-

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Outperforming the Market with John Merrill

1 × $6.00

Outperforming the Market with John Merrill

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Options, Futures, and Other Derivative Securities

1 × $6.00

Options, Futures, and Other Derivative Securities

1 × $6.00 -

×

Gann Masters II with Hallikers Inc

1 × $6.00

Gann Masters II with Hallikers Inc

1 × $6.00 -

×

Day Trading and Swing Trading the Currency Market with Kathy Lien

1 × $6.00

Day Trading and Swing Trading the Currency Market with Kathy Lien

1 × $6.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

The Telecoms Trade War with Mark Naftel

1 × $6.00

The Telecoms Trade War with Mark Naftel

1 × $6.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00 -

×

Zap Seminar - Ablesys

1 × $6.00

Zap Seminar - Ablesys

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00 -

×

RSI Basic with Andrew Cardwell

1 × $54.00

RSI Basic with Andrew Cardwell

1 × $54.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00

Precision Pattern Trading Workbook with Daryl Guppy

1 × $6.00 -

×

LPC System

1 × $5.00

LPC System

1 × $5.00 -

×

AstroScan Regulus 4.1E newastro.net

1 × $6.00

AstroScan Regulus 4.1E newastro.net

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Value Investing King of Trading Methods in the Commodity Markets - Hal Masover

1 × $6.00

Value Investing King of Trading Methods in the Commodity Markets - Hal Masover

1 × $6.00 -

×

Carter FX 2.0 with CFX University

1 × $5.00

Carter FX 2.0 with CFX University

1 × $5.00 -

×

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00 -

×

Master Commodities Course

1 × $6.00

Master Commodities Course

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Trading Rules that Work

1 × $6.00

Trading Rules that Work

1 × $6.00 -

×

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00 -

×

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00 -

×

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Reverse Engineering Deals on Wall Street with Microsoft Excel with Keith Allman

1 × $6.00

Reverse Engineering Deals on Wall Street with Microsoft Excel with Keith Allman

1 × $6.00 -

×

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00 -

×

How to Spot Trading Opportunities

1 × $6.00

How to Spot Trading Opportunities

1 × $6.00 -

×

Risk Stop Loss and Position Size with Daryl Guppy

1 × $6.00

Risk Stop Loss and Position Size with Daryl Guppy

1 × $6.00 -

×

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00 -

×

Get More Leads Quickly with Brittany Lynch

1 × $6.00

Get More Leads Quickly with Brittany Lynch

1 × $6.00 -

×

Oil Trading Academy Code 3 Video Course

1 × $6.00

Oil Trading Academy Code 3 Video Course

1 × $6.00 -

×

Master Strategies of Super Achievers By Steven Scott

1 × $23.00

Master Strategies of Super Achievers By Steven Scott

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

JokerSZN Course with David

1 × $20.00

JokerSZN Course with David

1 × $20.00 -

×

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00

Candlestick & Pivot Point Strategies with John L.Person

1 × $6.00 -

×

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00 -

×

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00 -

×

Investing Smart. How to Pick Stocks with Investors Business Daily By Dhun H.Sethna

1 × $4.00

Investing Smart. How to Pick Stocks with Investors Business Daily By Dhun H.Sethna

1 × $4.00 -

×

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00 -

×

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

Learn Investing & Trading with Danny Devan

1 × $23.00

Learn Investing & Trading with Danny Devan

1 × $23.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

SRs Trend Rider 2.0

1 × $6.00

SRs Trend Rider 2.0

1 × $6.00 -

×

Pentagonal Time Cycle Theory

1 × $6.00

Pentagonal Time Cycle Theory

1 × $6.00 -

×

Project Manager’s Spotlight on Risk Management with Kim Heldman

1 × $5.00

Project Manager’s Spotlight on Risk Management with Kim Heldman

1 × $5.00 -

×

Intro To Short Selling with Madaz Money

1 × $31.00

Intro To Short Selling with Madaz Money

1 × $31.00 -

×

6 (The Proper BackGround)

