-

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00 -

×

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00 -

×

Power Combo with Random Walk Trading

1 × $15.00

Power Combo with Random Walk Trading

1 × $15.00 -

×

Long-Term Secrets to Short-Term Trading with Larry Williams

1 × $6.00

Long-Term Secrets to Short-Term Trading with Larry Williams

1 × $6.00 -

×

Successful Stock Speculation (1922) with John James

1 × $6.00

Successful Stock Speculation (1922) with John James

1 × $6.00 -

×

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00 -

×

Trading - Candlelight - Ryan Litchfield

1 × $6.00

Trading - Candlelight - Ryan Litchfield

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

CFA Level 1 – PassMaster 2004 CD with Stalla

1 × $6.00

CFA Level 1 – PassMaster 2004 CD with Stalla

1 × $6.00 -

×

Pro Indicator Pack with Trade Confident

1 × $15.00

Pro Indicator Pack with Trade Confident

1 × $15.00 -

×

Forex Trading for Newbies Complete Course with Chuck Low

1 × $6.00

Forex Trading for Newbies Complete Course with Chuck Low

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

CHARTCHAMPIONS Course

1 × $10.00

CHARTCHAMPIONS Course

1 × $10.00 -

×

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00 -

×

All About Mutual Funds with Bruce Jacobs

1 × $6.00

All About Mutual Funds with Bruce Jacobs

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00 -

×

Inner Circle Course with Darius Fx

1 × $24.00

Inner Circle Course with Darius Fx

1 × $24.00 -

×

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00 -

×

Wall Street Stories with Edwin Lefevre

1 × $6.00

Wall Street Stories with Edwin Lefevre

1 × $6.00 -

×

Investing for the Long Term with Peter Bernstein

1 × $6.00

Investing for the Long Term with Peter Bernstein

1 × $6.00 -

×

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Ichimoku Cloud Triple Confirmation Indicator and Scan with AlphaShark

1 × $31.00

Ichimoku Cloud Triple Confirmation Indicator and Scan with AlphaShark

1 × $31.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

How to Invest in ETFs By The Investors Podcast

1 × $6.00

How to Invest in ETFs By The Investors Podcast

1 × $6.00 -

×

How to Collect Income Being Short with Don Kaufman

1 × $6.00

How to Collect Income Being Short with Don Kaufman

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Key to Speculation on the New York Stock Exchange

1 × $6.00

Key to Speculation on the New York Stock Exchange

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

True Momentum System Basic Package with Sam Shames

1 × $13.00

True Momentum System Basic Package with Sam Shames

1 × $13.00 -

×

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Cracking The Forex Code with Kevin Adams

1 × $6.00

Cracking The Forex Code with Kevin Adams

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Stonhill Forex 201 Advanced Course

1 × $5.00

Stonhill Forex 201 Advanced Course

1 × $5.00 -

×

W.D. Gann’s Secret Divergence Method with Hexatrade350

1 × $5.00

W.D. Gann’s Secret Divergence Method with Hexatrade350

1 × $5.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

$297.00 Original price was: $297.00.$6.00Current price is: $6.00.

File Size: 0.99 GB

Delivery Time: 1–12 hours

Media Type: Online Course

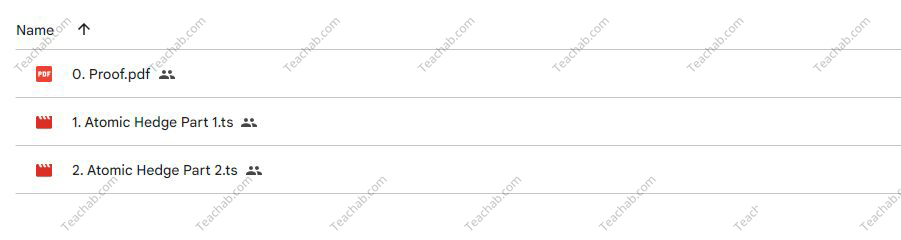

Content Proof: Watch Here!

You may check content proof of “The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman” below:

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

Introduction

In the volatile world of investing, balancing risk and return is a crucial skill. Don Kaufman’s “Reducing Risk and Maximizing Returns Blueprint,” featuring the Atomic Hedge Strategy, offers a sophisticated approach to achieving this balance. This guide delves into the method and practical applications taught in Kaufman’s groundbreaking class.

Understanding the Atomic Hedge Strategy

What is the Atomic Hedge Strategy?

The Atomic Hedge Strategy is an investment approach designed to minimize risk while enhancing potential returns through strategic asset allocation and derivatives use.

Core Principles of the Strategy

This strategy integrates principles of hedging, diversification, and leverage to protect and grow capital.

Components of the Strategy

Risk Assessment Techniques

Tools and methods for assessing potential risks in investment portfolios.

Derivative Instruments

Overview of the derivative instruments used in the Atomic Hedge Strategy, such as options and futures.

Building a Diversified Portfolio

Asset Allocation

How to allocate assets effectively to balance risk and return.

Sector Rotation

Utilizing sector rotation to capitalize on market cycles and economic indicators.

Implementing Hedge Techniques

Options Strategies

Detailed exploration of options strategies used to hedge positions and reduce portfolio volatility.

Using Futures for Hedging

How to use futures contracts as a hedge against market downturns and volatility.

Optimizing the Strategy

Backtesting

The importance of backtesting the strategy to ensure its effectiveness across different market conditions.

Adjustments and Tweaks

How to make necessary adjustments to the strategy as market conditions change.

Risk Management

Setting Stop Losses

Guidance on setting stop losses to protect against significant losses.

Risk/Reward Ratios

Calculating and utilizing risk/reward ratios to make informed trading decisions.

Performance Monitoring

Tracking and Analysis

Methods for monitoring the performance of your investments under the Atomic Hedge Strategy.

Key Performance Indicators (KPIs)

Identifying which KPIs to track to assess the success of your strategy.

Advanced Applications

Leveraging Machine Learning

Exploring how machine learning can enhance prediction accuracy and investment decisions.

Global Macro Strategies

Incorporating global macroeconomic factors into the Atomic Hedge Strategy to improve its robustness and return potential.

Real-World Case Studies

Successful Implementations

Analysis of successful real-world applications of the Atomic Hedge Strategy.

Lessons Learned from Failures

What can be learned from less successful attempts and how to avoid common pitfalls.

Continued Education and Resources

Ongoing Learning

Opportunities for further education through workshops, webinars, and advanced courses offered by Don Kaufman.

Supplementary Materials

Recommendations for books, articles, and online resources to enhance understanding and application of the strategy.

Conclusion

Don Kaufman’s Atomic Hedge Strategy provides a systematic approach to reducing risk while striving for higher returns. By applying the principles outlined in his class, investors can develop a more resilient and dynamic investment portfolio.

FAQs

1. Is the Atomic Hedge Strategy suitable for all types of investors?

The strategy is best suited for investors who have a basic understanding of derivatives and are comfortable with a moderate level of risk.

2. How much capital is needed to effectively implement this strategy?

While there is no set minimum, having a substantial capital base allows for more flexibility in diversification and hedging techniques.

3. Can the Atomic Hedge Strategy be applied during market downturns?

Yes, one of the key strengths of this strategy is its potential to hedge against market downturns effectively.

4. How often should the strategy be reviewed or adjusted?

Regular review, at least quarterly, is recommended to adjust for market changes and rebalance the portfolio as necessary.

5. What are the first steps to take if interested in learning this strategy?

Enrolling in Don Kaufman’s class is an excellent start, providing both foundational knowledge and practical insights.

Be the first to review “The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.