart Why Aren’t You Rich with Ben Branch

1 × $6.00

If You Are So Smart Why Aren’t You Rich with Ben Branch

1 × $6.00 -

×

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00 -

×

The Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility Course - George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course Workbook: Step-by-Step Exercises to Help You Master The Volatility Course - George Fontanills & Tom Gentile

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00 -

×

AutoTrader-Fully Automated Trading System with Trading123

1 × $46.00

AutoTrader-Fully Automated Trading System with Trading123

1 × $46.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

$297.00 Original price was: $297.00.$6.00Current price is: $6.00.

File Size: 0.99 GB

Delivery Time: 1–12 hours

Media Type: Online Course

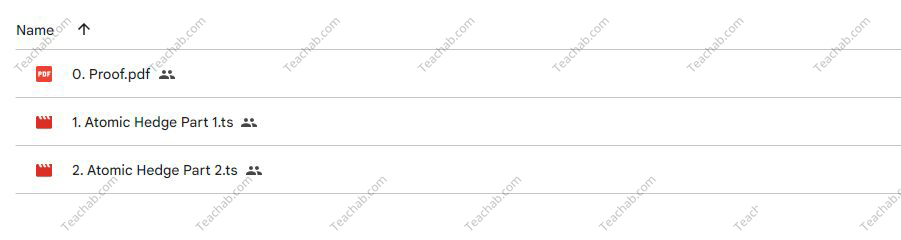

Content Proof: Watch Here!

You may check content proof of “The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman” below:

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

Introduction

In the volatile world of investing, balancing risk and return is a crucial skill. Don Kaufman’s “Reducing Risk and Maximizing Returns Blueprint,” featuring the Atomic Hedge Strategy, offers a sophisticated approach to achieving this balance. This guide delves into the method and practical applications taught in Kaufman’s groundbreaking class.

Understanding the Atomic Hedge Strategy

What is the Atomic Hedge Strategy?

The Atomic Hedge Strategy is an investment approach designed to minimize risk while enhancing potential returns through strategic asset allocation and derivatives use.

Core Principles of the Strategy

This strategy integrates principles of hedging, diversification, and leverage to protect and grow capital.

Components of the Strategy

Risk Assessment Techniques

Tools and methods for assessing potential risks in investment portfolios.

Derivative Instruments

Overview of the derivative instruments used in the Atomic Hedge Strategy, such as options and futures.

Building a Diversified Portfolio

Asset Allocation

How to allocate assets effectively to balance risk and return.

Sector Rotation

Utilizing sector rotation to capitalize on market cycles and economic indicators.

Implementing Hedge Techniques

Options Strategies

Detailed exploration of options strategies used to hedge positions and reduce portfolio volatility.

Using Futures for Hedging

How to use futures contracts as a hedge against market downturns and volatility.

Optimizing the Strategy

Backtesting

The importance of backtesting the strategy to ensure its effectiveness across different market conditions.

Adjustments and Tweaks

How to make necessary adjustments to the strategy as market conditions change.

Risk Management

Setting Stop Losses

Guidance on setting stop losses to protect against significant losses.

Risk/Reward Ratios

Calculating and utilizing risk/reward ratios to make informed trading decisions.

Performance Monitoring

Tracking and Analysis

Methods for monitoring the performance of your investments under the Atomic Hedge Strategy.

Key Performance Indicators (KPIs)

Identifying which KPIs to track to assess the success of your strategy.

Advanced Applications

Leveraging Machine Learning

Exploring how machine learning can enhance prediction accuracy and investment decisions.

Global Macro Strategies

Incorporating global macroeconomic factors into the Atomic Hedge Strategy to improve its robustness and return potential.

Real-World Case Studies

Successful Implementations

Analysis of successful real-world applications of the Atomic Hedge Strategy.

Lessons Learned from Failures

What can be learned from less successful attempts and how to avoid common pitfalls.

Continued Education and Resources

Ongoing Learning

Opportunities for further education through workshops, webinars, and advanced courses offered by Don Kaufman.

Supplementary Materials

Recommendations for books, articles, and online resources to enhance understanding and application of the strategy.

Conclusion

Don Kaufman’s Atomic Hedge Strategy provides a systematic approach to reducing risk while striving for higher returns. By applying the principles outlined in his class, investors can develop a more resilient and dynamic investment portfolio.

FAQs

1. Is the Atomic Hedge Strategy suitable for all types of investors?

The strategy is best suited for investors who have a basic understanding of derivatives and are comfortable with a moderate level of risk.

2. How much capital is needed to effectively implement this strategy?

While there is no set minimum, having a substantial capital base allows for more flexibility in diversification and hedging techniques.

3. Can the Atomic Hedge Strategy be applied during market downturns?

Yes, one of the key strengths of this strategy is its potential to hedge against market downturns effectively.

4. How often should the strategy be reviewed or adjusted?

Regular review, at least quarterly, is recommended to adjust for market changes and rebalance the portfolio as necessary.

5. What are the first steps to take if interested in learning this strategy?

Enrolling in Don Kaufman’s class is an excellent start, providing both foundational knowledge and practical insights.

Be the first to review “The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.