1 × $6.00

6 (The Proper BackGround)

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

What Ranks Schema Course with Clint Butler

1 × $23.00

What Ranks Schema Course with Clint Butler

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00 -

×

War Room Psychology Vol.3 with Trick Trades

1 × $23.00

War Room Psychology Vol.3 with Trick Trades

1 × $23.00 -

×

Full Volume Forex Training Course with ThatFXTrader

1 × $5.00

Full Volume Forex Training Course with ThatFXTrader

1 × $5.00 -

×

Gamma Options Boot Camp with Bigtrends

1 × $74.00

Gamma Options Boot Camp with Bigtrends

1 × $74.00 -

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

Warrior Trading: Inside the Mind of an Elite Currency Trader with Clifford Bennett

1 × $6.00

Warrior Trading: Inside the Mind of an Elite Currency Trader with Clifford Bennett

1 × $6.00 -

×

Snapbacks CD

1 × $6.00

Snapbacks CD

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

Campaign Trading with John Sweeney

1 × $6.00

Campaign Trading with John Sweeney

1 × $6.00 -

×

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00 -

×

Generating Consistent Profits On Smaller Accounts

1 × $23.00

Generating Consistent Profits On Smaller Accounts

1 × $23.00 -

×

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

Dynamite TNT Forex System with Clarence Chee

1 × $6.00

Dynamite TNT Forex System with Clarence Chee

1 × $6.00 -

×

CFA Level 2 - Sample Item Sets 2003

1 × $6.00

CFA Level 2 - Sample Item Sets 2003

1 × $6.00 -

×

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00 -

×

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00

Market Risk Analysis, Volume IV, Value at Risk Models with Carol Alexander

1 × $6.00 -

×

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

ePass Platinum

1 × $31.00

ePass Platinum

1 × $31.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Option Buying Course

1 × $5.00

Option Buying Course

1 × $5.00 -

×

WickOrTreat Trading Course with WickOrTreat

1 × $6.00

WickOrTreat Trading Course with WickOrTreat

1 × $6.00 -

×

Pristine - Tom Willard – Creating The Ultimate Trading Psychology Using 3 Key Concepts

1 × $6.00

Pristine - Tom Willard – Creating The Ultimate Trading Psychology Using 3 Key Concepts

1 × $6.00 -

×

Trading Forex With Market Profile

1 × $15.00

Trading Forex With Market Profile

1 × $15.00 -

×

MT4 High Probability Forex Trading Method

1 × $6.00

MT4 High Probability Forex Trading Method

1 × $6.00 -

×

TickScalper Trading System

1 × $23.00

TickScalper Trading System

1 × $23.00 -

×

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00 -

×

Mql4 Bundle: Basics, Scripts, Indicators, Experts with Jim Hodges

1 × $15.00

Mql4 Bundle: Basics, Scripts, Indicators, Experts with Jim Hodges

1 × $15.00 -

×

Mindset Trader Day Trading Course with Mafia Trading

1 × $6.00

Mindset Trader Day Trading Course with Mafia Trading

1 × $6.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

$297.00 Original price was: $297.00.$6.00Current price is: $6.00.

File Size: 0.99 GB

Delivery Time: 1–12 hours

Media Type: Online Course

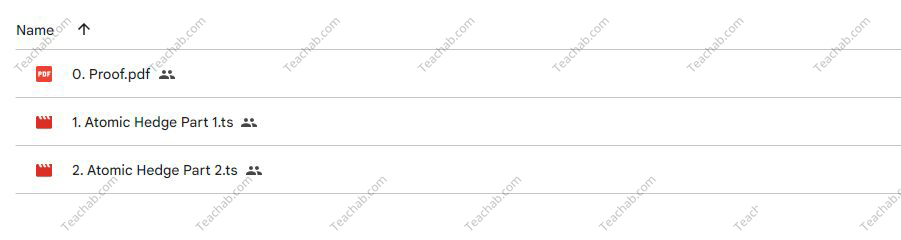

Content Proof: Watch Here!

You may check content proof of “The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman” below:

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

Introduction

In the volatile world of investing, balancing risk and return is a crucial skill. Don Kaufman’s “Reducing Risk and Maximizing Returns Blueprint,” featuring the Atomic Hedge Strategy, offers a sophisticated approach to achieving this balance. This guide delves into the method and practical applications taught in Kaufman’s groundbreaking class.

Understanding the Atomic Hedge Strategy

What is the Atomic Hedge Strategy?

The Atomic Hedge Strategy is an investment approach designed to minimize risk while enhancing potential returns through strategic asset allocation and derivatives use.

Core Principles of the Strategy

This strategy integrates principles of hedging, diversification, and leverage to protect and grow capital.

Components of the Strategy

Risk Assessment Techniques

Tools and methods for assessing potential risks in investment portfolios.

Derivative Instruments

Overview of the derivative instruments used in the Atomic Hedge Strategy, such as options and futures.

Building a Diversified Portfolio

Asset Allocation

How to allocate assets effectively to balance risk and return.

Sector Rotation

Utilizing sector rotation to capitalize on market cycles and economic indicators.

Implementing Hedge Techniques

Options Strategies

Detailed exploration of options strategies used to hedge positions and reduce portfolio volatility.

Using Futures for Hedging

How to use futures contracts as a hedge against market downturns and volatility.

Optimizing the Strategy

Backtesting

The importance of backtesting the strategy to ensure its effectiveness across different market conditions.

Adjustments and Tweaks

How to make necessary adjustments to the strategy as market conditions change.

Risk Management

Setting Stop Losses

Guidance on setting stop losses to protect against significant losses.

Risk/Reward Ratios

Calculating and utilizing risk/reward ratios to make informed trading decisions.

Performance Monitoring

Tracking and Analysis

Methods for monitoring the performance of your investments under the Atomic Hedge Strategy.

Key Performance Indicators (KPIs)

Identifying which KPIs to track to assess the success of your strategy.

Advanced Applications

Leveraging Machine Learning

Exploring how machine learning can enhance prediction accuracy and investment decisions.

Global Macro Strategies

Incorporating global macroeconomic factors into the Atomic Hedge Strategy to improve its robustness and return potential.

Real-World Case Studies

Successful Implementations

Analysis of successful real-world applications of the Atomic Hedge Strategy.

Lessons Learned from Failures

What can be learned from less successful attempts and how to avoid common pitfalls.

Continued Education and Resources

Ongoing Learning

Opportunities for further education through workshops, webinars, and advanced courses offered by Don Kaufman.

Supplementary Materials

Recommendations for books, articles, and online resources to enhance understanding and application of the strategy.

Conclusion

Don Kaufman’s Atomic Hedge Strategy provides a systematic approach to reducing risk while striving for higher returns. By applying the principles outlined in his class, investors can develop a more resilient and dynamic investment portfolio.

FAQs

1. Is the Atomic Hedge Strategy suitable for all types of investors?

The strategy is best suited for investors who have a basic understanding of derivatives and are comfortable with a moderate level of risk.

2. How much capital is needed to effectively implement this strategy?

While there is no set minimum, having a substantial capital base allows for more flexibility in diversification and hedging techniques.

3. Can the Atomic Hedge Strategy be applied during market downturns?

Yes, one of the key strengths of this strategy is its potential to hedge against market downturns effectively.

4. How often should the strategy be reviewed or adjusted?

Regular review, at least quarterly, is recommended to adjust for market changes and rebalance the portfolio as necessary.

5. What are the first steps to take if interested in learning this strategy?

Enrolling in Don Kaufman’s class is an excellent start, providing both foundational knowledge and practical insights.

Be the first to review “The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.